Happy Sunday,

Hope you're having a properly lazy weekend.

Let’s have a lazy thought. A South African winemaker wants to sell premium bottles to a London importer. Simple transaction, right? Wrong.

The winemaker pays 3-6% in banking fees, waits 5-12 days for settlement, and drowns in paperwork to prove his wine's origin and quality. Meanwhile, the London buyer pays similar fees, deals with currency conversion hassles, and has no real-time visibility into when the wine ships or arrives.

This friction is especially acute in the segment of agriculture that crosses borders. about 20% of the world’s $2.7 trillion agricultural output is traded internationally each year which is roughly $500–600 billion worth of goods exposed to these delays, fees, and compliance hurdles.

Small farmers in emerging markets get squeezed by intermediaries, importers can't verify product provenance, and everyone loses money to inefficient payment rails that were designed decades before the internet existed.

But what if that same wine trade could settle in seconds with 0.15% fees, complete transparency from vineyard to warehouse, and immutable documentation that satisfies both customs officials and sustainability-conscious consumers?

That's exactly what AgriDex built. The platform has already processed trades equivalent to 32 million avocados, facilitated live farmland sales in Zambia, and helped exporters from South Africa ship everything from wine to coffee with dramatically lower costs and faster settlement.

AgriDex represents a real-world asset platform with actual real-world usage, solving concrete problems for an industry that desperately needs modernisation.

This October, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), Balaji Srinivasan (Founder, The Network State), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Don’t miss your chance to be part of the defining crypto event of the year.

Use code TOKENDISPATCH15 for an exclusive discount

The Agricultural Trade Problem

Global food production is remarkably efficient. We can grow, harvest, and process agricultural products at massive scale with sophisticated technology. But when it comes to trading these products across borders, we're still operating with 1990s infrastructure.

Consider the typical export journey for a coffee farmer in Africa selling to a roaster in Europe. The farmer deals with multiple intermediaries, each taking a cut. Payment might require converting local currency to dollars, then to euros, with banks charging fees at every step. Documentation proving origin, quality, and sustainability credentials gets passed through fax machines and email. Settlement takes days or weeks, during which currency fluctuations can eat into already thin margins.

These inefficiencies compound throughout the supply chain.

Bottlenecks at ports and borders cost $50 per container per day in demurrage, with shipments sitting idle for 7+ days due to customs code complexity, redundant paperwork, and backlogged labs, drastically raising fertilizer and food prices in developing regions. Multiple intermediaries extract up to 45% of the value chain margin. For staples like bananas in Uganda, studies show that the farmer receives barely half the retail price: middlemen and wholesalers capture the rest, sometimes taking a $0.20 margin per $1 end price.

For farmers operating on slim margins, that's devastating. For consumers, it shows up as higher food prices and reduced transparency about what they're actually buying.

The problem is structural. Traditional agricultural trade relies on correspondent banking relationships, paper-based documentation, and manual reconciliation processes that haven't fundamentally changed in decades. Digital transformation in agriculture has focused on production — precision farming, IoT sensors, satellite monitoring — but largely ignored the financial and documentation infrastructure that connects producers to global markets.

This creates what AgriDex founder Henry Duckworth calls the "friction tax" on global food trade. It's particularly brutal for emerging market producers who face additional challenges like currency controls, underdeveloped legal systems, and limited access to trade finance.

Enter AgriDex

AgriDex is a digital marketplace where farmers and exporters can sell their products to buyers around the world. Think of it like Amazon, but specifically for agricultural goods like coffee, wine, or grains. The key difference is that AgriDex uses blockchain technology to make international payments instant and cheap, while keeping perfect records of every transaction.

Instead of trying to digitise existing trade finance processes, they built entirely new infrastructure using Solana blockchain, USDC stablecoins, and Stripe's Bridge technology to create something closer to the seamless experience you'd expect from modern financial technology.

👉🏼 Explore AgriDex

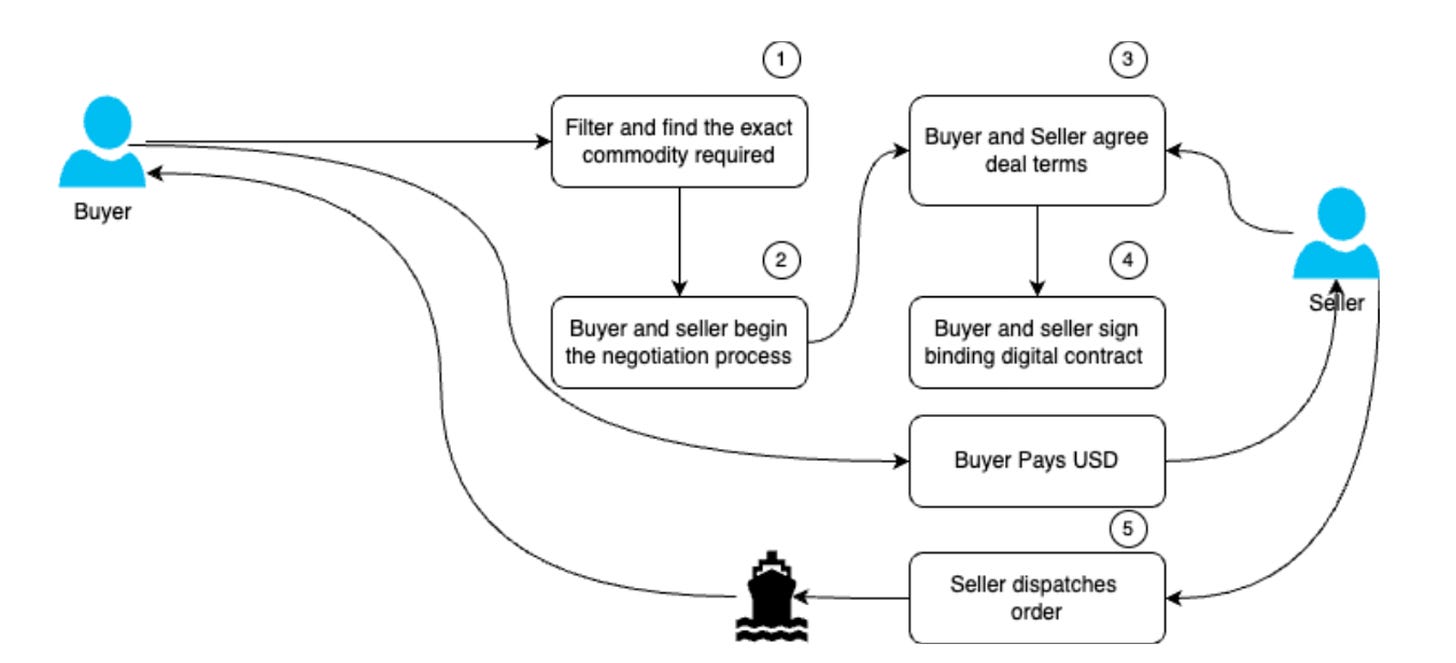

How does it work in practice?

A farmer or exporter lists their products on AgriDex with complete documentation such as origin certificates, quality testing, sustainability credentials.

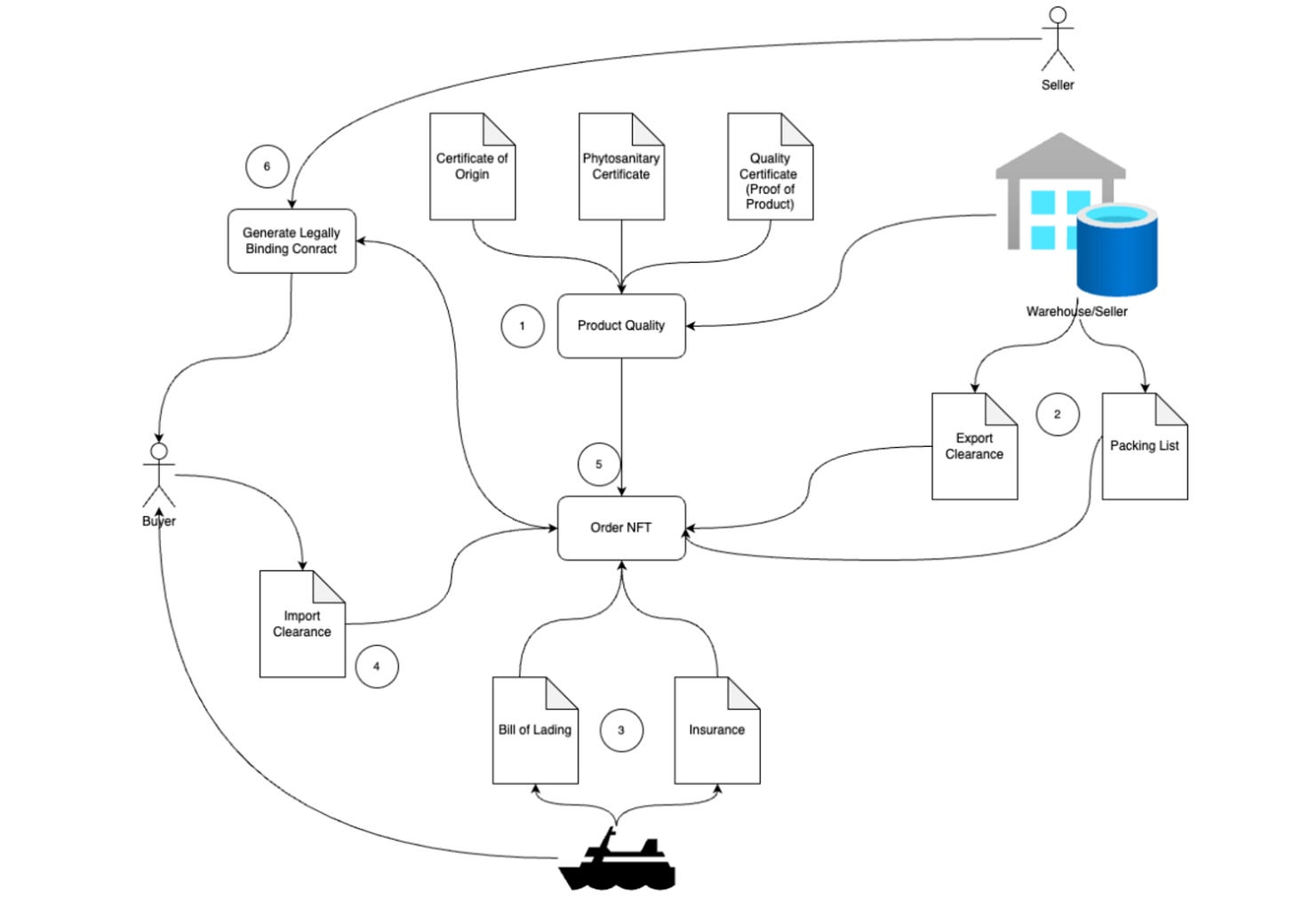

A buyer reviews the listing and agrees to terms. The agreement gets recorded on-chain as an NFT containing all transaction metadata.

Payment flows through USDC on Solana, but users never see crypto complexity thanks to Stripe Bridge handling local currency conversion automatically.

The result? Settlement in under 5 seconds and fees of 0.15-0.5%. Immutable documentation that can't be forged or lost. And complete transparency from farm to final destination.

AgriDex didn't start by trying to convince farmers to use crypto wallets. They started with established exporters who already had banking relationships and regulatory compliance, then gave them better tools for the same processes they were already doing.

AgriDex has processed trade volumes equivalent to 32 million avocados across multiple commodity categories.

Their first major showcase involved South African wine and olive oil exports to London, settling instantly at 0.15% fees per side. A subsequent coffee trade from the UK to South Africa demonstrated cross-border payments in different currencies, with the platform handling ZAR-to-GBP conversion seamlessly.

These are commercial transactions with real money, real products, and real businesses that chose AgriDex because it offered better economics than traditional alternatives.

The platform has attracted partnerships with established agricultural groups including the Parrogate Group, Oldenburg Vineyards, and Future Farms. These companies invested in AgriDex not just financially but operationally, committing to route actual trade flows through the platform.

The Technology Stack

AgriDex's technical architecture solves several problems that have plagued previous attempts at agricultural blockchain platforms. Built on Solana, it can handle high transaction volumes at low cost, which is critical for commodity trading where margins are thin and volume is high.

With the integration with Stripe, users can initiate payments in their local currency and receive settlements in their preferred currency, while USDC provides the settlement layer. This abstracts away crypto complexity while preserving the speed and cost advantages of blockchain settlement.

Each trade creates an NFT containing complete transaction metadata — product specifications, price, quality certificates, provenance data, and payment confirmation. These NFTs serve as tamper-resistant trade receipts that can be shared with customs officials, sustainability auditors, or supply chain partners without risking data manipulation.

The platform also supports advanced features like automated invoice processing, multi-currency settlements, and compliance reporting for sustainability frameworks. AgriDex claims coverage of most of the 1,100 EU sustainability datapoints, positioning their platform as infrastructure for increasingly complex global trade compliance requirements.

Crucially, the system operates under established legal frameworks. Contracts are governed by English company law, providing familiar dispute resolution mechanisms for international traders. This bridges the gap between blockchain innovation and traditional legal systems that actually matter when things go wrong.

Beyond Simple Tokenisation

AgriDex operates in the emerging agricultural RWA space, but their approach differs significantly from competitors. Understanding these differences reveals why their model might have more staying power than previous attempts.

1/ Agrotoken focuses on creating grain-backed stablecoins. Essentially turning commodities into money. Each SOYA or CORN token represents one ton of collateralised grain, priced via established commodity indices. It's innovative, but limited to specific staple crops and requires sophisticated custody infrastructure.

2/ LandX tokenises future crop yields, allowing investors to buy exposure to agricultural production before harvest. This creates interesting DeFi opportunities but pushes investors up the risk curve with weather, pest, and price volatility.

3/ Dimitra and Regen Network focus on carbon credits and regenerative agriculture, tokenising environmental impact rather than commodity trades. Important for climate goals, but addressing different use cases than cross-border commerce.

Earlier platforms like GrainChain and AgriDigital proved blockchain could work for agricultural supply chains but didn't evolve toward full tokenisation or DeFi integration. Binkabi pioneered warehouse receipt tokenisation in Africa but remained focused on localised markets.

AgriDex sits at the intersection of all these approaches. They tokenise trade documentation rather than physical commodities, avoiding custody complexities while maintaining transparency benefits. They focus on cross-border settlement rather than yield speculation, targeting immediate operational problems rather than financial engineering. And they integrate with existing trade finance rather than trying to replace it entirely.

The $AGRI Token

AgriDex's native token AGRI launched in December 2024 with a 1 billion total supply and initial price around $0.065. The token serves multiple functions within the platform ecosystem which includes governance voting, fee payment discounts, liquidity rewards, and planned staking for sustainability project funding.

The tokenomics include a buyback mechanism using platform profits and a roadmap that sequences MVP product development, KYC/AML onboarding, fiat-crypto integration, ESG reporting, and additional finance modules through 2025.

The key question for AGRI's value proposition is whether platform utility will drive sustainable demand. Unlike pure governance tokens, AGRI has real utility for platform participants. Fee discounts create natural buying pressure from active traders, while staking rewards could attract yield-seeking capital.

But token value ultimately depends on platform adoption. If AgriDex processes their target $40 million in annual transaction volume through their new Loam payments platform, fee revenues could support meaningful token economics. If they capture a significant portion of their $4.5 billion pipeline in pending trade commitments, AGRI could see substantial demand from ecosystem participants.

The risk is that agricultural trade moves slowly and adoption curves are measured in years, not months. AGRI holders are essentially betting on AgriDex's ability to execute on a multi-year vision of transforming global food trade infrastructure.

Then there’s Loam, AgriDex's newest product which represents the platform's evolution from trade documentation to complete payment infrastructure. Launched in April 2025, Loam targets $40 million in transaction volume by year-end by focusing specifically on cross-border payment friction.

The platform settles transactions in under 5 seconds with fees below 0.5%, compared to traditional agricultural payment rails that can take weeks and cost 5-12% in total fees. For the cocoa trade from Nigeria to Rotterdam that currently loses 12.6% to transaction costs, Loam represents dramatic cost savings that can be passed through to producers.

RWA Agriculture's Moment

AgriDex operates within the broader context of rapidly expanding real-world asset tokenisation. The RWA market has grown over 260% in 2025, reaching approximately $28.4 billion in total value. Private credit leads at over $16 billion, followed by tokenised Treasuries at $7.5 billion.

Agricultural RWAs represent a small but growing portion of this market, with unique characteristics that differentiate them from financial asset tokenisation. Food security concerns make agricultural trade politically important across jurisdictions. Sustainability and traceability requirements create natural demand for transparent documentation systems. And the global nature of food production creates arbitrage opportunities for platforms that can efficiently connect producers to markets.

The timing appears favourable for agricultural blockchain adoption. Institutional acceptance of tokenised assets is growing, with major financial institutions like BlackRock and J.P. Morgan launching tokenised funds. Regulatory frameworks are becoming clearer, particularly around stablecoin usage for commercial payments. And the underlying technology has matured to the point where blockchain platforms can offer genuine operational advantages over legacy systems.

AgriDex's approach of focusing on operational improvements rather than financial engineering may prove more sustainable than purely speculative RWA projects. By solving real problems for existing businesses, they're building a platform that could survive crypto market cycles and regulatory uncertainty.

For agricultural exporters, particularly in emerging markets, AgriDex represents immediate operational benefits. The cost savings alone—from 3-6% to 0.15-0.5%—can meaningfully improve margins in a low-margin business. Faster settlement improves cash flow and reduces currency exposure. And transparent documentation can enable premium pricing for quality and sustainability attributes.

For importers and buyers, the platform offers better supply chain visibility and reduced administrative burden. Real-time tracking, automated compliance reporting, and immutable documentation reduce operational costs while improving quality assurance. The ability to verify provenance and sustainability claims is increasingly important for consumer-facing brands.

For financial institutions, AgriDex could represent either a threat or an opportunity. Banks that provide trade finance might see reduced demand for their services, but could also partner with AgriDex to offer blockchain-enhanced products to existing clients. The standardised data and transparent transactions could improve underwriting for agricultural lending.

For investors, agricultural RWAs offer diversification benefits and exposure to a sector that's largely uncorrelated with traditional financial markets. Climate change and growing global population create long-term tailwinds for agricultural innovation. The challenge is distinguishing between platforms with real utility and those riding RWA hype.

For policymakers, agricultural blockchain platforms raise questions about financial inclusion, food security, and economic development. Platforms that reduce friction for emerging market producers could support development goals, but regulatory frameworks need to balance innovation with consumer protection.

The stakes extend beyond platform success to questions about financial inclusion, food security, and global development. If blockchain can genuinely reduce friction in agricultural trade, it could help small farmers access global markets, improve food traceability, and create more efficient allocation of global food resources.

That's the kind of real-world impact that could justify the hype around tokenising everything.

But it requires execution, adoption, and sustained value creation, not just technological innovation. AgriDex's early traction suggests they understand this challenge. Their continued growth will show whether blockchain can actually deliver on its promises beyond finance and speculation.

That’s it about AgriDex. Will come to you with another cool product next week.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.