All's well that ends well ☺️

Crypto hedge funds rebound in 2023, eyeing a strong 2024. MicroStrategy's BTC purchases and the stock surge. European crypto stats. Ark Invest's selling moves. Solana's BONK hits the slide down.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

So, crypto is back!

Crypto hedge funds? Bouncing back after a tough 2022.

Many anticipate a strong 2024.

Impressive gains: Pantera Capital’s fund up by 80% in 2023, Chainview Capital doubled, and Stoka Global LP soared 268%.

The sector recovers despite not matching Bitcoin's 150% rally.

One-third of crypto hedge funds closed post-FTX collapse and other market challenges: about 250 of 712 funds closed.

Average 44% return for crypto hedge funds as of December 20, 2023.

Dan Slavin of Chainview Capital predicts a resurgence similar to the Bitcoin breakout three years ago.

“It’s looking like there’s going to be another token mania coming.”

What's 2024 looking like?

Predictions of heightened cryptocurrency market activity by institutional investors in 2024.

Factors influencing this trend

Potential spot bitcoin ETF approval

Anticipated U.S. Federal Reserve rate cuts

Improved regulatory clarity

Rising Interest from Institutions Since Late 2023

Deribit data shows a notable increase in institutional investor activity starting October 2023.

Optimism about the Federal Reserve cutting rates three times in 2024 has been fuelling share prices.

Futures markets predict the first rate cut of 25 basis points in March 2024, as per CME Group data.

The year 2024 is expected to bring greater regulatory clarity.

Key developments: The EU's MiCA legislation, and regulatory advancements in Singapore, Hong Kong, Japan, and the UK's Digital Securities Sandbox.

Crypto Market

Bitcoin: +50% this quarter; Ether: +30%.

Solana (SOL) surged over 1,000% YTD, up 95% in december.

BNB is up 43.0% over the last month.

TTD Numbers 🔢

14,620 BTC

MicroStrategy is buying more Bitcoin.

Now got an additional 14,620 BTC (for $615.7 million) between Nov. 20, 2023, and Dec. 26, 2023.

Total Holdings: The firm now holds 189,150 BTC, with an overall investment of approximately $5.9 billion.

Previous Bitcoin Purchases

Why? Anticipation of ETF approval by January 10.

Michael Saylor views the potential approval of a spot Bitcoin ETF as a major development for mainstream investment in BTC (We all do).

All of this pushed the stocks high: MicroStrategy's (MSTR) stock price surged by over 350% in 2023.

Financial Health: Total liabilities at $2.534 billion as of Sept. 30, with a year-over-year decrease of 7.7%.

If you think, what's with this Bitcoin stocking - it's the ETF brigade that's all in it - holding MicroStrategy shares

TTD Europe 🇪🇺

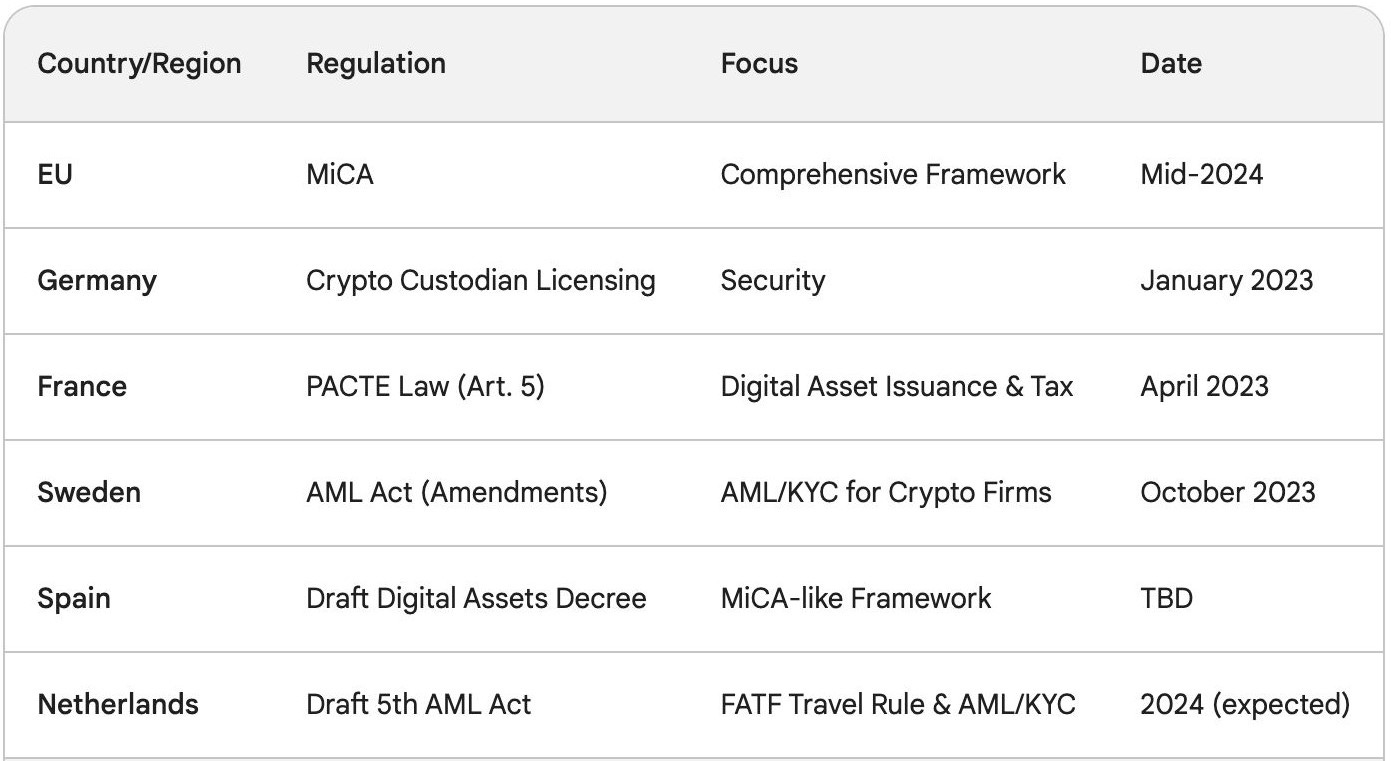

Major Crypto Regulations in Europe - 2023

Here’s the 2023 crypto stats in Europe

Growth

Almost 1,000 new virtual asset service providers (VASPs) registered in the EU in 2023, bringing the total to over 11,597.

2023 ending with roughly 34 new crypto entities registered per week in the EU.

Central, Northern, and Western Europe (CNWE) is the second-largest cryptocurrency economy globally, accounting for 17.6% of global transaction volume between July 2022 and June 2023.

Leaders

Czechia leads with 9,372 registered VASPs, but 83% are individuals (likely higher with updated data).

Poland follows with 1,067 VASPs, seeing rapid growth in Q4 2023.

Regulation

MiCA (Markets in Crypto-Assets) regulation takes effect in December 2024, impacting registration rates.

MiCA may cause a drop in overall registered entities due to stricter requirements, excluding individuals and "letter-box" companies.

Where’s ETF? 🚨

The potential approval of a spot Bitcoin ETF in the US could create problems for the original vision of Bitcoin - analysts👇🏻

TTD ARK💰

Ark Invest, led by Cathie Wood, has sold its entire Grayscale Bitcoin Trust (GBTC) holdings.

Half of the proceeds from the GBTC sell-off, approximately $100 million, have been allocated to the Bitcoin Futures ETF BITO, as reported by Bloomberg analyst Eric Balchunas.

Alongside, Ark Invest has sold 148,885 Coinbase shares worth $27.5 million through its ARK Next Generation Internet ETF (ARKW).

These moves are seen as proactive steps in anticipation of the potential approval of a spot Bitcoin ETF by the SEC before January 10, 2024.

TTD Solana 📶

Solana's new superstar BONK experiences sharp decline from peak.

The price of Bonk is $0.00001325 currently. 14.80% price decline in the last 24 hours and a 32.80% decline in the past 7 days.

It is now 61.30% down from all-time high.

Market Cap Slide: Once surpassing $1 billion, BONK's market cap now stands at $805 million, ranking it as the 90th largest crypto-asset. It peaked at the 69th spot on December 14.

The pullback suggests profit-taking by early investors.

Solana developers received BONK in an airdrop last year, with those retaining the asset seeing substantial returns.

Despite the recent fall, BONK has surged by 17,196% since its launch last Christmas, benefiting long-term holders.

High Trading Volumes on Solana DEX:

Despite the pullback, Solana-based decentralised exchange applications saw high trading volumes.

$1.44 billion worth of tokens traded in the past 24 hours, accounting for 26% of all DEX trading volumes.

This had happened

TTD Surfer 🏄

Worldcoin, the crypto project co-created by OpenAI CEO Sam Altman, has launched in Singapore after pausing in India.

Crypto exchange Bitzlato has announced the temporary suspension of all Bitcoin withdrawals.

The Ledger Live software, used for managing cryptocurrency wallets, has been found to track users and collect data about them.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋