Today’s edition is brought to you by Ledger Wallet. The hardware wallet trusted by everyone. Buy Ledger Flex to claim your Bitcoin (limited offer) 🫵

Hello y'all. We are closing in on 2024 and there’s one big thing that’s carried crypto through the year - exchange-traded funds, or ETFs.

Today we take you through the year that was and the year that will be for crypto ETFs.

First up, show us some love on X 🤞

As Times Square's crystal ball drops to welcome 2025, Bitcoin ETFs will quietly celebrate their own milestone: their first birthday.

In those twelve months, Wall Street's relationship with crypto has transformed from scepticism to stampede.

The same BlackRock that once dismissed crypto as an "index of money laundering" now manages $52 billion worth of it.

That’s worth more than the market cap of auto giants such as BMW and Volvo Group.

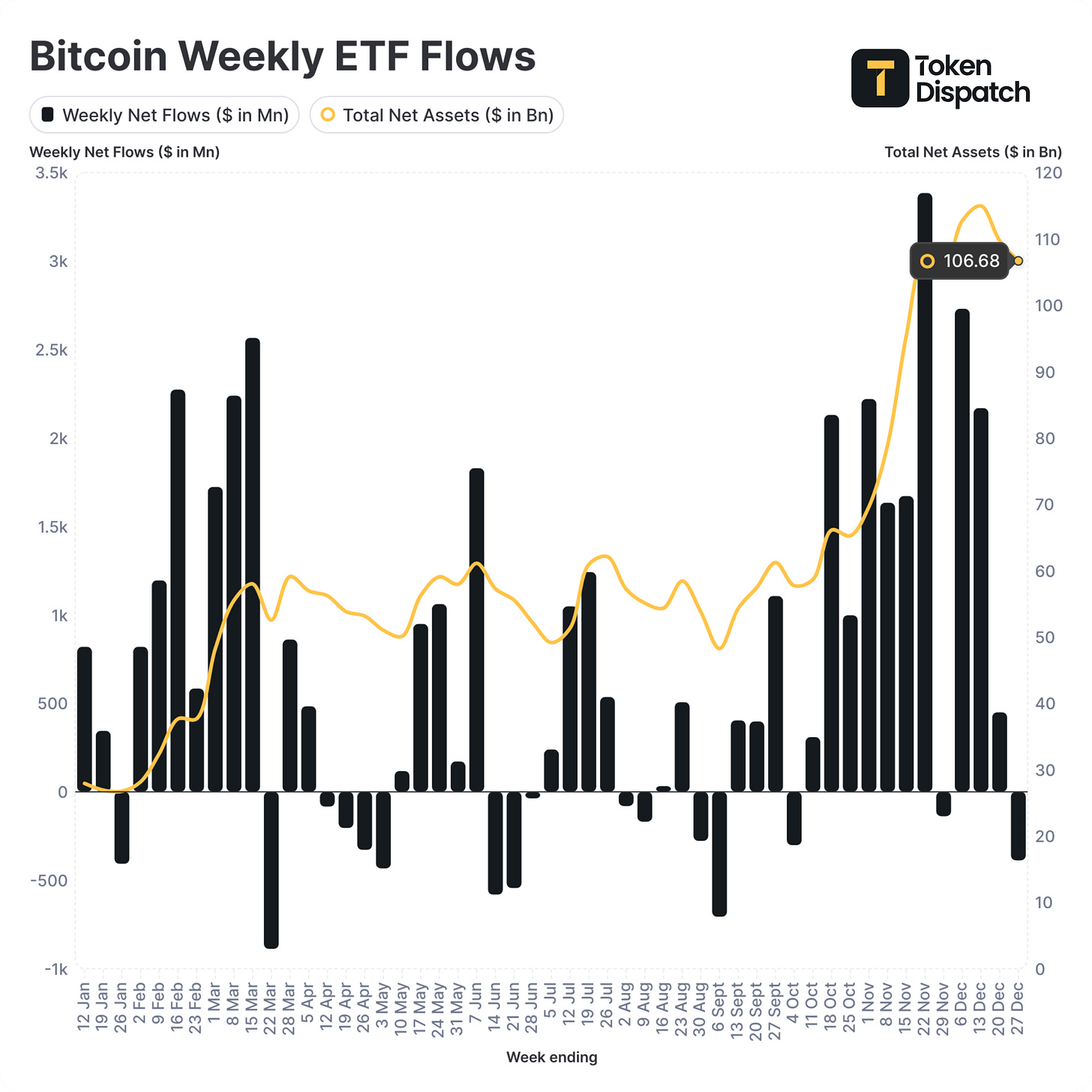

The numbers are staggering: $107 billion in total crypto ETF assets. Over 5% of all Bitcoin now sits in ETF vaults.

More than what Bitcoin founder Satoshi Nakamoto holds. Trading volumes that would make blue-chip stocks blush.

But here's what is keeping Wall Street veterans up at night: According to BlackRock's head of ETFs, only a "tiny fraction" of their clients have bought in.

The biggest financial revolution of 2024 is just getting started.

As the crypto world barrels into 2025, that first candle on Bitcoin ETFs' birthday cake might as well be rocket fuel for the rest of the crypto ecosystem.

If 2024 was about opening the doors to Wall Street, 2025 promises to bring at least one most-anticipated thing to the crypto ecosystem - mass adoption.

We tell you how, in this year’s last Wormhole - the weekly Saturday deep-dive.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

The Great Wall Street Migration

For more than a decade, mass adoption of digital assets remained elusive for the crypto ecosystem.

2024 brought the much-needed watershed moment.

Wall Street just has a way of turning fringe ideas into mainstream finance. The $13 trillion ETF industry that started with a single gold fund in 2004.

As Bitcoin ETFs transform from experimental products into core portfolio holdings, we're watching the same playbook unfold for crypto.

When eleven spot Bitcoin ETFs hit the market in January 2024, sceptics questioned if institutional investors would actually show up. They did - in force.

Within months, daily trading volumes of ETFs regularly exceeded $2 billion. In fact, investment advisors adopted crypto ETFs faster than any other ETFs in the history.

The same BlackRock that was sceptical about crypto’s credibility just seven years ago, now recommends interested investors to set aside 1-2% of the portfolio weightage for Bitcoin.

In less than a year since the launch, BlackRock's iShares Bitcoin Trust (IBIT) emerged as the undisputed leader, amassing $52 billion in assets under management.

Fidelity's FBTC and Grayscale's GBTC rounded out the top three, collectively managing over $80 billion in Bitcoin exposure.

Just six months since the launch of Bitcoin ETFs, Ethereum counterparts received the nod.

After three months of dull interest - a period many attributed to the need for "ETH education" - December witnessed an extraordinary surge: $2.056 billion in net inflows.

All these numbers show one thing about crypto ETFs: market maturation and mass adoption.

When you show a path to have exposure to one of the most lucrative, yet inflation-beating, assets in today’s era, investors will jump in.

Nathan McCauley, CEO and co-founder of Anchorage Digital, told The Block.

“Since January, the story of the crypto ETFs has been one of continued market maturation. From the diversification of custody providers to the recent approval of Bitcoin ETF options, the market is becoming more sophisticated for institutional and retail participants alike.”

Just when the Bitcoin and Ethereum ETFs felt like landmark moments, November saw the launch of Bitcoin ETF Options.

This took crypto ETFs even closer to the traditional finance traders with much-needed risk-leverage and a brand-new playground.

Read: Bitcoin’s Graduation? Enter BTC ETF Options 🥁

IBIT options alone generated $1.86 billion in first-day trading volume, with over 80% driven by call orders - a clear signal of institutional optimism.

Something more significant happened in November before the BTC ETF Options.

Dawn of New Regulatory Era

The crypto markets got their game-changer in November: A Trump victory and a wholesale remake of the regulatory landscape.

Gone is Gary Gensler's restrictive US Securities and Exchange Commission (SEC) regime, replaced by a dramatically different vision under Paul Atkins, Trump's pick for SEC chair.

Read: Crypto's Dream Regulator ✨

The shift isn't subtle. Trump's appointment of David Sacks, former PayPal COO, as his "AI and crypto czar" signals a fundamental rethinking of crypto regulation.

His administration's proposed elimination of capital gains taxes on US-based crypto projects could reshape the competitive landscape overnight.

Now picture this for a November: an aggressively pro-crypto Donald Trump administration getting re-elected to the White House, institutions and retailers riding on the success of ETFs and Bitcoin ETF Options seeing 80% of their first-day activity driven by call orders at the bourses.

Bitcoin smashed through multiple all-time highs to break past the historic $100K mark.

What does all this mean for 2025?

This regulatory thaw could unleash a wave of innovation that was previously unthinkable.

The expiration of Trump's Tax Cuts and Jobs Act in late 2025 opens the door for comprehensive crypto tax reform, including the "Providing Tax Clarity for Digital Assets" bill that would revolutionise staking taxation.

With all this momentum, value of ETF assets could double to $200 billion in 2025, predicts Bitwise's research team.

Historical ETF adoption patterns suggest year one is typically the slowest, with acceleration in subsequent years

Major wirehouses - Morgan Stanley, Merrill Lynch, and others - are poised to fully integrate crypto ETFs into their platforms

Institutional investors tend to "ladder up" their allocations, starting small and building positions over time

What’s more important than all this is that the benefits of the success of BTC and ETH ETFs are likely to spill over beyond just Bitcoin and Ethereum.

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

2025: Rise of Altcoin ETFs

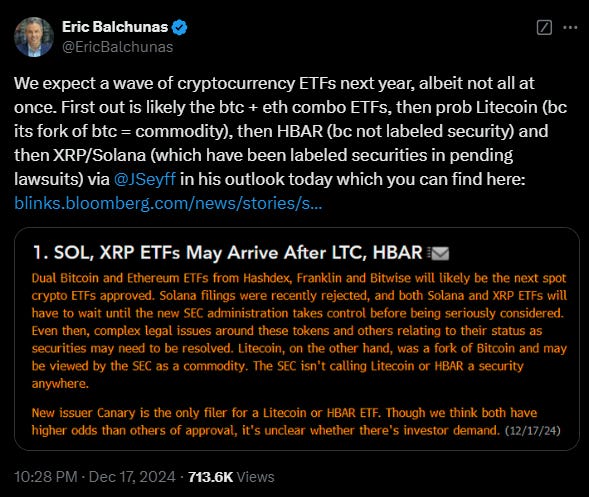

With this dramatic regulatory shift as backdrop, 2025 promises an explosion of new crypto ETF offerings. The transformation is already underway.

Solana leads the pack of potential approvals.

ETF Store President Nate Geraci expects Solana and a host of other crypto ETFs will follow the success of BTC and ETH ETFs.

A crypto-friendly administration and regulatory environment, will lead to a SOL ETF within the next year, Alexander Blume, CEO of Two Prime Digital Assets, said.

But Solana is just the beginning. A wave of filings has hit the SEC's desk.

Multiple firms seeking approval for XRP ETFs following Ripple's legal victories

Hedera positioning itself as an institutional-grade blockchain solution

Even Dogecoin, cryptocurrency's favourite meme, has attracted serious ETF interest

ETFs for Dogecoin - the memecoin? Yes, sire.

Bloomberg’s ETF expert Eric Balchunas. "Today's satire is tomorrow's ETF," Balchunas had told The Block.

How soon can they be expected? JPMorgan analysts feel the launch could see some delay.

Unresolved securities lawsuits could delay new approvals, and the SEC may require clearer designation of which crypto assets qualify as securities.

Yet even these hurdles might dissolve under Trump's administration.

Security and Sophistication Key in 2025

One of the major concerns of Bitcoin ETFs was centralised custody.

The concentration of ETF custody - with Coinbase handling 8 out of 11 Bitcoin ETFs - presents both opportunities and challenges.

Recent FBI warnings about North Korean hackers targeting crypto ETFs underscore the need for robust security infrastructure as the market expands.

Read: Is $50B+ in US Bitcoin ETFs Safe? 🚨

With the potential repeal of SEC Rule SAB 121, it could spark another revolution, allowing traditional banks and brokers to directly custody digital assets.

Result? Eliminate a major barrier to institutional adoption while potentially reshaping the competitive landscape currently dominated by specialised crypto custodians.

Meanwhile, VanEck's 2025 predictions paint a picture of increasing product sophistication.

Beyond simple spot exposure, they envision Ethereum ETFs that incorporate staking yields, offering traditional investors their first taste of crypto's native income generation.

Something that Bitcoin ETF Options brought to the traders’ desk: risk leverage and variety.

IBIT options have already proven themselves to be a significant development in the evolution of crypto derivatives market liquidity, explains Gordon Grant, a cryptocurrency derivatives trader.

As traditional finance embeds itself deeper into crypto markets, 2024 is signing off with promises of innovation beyond simple market access.

Bitwise's recent filing for an ETF tracking companies with significant Bitcoin holdings signals the emergence of hybrid investment vehicles.

Strive Asset Management, founded by Vivek Ramaswamy, is pushing boundaries with its proposed Bitcoin Bond ETF, focusing on convertible securities issued by crypto-holding companies.

This marks the beginning of what some analysts predict will be a wave of specialised crypto investment products.

The emergence of sector-specific crypto ETFs seems increasingly likely, mirroring the evolution of traditional ETF markets.

Two Prime Digital Assets CEO Alexander Blume

"We could see ETFs targeting DeFi protocols, gaming tokens, or infrastructure plays …the market is mature enough to support more nuanced exposure."

Token Dispatch View 🔍

The transformation of crypto from a niche asset to a mainstream investment vehicle happened faster than anyone predicted.

2024's ETF revolution isn't just about the numbers – impressive as $107 billion in assets might be.

It's about what these numbers represent: the bridging of two worlds that once seemed irreconcilable.

Three key factors will likely define crypto ETFs' trajectory in 2025.

First, the institutional adoption cycle is just beginning.

When BlackRock – the world's largest asset manager – says only a "tiny fraction" of their clients own crypto ETFs, it's not admitting weakness; it's signalling massive untapped potential.

The pattern mirrors the early days of gold ETFs, where institutional participation started small but grew exponentially as comfort levels increased.

Second, the incoming Trump administration's crypto-friendly stance could catalyse a transformation far beyond just approving new ETFs.

The proposed elimination of capital gains taxes on US-based crypto projects, combined with regulatory clarity, could reshape the competitive landscape.

The real opportunity lies not just in new ETF approvals, but in the innovation they'll unlock – from staking yields in Ethereum ETFs to sector-specific crypto exposure.

Third, the rise of sophisticated investment products – ETF options, Bitcoin bond ETFs, and sector-specific funds – suggests the market is maturing faster than expected.

This sophistication brings new challenges, particularly around security and custody.

The concentration of assets with a few custodians remains a concern that the industry must address.

Looking ahead, while Solana and other altcoin ETFs seem inevitable, the real story of 2025 might be less about which new coins get ETF approval and more about how these investment vehicles evolve.

The emergence of hybrid products and sector-specific ETFs could offer investors more nuanced ways to participate in the crypto economy.

2025 could be the year when crypto ETFs stop being viewed as exotic investments and start being treated as standard portfolio components.

The infrastructure is built, the regulatory environment is improving, and Wall Street has moved from scepticism to embrace.

For those still on the sidelines, 2025 might be the year FOMO finally wins. But as always in crypto, those who adapt fastest will win big.

It isn't whether institutions will embrace crypto ETFs, but whether they'll be able to keep up with the pace of innovation in this rapidly evolving space.

Week in Funding 💰

ChainOpera AI. $17M. Decentralised platform for generative AI applications. An AI OS that allows the sharing of computational power and high-quality data.

Nodepay. $7M. Network infrastructure for decentralised bandwidth for AI training. Users will be able to sell their unused internet to AI companies.

Hivera. $5M. Decentralised physical infrastructure network for users to contribute their data for AI training and earn rewards for their contributions.

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋