Are bulls running? 🐂

Crypto's piggy bank is overflowing and Bitcoin bags big. XRP rides a fake news rollercoaster. FDIC's office drama overshadows crypto talks. Memecoin ‘Grok’ falls 74% on creator scam claim.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

What we feelin?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Crypto funding inflows are having a blast.

For the third week in a row, there's been a flood of cash into crypto funds.

2023 marks the third-highest annual inflows on record, and year-to-date inflows total $1.14 billion.

Leading the charge in this money marathon is Bitcoin.

Last week alone, it scooped up $240 million of the $293 million in net inflows.

Bitcoin's value has increased by about 37% since early October, with a year-to-date growth of approximately 122%.

👓 Eye on the ETPs: Bitcoin exchange-traded product (ETP) volumes are making up 19.5% of total Bitcoin trading volumes on exchanges - signalling increased participation from ETP investors.

What does this mean? ETP investors are diving into this rally with all excitement.

Ether Funds: Ether funds saw $49 million in net inflows last week, the largest since August 2022. Likely influenced by BlackRock's recent application for a spot ether ETF.

Solana funds also witnessed significant inflows, with the asset rising over 40% to peak around $62.

Crypto Market Cap Surges: The total crypto market cap has seen a $600 billion increase since November 2022.

Glassnode data shows that the amount of BTC being stored is now outpacing the amount mined by 2.4 times. Also reveals an increase in Bitcoin storage by long-term holders (LTHs), entities that hold coins for 155 days or more. This trend suggests a strong conviction in Bitcoin's long-term value.

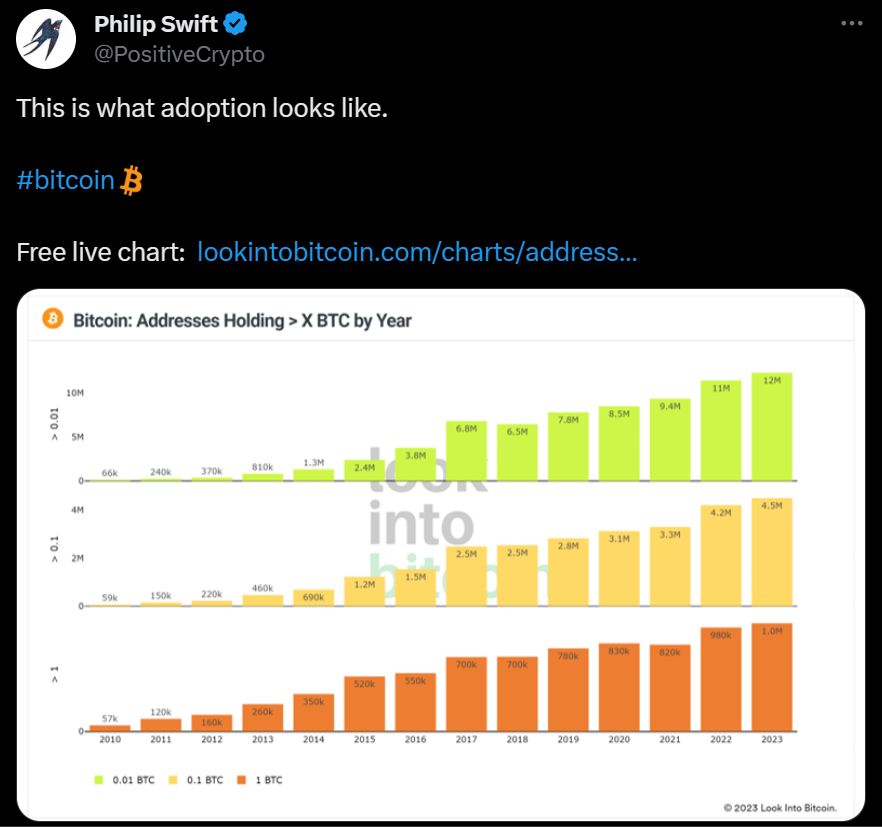

And the adoption?

Everyone is buzzing. Why?

A spot bitcoin ETF approval could attract fresh capital

ETF approval = win against SEC = softer regulatory approach in future.

But wait … a reality check

JPMorgan isn’t sold on these ideas.

Analysts, led by Nikolaos Panigirtzoglou, are looking at this bullrun with a bit of skepticism.

ETFs already exist in Canada and Europe and have received “little interest from investors since their inception.”

The bullish sentiment around next year’s Bitcoin halving unconvincing, suggesting its effects are already priced in.

US CPI Data - the next boost?

Analysts are keenly awaiting the US Consumer Price Index data, a crucial indicator for inflation trends, ahead of the Federal Reserve's next policy meeting.

The five-week run shot bitcoin price almost 40% higher, but now stalled around the $37,000 area.

Bulls might be looking to Tuesday's Consumer Price Index (CPI) as a fresh catalyst higher.

Economists expect monthly headline CPI in October to have slowed to 0.1% from 0.4% in September.

Year-over-year CPI is anticipated to have fallen to 3.3% from 3.7%.

Core CPI, sans food and energy costs, has remained flat from September – 0.3% monthly and 4.1% year-over-year.

Both above the US Federal Reserve's 2% target.

Economists predict that October's CPI will show a slowdown in inflation, which could potentially drive Bitcoin's price higher.

TTD Numbers🔢

$4 billion

Tether has been busy at the mint, issuing 4 billion USDT in just one month - making it nearly one-fifth of all USDT issued this year.

This includes 1 billion USDT on the Tron blockchain and another 1 billion on Ethereum, with two more batches of 2 billion each on Tron.

According to Whale Alert, a blockchain data provider, Tether's total minting for 2023 is at a staggering 22.75 billion USDT.

Out of this, 57% was issued on the Tron blockchain, with the rest on Ethereum.

Paolo Ardoino, Tether's CTO and new CEO, explains that the latest 1-billion-USDT transaction is for “inventory replenish.”

It's not just a recent trend.

Back in March 2023, Tether minted 9 billion USDT, followed by another 3 billion the previous month.

Mid-summer was no different, with 3.75 billion USDT added between June and July.

Tether's not just printing new coins; they're also burning them.

In August, 1.2 billion USDT was burned on the Tron blockchain, following the burning of 3.1 billion Tron USDT in June and 2 billion Ethereum USDT in February.

Is there any parallels between Tether's aggressive minting and significant market events?

The closures of Silicon Valley Bank, Silvergate, and Signature Bank in March had led to speculation about Tether's exposure, which the company has firmly denied.

Amidst all this, Tether's CEO teases the crypto world with the promise of five new projects in 2024.

TTD Fake 👁️

XRP investors recently rode a rollercoaster of emotions, all thanks to a faked filing about a BlackRock XRP exchange-traded product.

A Delaware filing suggested BlackRock was launching an “iShares XRP Trust,” hinting at an upcoming exchange-traded fund (ETF). XRP's price responded with a swift 12% jump, soaring to $0.73.

The thrill, however, was short-lived.

Within 30 minutes, the revelation that the filing was fake sent XRP tumbling down, erasing all its gains.

Bloomberg ETF analyst Eric Balchunas debunked the news after speaking with BlackRock, confirming it was a hoax.

Speculations arose that someone impersonated BlackRock managing director Daniel Schwieger to list the XRP trust on the Delaware corporations' website, triggering the whole fiasco.

Look on the brighter side. BlackRock did file for a spot Ether ETF on Nov. 9, a real move by the asset management giant signalling its interest in expanding beyond Bitcoin.

To clear any doubts, Seyffart from BlackRock reiterated that the spot Ether ETF is indeed legitimate, as confirmed by a 19b-4 submission by Nasdaq to the Securities and Exchange Commission.

TTD WTF 🙄

A recent Wall Street Journal report has rocked the Federal Deposit Insurance Corp. (FDIC) with allegations of rampant sexism and misconduct.

The Wall Street Journal's exposé on the FDIC paints a picture of a workplace plagued by sexual harassment, misogyny, and inappropriate behaviour.

The report includes accounts of female employees being propositioned, harassed, and pressured into uncomfortable situations by male colleagues.

💬 Crypto Leaders Weigh In: The scandal has caught the attention of prominent figures in the crypto world. Caitlin Long, CEO of Custodia Bank, took to Twitter to express her dismay, comparing the banking sector's issues with sexism to those in the crypto industry.

Long's critique extends beyond sexism, accusing federal banking institutions, including the Federal Reserve, of hypocrisy.

She references her ongoing lawsuit against the Fed for refusing to accredit Custodia Bank, suggesting this denial might stem from the bank's crypto-friendly stance.

Sam Callahan, a blockchain analyst, points out the irony of a “party culture” at a top banking regulator amidst a banking crisis.

With the FDIC set to testify before the Senate, timing of the Journal’s story is a bit questionable?

The upcoming FDIC Senate testimony, initially focused on crypto and de-banking, now finds itself overshadowed by these allegations.

Crypto lobbyist Ron Hammond hints that the hearing's tone will inevitably be affected by the FDIC's reported toxic culture.

TTD Memecoin 🤡

Remember Grok meme coin, the latest sensation?

If not, read: Who's Grok? 🤖

A token that's riding high on the coattails of Elon Musk's AI chatbot, Grok.

Journey of Grok

Initial Surge: Mimicking Elon Musk’s AI project's name, the Grok memecoin initially soared, riding the wave of Musk's announcement of Grok AI and the frenzy around memecoins.

Sudden Plunge: Blockchain investigator ZachXBT raised alarms on Nov. 13, alleging that Grok's social media presence was repurposed from a defunct memecoin project named ANDY.

Dramatic Price Drop: Grok's price crashed by 74% within five hours, plummeting from its all-time high of $0.027 to a low of $0.007 (now $0.01092), as per DexTools data.

Damage Control Attempts: In response to the crash, Grok’s team attempted to salvage the situation by burning about $1.7 million worth of tokens, hoping to stabilise the price by reducing the supply.

Token Burn Confirmed: Etherscan transactions confirmed that 90 million GROK tokens were sent to a burn address.

Additionally, the Grok team claimed to have burned all tokens from the deployer address, totaling 180 million GROK, roughly valued at $2 million.

Market Cap Highs and Lows: At its height, Grok boasted a market capitalisation of nearly $200 million.

Its launch on Nov 5 coincided with Musk's AI announcement, leading to a staggering 33,650% increase in value in just over a week.

TTD Surfer 🏄

Decentralised stablecoin protocol Raft lost $6.7 million in a recent security exploit, despite undergoing multiple security audits.

Cathie Wood's ARK Invest sold over 200,000 shares of Grayscale Bitcoin Trust (GBTC) worth around $6 million.

South Korean cryptocurrency exchange Bithumb is reportedly planning for an initial public offering (IPO) in the second half of 2025.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋