Allo Wants Your Stocks Trading Like Crypto

A look at the platform bringing tokenised equities and Bitcoin products to BNB Chain.

You can already buy stocks, and your broker settles the transactions in two days, typically with minimal fees, and the system generally functions smoothly. But imagine if you could buy the same stocks, but on a blockchain. You could trade them at 4 AM if you wanted, and instead of receiving shares, you’d receive tokens representing those shares. Plus, you could use those tokens as collateral to borrow other tokens.

This is Allo.xyz. They’ve tokenised $2.4 billion in real-world assets, raised over $100 million (including a Bitcoin-backed credit facility, which is a fun phrase), and built what they’re calling “the world’s first exchange for tokenised stocks with 24/7 trading.” They have about 60,000 users, partnerships with Binance ecosystem players, and a token called RWA that you can use for... well, we’ll get to that.

The question is: Does anyone actually need this? And if they do, can Allo deliver it better than the dozen other companies trying to do something similar?

👉🏼 Explore Allo

What Allo Actually Does

Allo is a Real-World Asset (RWA) tokenisation platform built on the BNB Chain. It takes traditional financial assets, particularly stocks, and creates blockchain-based versions that can be traded around the clock.

Allo holds real stocks in secure custody through regulated partners. For every real share held, the platform mints a corresponding token on the blockchain. For example, if you buy one aTSLA token, that represents one actual Tesla share sitting in custody. If you buy 0.5 aAAPL, that’s half a share of Apple.

These tokenised stocks can be traded on Allo’s exchange, AlloX, which operates 24/7 with an on-chain order book. Trades settle instantly or near-instantly, eliminating the two-day settlement period standard in traditional markets.

But Allo isn’t just about stocks. The platform has expanded into several related products:

alloBTC (Bitcoin Liquid Staking)

Allo’s biggest product by value is alloBTC, a liquid staking token for Bitcoin. Users deposit BTC and receive alloBTC tokens in return. These tokens can be used in DeFi protocols for lending, borrowing, or providing liquidity while the underlying Bitcoin continues earning staking rewards.

As of late 2024, Allo had staked over $50 million in Bitcoin through partnerships with Babylon Bitcoin Staking Protocol. This positions alloBTC as a key product in the growing Bitcoin DeFi ecosystem.

Fund Formation and Management

Allo provides tools for creating and managing tokenised investment funds. Users can set up Special Purpose Vehicles (SPVs) with built-in KYC/AML compliance, multi-signature security, and automated token distribution. The platform claims users can create a fund in under 60 seconds.

RWA Marketplace

Beyond stocks and Bitcoin, Allo’s marketplace supports tokenisation of real estate, private equity, commodities, and other tangible assets. The platform has processed over 25,000 transactions, with more than $2.2 billion in total tokenised assets deployed on BNB Chain.

Lending Against Assets

Allo recently secured a $100 million Bitcoin-backed credit facility from lenders, including Greengage and a US institution. This facility enables users to borrow against their Bitcoin and tokenised stock holdings without selling them.

The platform has also secured a $50 million term sheet for lending against SpaceX stock, allowing private market shareholders to access liquidity without going through traditional secondary markets.

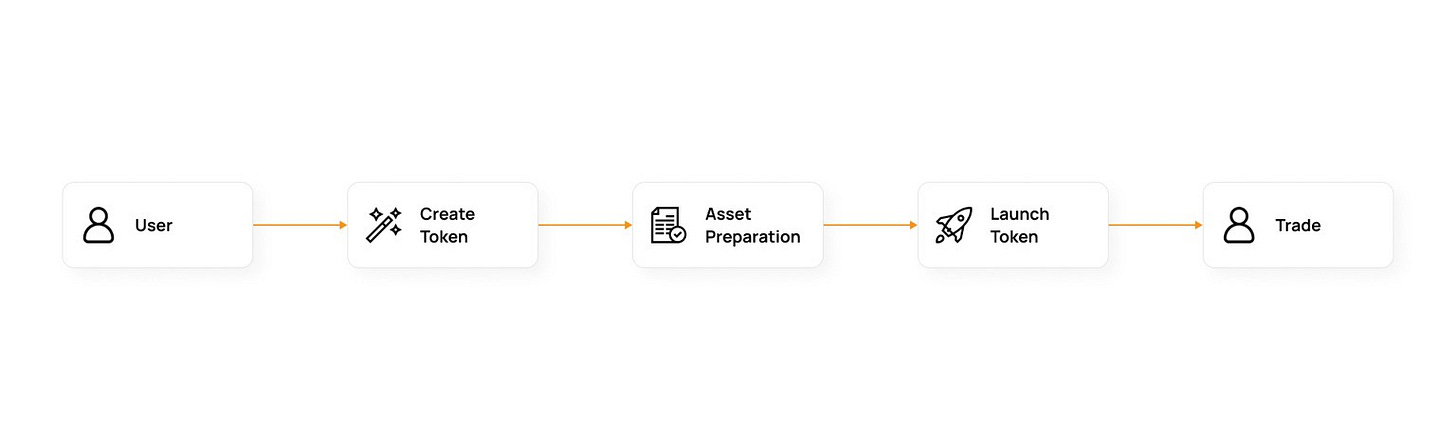

How It Works: Step by Step

Let’s walk through how someone would actually use Allo to buy tokenised stocks:

1. Account Setup

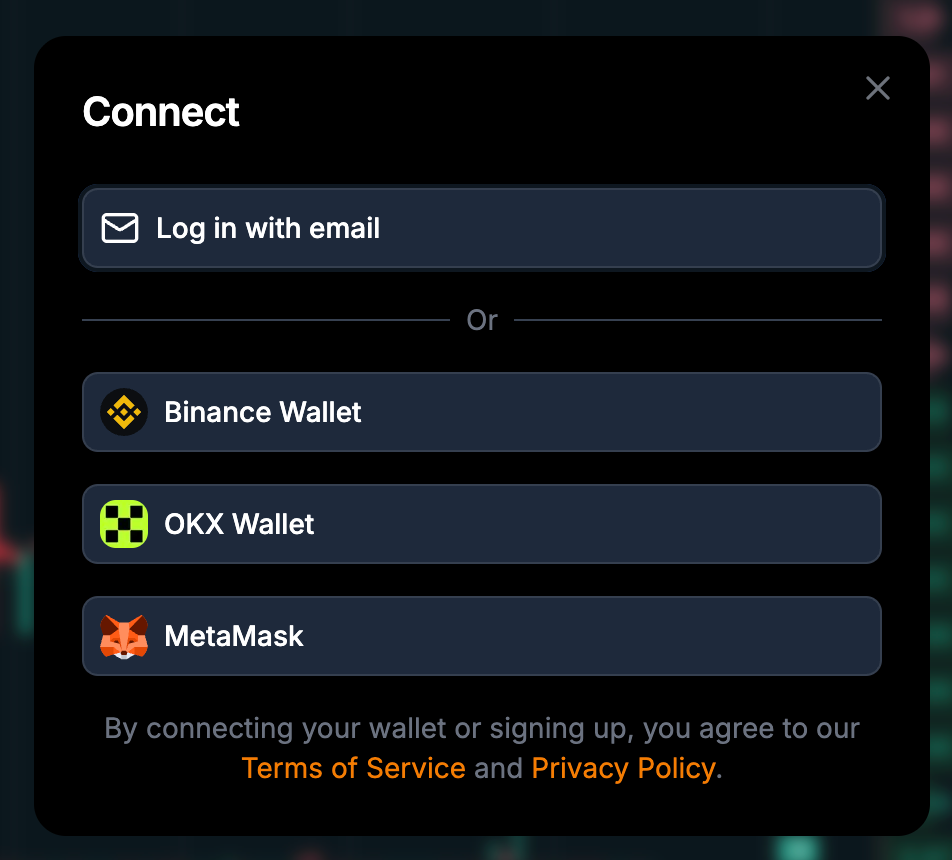

Users connect a Web3 wallet like MetaMask, Binance Wallet, or Phantom. Alternatively, they can sign up with just an email address. The platform handles wallet creation in the background for users who don’t want to manage private keys.

During signup, users complete KYC (Know Your Customer) verification. This is required because tokenised stocks are still securities subject to regulatory compliance.

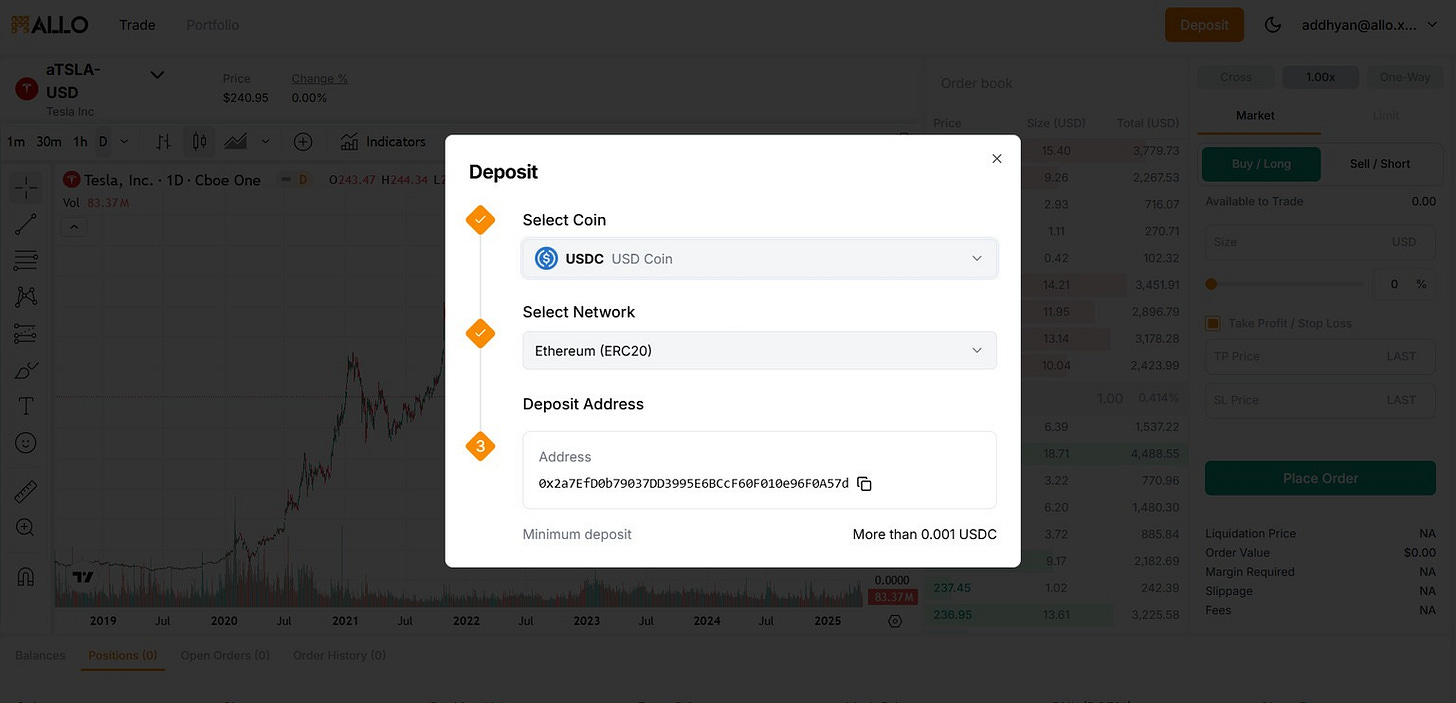

2. Deposit Funds

Users deposit stablecoins (USDC, USDT), other cryptocurrencies, or fiat currency through integrated payment rails. The platform supports deposits on multiple chains including Ethereum, Arbitrum, and BNB Chain.

3. Browse and Trade

The AlloX exchange lists over 140 tokenised assets. Each asset is prefixed with “a” (aTSLA for Tesla, aAAPL for Apple, aMSTR for MicroStrategy).

Users can place market orders (execute immediately at the current price) or limit orders (execute only at a specified price). The platform also supports advanced order types, including stop-limit and stop-market orders.

4. Fractional Ownership

Unlike traditional brokers, Allo allows fractional ownership with no minimums. Users can buy $10 worth of Amazon or $50 worth of Berkshire Hathaway, stocks that typically cost hundreds or thousands per share.

5. Zero Trading Fees

Allo charges zero commissions on stock trades. The platform makes money through spreads (the difference between buy and sell prices) and potentially through its lending and staking products.

6. Instant Settlement

When a trade executes, ownership transfers immediately on the blockchain. This eliminates the T+2 settlement period standard in traditional markets where trades take two business days to finalise.

7. Self-Custody

Users maintain control of their tokenised assets in their own wallets. This is different from traditional brokers where the broker holds securities on your behalf. With Allo, you truly own the tokens representing the stocks.

8. Using Tokens in DeFi

Because the tokenised stocks exist on-chain, users can theoretically use them in other DeFi protocols. They could provide liquidity, use them as collateral for loans, or incorporate them into automated trading strategies.

Why BNB Chain Matters

Allo’s decision to build on the BNB Chain is central to its value proposition. BNB Chain transactions cost fractions of a cent, compared to Ethereum’s mainnet where fees can reach $10-$50 during network congestion. For a platform marketing zero trading fees, keeping blockchain costs low is essential. The chain can process 100-150 transactions per second with 3-second block times, enabling the responsive trading experience users expect from centralised exchanges.

Because BNB Chain is Ethereum Virtual Machine (EVM) compatible, developers can use familiar tools and smart contracts can be easily ported from Ethereum. This lowers development costs and speeds time to market. Building on BNB Chain also provides natural integration points with Binance exchange, Binance Wallet, and other Binance ecosystem products, helping with user acquisition and liquidity.

Allo was selected for the BNB Chain MVB8 Accelerator Program in late 2024, a competitive program run by BNB Chain, Binance Labs, and CMC Labs. Selection came with up to $750,000 in investment and strategic support from the Binance ecosystem.

The RWA Token

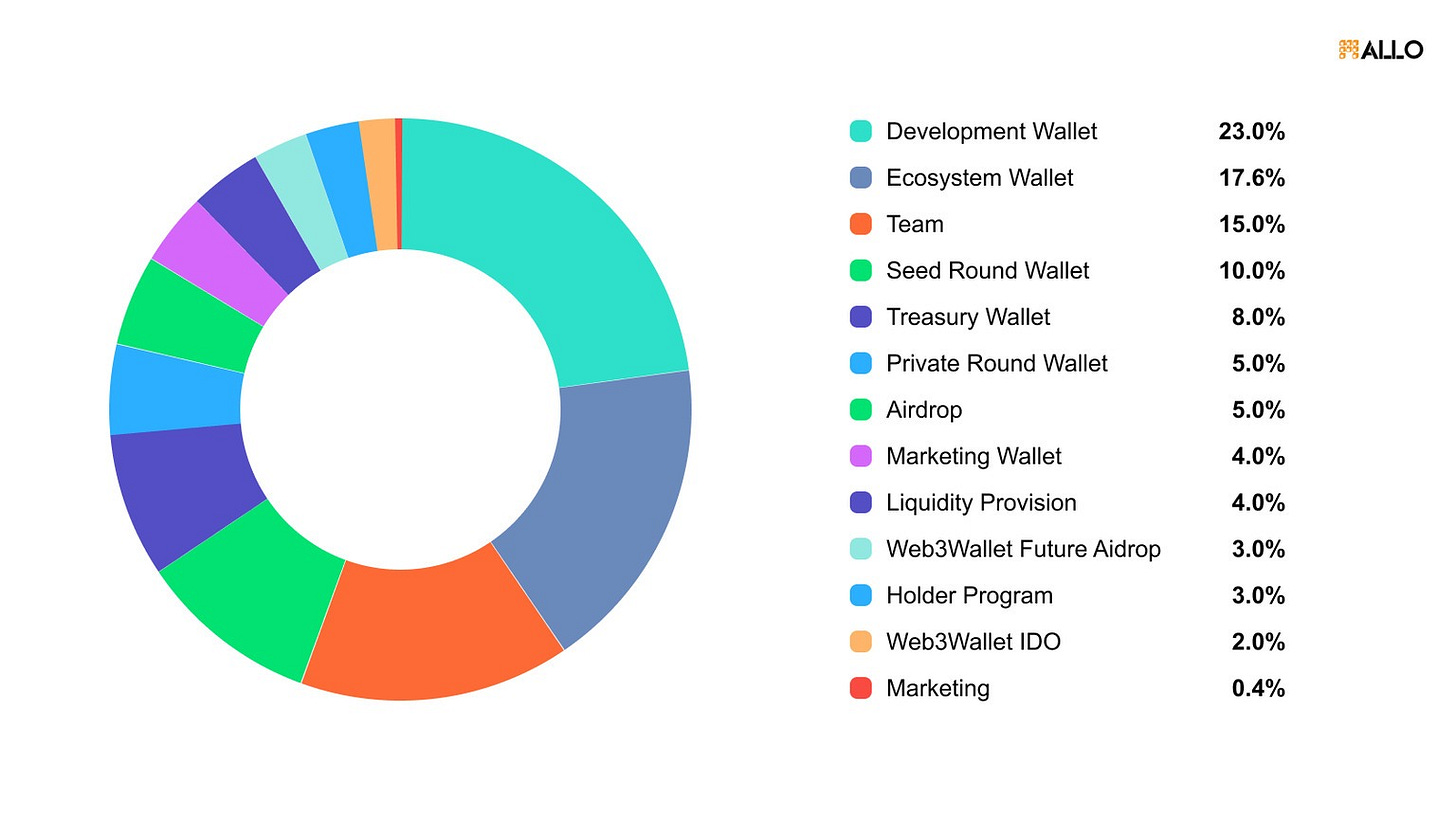

Allo has a native token called RWA (ticker: $RWA) that serves multiple functions within the ecosystem. The token has a maximum supply of 10 billion, with approximately 1.8 billion currently circulating. Trading around $0.004 USD, the market cap sits at approximately $7.6 million. The token operates as a BEP-20 token on BNB Chain at contract address - 0x9C8B5CA345247396bDfAc0395638ca9045C6586E.

The RWA token is used to mint digital representations of real-world assets on the platform.

When users want to tokenise stocks, real estate, or other assets, they pay fees in RWA. Users can stake RWA tokens to earn yields and protocol rewards, helping secure the network and incentivising long-term holding. Token holders can vote on protocol proposals, fee structures, and ecosystem development priorities. RWA tokens can also be used as collateral in Allo’s lending markets, and the platform distributes them as rewards for community engagement and promotional activities.

The tokenomics include various vesting schedules designed to align long-term incentives:

Seed & Private Rounds (1.5B tokens): 1-year cliff + 2-year linear vesting

Team (1.5B tokens): 1-year cliff + 3-year linear vesting

Development (2.3B tokens): 4-year linear vesting

Ecosystem (1.76B tokens): 1-year cliff + 2-year linear vesting

Airdrop & Immediate Liquidity (1.24B tokens): No vesting

The vesting structure suggests the team is thinking long-term, with most tokens locked for at least one year, and many locked for 3-4 years.

Funding and Investment

Allo has raised over $103 million across multiple funding rounds. A $2 million seed round in December 2024 was led by NGC Ventures, Gate Labs, and Morningstar Ventures, with participation from Chain Fund, Cluster Capital, and Cogitent. A $750,000 pre-seed round in September 2024 was led by YZi Labs (formerly Binance Labs). The biggest piece is the $100 million debt financing in December 2024, a Bitcoin-backed credit facility from a consortium that includes Greengage.

The investor lineup includes heavy hitters from both crypto and traditional finance. NGC Ventures is one of the largest institutional blockchain investors. Gate Labs is affiliated with the Gate.io exchange. Morningstar Ventures is a specialised crypto investment fund. YZi Labs is Binance’s investment arm. This funding, particularly the $100 million credit facility, provides Allo with the capital to scale its lending operations and onboard institutional clients.

Competitive Landscape

The RWA tokenisation space is getting crowded. Here’s how Allo stacks up against major competitors:

Securitise

The most established player in security tokenisation. Securitise has tokenised over $1.4 billion in assets and partners with major financial institutions. Their focus is primarily on private securities and funds, rather than public stocks.

Allo’s advantage: 24/7 trading and instant settlement for public equities.

Ondo Finance

Specialises in tokenised US Treasury products with over $1.25 billion in TVL. Strong institutional partnerships and regulatory compliance. Their USDY token is widely integrated into DeFi protocols.

Allo’s advantage: Broader asset coverage beyond just treasuries, including stocks and Bitcoin products.

Polymath

Pioneer in security token offerings (STOs) and creator of the ERC-1400 token standard. Strong focus on regulatory compliance but less emphasis on trading infrastructure.

Allo’s advantage: Actual functioning exchange with real liquidity, not just tokenisation infrastructure.

RealT

Focuses specifically on real estate tokenisation with fractional property ownership. Over 400 tokenised properties generating rental income for token holders.

Allo’s advantage: Multi-asset platform covering stocks, Bitcoin, and real estate rather than single-asset focus.

Synthetix

Provides synthetic assets through derivatives rather than actual custody. Users can gain exposure to stocks and commodities without the platform holding real assets.

Allo’s advantage: 1:1 backing with real assets provides legal ownership rights that synthetic assets don’t offer.

Allo differentiates itself through its focus on public equity markets, 24/7 trading, and Bitcoin integration. Most competitors focus on private markets, treasuries, or specific asset classes. Allo is attempting to cover the broadest possible range of real-world assets in a single platform.

Realistic Assessment

Allo addresses a genuine market inefficiency. Traditional stock markets weren’t designed for a global, 24/7 digital economy. T+2 settlement, market hours restrictions, and geographic limitations create friction that blockchain technology can eliminate. The technology is working with billions in processed transactions, partnerships with serious institutional players, and substantial funding from legitimate investors.

However, there are important considerations for Token Dispatch readers. Tokenised stocks are still securities, and Allo operates in a regulatory gray area that could change quickly. The platform’s involvement with the Qatar Financial Center suggests they’re taking compliance seriously, but regulations could tighten. Despite the “decentralised” narrative, users must trust Allo’s custody partners to actually hold the underlying stocks. If custody breaks down, tokens become worthless. This represents a centralisation point that traditional DeFi doesn’t have.

24/7 trading is only valuable if there’s liquidity around the clock. Most trading volume still happens during traditional market hours because that’s when real price discovery occurs. Off-hours trading might offer worse prices due to thin order books. While Allo tokens can trade 24/7, the underlying stocks only trade during regular market hours. This creates potential for price dislocations. What happens if major news breaks over the weekend and tokenised shares move significantly off their Friday closing prices?

Major financial institutions are entering tokenisation. BlackRock’s BUIDL fund crossed $2 billion in 2025. Traditional exchanges like SIX Digital Exchange are launching tokenised securities. Allo faces competition from players with deeper pockets and regulatory relationships. The utility of the RWA token is still developing. While staking and governance are standard, the specific mechanisms for value accrual aren’t yet clear.

That’s all about Allo. More cool products are coming.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The timing point around 24/7 trading creating price disloctions when major news breaks over weekends is underrated. Institutional competion from BlackRock and traditional exchanges makes the path forward interesting but uncertain. The custody centralization issue feels like the biggest vulnerability here.