Altcoin Season Incoming? 🌈

Impressive 2024 Q1 for Big Tech. Bull case for Altcoins. ICP founder says 95% of blockchains are snake oil. Consensys v SEC fight. Solo miner's 3.125 BTC lottery. DOJ rejects Tornado case dismissal.

Hello, y'all. We kick off another week brewing, so sing along 🎶

We had joy, we had fun | We had seasons in the sun | But the hills that we climbed | Were just seasons out of time | We had joy, we had fun …. 🪗

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Busy week ahead for investors. Fed, Jobs, and Big Tech Earnings.

Tech stocks soared on Wall Street Friday

Microsoft & Alphabet: Beat earnings estimates.

Microsoft & Alphabet (the parent company of Google) beat earnings estimates.

Microsoft: Revenue of $61.9 billion, stock up 2%.

Alphabet: Revenue of $80.5 billion, stock up 10%, record $2.2 trillion valuation.

Amazon: Up 3.5%, positioned ahead of earnings report.

Nvidia: Up 6.2%, biggest daily gain since March, on strong AI investment outlook.

What's the biggest take away? Enterprise AI in monetising AI ambitions.

Market Watch This week

Fed Meeting (Tuesday & Wednesday): No rate change expected, but all eyes are on Fed Chair Powell's press conference for clues on future rate cuts.

Big Tech Earnings (All Week): Amazon, Apple, AMD, and more tech giants report quarterly results, giving insights into consumer spending and tech industry health.

Jobs Report (Friday): Will the strong job growth continue in April? Investors are watching closely.

Altcoins Season Incoming?

We have few signs to look at.

1) ETH fees at a low

Ethereum transaction fees are at a 6-month low, and analysts at Santiment believe this could signal an altcoin rally sooner than expected.

Here's why?

Historically, low transaction fees on the Ethereum network have coincided with altcoin rallies. This is because traders move between periods of euphoria and fear, and high transaction fees are paid during periods of euphoria. Low transaction fees may indicate a period of low demand, which could precede a rally.

Ethereum's price has also risen slightly in the last week.

2) Tether dominance down

Historically, when Tether (USDT) dominance goes down, altcoins go up.This suggests a potential shift in investor focus from stablecoins like Tether to altcoins.

Moustache also points to a "backtest" on the Tether dominance chart. In this case, a "backtest" could indicate a temporary dip before a larger upward trend for altcoins.

3) Altcoins market cap

Despite Bitcoin's price swings, the total value of all altcoins has been steady, suggesting potential for a breakout.

Things has cooled down a bit, through the bumpy April.

Market cap down to $260 billion.

4) Bitcoin cools down

Bitcoin is trading at around $62K - 15% down from its March high of $73K.

Traditionally, altcoin seasons occur when Bitcoin price cools down or experiences a correction after a significant rise. This frees up capital that investors can then allocate to altcoins.

Bitcoin dominance? Still at 54%.

Believers will be believers, and here is one 👇

Don't you forget, eh? We are waiting in the wings for May, and you know what May is all about, eh? "Sell in May and go away, do not return until St. Leger's Day."

Block That Quote 🎙️

Dominic Williams, Internet Computer Founder.

"It's gotten to a place where people actually invest in snake oil. Like, 'who's got the best snake oil, I'm going to invest in that because their marketing is better."

Williams says 95% of Blockchains are "snake oil."

He thinks most blockchains are junk, fuelled by hype and bad marketing.

We wrote about the same occurrence very recently.

Read: Crypto's Billion-Dollar Zombies 🧟♀️

Williams says only 5% of blockchains have real value (including Bitcoin and Ethereum).

He believes the rest are just "snake oil" with fancy websites and empty promises.

He says Internet Computer, on the other hand, is the holy grail - a "third-generation" blockchain that can handle a truly decentralised internet.

Consensys Ain't Backing Off

Consensys, the company behind the popular MetaMask wallet, is suing the SEC.

They claim the SEC is overstepping its authority and trying to control Ethereum.

Here's the breakdown

SEC wants to classify Ethereum as a security. This would mean stricter regulations for projects built on Ethereum.

Consensys says Ethereum isn't a security. They argue it's a separate asset class with its own rules.

The SEC is also targeting MetaMask. They say features like swapping and staking make Consensys an unlicensed broker.

Consensys says MetaMask is just a wallet, like a web browser. They argue it doesn't give them control over user funds.

This lawsuit is a big deal for the crypto industry. It could determine how the SEC regulates Ethereum and other DeFi projects.

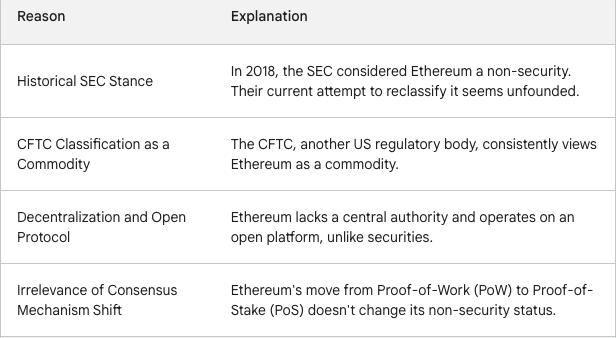

Why shouldn't Ethereum be classified as a security according to Consensys?

In the Numbers 🔢

3.125 Bitcoin

Solo Bitcoin Miner Wins the Lottery.

A lone Bitcoin miner defied the odds and solved a block solo, winning the full 3.125 BTC reward (around $200,000).

This is like winning the lottery in the Bitcoin world—it's incredibly rare (it has only happened 282 times out of the 841,300 blocks produced since Bitcoin’s inception 14 years ago).

Why so rare?

Hash Rate Rush: More miners compete for rewards, making solo success difficult.

Computational Power: Solving blocks requires serious computing muscle.

This miner likely had a powerful setup (around 0.12% of the total network hash rate) and might have switched from pool mining after the halving to try their luck.

Note: Solo Bitcoin mining refers to the process of mining Bitcoin completely independently, without joining a mining pool.

DOJ Opposes Dismissal of Tornado Cash Case

The US Justice Department (DOJ) is pushing back against attempts to dismiss charges against Roman Storm, co-founder of crypto mixer Tornado Cash.

DOJ Rejects Dismissal: The government wants Storm to face trial for money laundering and sanctions violations.

The Charges

Conspiracy to commit money laundering

Operating an unlicensed money transmitter

Violating sanctions

The DOJ argues Tornado Cash qualifies as a money transmitter even though it doesn't directly control funds. This could have wider implications for crypto privacy tools.

The Surfer 🏄

Arkham Intel found wallets associated with WBIT, a physical Bitcoin exchange-traded product (ETP) from WisdomTree. WBIT holds 8,900 BTC across 134 wallets, valued at around $579 million.

Crypto trader known by the Solana Name Service username "paulo.sol" has netted over $22.8 million in profits by strategically trading Solana-based meme coins such as Dogwifhat (WIF), Jeo Boden (BODEN), and Bonk (BONK).

Prosecutors in Taiwan are recommending 20-year prison sentences for the four main suspects in the fraud and money laundering case related to the cryptocurrency trading platform Ace Exchange.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋