aPriori Shares What Others Leave Behind

What happens when high-frequency traders build a staking protocol.

You stake your tokens. They earn 5%. You think that’s what staking pays.

But there’s another game happening on the same network - one you don’t see. Sophisticated players are pulling value from every block using infrastructure that ordinary users can’t access. Last year alone, over $1.1 billion was captured on Ethereum.

That’s MEV (Maximal Extractable Value). And retail stakers see almost none of it.

aPriori is attempting to fix this gap. It’s a liquid staking protocol that combines two things: keeping your assets liquid and capturing MEV value to share with stakers. The founding team includes engineers from Jump Trading, Citadel, and Coinbase who are people who’ve built the systems that perform similar value extraction in traditional markets.

This is not just another staking platform. It’s about changing who captures value in proof-of-stake networks. Because right now, those securing the network aren’t the ones benefiting most from what’s being extracted.

What is aPriori?

aPriori describes itself as an “intelligent coordination layer” for high-performance blockchains. While the phrase may sound abstract, its goal is simple yet transformative: to combine liquid staking with MEV capture so retail users earn more while maintaining full liquidity.

The protocol runs on Monad, a high-throughput EVM-compatible blockchain that processes 10,000 transactions per second with 800ms finality. This choice matters because aPriori’s order flow analysis systems need serious computational power to operate in real time.

The differentiation comes from integrating three components that usually exist separately:

Liquid Staking: Stake MON tokens and receive aprMON, a liquid staking token you can use across DeFi while the underlying MON continues earning rewards.

MEV Optimisation: Capture MEV through intelligent order flow routing and block-building infrastructure, then redistribute it to stakers.

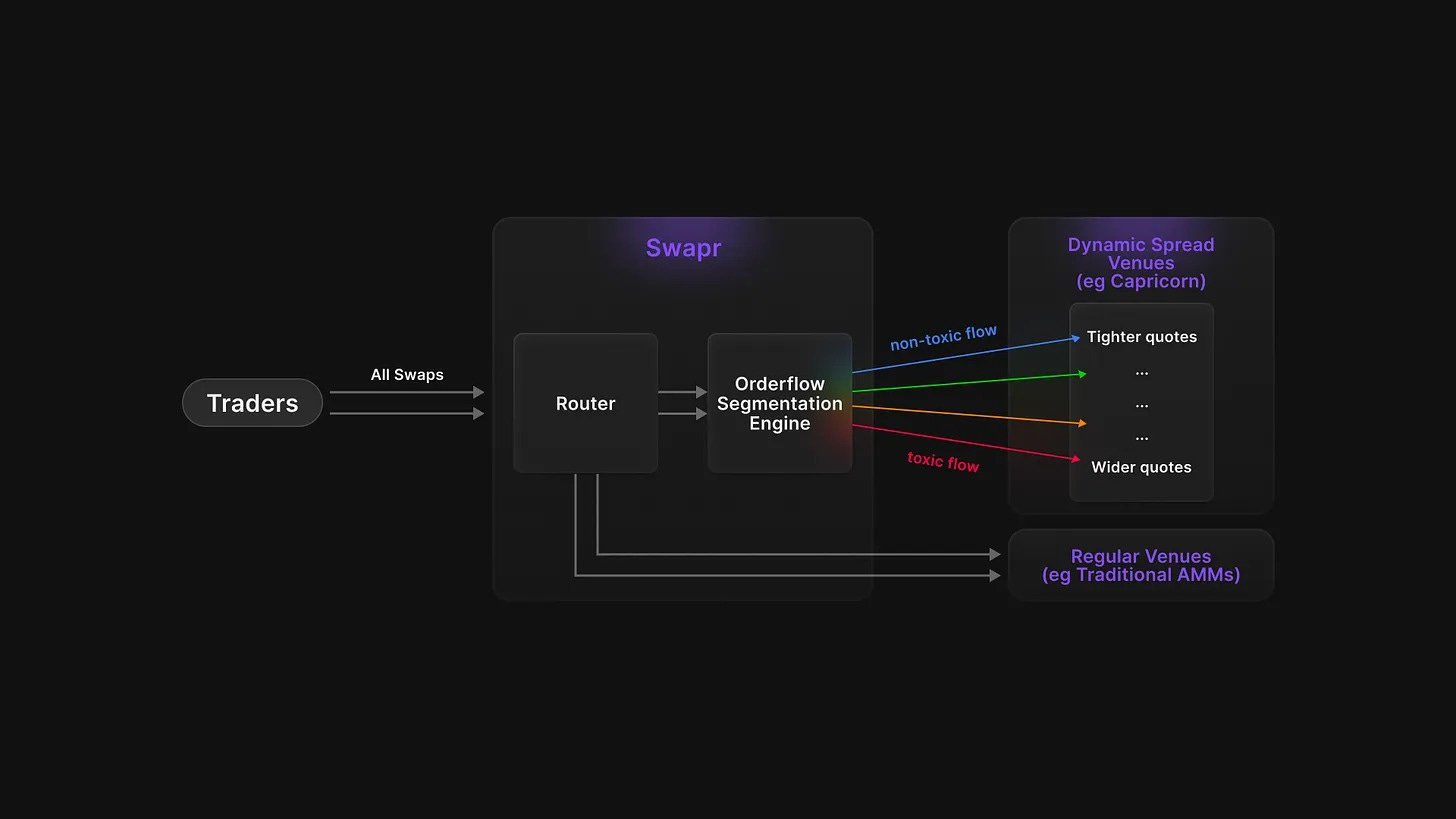

AI-Powered Routing: An order flow segmentation engine that analyses trades in real time to identify toxic flow (arbitrage, informed trading) versus clean retail flow, routing each to appropriate venues.

The Monad blockchain provides the foundation. Unlike chains that process transactions sequentially, Monad uses parallel execution where transactions run simultaneously. This matches how traditional high-frequency trading systems work: optimise for throughput first, then ensure consistency. For aPriori’s use case of real-time trade classification and routing, this architecture is necessary infrastructure.

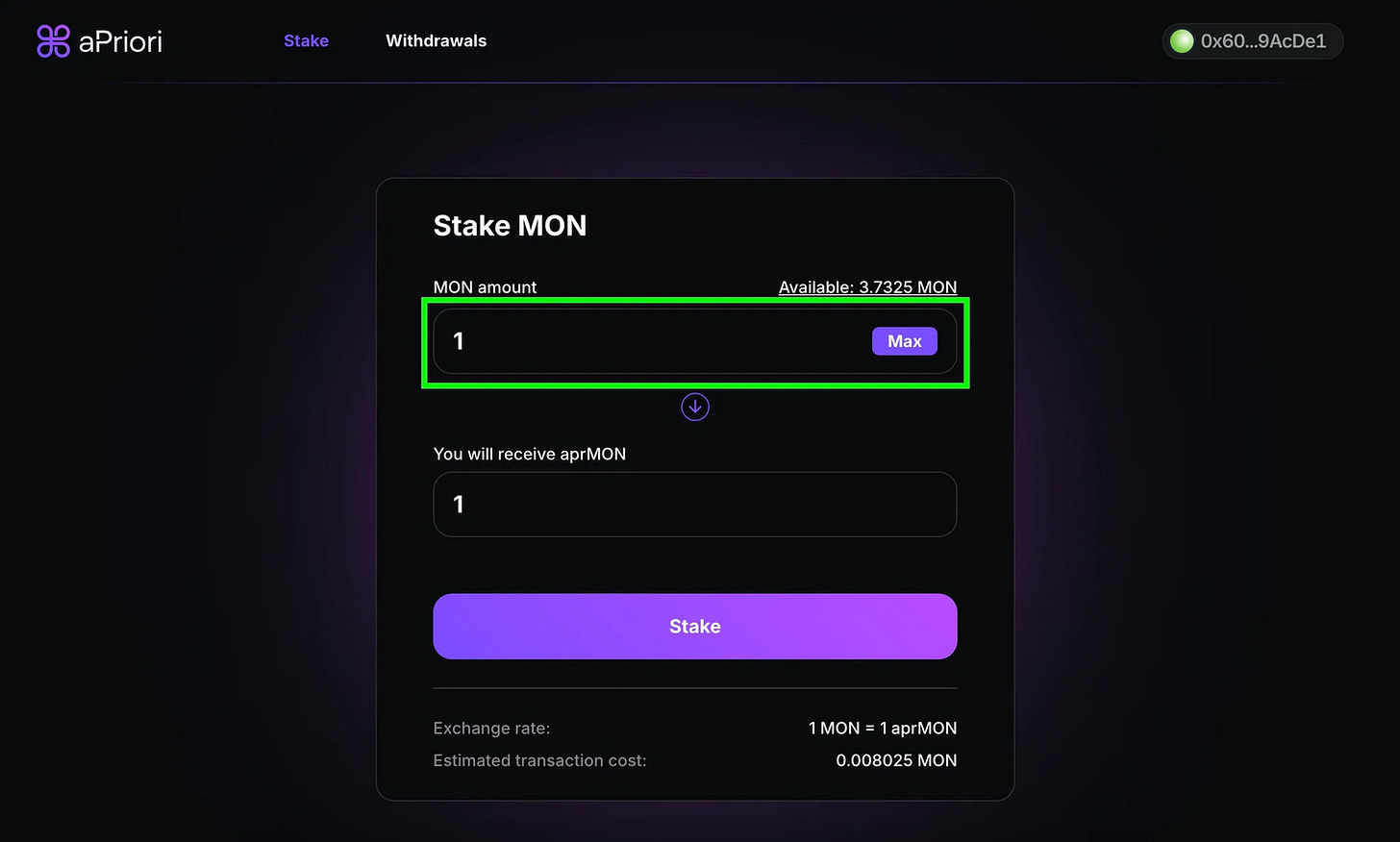

Getting started requires connecting a Web3 wallet to the aPriori interface at apr.io. You deposit MON tokens and immediately receive aprMON representing your position. The interface shows expected yields from both staking and MEV capture, though actual returns vary with network performance.

Using aprMON in DeFi works like any liquid staking token. Lending protocols accept it as collateral. DEXs have aprMON trading pairs where you can provide liquidity. Yield aggregators can deploy it automatically across multiple strategies.

How aPriori Works

The staking process follows three streamlined steps:

Deposit MON tokens into aPriori’s staking vault. The protocol automatically delegates these tokens across a curated list of high-performing validators and actively rebalances to maintain network decentralisation.

Receive aprMON tokens that represent your stake. Unlike rebasing tokens that change your balance, aprMON uses a reward-bearing model. Your token count stays constant while each token becomes more valuable as rewards accumulate. This design works better with DeFi protocols that don’t expect balances to change automatically.

Deploy aprMON anywhere while earning rewards. Use it as collateral in lending protocols, provide liquidity on DEXs, or hold it. The underlying MON keeps earning both staking rewards and MEV-derived profits.

The MEV capture works through a block-space auction system. Validators on Monad can source blocks from external networks of block builders who compete to construct optimal transaction orderings. When builders find profitable MEV opportunities (like arbitrage between DEXs or liquidating underwater positions), they bid for block space. The protocol captures this value and redistributes it to aprMON holders.

Meanwhile, aPriori’s Order Flow Segmentation Engine continuously analyses transactions across Ethereum, BNB Chain, and Monad. It classifies trades based on wallet behavior, transaction patterns, and flow quality. “Toxic” flow (trades likely to be profitable arbitrage or informed trading) gets routed to venues that can absorb it. “Clean” retail flow is sent to liquidity pools offering tighter spreads.

This feeds into Swapr, aPriori’s DEX aggregator that provides the frontend for this intelligent routing. When you swap tokens through Swapr, the system determines your trade’s likely impact and routes it accordingly.

Validators earn rewards from both block production and MEV auctions. Stakers earn from consensus rewards plus MEV redistribution. Builders compete to construct profitable blocks. The system aligns incentives so each participant benefits from network health rather than extracting value at others’ expense.

Benefits of Using aPriori

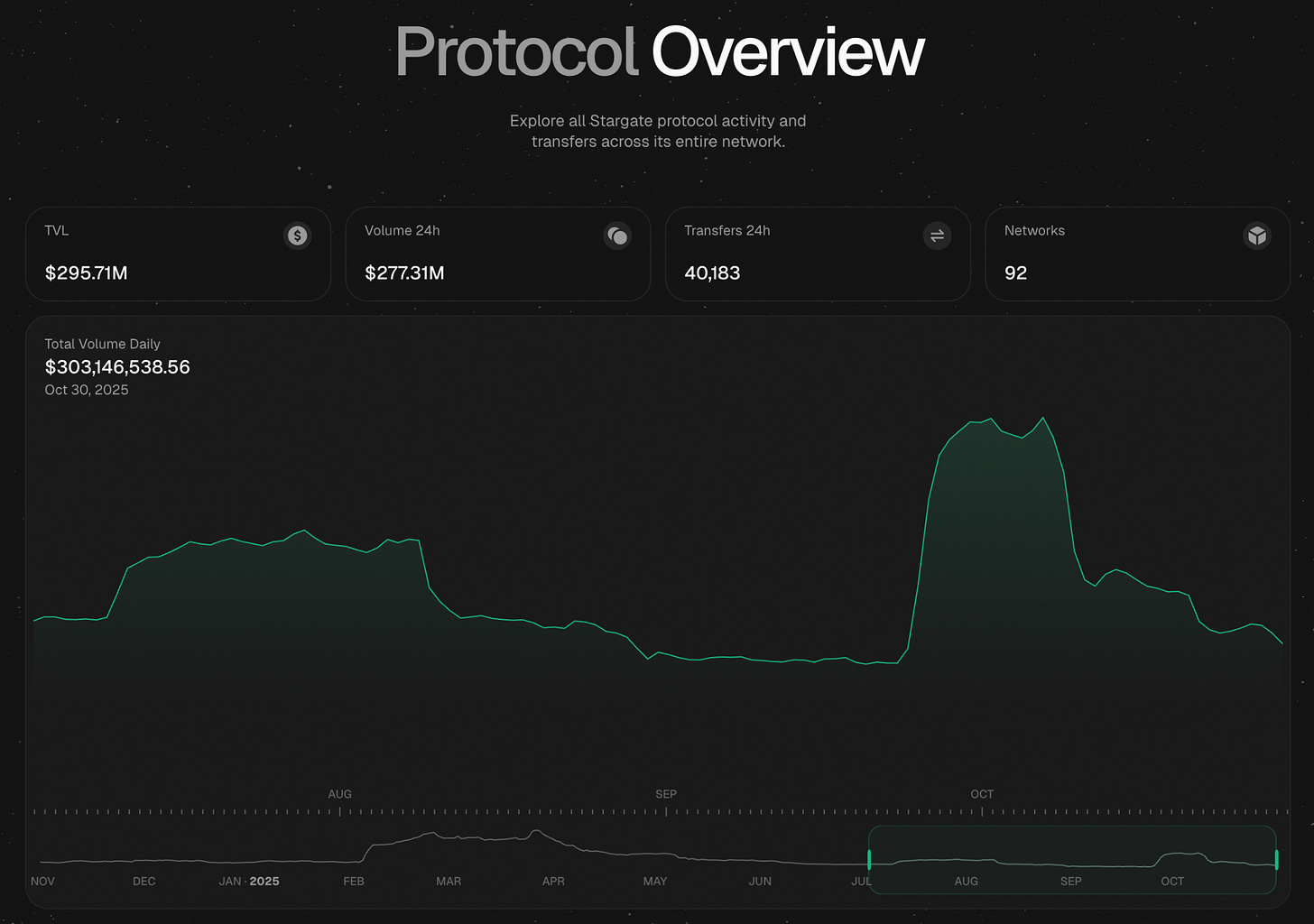

The primary benefit of aPriori is earning more. Standard staking on proof-of-stake networks typically generates 4-7% annually. MEV extraction adds another revenue stream. During the volatility spike in August 2024, MEV revenues jumped 700% within three days. By capturing and redistributing this value, aPriori increases total yields beyond what standard staking provides.

The liquid staking component solves capital efficiency. When you stake traditionally, your assets lock for days or weeks. If a better yield opportunity appears elsewhere, you’re stuck. aprMON stays liquid. You can exit positions, chase yields in other protocols, or use it as collateral without sacrificing staking rewards.

Security comes from multiple layers. Monad’s architecture provides the base layer with parallel execution and fast finality. The staking vault distributes deposits across multiple validators, reducing single points of failure. Smart contracts handling the staking and MEV distribution have been audited, though all DeFi protocols carry inherent smart contract risk.

Speed matters for MEV capture. When you’re trying to classify and route trades in under 500 milliseconds, the underlying blockchain needs to keep up. Monad’s 10,000 TPS and 1-second block times enable real-time order flow analysis that wouldn’t be practical on slower chains.

MEV extraction has traditionally required sophisticated infrastructure and technical knowledge. Running MEV bots, analysing mempool data, and constructing optimal transaction bundles isn’t accessible to retail users. aPriori packages this into a simple staking interface where users deposit tokens and automatically participate in MEV profit sharing.

Ecosystem and Partnerships

aPriori has raised $30 million total: $2 million pre-seed, $8 million seed led by Pantera Capital, and $20 million strategic round. Investors include HashKey Capital, Primitive Ventures, IMC Trading, Consensys, OKX Ventures, and strategic angels from Pyth Network, Wormhole, Pendle Finance, and Jito Labs.

The investor composition matters. These aren’t generic crypto VCs. IMC Trading is a market maker. Jito Labs built MEV infrastructure on Solana. The angels come from protocols dealing with similar technical challenges around order flow, cross-chain infrastructure, and yield optimisation.

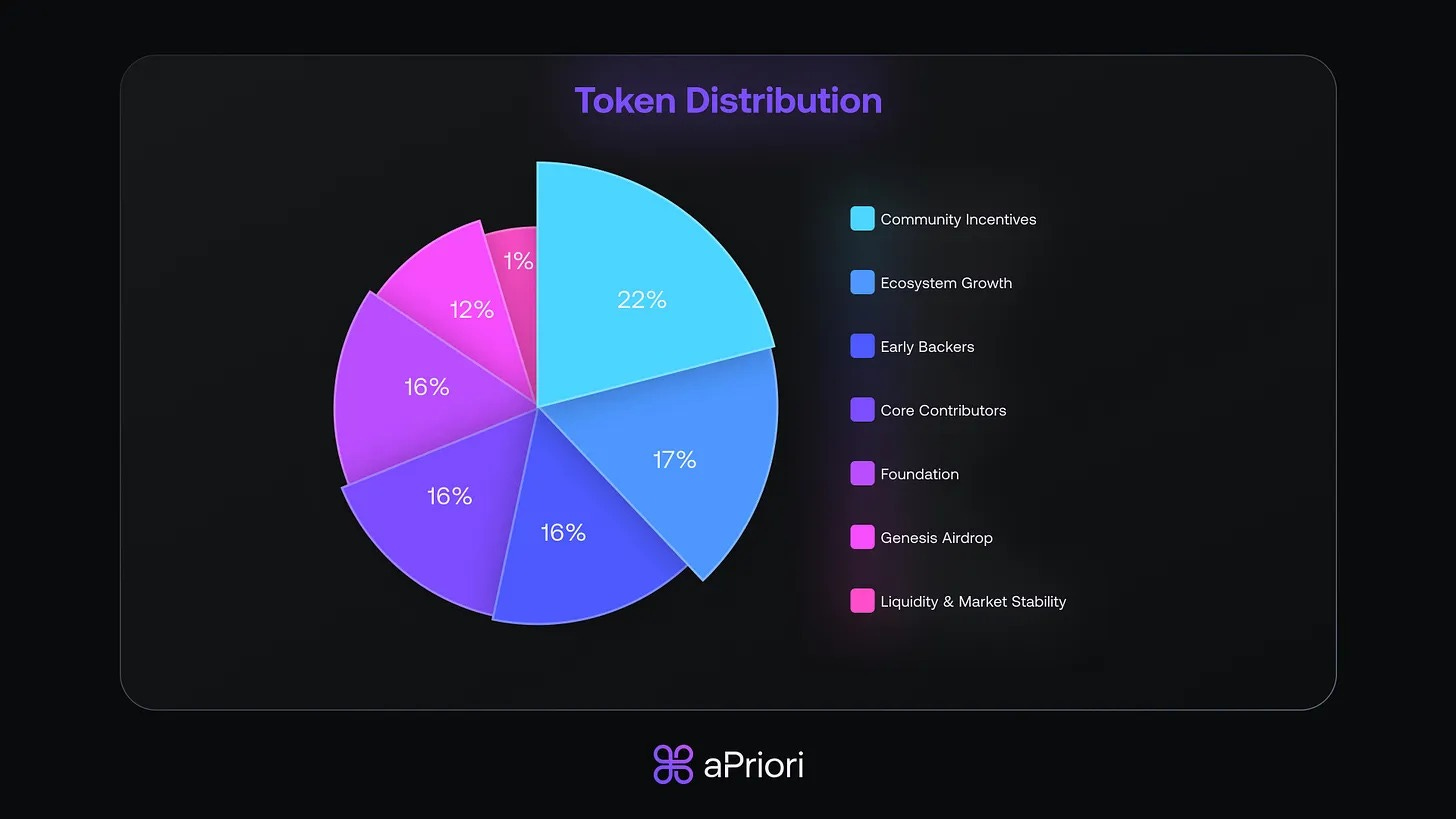

APR token economics: 1 billion fixed supply, 185 million currently circulating. Distribution includes 16% to early backers (3-year vesting, 1-year cliff), 16% to core contributors (4-year vesting with 1-year cliff), 16% to foundation operations, 12% to Genesis Airdrop, 22% to community incentives, 17% to ecosystem growth, and 1% to liquidity.

The APR token serves governance and incentive functions where holders vote on validator criteria, fee parameters, and protocol upgrades. It’s also used in staking incentive programs and ecosystem partnerships.

Exchange listings include Coinbase, Binance, Kraken, Bitget, and OKX. The wide availability provides liquidity and price discovery, though trading volumes have been volatile since launch.

Competitive Landscape

Lido dominates liquid staking with over $33 billion TVL across multiple chains. They offer straightforward liquid staking without MEV optimisation. EigenLayer focuses on restaking, letting users secure additional protocols with their staked assets. Rocket Pool emphasises decentralisation with a permissionless validator set.

On Monad specifically, competitors include Magma and Kintsu, both offering liquid staking. The differentiation comes from aPriori’s MEV integration and the team’s trading infrastructure background.

The technical moat is the order flow segmentation engine. Building AI models that classify trade toxicity in real time requires specific expertise (the team’s high-frequency trading background) and continuous data collection across multiple chains. Training these models, maintaining the infrastructure, and keeping them updated as trading patterns evolve creates barriers to entry.

The MEV infrastructure adds another layer. Running block-building auctions, integrating with validator networks, and managing the redistribution mechanics requires coordination across multiple parties. This is harder to replicate than basic liquid staking.

The liquid staking market reached $72 billion in 2025 and continues growing as more institutions adopt staking. And as more high-performance chains launch and trading volume increases, the total MEV opportunity expands. Protocols that can capture and redistribute this value become more valuable.

aPriori sits at the intersection by growing liquid staking demand plus growing MEV extraction. The combination addresses real inefficiencies in how staking rewards get distributed while solving the capital efficiency problem.

The roadmap includes mainnet launch on Monad (currently live in testnet), deeper DeFi integrations for aprMON, enhanced AI models for trade classification, potential cross-chain expansion, and partnerships with major DeFi protocols.

For Token Dispatch readers evaluating where DeFi infrastructure is headed, aPriori shows what happens when traditional finance expertise meets crypto infrastructure challenges. Whether it succeeds depends on mainnet execution, but the approach of democratising MEV profits and maintaining liquidity solves real problems that existing protocols leave unaddressed.

The Genesis Airdrop is live for early contributors. Testnet is operational. Mainnet launch follows on Monad.

That’s all for today. See you soon with another one.

Until then … DYOR,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.