Hello!

3Jane.xyz introduces a "credit-based money market" to address the over-collateralisation problem. Its approach expands beyond asset-backed loans to include future-backed loans.

Check out our Thursday edition to know more.

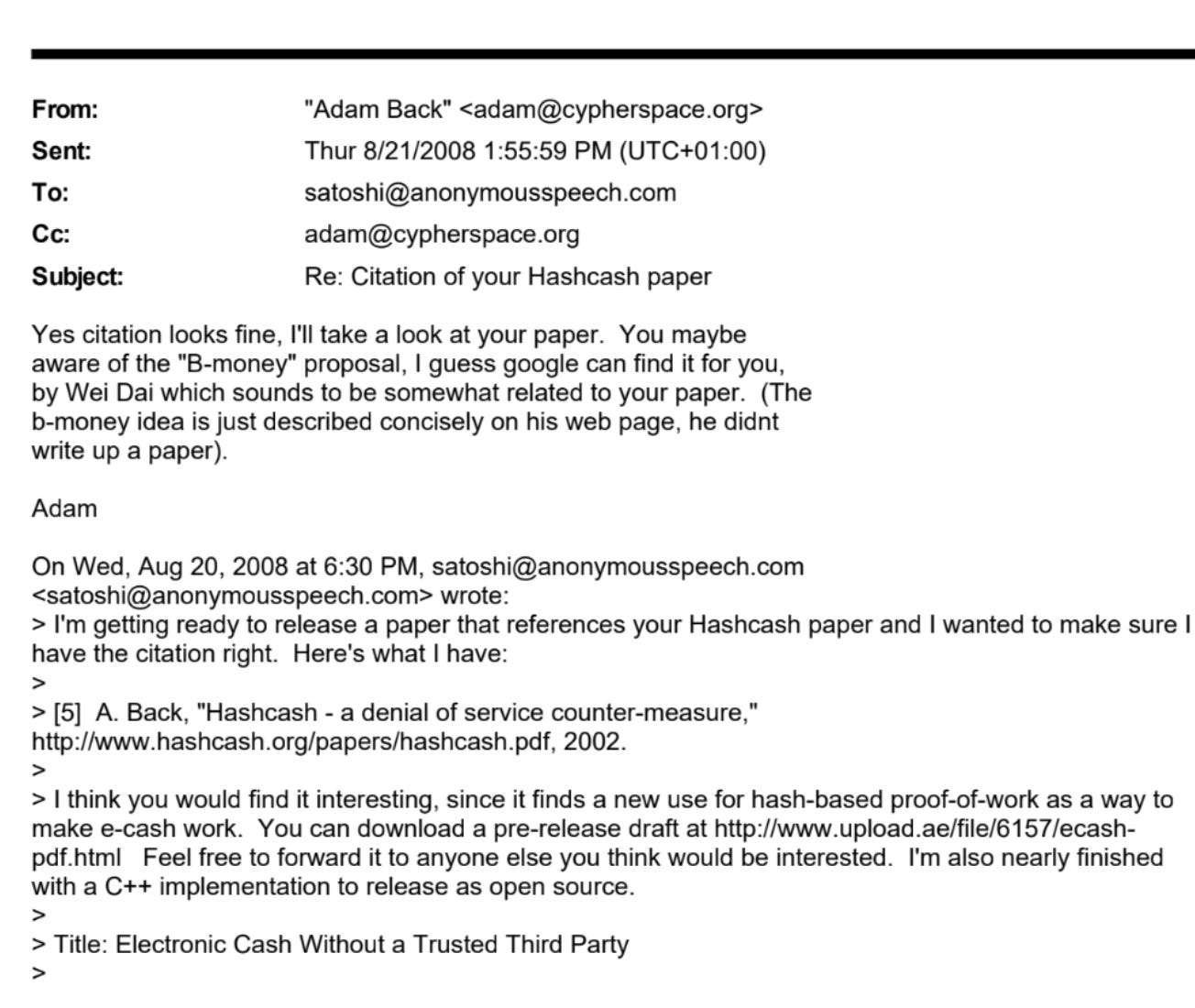

Adam Back almost deleted the email.

It was August 2008, and his inbox overflowed with the usual academic detritus—Let’s assume—conference announcements, collaboration requests, the endless churn of scholarly correspondence.

The sender's name meant nothing to him: Satoshi Nakamoto.

"I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party."

Back skimmed the message.

It mentioned Hashcash, his decade-old proof-of-work system, as inspiration for something called Bitcoin.

He opened the attached whitepaper—nine pages of dense cryptographic concepts—gave it a cursory glance, and typed back a brief response suggesting the author look into Wei Dai's b-money work instead.

Then he closed his laptop and forgot about it.

What Back couldn't know, sitting in his London office that day, was that he'd just become the only person personally cited in what would become the most consequential financial document of the twenty-first century.

"I initially failed to read the Bitcoin whitepaper carefully," Back says now, his voice carrying the weight of hindsight. "That was probably my biggest mistake."

The irony cuts deep. Today, as CEO of Blockstream and one of Bitcoin's most influential architects, Back embodies the strange contradictions of the cryptocurrency world: the accidental prophet who missed his own prophecy, the inventor whose creation escaped his understanding, the academic who stumbled into revolutionising money itself.

Sign up to get Token Dispatch in your inbox 👇🏻

The Sinclair Kid

Adam Back was ten when he first touched a Sinclair ZX81. Other kids in 1980s London kicked footballs around concrete playgrounds. Back sat at his desk, mesmerised by a blinking cursor.

The computer had 1KB of memory—less than a text message holds today. But to Back, it was infinite. He taught himself BASIC, pulled apart video games, hunted through code for hidden keys and secret functions. While his classmates played games, Back wanted to know how they worked.

He carried that obsession through school, excelling in mathematics and physics, then into his Ph.D. at the University of Exeter.

Officially, he studied distributed systems.

Unofficially, he spent most of his time thinking about something that didn't quite exist yet: electronic money.

Back spent approximately two-thirds of his PhD time working on encryption and electronic cash concepts, areas that were largely theoretical at the time.

It was 1995.

The internet ran on dial-up.

Amazon sold books.

The idea that people could send money to each other without banks seemed absurd.

Back didn't think it was absurd at all.

The Cypherpunk Underground

By the mid-1990s, Back had found his tribe: the cypherpunks.

Here, in a flood of encrypted emails, cryptographers and hackers debated the future of privacy. They had a simple philosophy: don't ask governments for freedom, build it yourself.

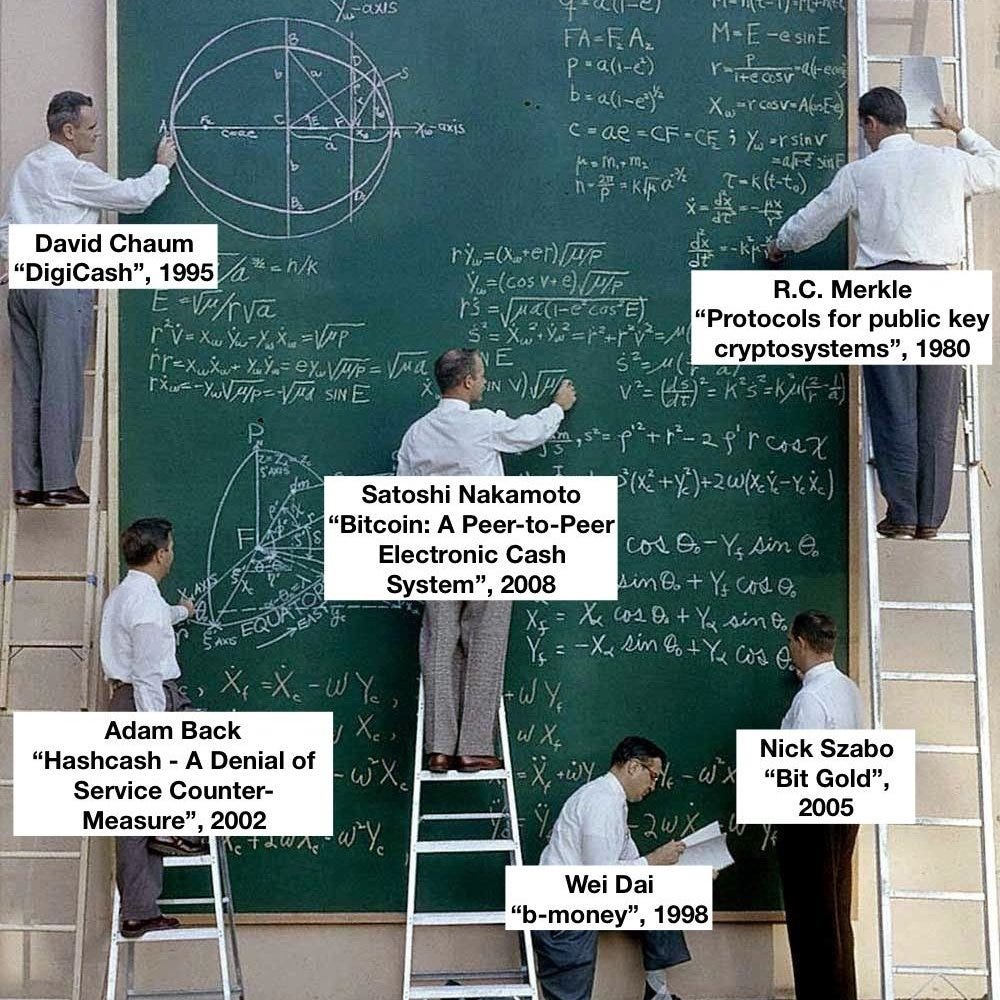

The cypherpunks weren't academics. They were builders. David Chaum worked on digital cash. Wei Dai sketched out anonymous money systems. Hal Finney coded encrypted communication tools.

While politicians argued about privacy rights, the cypherpunks wrote software.

Back fit right in. He'd grown up breaking codes for fun. Now he was surrounded by people who wanted to make unbreakable ones.

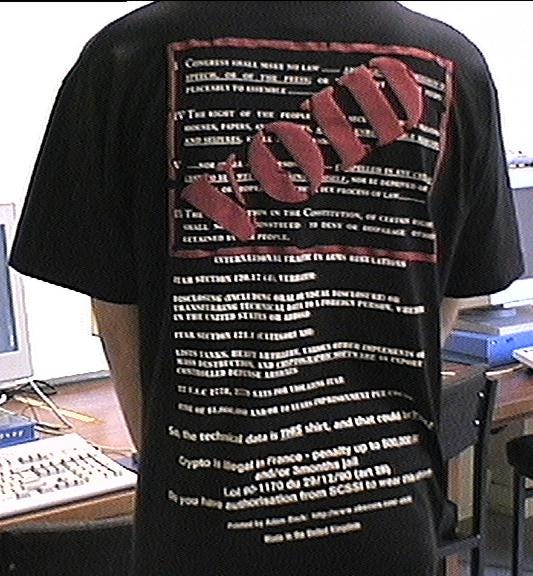

His most audacious protest came through what he called "munitions" T-shirts. When US export regulations classified cryptographic software as weapons, Back printed ultra-compact RSA encryption implementations on clothing and email signatures.

The 2-line and 3-line Perl scripts cleverly highlighted the absurdity of treating mathematical formulas as restricted weapons while demonstrating cryptography's elegant power.

But Back's most significant contribution was yet to come.

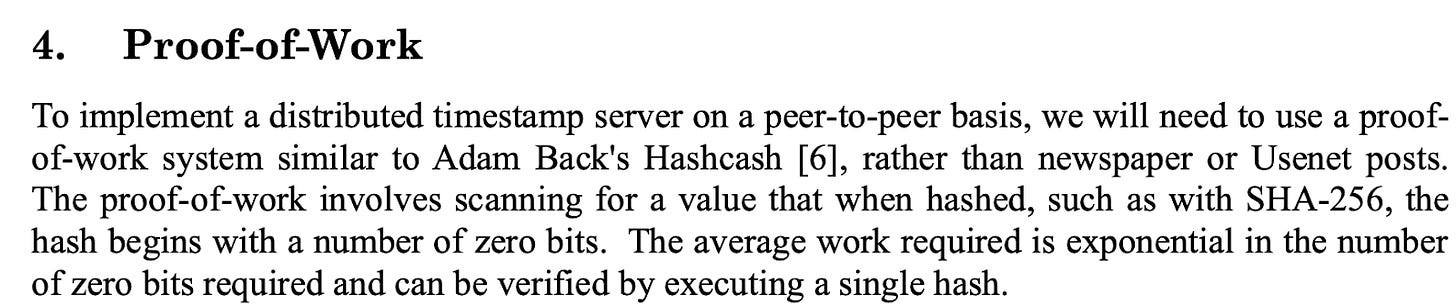

The Hashcash Revolution

In 1997, facing an avalanche of email spam, Back invented something that would change everything: Hashcash.

Hashcash flipped the economics of email. Instead of letting anyone send messages for free, it required computational work—a digital tax paid in processing power.

Legitimate users sending a few emails would barely notice the cost.

Mass mailers would face a bill they couldn't afford.

The mechanics were straightforward: find a number that, when combined with your message and run through a hash function, produces a result starting with several zeros.

Easy to verify, expensive to fake at scale.

Back released Hashcash expecting it to solve his spam problem. It worked, sort of. A few mail servers adopted it.

The concept gained modest traction in academic circles. Then it faded into the background noise of internet history.

What Back didn't realise was that he'd solved something far more valuable than spam.

Every previous attempt at electronic cash had stumbled on the same problem: how do you stop people from copying and spending the same digital coin twice?

David Chaum's eCash had required banks to validate every transaction. Other systems needed central authorities to keep track of balances. All of them created chokepoints that governments could shut down or hackers could attack.

Hashcash suggested a different path.

With the proof-of-work concept, instead of trusting institutions, you could trust mathematics. Computational work became proof of authenticity. The network could police itself.

Back kept building throughout this period, crafting ever more sophisticated privacy tools. He developed credlib, implementing advanced credential systems designed by Stefan Brands and David Chaum. He coded credential systems that let people prove facts about themselves without revealing their identities. He developed ways to keep email conversations secret even if encryption keys were later compromised.

But he never connected the dots.

The idea that his anti-spam tool could become the foundation for an entirely new kind of money never crossed his mind.

The Satoshi Correspondence

Then came August 2008.

Satoshi Nakamoto's email wasn't particularly remarkable—just another academic inquiry in Back's inbox.

The mysterious figure explained he was working on an electronic cash system and wondered if it might relate to Hashcash.

Back responded professionally, pointing Satoshi toward Wei Dai's b-money proposal, which seemed more relevant to what Satoshi was building.

Thanks to Craig Wright and his claims, Court records released in 2024 revealed the full exchange.

Professional. Courteous. Historically pivotal.

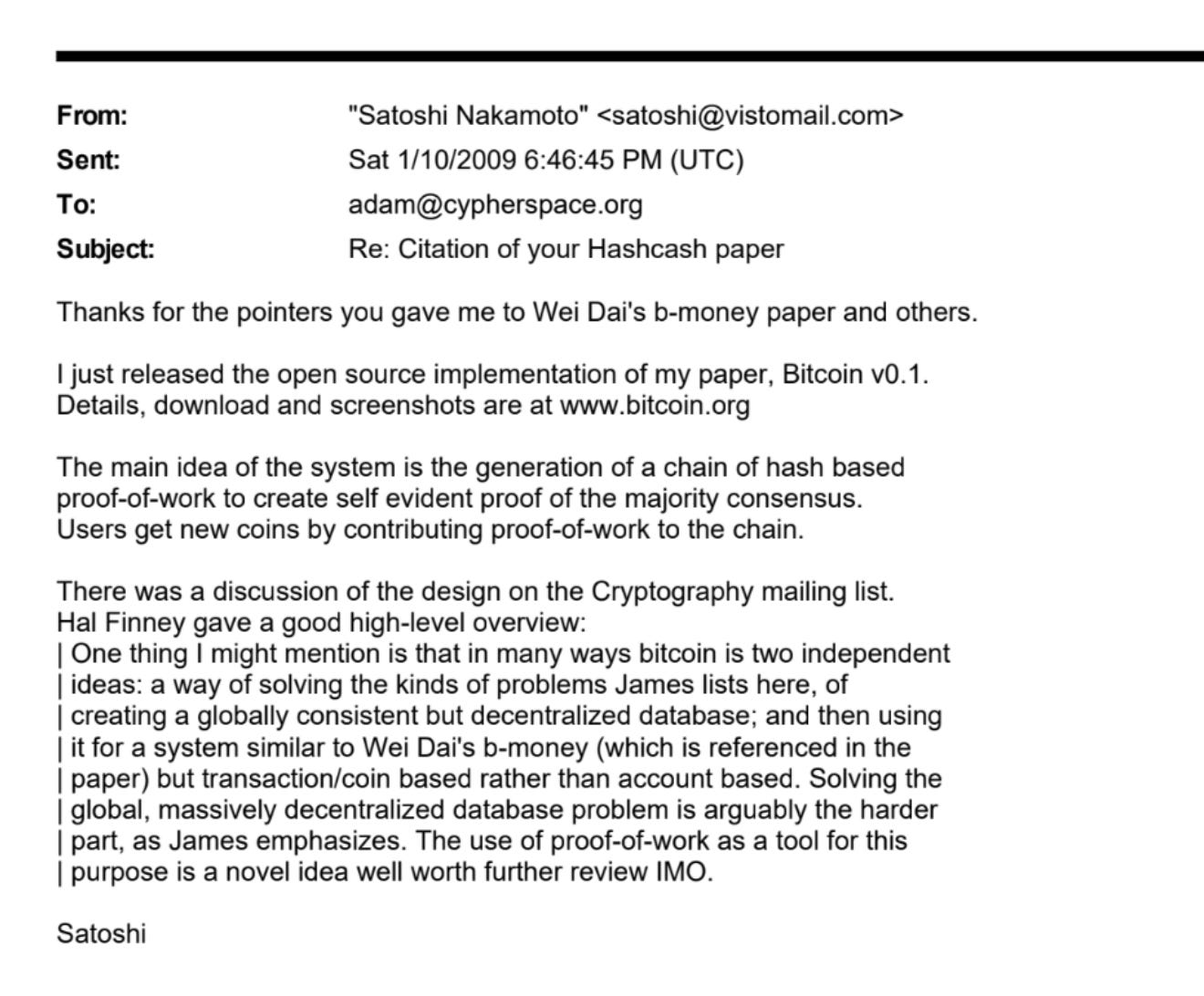

Satoshi reached out again when Bitcoin launched in January 2009, still respectful of Back's earlier work.

Back barely noticed.

"I had questions about its sustainability," he admits. "It was 2009, there was no exchange, no value. Earlier systems had failed due to centralisation or unverifiable issuance, but Bitcoin's decentralised model promised a better path."

The Bitcoin whitepaper explicitly cited Back's work:

Yet Back didn't begin actively using or promoting Bitcoin until around 2013. His biggest regret? "Not buying more earlier."

Same Back, same.

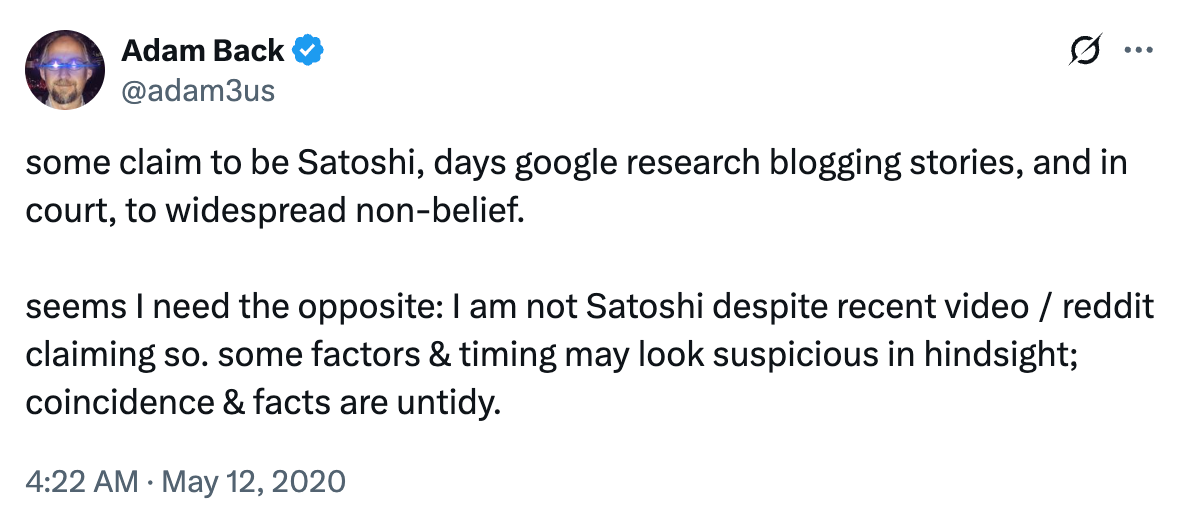

The speculation writes itself. Some claim Back is Satoshi, the inventor hiding behind his own invention. He denies it consistently. The real irony cuts deeper: the man who made Bitcoin possible was too busy examining its flaws to recognise its genius.

The Blockstream Vision

Back woke up in 2013.

Bitcoin wasn't going away. Its problems weren't fatal flaws—they were engineering challenges.

So he assembled a team. Pieter Wuille. Gregory Maxwell. Matt Corallo.

The best cryptographers he could find.

Blockstream launched in 2014 with a simple thesis: Bitcoin could scale without breaking. No compromises on decentralisation.

No shortcuts that invited censorship. Just better engineering.

LinkedIn founder Reid Hoffman wrote the first checks. Other investors followed. The funding enabled recruitment of some of the brightest minds in cryptography and distributed systems, creating a research powerhouse focused exclusively on Bitcoin.

Back started as president and COO. By October 2016, he'd taken the CEO role. The company's roadmap reflected his obsessions: sidechains to extend Bitcoin's capabilities, the Liquid Network for faster settlement, and something audacious—satellites.

The satellite project launched in August 2017. Four orbital transmitters beaming Bitcoin's blockchain to Earth. No internet required. No ISPs to block access. No governments to pull plugs.

Critics called it a publicity stunt. Back saw it differently. This was insurance against the unthinkable. Entire nations cut off from the financial grid, dissidents operating in digital darkness, Bitcoin surviving even if the internet didn't.

It was classic Back—taking abstract cryptographic concepts and turning them into practical tools for freedom.

The Block Size Wars

Bitcoin's success bred new problems. By 2017, the network was choking. Transactions stalled. Fees spiked. The community fractured over a simple question: make blocks bigger or keep them small?

Back chose small. Bigger blocks meant fewer people could run nodes. Fewer nodes meant more centralisation. More centralisation meant Bitcoin dies.

The battle wasn't really about technology. It was about control.

"The block size debate was more about governance than technology," Back reflects. "The market ultimately chose decentralisation: what investors wanted prevailed."

When Bitcoin Cash forked away in August 2017, attempting to implement larger blocks, the market delivered its verdict. Bitcoin Cash's value collapsed relative to Bitcoin, validating Back's position that users prioritised decentralisation over transaction throughput.

"This event solidified confidence in Bitcoin's free market foundation and immutability," Back explains. "People are still drawing strength from that. Michael Saylor said the market outcome gave him confidence in Bitcoin's immutability as digital gold."

For Back, the victory proved everything. Bitcoin had resisted capture. Corporate interests, mining cartels, even charismatic leaders—none could bend it. The cypherpunk dream was real.

The Satoshi Allegations

Back's unique position in Bitcoin's origin story has made him a recurring subject of speculation about Satoshi Nakamoto's identity. These theories gained renewed attention in 2020 when a YouTube video presented circumstantial evidence suggesting Back might be Bitcoin's mysterious creator.

British spelling. Advanced C++ skills. Suspicious timing around his 2009 move to Malta. The evidence was circumstantial but compelling.

The case relies on several coincidences that conspiracy theorists find compelling: similarities in writing style, shared preferences for British spelling, advanced C++ programming skills matching Bitcoin's original codebase, and suspicious timing around his 2009 move to Malta.

The logic breaks down quickly. If Back were Satoshi, why build Blockstream? Why work for profit when you're sitting on a million-Bitcoin fortune? Why struggle to buy Bitcoin in 2013 when you could have mined it in 2009?

But logic doesn't kill conspiracy theories. Back's denials only fuel them. HBO's recent documentary reignited the speculation. The more he protests, the more suspicious he looks.

The irony persists: the man who enabled Bitcoin's creation can't escape being accused of creating it.

Read: "I'm not Satoshi" 💔

The Hyperbitcoinization Prophet

Back sees the future clearly. Bitcoin doesn't just succeed—it conquers.

Hyperbitcoinisation. The word sounds academic, but the concept is radical. Bitcoin becomes the world's money. Fiat currencies collapse. The global economy runs on digital gold.

"Treasury companies are an arbitrage of the dislocation between the bitcoin future and today's fiat world," Back explains. "A sustainable and scalable $100-$200 trillion trade front-running hyperbitcoinization."

He points to companies like MicroStrategy as early pioneers of this trend. Michael Saylor's company has accumulated over 400,000 Bitcoin, using corporate treasury strategy to make a massive bet on Bitcoin's future dominance. Back sees this as logical arbitrage rather than speculation.

"Bitcoin is effectively the hurdle rate; it's very hard to outperform bitcoin," he notes. "That's why you get companies switching to the Bitcoin standard—it's the only way for them to keep up with Bitcoin."

Back's recent investments reflect this conviction.

In May 2025, he invested $1.5 million in H100 Group, a Swedish health company that became the first public firm in Sweden to adopt a Bitcoin treasury strategy.

He invested €12.1 million in The Blockchain Group, Europe's first Bitcoin Treasury Company.

These investments, structured as convertible bonds and paid entirely in Bitcoin.

Building Tomorrow's Infrastructure

Under Back's leadership, Blockstream has continued aggressive expansion. Following a $210 million funding round in October 2024, the company has accelerated development across multiple business lines, including spinning out Blockstream Mining as an independent company with over $350 million in additional financing.

At the Bitcoin 2025 conference in Las Vegas, Back unveiled Blockstream's ambitious vision encapsulated in the tagline "The Future of Finance Runs on Bitcoin." The presentation showcased a new self-custodial mobile wallet and plans to help Bitcoin grow from 100 million users to 1 billion.

"We're laser-focused on Bitcoin," he declared. "At Blockstream, we are here to provide the infrastructure to enable that."

The company has strengthened its global presence through strategic expansions, opening research centers in Lugano, Switzerland, and Tokyo, Japan.

The expansion reflects Back's evolving strategy. Asia matters. Europe matters. Bitcoin needs infrastructure everywhere, not just Silicon Valley offices.

He watches institutional adoption with mixed feelings. ETFs bring new money but threaten decentralisation. The balance matters.

"So long as there's a decent proportion of Bitcoin in individual hands and cold storage by people who are paying attention to what matters for Bitcoin... then it should be okay," he explains.

Ask Back about Bitcoin's price and he doesn't hedge.

"A million easy" within five years.

His confidence stems from structural changes in global finance rather than mere speculation. He points to growing institutional adoption, regulatory clarity, and what he sees as inevitable recognition of Bitcoin's superior monetary properties.

Token Dispatch View 🔍

Adam Back's story embodies an essential truth about technological revolutions: they often emerge from deep philosophical commitments rather than business plans.

His invention of Hashcash was meant to stop spam.

His involvement in the cypherpunk movement was about preserving human freedom in an increasingly digital world.

Yet these principled efforts created the foundation for what may prove to be humanity's most important financial innovation.

Back's journey from a curious teenager reverse-engineering video games to one of Bitcoin's most influential figures demonstrates how individual innovators, working with clear vision and technical skill, can create technologies that transform entire economic systems.

The mystery surrounding Satoshi Nakamoto's identity may never be resolved, but Adam Back's role in Bitcoin's creation and development is undeniable. Whether through his early cryptographic innovations, his leadership of Blockstream, or his strategic investments in Bitcoin-focused companies, Back continues shaping the development of what could become the world's dominant monetary system.

As Bitcoin faces new challenges and opportunities, Back's continued leadership will likely remain crucial to preserving its revolutionary potential while enabling evolution into truly global financial infrastructure. His consistent advocacy for decentralisation and individual sovereignty has helped maintain Bitcoin's core values during rapid institutionalisation and mainstream adoption.

The shy kid with a Sinclair ZX81 has become the quiet architect of tomorrow's money. And if his predictions prove correct, the revolution he helped create is just beginning.

"It's still early for retail investors," Back reminds us, even as Bitcoin approaches six-figure prices. For the man who literally wrote the code that makes Bitcoin possible, that's not wishful thinking, it's a promise.

See ya, next Friday.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.