Are We Consolidating? 🤷♀️

Crypto market goes in a range. Ethereum's SEC dilemma and the ETF approval delay. Millionaire trader, a memecoin insider? BlackRock gets memes and NFTs. The $6B China Fraud. FTX reality check.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Yesterday was FOMC day.

The results?

Bitcoin: 6% up in 24 hours. After touching $61K very recently, bounced back to $67K.

Ether: Overcame SEC jitters - 9% up in 24 hours.

Why? The Fed is sticking to its guns with three rate cuts this year, easing everyone's worries about them turning all hawkish on us.

"We are making good progress on bringing inflation down." - Fed Chair Jerome Powell.

CMEGroup's FedWatch tool numbers changes:

Until yesterday - there was a 99% chance interest rates would stay the same. And 1% chance they go down.

Now? 89% and 11 % respectively.

Also, DOGE Takes Off: 16% up. Thanks to Coinbase, offering futures contracts for it and its buddies Litecoin and Bitcoin Cash.

But, the Bitcoin ETFs Exodus.

The third day of outflows bleeds $261 million.

GBTC is leading with $386.6 million outflow.

Total outflow = $742 million in just 3 days.

The measly inflows from the other 8 ETFs couldn't even come close to stopping the bleeding.

What's happening with Ether ETFs?

SEC delays again: Decision on Ethereum ETFs (VanEck, Hashdex and ARK 21Shares) delayed until the end of May.

The SEC says they need more time to chew things over.

Scrutinizes Ethereum Foundation: SEC subpoenas target firms linked to the Ethereum Foundation. Security classification could heavily regulate ETH and hinder ETF prospects.

An enquiry: Ethereum Foundation received a confidential enquiry from an unnamed state authority, as evidenced by a GitHub commit. This news comes after the Foundation removed a "Warrant Canary" from its website, which previously signaled no undisclosed government contact.

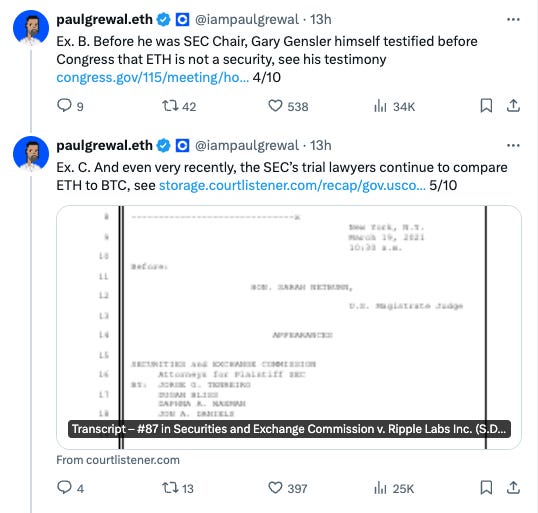

Coinbase is throwing down for Ethereum: Their chief legal officer is urging the SEC to approve Ethereum ETFs, pointing to the fact that both the SEC and CFTC have previously acknowledged Ethereum as a commodity, not a security.

Millionaire Trader. Memecoin Insider?

A mystery trader just pulled off a millionaire-maker trade in under an hour, raking in $8.9 million on the memecoin Shroom.

But here's the twist: they bought the coins right when the developers added more money to the project, raising serious insider trading suspicions.

Shroom, a memecoin with no real use, has since crashed over 70%.

BlackRock Gets Memes and NFTs

Investment giant BlackRock launched a digital fund with $100 million on Ethereum, hinting at Real-World Assets (RWA) focus.

And the welcome party? they promptly got bombarded with memecoins like Pepe and Doge imitators, along with some questionable NFTs featuring CryptoDickbutts and angry cartoon characters.

BlackRock also received some real estate tokens (RIO) that promptly shot up 47% after the association.

The Surfer 🏄

Base Network Explodes: On Tuesday, the network's daily trading volume jumped 51%, reaching a new high of $356 million. Base's total value locked (TVL) also hit an all-time high of $745.3 million. This growth spurt seems to be fueled by the recent Dencun upgrade, which significantly lowered fees for users.

Coinbase plans to launch futures trading for Dogecoin, Litecoin, and Bitcoin Cash on April 1. Coinbase Derivatives submitted letters to the CFTC outlining its plans to launch cash-settled futures contracts.

UN report: Claims North Korea stole $3 billion from crypto firms between 2017 and 2023. This stolen loot reportedly funds 40% of North Korea's WMD programs. Notorious North Korean hackers like Lazarus and Kimsuky are likely behind these attacks.

The $6 Billion China Fraud: Woman found guilty of money laundering bitcoin tied to alleged $6B China fraud. Over $2.2 billion worth of bitcoin seized by U.K. police in 2018. The scheme involved duping 130,000 Chinese investors out of billions.

FTX Reality Check: FTX had only 105 Bitcoins left when the rescue crew arrived. FTX's new boss, John Ray, is slamming Sam Bankman-Fried's claims that customers lost nothing in the exchange's collapse. Ray calls these claims "delusional" and says they downplay the massive fraud that took place.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋