Adios Amigo 🫡

SEC's crypto enforcer, David Hirsch, quits after 9 years. Crypto lost its charm, or it's future of money? US miners hit $22.8B Mcap in June. $600M digital assets outflows. Tether's gold-backed tokens.

Hello, y'all … I should have known from the start | You know you have got to stop (from my heart) | You are tearing us apart (my heart) | Quit playing games with my heart 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

SEC is on a continuing mission to grapple with how to regulate crypto.

But here’s a little bump.

The SEC's point person for crypto enforcement, David Hirsch, is calling it quits.

After 9 years of contribution.

What? What we know about him.

What he has to say.

“What the hell are you doing?”

That’s what someone asked Hirsch at a conference run by the Digital Assets Council of Financial Professionals in June 2023.

Hirsch assured everyone the SEC wasn't trying to kick crypto out of the US.

But they gotta follow the rules, and he said - "We're not your lawyers!"

What was he doing? Hirsch took the helm of the Crypto Unit in October 2022, just as the crypto market was reeling from major collapses like FTX.

During his tenure, the SEC launched a series of high-profile enforcement actions against companies behind these meltdowns.

That includes Terraform Labs and several crypto exchanges.

Major ones

Coinbase: Sued for operating as an unregistered securities broker and exchange. Coinbase fought the case, but a judge recently rejected their arguments and allowed the lawsuit to proceed.

Binance: Sued for allegedly violating securities laws and regulations. Changpeng Zhao, or CZ, the former CEO of Binance, serves a 4 prison sentence in the US after pleading guilty to money laundering charges in April 2024.

Kraken: Sued, alleging that it operated an unregistered exchange. Kraken settled charges by paying a $30 million fine and discontinuing its staking service for U.S. customers.

Read: SEC Can't Stop Suing 👨⚖️

In 2023, the SEC under Gary Gensler has brought a total of 46 enforcement actions - 53% up from 2022.

Hirsch's departure leaves a vacancy at a critical time for the SEC.

It coincides with a period of increased focus on crypto regulation.

The SEC even doubled the size of its crypto enforcement.

This has drawn criticism from some, one of the most popular among them?

US presidential candidate Donald Trump.

He promised to end Joe Biden’s ‘war on crypto.’

Read: 'Give Me Liberty, or Give Me Death!' 🤌

What's next?

Who will replace him? Nobody from the SEC has filled the position yet.

Hirsch plans to take a break before pursuing new opportunities.

Details are too be revealed “soon.”

But he’s definitely not joining "Pump.fun"

This drama started with a lighthearted social media post by Pump.fun congratulating Hirsch on his "new role" as their trading director.

The sarcastic post suggested Hirsch's SEC days were behind him and it was time to "launch over 1,000 coins per day."

People took the post so seriously that even Binance congratulated him.

SEC vs Ripple

Ripple Labs' attempt for a lighter punishment in its ongoing legal battle with the SEC hit a snag.

On June 13th, Ripple pointed to the SEC's recent settlement with Terraform Labs ($4.5 billion), proposing a civil penalty of just $10 million – a fraction of the SEC's proposed $876.3 million.

The SEC fired back a day later, calling Ripple's comparison to Terraform Labs "inaccurate."

The SEC argues Terraform's situation is unique – the company is bankrupt, agreed to investor refunds, and ousted leadership involved in the alleged violations.

Ripple isn't offering similar concessions – no investor repayments, no leadership changes, and no admission of wrongdoing.

Block That Quote 🎙️

Youwei Yang, BIT Mining Chief Economist.

"Crypto has lost its charm."

The reason? AI.

"There is only a certain amount of hot money in the market and it is devoted to AI now, until crypto can breakout some convincing narrative or constructive advancement, in the meantime crypto will just be trading sideways waiting for major market shocks."

Investors chase the "fear of missing out" (FOMO) with AI-related stocks.

There is a silver lining

"The intersection of artificial intelligence and crypto is going to be even bigger than people imagine, as the two industries could add a collective $20 trillion to global GDP by 2030," - Juan Leon, Senior Crypto Research Analyst at Bitwise.

Leon believes AI and crypto could add $20 trillion to the global economy by 2030.

Read: $20T by 2023 👀

Balaji Srinivasan, former Coinbase CTO - “Money after AI is crypto”

His prediction? Crypto will be the future of money in an AI-powered world.

US Miners Hit $22.8B Market Cap In June

Who said? JPMorgan report.

Almost all the companies outperformed Bitcoin in the first two weeks of June.

Why? Two key factors.

Diving into AI: Several mining companies, like Core Scientific, are exploring opportunities in AI field. Core Scientific, for instance, struck a deal with AI cloud provider CoreWeave to expand their revenue streams. Following the path are, other mining firms, such as Hut 8 and IREN

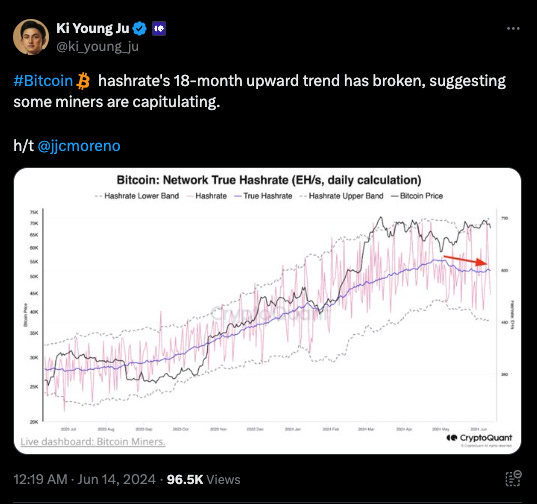

US miners grab a bigger slice of the pie: The second month of network hashrate gains for U.S. miners. Their share of the network hashrate (computing power) has climbed to 23.8%, up from 21% just two months ago. This increase comes as less efficient miners are squeezed out after the recent Bitcoin halving.

Bitcoin's network hashrate has decreased by 5% since the halving.

Miners are capitulating?

What to expect next?

JPMorgan analysts predict a rise in Bitcoin's hashprice (miner earnings) as the overall network hashrate dips. This could further benefit US miners with their growing share.

In The Numbers 🔢

$600 million

Digital asset investment products outflows for last week, reports Coinshares.

It’s the largest since March 22, 2024.

Reason? The recent Federal Open Market Committee (FOMC) meeting spooked the market a bit.

Interest rates steady at 5.25% - 5.50%.

The bearish sentiment even pushed some investors towards short-bitcoin products and some Altcoins.

Spot Bitcoin ETFs outflows? $621 million.

In contrast, Ethereum investment products saw $13 million inflows.

Lido and Ripple, saw $3 million inflows in total.

Crypto wasn’t the only sector impacted.

Investors dumped almost $22 billion from US equity funds.

The largest outflows since December 2022.

Tether Launches Gold-Backed Stabecoin

Tether, world's biggest stablecoin, has launched Alloy by Tether.

What is that about? New synthetic dollar backed by tokenised gold. Users can create aUSD₮ tokens using Tether Gold (XAU₮) as collateral.

A platform lets users create digital assets backed by the stability of gold.

New "Tethered assets" category: Tether is launching a new line of digital assets, starting with aUSDT.

aUSDT: This token is pegged to the dollar, but gets its value from real gold stored in Switzerland.

Over-collateralised for security: Tether promises there's more gold backing aUSDT than the tokens themselves, adding an extra layer of safety.

Creating more: This open platform lets users create new synthetic assets backed by their holdings, like aUSDT.

Not Tether's first Gold rodeo: Tether already has a gold-backed token called XAUT, but it hasn't gained as much traction as their mega-popular USDT stablecoin.

What's the verdict? This could be a game-changer for Tether.

Offering investors a new way to hold gold in the digital world.

Questions about how transparent and secure the gold storage is remain, and so does the market reaction in terms of adoption.

The Surfer 🏄

VanEck is launching the first Bitcoin ETF on the Australian Securities Exchange (ASX) on June 20. VanEck has received regulatory approval after three years of effort to bring Bitcoin ETFs to Australia.

Chinese telecom giant Coolpad is investing $13.5 million in Bitcoin mining rigs. Major shift for Coolpad, which has traditionally focused on smartphones. Plans to acquire 2,700 Bitcoin mining servers for mining computing power.

South Korea will reevaluate 600 crypto listed on local exchanges. The review aims to ensure compliance with new regulations under the Virtual Asset User Protection Act.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋