$11B Crypto Scam Operation 🥷

Elliptic exposes online marketplace Huione Guarantee linked to Cambodia’s ruling family running global scams. CFTC calls BTC and ETH commodities - case closed? Buterin advocates ETH network upgrades.

Hello, y'all. We like all things spicy. Et toi?

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

A marketplace, fraudsters, Cambodia's royal fam, and $11 billion crypto scam.

All things spicy.

What is Huione Guarantee? A bazaar filled with virtual pickpockets and romance-faking fraudsters, all peddling their scamming schemes, according to blockchain analysts Elliptic.

That's kinda what Huione Guarantee sounds like.

Blockchain analysts Elliptic report👇

Huione Guarantee: The multi-billion dollar marketplace used by online scammers

The online marketplace is accused of facilitating a massive crypto scam worth at least $11 billion.

Money movers

This Cambodian bazaar isn't selling silk scarves.

We're talking big-time cybercrime.

The platform may be turning a blind eye to merchants offering.

Money laundering services

"Pig butchering" scams (investment fraud using social engineering)

Sexploitation schemes

Sales of electric shock collars (potentially for forced labour)

But Huione Guarantee doesn't just provide the tools - they also offer the getaway car.

How does Huione Guarantee operate?

Network of instant messaging channels: Huione Guarantee operates through a vast network of channels on messaging apps. Each channel is managed by a merchant offering various scam-enabling services.

Escrow Services: The platform acts as a guarantor, ensuring transactions go smoothly (supposedly preventing fraud). Payments are primarily made in stablecoin Tether (USDT), but other methods exist.

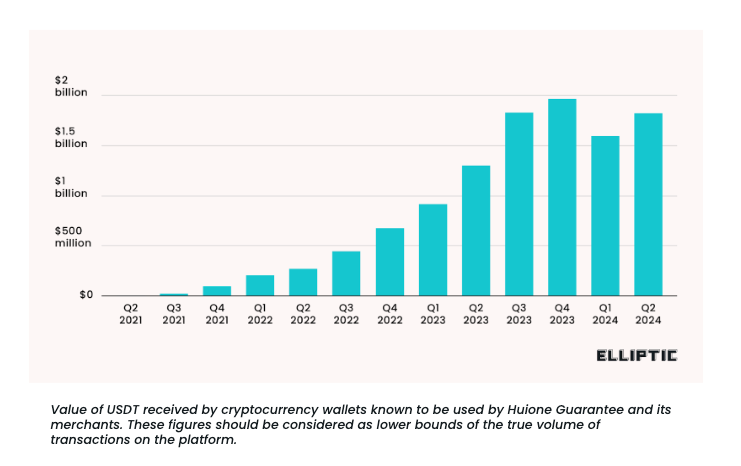

Focus on Crypto Transparency: Crypto transactions' transparency allows Elliptic to track USDT payments, unlike traditional methods.

Two way road: Blockchain transactions are transparent, allowing investigators to track suspicious flows.

What do they sell?

Huione merchants use private messaging channels, allowing the platform to distance itself from the specific business of customers.

Have a look at the merchants openly offering money laundering services and tools to build “pig butchering” scams.

Money laundering: A significant portion of merchants specialise in laundering scam proceeds.

Scam software development: Building fake crypto investment websites and other tools used in "pig butchering" scams.

Personal data & AI tools: Merchants sell stolen personal information and "AI face changing" software to help scammers target and manipulate victims.

Equipment for "scam compounds": Electric batons, shackles, and tear gas – tools used to control and torture forced labourers within scam compounds.

Now that’s DISTURBING!

Who's behind Huione Guarantee?

Huione Group: The platform is owned by Huione Group, a Cambodian conglomerate with ties to the country's ruling family.

Huione Pay, a subsidiary offering payment and foreign exchange services, is also linked to Huione Guarantee.

The ruling family connection?

One of the directors (Hun To) is cousin of the Cambodian prime minister.

Hun To, has faced allegations of money laundering and connections to organised crime.

Elliptic's says Huione International Payments, another Huione Pay subsidiary, actively launders scam proceeds on Huione Guarantee.

USDT's role

The report highlights the use of Tether's USDT stablecoin for payments within the marketplace.

Tether claims it wasn't directly notified and blames "bystander reporting" for hindering their ability to stop illicit activities.

"When blockchain analysts choose to publicise their findings without engaging directly with us, it limits our ability to act swiftly to freeze illicit activities linked to our stablecoins ... This becomes a bystander effect, where individuals observe wrongdoing but choose to record it for social media engagement and notoriety." - a spokesperson for Tether.

A January United Nations report alleges USDT is a favourite tool for laundering billions of dollars in Southeast Asian crime rings.

UN report claims over $17 billion in USDT was linked to criminal activity in a year.

Tether has frozen $300 million in suspected illicit funds, but the UN says more is needed.

Tether was pretty disappointed with the report as well.

“We are disappointed in the UN’s assessment that singles out USDT highlighting its involvement in illicit activity while ignoring its role in helping developing economies in emerging markets, completely neglected by the global financial world simply because servicing such communities would be unprofitable for them.”

Block That Quote 🎙️

Consensys founder and Ethereum co-founder, Joe Lubin

“US regulators were asleep at the wheel”

Lubin was speaking at the Ethereum Community Conference in Brussels on July 10.

Lubin claims they were "asleep at the wheel" while sneaky Senators and big banks swooped in to shape crypto policy for their own benefit.

“They worked with Chair Gensler to say, 'Hey, let’s use these nearly 100-year-old laws and expand your jurisdiction and just control this new technology so that we can essentially fold it into the current infrastructure’ and big banks and big finance can continue to operate and maybe create a dumbed-down version of decentralisation.”

About SEC chair Gary Gensler.

“During his tenure at MIT, he said 75% of these tokens are not securities. Ether is not a security. Gensler asked Congress for a mandate to regulate this new technology because he didn’t have a mandate to regulate the technology.”

Lubin sees the upcoming elections as a potential game-changer.

“We’re making real headway, and we’re much less fearful, we’re going forward, and I think there’s going to be a lot less friction going forward in the US.”

Timeline: Consensys vs SEC

BTC and ETH Are Commodities - Case Closed?

Rostin Behnam, head at the Commodity Futures Trading Commission (CFTC), is back at it again.

Reiterated his stance that Bitcoin and Ethereum are commodities and should be regulated by his agency.

This time, he's testifying before the Senate's Agriculture Committee.

Apparently, a judge in Illinois recently threw down a ruling that says Bitcoin, Ethereum, and even some other cryptocurrencies are COMMODITIES.

Loud and clear.

“In its decision, the court re-affirmed that both Bitcoin and Ether are commodities under the Commodity Exchange Act.”

It means the CFTC can get involved and make sure nobody gets ripped off in the wild west of crypto.

He told lawmakers his agency wants millions more to police crypto as cases make up 50% of workload.

Behnam referenced a 2022 report calling for the CFTC to play a bigger role in overseeing digital commodities.

Outlined five key areas where the CFTC could improve digital asset regulation.

Tailoring rules to address the unique risks of cryptocurrencies.

Implementing a permanent fee-based funding model for the CFTC.

Requiring comprehensive disclosure of crypto assets by registered entities.

Strengthening KYC and AML practices.

A framework for classifying digital assets as commodities or securities under existing laws.

In The Numbers 🔢

$580 million

The value of BTC left in German government’s wallet.

It was $3.5 billion a month ago.

It’s a dynamic number, as Bitcoin moves in and out. You can track it here 👇

They've offloaded over $2 billion worth of Bitcoin in the past week alone.

Read more about the fire sale: Germany's Flash Sell-Off 🚨

But, it's not Germany selling Bitcoin

The culprit: The state of Saxony in eastern Germany that's been dumping Bitcoin.

Why the sell-off? No choice in the matter.

Saxony seized nearly $3 billion worth of Bitcoin in January from a criminal website.

Standard procedure for confiscated assets dictates they must be sold.

So, Saxony's just following the rules.

Why the BKA wallet? The Bitcoin is being sold from a German Federal Criminal Police Office (BKA) wallet.

This is likely because the BKA has the technical know-how to handle such a large amount of crypto, not because they're making the call. Saxony's still in charge.

Confiscated assets usually need a court order before being sold.

Saxony likely requested an emergency sale due to Bitcoin's volatility.

Saxony might be selling too fast. There's a chance Saxony is trying to sell too much Bitcoin at once. Recent reports indicate they received $200 million back from exchanges, suggesting a lack of buyers for such a large sum.

Buterin Advocates Ethereum Upgrades

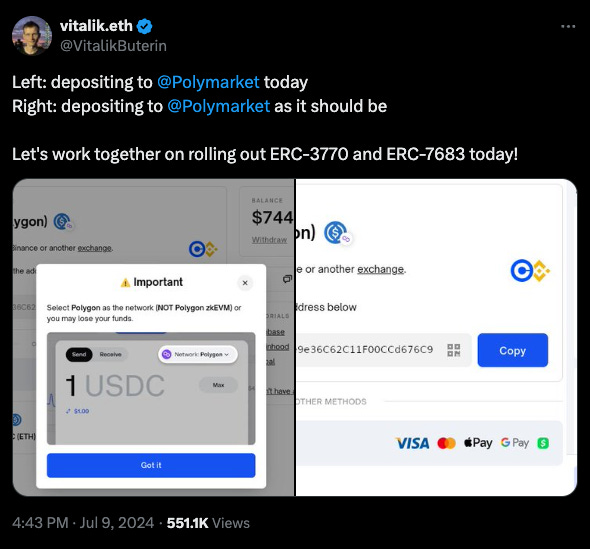

Ethereum co-founder Vitalik Buterin is calling for two key upgrades, ERC-3770 and ERC-7683.

Why? To streamline user experience and transaction processes on the Ethereum network.

What's the Problem? Sending crypto on Ethereum can be confusing, especially with the rise of non-Ethereum chains compatible with the Ethereum Virtual Machine (EVM). Addresses lack clear identifiers, increasing the risk of user error and potential fund loss.

How do these upgrades help?

ERC-3770: Introduces a new address standard.

Imagine your Ethereum address with a clear chain identifier at the beginning, making it instantly recognisable for both users and dApps. This reduces confusion and minimises the risk of sending funds to the wrong network.

ERC-7683: Simplifies cross-chain swaps.

It creates a standardised protocol for sending crypto between different Layer 2 networks (scaling solutions built on top of Ethereum). No more worrying about choosing the right intermediary or fiddling with APIs – ERC-7683 makes cross-chain exchanges smoother and more user-friendly.

The Surfer 🏄

Jack Dorsey's Block has sold its first Bitcoin mining chips to Core Scientific. This is one of the largest ASIC agreements in the history of Bitcoin mining.

YieldMax has launched an inverse Coinbase ETF, allowing traders to profit from the decline of Coinbase's stock. The ETF uses bearish option contracts to perform well when the stock goes down, while also shorting puts to earn a yield.

Marc Andreessen sends $50K in Bitcoin to an AI bot on Twitter called the "Truth Terminal." The AI bot negotiated a grant with Andreessen for hardware upgrades and a token launch. The transaction was verified on the Bitcoin blockchain.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋