A Cold Red Birthday 🔻

Bitcoin climbs $45K. Shorts liquidate. Bitcoin drops below $41K. Longs liquidate. Jim Cramer flip. Saylor's Bitcoin plan. Crypto stocks see red. Polymarket's ETF prediction. New tax rules in US.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

It's the OG block's bday.

Call it “Genesis Block Day.”

Fifteen years ago, Bitcoin's Genesis Block laid the first stone in the crypto revolution. The first bitcoin was mined by Satoshi Nakamoto on the afternoon of January 3, 2009.

Satoshi Nakamoto wrote in the block: The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

Note: January 9 is like Bitcoin’s official party, but January 3 is where the story began.

It was an easy, happy day till it turned out to be the cold red party.

Crypto's big dive

The price of Bitcoin plunged 8% on Jan 3, retracing all of its gains from the start of the year. The bearish wave swept across the top 10 cryptocurrencies, mirroring Bitcoin's woes.

The big Liquidation

As per data on Coinglass, in the past 24 hours, 182,675 traders were liquidated, the total liquidations comes in at $636.97 million

Why the fall?

This price slump coincides with the crypto market eagerly awaiting the SEC's decision on multiple spot Bitcoin ETF applications in the coming days.

Some analysts, including Matrixport's Markus Thielen, predict a "sell-the-news" event regardless of the decision, potentially further impacting prices.

Contrasting Predictions: This prediction stands in contrast to the more optimistic outlooks from Bloomberg Intelligence and JP Morgan analysts who believe the SEC may approve at least one application.

Bitcoin’s mid-cycle top

CryptoCon, a popular analyst, suggests a cooldown for Bitcoin at the start of 2024, predicting a drop based on DMI data.

Read 👇

Bitcoin may experience a 30% drop, returning to around $30,000.

DMI Indicator: The directional movement index (DMI) has entered a zone typically associated with bearish reversals.

The current DMI pattern resembles mid-2019, when Bitcoin reached its mid-cycle peak and subsequently fell by over 50%.

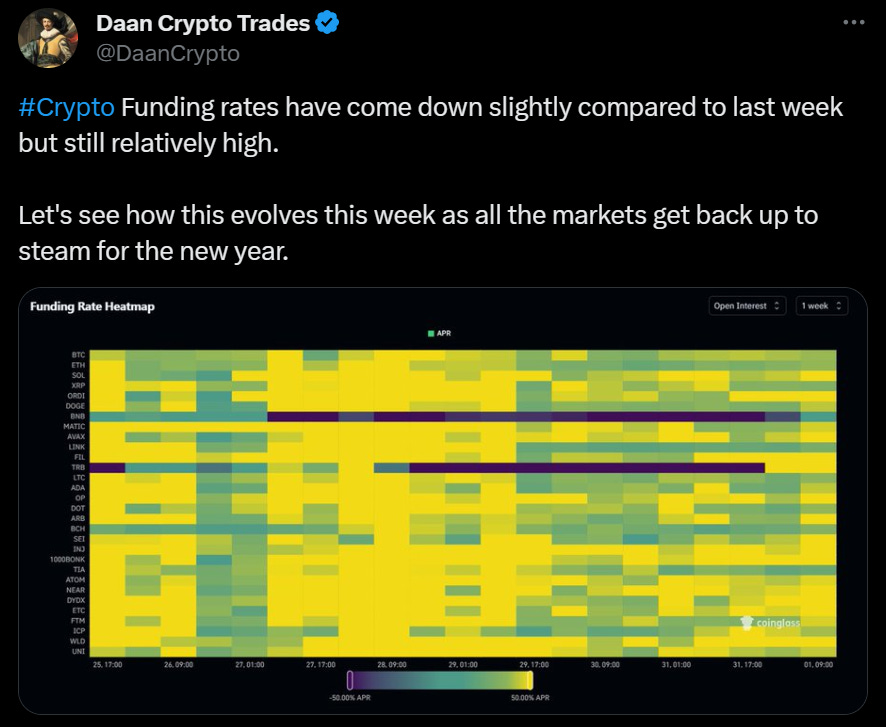

Funding rates👇

Bitcoin ATMs Shrink

For the first time in a decade, the global count of Bitcoin ATMs has decreased by 11.1% at the beginning of 2024.

As of January 1, 2024, there are 33,628 crypto ATMs, down from 37,827 a year earlier.

The US saw 15.4% drop in Bitcoin ATM numbers but still hosts 82% of the global total. Australia, Canada, Spain, and Poland saw increases.

Exchange Volume Hits $1.1 Trillion

Since September 2022, monthly cryptocurrency exchange trading volume exceeded $1 trillion for the first time.

December's Trading Surge: Exchange volume reached $1.1 trillion in December, the highest since May 2022 when it was $1.35 trillion.

Leading Exchanges: Binance led December's trading with 39.3% of the volume, followed by Upbit and OKX.

TTD Blockquote 🔊

CNBC TV personality Jim Cramer.

“You can’t kill it … (Bitcoin)”

Who has a newly found positive approach towards crypto? Yeah Mr.Cramer.

Jim Cramer, a long-time crypto critic, acknowledges Bitcoin's resilience on CNBC's "Squawk on the Street."

Known for his bearish stance alongside Warren Buffett and Charlie Munger, Cramer has been notably skeptical about cryptocurrency.

Cramer's comments follow Bitcoin's rise above $45,000.

In 2022, he expressed concerns about the crypto market, especially after a significant market drop.

This led to the creation of the Inverse Cramer meme and ETF concepts, suggesting doing the opposite of what he says.

And now his view on Bitcoin:

“It's a reality and it's a technological marvel.”

“I think people have to start recognising that it's here to stay; the SEC has been against it the whole time.”

“Now, that doesn't mean that every one of these is here to stay,”

“But I do think that it's about this, a remarkable comeback, that was unexpected. Except for all the bulls who turned out to be right.”

The Response 👇

TTD Trading 💰

On the first trading day of the year.

Bitcoin: Went up - 21-month high, surpassing $45,000.

Ether's Gain: Ether increased by 1%, trading near $2,400.

Coinbase Decline: Coinbase's stock fell 9.8% - its worst daily decline since mid-2023.

Bitcoin Miners: Bitcoin miners like Marathon Digital and Riot Platforms also experienced declines.

MicroStrategy: Saw a 7.9% gain on Tuesday.

Equity Market Downturn: The S&P 500 and Nasdaq Composite experienced declines, continuing a trend from late last week.

MicroStrategy and Saylor

Michael Saylor, co-founder of MicroStrategy, is set to sell 315,000 company shares, valued at nearly $216 million.

Purpose of the Sale

Saylor plans to use the proceeds to buy more Bitcoin personally.

He also aims to address financial obligations.

This move follows Saylor's statement in a 2023 earnings call about a stock option from 2014 expiring in April.

He intends to sell 5,000 shares per trading day between January 2 and April 25.

MicroStrategy remains the largest listed corporate holder of Bitcoin: 189,150 BTC.

Where’s ETF? 🚨

Traders on the decentralised prediction platform Polymarket believe there is an 89% chance that the U.S. SEC will approve an ETF by January 15👇🏻

TTD Voters 📝🗳

The 2024 US elections may see crypto users as a significant swing voting bloc, according to a CCI poll conducted in December 2023 with 454 US voters.

Poll Findings

83% of polled voters prefer candidates who support clear cryptocurrency regulations.

The primary concern among voters is inflation and the cost of living.

In a hypothetical matchup, 51% favor Donald Trump over Joe Biden.

For Congress, 46% lean towards Democratic candidates, with 42% favouring Republicans.

Current Political Landscape

Biden and Trump lead in their respective parties.

Biden's support among Democrats might be affected by his handling of international issues.

Trump faces legal challenges that could impact his candidacy.

TTD Tax 📒

US citizens must now be vigilant about a new cryptocurrency tax requirement effective from December 31, 2023.

Transactions over $10,000 in crypto must be reported to the IRS within 15 days.

This includes: personal information like names, addresses, and social security numbers.

Non-compliance or incorrect reporting could result in felony charges.

Coin Center's Suggestions

Proposed a de minimis exemption for smaller transactions.

Suggested excluding second parties of crypto transactions from reporting requirements.

Also, Research suggests a significant lack of crypto tax reporting in 2022, with only about 0.53% of crypto investors declaring their activities to tax authorities.

TTD Surfer 🏄

Square Enix is restructuring its organisation to focus on implementing AI, blockchain, Web3, and cloud technologies in 2024.

Crypto exchange OKX is implementing new rules for its UK users in compliance with the Financial Conduct Authority (FCA).

Blockchain explorer Etherscan has acquired Solscan, a leading block explorer for the Solana blockchain.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋