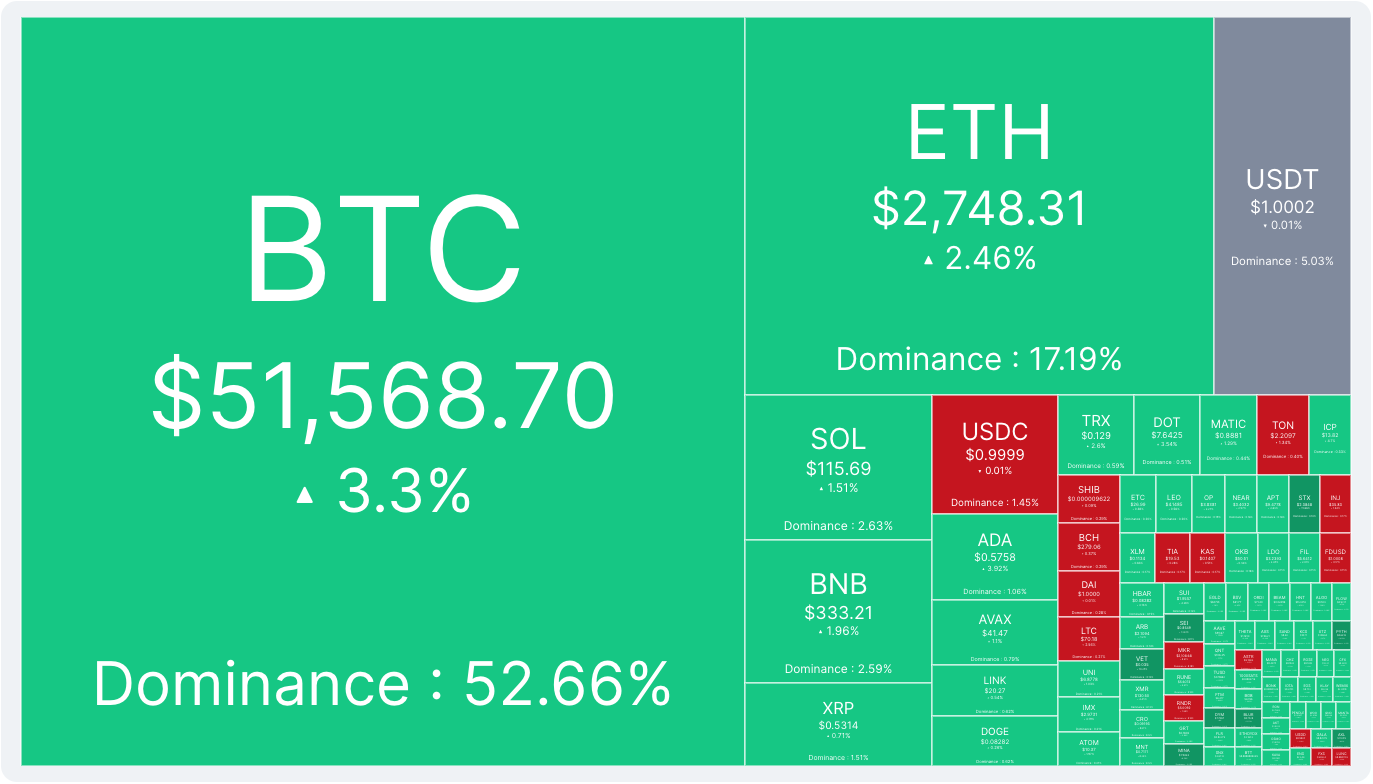

$2T Market Cap 👀

Bitcoin crosses $1 trillion market cap. Crypto flirts with $2 trillion. Bitcoin ETFs sucking up 10X more BTC than miners can produce. Bitcoin OG calls $600k by 2026. Nvidia flips Amazon in market cap.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

Climbing is a tough gig. It really is 👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Bitcoin regains $1 trillion market cap.

Ethereum at $329 billion.

Crypto closing in on $2 trillion.

Bull market climbs the wall of worries.

The Fear & Greed Index for Bitcoin, which aggregates data on market momentum, volatility, volume and social media, hit 79 out of 100 yesterday. Its highest score since Bitcoin reached $69,000 in November 2021.

What are we talking about here?

America's love affair with cryptocurrencies is flourishing.

But…there are always them worries.

Debt, Debt Everywhere: US public and consumer credit card debt are at record highs, sparking concerns about the future.

$34 trillion in public debt

$1.13 trillion in consumer credit card debt.

Christos Makridis an associate research professor at Arizona State University. slips in a word of caution.

Read: How much longer can indebted Americans keep buying crypto?

Interest Rates Bite: The growth of public debt correlates with rising interest rates, impacting housing affordability and the broader economy.

Rising rates linked to debt growth could hurt housing affordability and the economy.

What to do in uncertain times?

Diversification: Spread investments beyond traditional markets.

Crypto investments.

Fed's money-printing fuelled asset bubbles, driving the crypto frenzy. Americans gamble hard-earned cash on digital assets.

However, the party may soon be over.

Fed tightens its grip, interest rates surge. This could trigger a sharp correction in asset values. Debt-burdened Americans will face increasing difficulty servicing loans, raising default and bankruptcy risks.

So, after the $50K high, Bitcoin dips a bit.

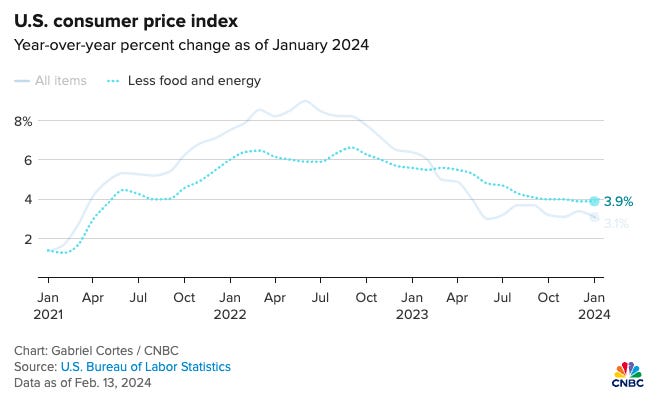

The inflation report impact.

The United States announced that the adjusted CPI annual rate in January was 3.1%, which was expected to be 2.90% and the previous value was 3.40%.

Despite previous hints at rate cuts this year, the recent inflation data might delay any reductions = expect less investments.

What happens to Bitcoin? It blasts past $50k to hit $1 trillion market cap.

Block that Quote 🎙️

Adrian Orr, Governor Reserve Bank of NZ

“It’s a great business to be in, central banking, where you print money and people believe it.”

During a parliamentary meeting, Governor Adrian Orr said this.

Did New Zealand's central bank governor reveal a truth hidden in jest?

It resonated with Bitcoiners, who saw a deeper meaning.

They're all calling for decentralisation as the solution.

Orr about digital currencies: “It’s neither a means of exchange, it’s not a store of value and it’s not a unit of account.”

Orr about stablecoins: “They’re only as good as the balance sheet of the person offering that stablecoin.”

Bitcoin ETF FOMO rally? ⛏️

Bernstein analysts are forecasting a potential price surge this year, fuelled by the recent launch of Bitcoin ETFs and FOMO among investors.

The Bullish Case

ETF Hype: The market hasn't fully priced in the potential of ongoing ETF inflows.

Supply Squeeze: The Bitcoin halving will further restrict supply, potentially boosting demand.

FOMO Factor: Fear of missing out could drive new investors to jump in.

Retail Interest: "Believers" are finding ways to participate through ETFs, with "curious newcomers" showing growing interest.

Gautam Chhugani and Mahika Sapra

“We think the best days of Bitcoin are ahead, and the ETF-led Bitcoin market is poised for what we expect to be a FOMO rally."

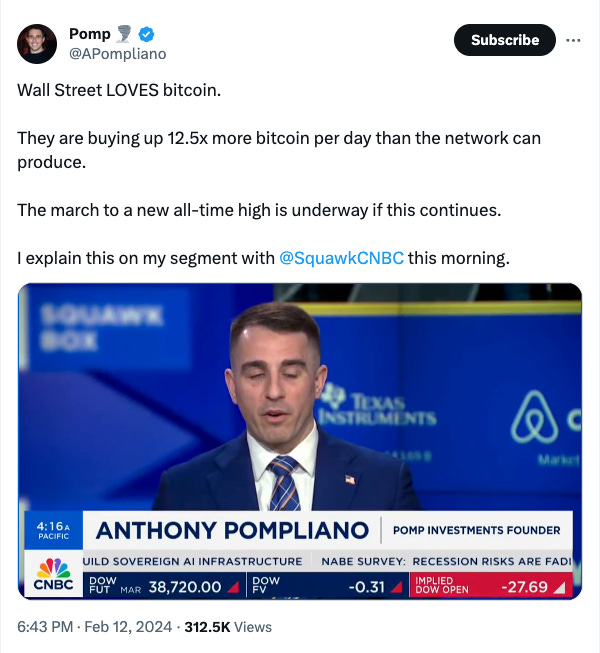

Outpacing Miners

Over the past two days, spot Bitcoin ETFs gobbled up 10 times more Bitcoin than miners could even produce.

$493.4 million flowed into spot Bitcoin ETFs on Feb. 12th, representing roughly 10,280 BTC.

BlackRock led the charge with $374.7 million inflow.

Miners, on the other hand, could only manage to create 1,059 BTC worth around $51 million.

Similar story on Feb. 9th, with ETFs pulling in $541.5 million compared to mining's $45 million.

Where’s ETF?🚨

Bitcoin ETFs Surpass $3 Billion Net Flows, Shattering Gold ETF launch👇

Bitcoin OG Call 🤙

Bitcoin bull Tuur Demeester, known for his accurate price calls, sees BTC soaring to staggering heights, exceeding even his previous forecast of $500k.

His Bold Call

Minimum of $200k, potentially reaching $600k by 2026.

Driven by "trillions" in global bank bailouts and stimulus.

His Track Record

Accurately predicted the 2021 all-time high.

Believes $50k is a catalyst for mainstream adoption.

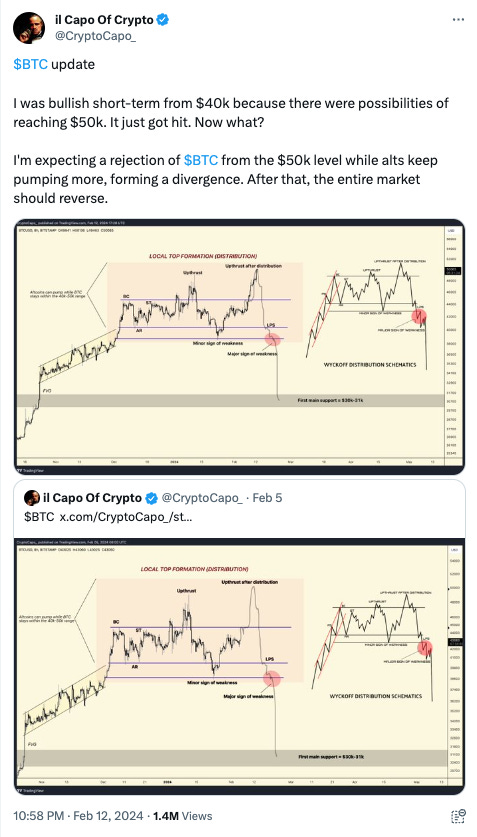

Not everyone shares this optimism. Popular trader Il Capo of Crypto expects a reversal from $50k, predicting a drop to $12k.

Nvidia flips Amazon ⏰

Nvidia has overtaken Amazon in market cap, becoming the 4th largest tech company.

Nvidia closed at $1.78 trillion, Amazon at $1.75 trillion (as of Feb 14th).

Chip Makers FTW: With AI being the belle of the ball, chip makers like Nvidia are getting all the attention, powering up the future of tech.

Amazon's Position

FAANG Member: Amazon has been a dominant player in the tech sector, traditionally part of the "FAANG" group.

Amazon's financial success is partly attributed to robust AI investments.

Can Nvidia hold its lead and challenge Google for the #3 spot? Let the AI boom decide that.

At number 10. It's Bitcoin.

The Quarterly reports ✍🏻

Robinhood: Revenue $43 million, and transaction-based revenue increased 8% year-over-year to $200 million. Monthly active users decreased 4% to 10.9 million, but assets under custody increased to $102.6 billion, a 65% year-over-year.

CoinShares: Revenue of $42.12 million. Total assets under management (AUM) as of Dec 31, 2023, was $3.81 billion. The company said that the 109% increase in its AUM since the end of 2022

The Surfer 🏄

The UK financial regulator said it issued 450 consumer alerts in the last three months of 2023 against firms illegally promoting crypto.

ENS Labs has received an offer from Manifold Finance to settle the eth.link domain dispute. ENS community mulls $300,000 settlement.

Swiss-based FINMA-regulated banks can now offer liquid staking via Taurus and Lido. Taurus is working with Deutsche Bank and Santander.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋