1 billion crypto users in 2024? 👀

Analysts predict 1B crypto users in 2024. ETF to lead Bitcoin’s tragic demise? Hong Kong’s financial regulator opens door for spot crypto ETFs. China proposes ban on converting game tokens to fiat.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

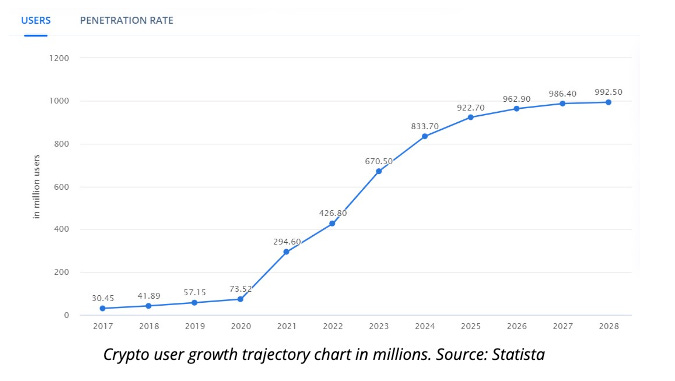

While the year 2023 posed challenges for the crypto industry, analysts remain optimistic about its growth. Projections suggest that the number of crypto users is expected to surge to nearly one billion in 2024.

Current Status: Rise in Global Crypto Owners

As of December 1, global crypto owners reached 575 million, a significant increase from the 432 million recorded at the beginning of 2023, according to a report by Bitfinex analysts. The optimistic outlook suggests that this number could escalate to between 850 and 950 million.

Factors Driving Growth: Bullish Market Conditions

Bitfinex analysts attribute this potential growth to the continuation of bullish market conditions throughout 2024. They emphasize the increasing global interest in and acceptance of cryptocurrencies as key drivers for this upward trend.

Investment Activities on the Rise

The report highlights the growth in investment activities within the crypto space. Notably, the approval of a spot Bitcoin exchange-traded fund (ETF) could further propel market expansion, surpassing anticipated inflows based on current charts. Grayscale CEO Michael Sonnenshein emphasized in a December 20 CNBC interview that a spot Bitcoin ETF approval could significantly boost Bitcoin adoption, potentially tapping into the $30 trillion "advised market" in the United States.

Varied Projections: Insights from Different Sources

Apart from Bitfinex, statistics from Statista offer their own perspective on crypto user growth. According to Statista's projections, the number of crypto users could reach nearly 833 million in 2024 and is expected to climb to around 992 million by 2028. These diverse insights underscore the dynamic nature of the crypto landscape and the varying expectations for its future trajectory.

Analysts hold out hope for new crypto highs in 2023

Ruslan Lienkha, chief of markets at crypto lender and exchange YouHodler.

"The market expects spot ETFs approval at the beginning of January, and overall financial markets seem very bullish with the domination of buyers."

Nicholas Colas, founder of DataTrek Research.

"Another +20% year for the S&P 500 can definitely occur, but it requires that everything go exactly right. The US/global economy cannot stumble, and nor can corporate earnings. Interest rates must continue to decline.”

Blockquote 🔊

Arthur Hayes, BitMEX founder.

“Imagine a future where the largest Western and Chinese asset managers hold all the Bitcoin in circulation. This happens organically as people confuse a financial asset with a store of value. Because of their confusion and laziness, people purchase Bitcoin ETF derivatives rather than buying and hodling Bitcoin in self-custodied wallets. Now that a handful of firms hold all the Bitcoin, and have no actual use for the Bitcoin blockchain.”

Hayes warns that the potential success of spot ETFs could lead to the demise of Bitcoin in his latest post.

Hayes argues that if people favour ETFs over holding Bitcoin directly, it could lead to traditional asset managers controlling a majority of the Bitcoin supply. This could result in a decline in Bitcoin transactions and potentially render the mining process unsustainable.

Concerns Beyond Bitcoin

Hayes argues that aside from killing Bitcoin, the crypto industry may lose its fight to separate money from the state if these ETFs become too successful.

The author suggests that the success of Bitcoin ETFs could lead to greater government control over the cryptocurrency, potentially undermining one of the core tenets of the crypto industry.

Where’s ETF?🚨

Bloomberg Intelligence analyst Eric Balchunas predicted that each Bitcoin ETF hopeful will need to have explicit authorised participant parameters in its S-1 before it’s considered for approval👇🏻

TTD Numbers 🔢

$49M

The amount Curve Finance is to disburse in compensation

Curve DAO Votes for Compensation: In a decisive move, Curve DAO has voted to offer compensation to liquidity providers (LPs) affected by a July hack that pilfered $61 million.

Hack Recap: During the July 30th exploit, attackers siphoned funds from four Curve pools: alETH/ETH, pETH/ETH, msETH/ETH, and CRV/ETH. The incident sent shockwaves through the DeFi community, raising concerns about protocol security.

Compensation Details: After community deliberation, Curve DAO approved the disbursement of $49.2 million worth of CRV tokens to eligible LPs. This value accounts for both stolen funds and missed CRV emissions in the aftermath of the hack.

Token Vesting: To prevent market manipulation, the $49.2 million compensation package will be distributed linearly over one year. This translates to roughly 196,626.29 CRV tokens released per day, with a daily value of approximately $121,000 based on current market prices.

Recovering Losses: While the compensation package aims to mitigate financial losses for affected LPs, the CRV token's volatility introduces uncertainty. The final value of the compensation received could ultimately be higher or lower than the initial $49.2 million depending on market fluctuations.

Path Forward: This decision reflects Curve DAO's commitment to its community and a desire to maintain trust in the protocol. However, the incident also highlights the ongoing challenges of ensuring security in the evolving DeFi landscape.

TTD Hong Kong 🇭🇰

Hong Kong embraces Crypto: SFC Approves Spot Crypto ETFs

Green Light for Crypto Funds: The Securities and Futures Commission (SFC) is now welcoming applications for various crypto funds, including Virtual Asset Spot exchange-traded funds (VA Spot ETFs).

Shifting Stance: This marks a significant change for Hong Kong, which previously held a more cautious approach towards crypto regulation.

Contrast to Mainland China: The move comes amidst China's ongoing crackdown on cryptocurrency activities.

Crypto-Friendly Hong Kong: In contrast to mainland China, Hong Kong has adopted a more receptive approach to crypto firms and fostered collaboration with banks.

Global Hub Ambitions: In October 2022, Hong Kong issued policy statements aimed at solidifying its position as a leading global financial hub, with crypto playing a key role.

TTD China 🇨🇳

China Considers Ban on Converting Game Tokens to Fiat Currency

Crackdown on Virtual Assets: China's gaming industry faces a potential shakeup with a proposed ban on converting game tokens to fiat currency.

GAPP Guidelines: The General Administration of Press and Publication of China (GAPP) has outlined new regulations aimed at restricting the use of game tokens and tightening control over online games.

Key Regulations: The proposed guidelines include:

Licensing Requirement: Game developers seeking to operate in China must obtain a license from the GAPP.

Data Storage: Customer data must be stored within China for a period of two years.

Content Control: Game content must adhere to socialist values and promote "patriotic education."

Public Consultation: The GAPP is accepting public feedback on the proposed regulations until January 22, 2024.

TTD Surfer 🏄

Elon Musk’s “everything app” X (formerly Twitter) is expected to launch in-app payment services on its social media platform around mid-2024.

Travis Kling, Chief Investment Officer of Asset management firm Ikigai, said the firm sold a $65 million claim to its FTX funds because the price was “much, much higher” than expected.

The Central Bank of Nigeria (CBN) has lifted a two-year ban on banks engaging with digital currencies, allowing Nigerian banks to now facilitate cryptocurrency transactions.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋