Arthur Hayes: The Derivatives Genius 👨🏻💻

The curious case of the futures contract that forgot to expire

Arthur Hayes travels with suitcases full of stuffed animals.

The 40-year-old crypto billionaire has collected over 100 plush toys, names each one, and brings them along to celebrate milestones. In his Miami apartment, where he served six months of house arrest, visitors could find a chartreuse starfish, a fox, an armadillo, a giraffe, an elephant, an octopus, a snake, and an anthropomorphised bok choy lined up like a childhood bedroom.

This might seem odd for someone who built the financial instrument that now dominates cryptocurrency trading. But Hayes has never been conventional.

In 2013, Bitcoin traders had a problem that was both completely stupid and mathematically fascinating.

Every month their futures contracts would expire, forcing them to roll positions like they were playing some kind of expensive financial Sisyphus simulator.

Roll the contract, pay fees, repeat forever, gradually transfer all your money to exchanges through transaction costs.

Arthur Hayes, a derivatives trader who had spent his career at Deutsche Bank and Citigroup figuring out how to profit from the fact that markets are held together with mathematical duct tape, looked at this situation and had what can only be described as an extremely expensive thought.

"What if time didn't exist?"

Not in a philosophical sense - Hayes wasn't having an existential crisis about the nature of temporal reality.

He was wondering what would happen if you could create a futures contract that never expired, eliminating the monthly fee-extraction ritual that was slowly bankrupting every Bitcoin trader on earth.

The answer made him a crypto kingpin, created the financial instrument that now underpins most cryptocurrency trading, and eventually landed him with federal criminal charges for building it without asking the right people for permission first.

This is a story about what happens when someone applies traditional financial engineering to markets that were designed by computer programmers who thought regulation was just a synonym of "suggestions."

Vibecode Like a Quant

That’s what Almanak delivers.

It’s like having your own army of digital quants, AI agents that analyze markets, build strategies, and execute them 24/7.

Almanak removes the guesswork and makes sophisticated DeFi strategy accessible to anyone, reducing the strategy deployment time from months to minutes.

The vision is bold and the community recognizes it. Almanak’s community round on Legion is live right now.

DeFi isn’t waiting. Neither should you.

Hayes grew up in Detroit in the 1980s, where both parents worked for General Motors and understood that education was the only reliable way to escape the automotive industry's boom-bust cycles. They moved to Buffalo so he could attend Nichols School, a preparatory academy where rich kids learned Latin and poor kids learned to network with rich kids.

He finished second in his class while playing varsity tennis. After bouncing between Hong Kong University and Wharton, he graduated in 2008 with a degree in Economics and Finance, which was perfect timing if you enjoyed watching the global financial system collapse in real-time.

Instead of staying in New York to participate in the post-crisis soul-searching about whether Wall Street was fundamentally broken, Hayes moved to Hong Kong. This turned out to be prescient, since Hong Kong was where you could trade exotic derivatives without quite as many people asking pointed questions about systemic risk.

Learning the Language of Derivatives

As a broke intern, Hayes turned food delivery into profit, charging spreads on every order for colleagues and making hundreds weekly. When recruiters visited Wharton, he impressed them by taking them to Philadelphia nightclubs. His fashion choices at work were legendary - one Casual Friday, he wore a tight pink polo, acid-washed jeans, and bright yellow sneakers, prompting a department head to ask "Who the fuck is that?" The incident got Casual Fridays cancelled.

Deutsche Bank hired Hayes as an equity derivatives trader in their Hong Kong office in 2008. That’s where Hayes gravitated toward the complex mathematics of derivatives — financial instruments whose value derives from underlying assets.

His specialty was delta-one trading and ETFs - the financial equivalent of plumbing. Not glamorous, but absolutely essential, and profitable if you understood how the pipes connected.

After three years of learning how to make money from price discrepancies that existed for approximately seventeen seconds, he moved to Citigroup in 2011. Then in 2013, bank regulations decided that fun was over and Hayes got laid off, which freed him to discover Bitcoin at exactly the moment when it needed someone who understood how financial plumbing actually worked.

Bitcoin in 2013 was trading on exchanges built by people who could code blockchain protocols but had never heard of margin requirements. Hayes saw a market that operated 24/7 with no circuit breakers, no central authority, and definitely no sophisticated risk management. It was either the future of finance or an elaborate way to lose money very quickly, and Hayes figured those weren't mutually exclusive possibilities.

The infrastructure was basic, but the underlying mechanics fascinated him. Here was a market that desperately needed the kind of financial engineering he had learned in traditional finance.

Building BitMEX

He teamed up with Ben Delo, a mathematician who could build trading engines, and Samuel Reed, who actually understood how cryptocurrencies worked. In January 2014, they started building BitMEX - Bitcoin Mercantile Exchange - which they described as "the best peer-to-peer trading platform" in competition with exchanges that mostly specialised in being barely functional.

The three founders brought complementary skills: Hayes understood market structure and derivatives, Delo could build sophisticated trading engines, and Reed knew cryptocurrency technology inside and out.

BitMEX launched live trading on November 24, 2014, with a focus on Bitcoin derivatives. The timing reflected months of careful development and stress testing. By the time they went live, the founders were literally scattered across the globe—Hayes and Delo in Hong Kong, Reed calling in from his honeymoon in Croatia.

The early product lineup included leveraged Bitcoin contracts and quanto futures, which allowed traders to express views on Bitcoin's price without actually holding the underlying asset. These were sophisticated instruments that required understanding of margin, liquidation mechanics, and cross-currency hedging.

But Hayes and his team were just getting started.

On May 13, 2016, BitMEX announced something that had never existed before: the XBTUSD perpetual swap. A futures-like contract that never expires, with funding payments between long and short positions that keep the contract price anchored to spot Bitcoin prices. The perpetual swap offered up to 100x leverage and was cash-settled in Bitcoin.

Traditional futures expire monthly, creating this absurd cycle where traders had to constantly roll positions and pay fees. Hayes borrowed a funding mechanism from currency markets and applied it to Bitcoin futures. Instead of expiring, the contracts would use funding payments between long and short positions to keep prices anchored to spot Bitcoin prices. When the contract traded above spot, longs paid shorts. When it traded below, shorts paid longs. The market became self-correcting.

This eliminated expiry dates, reduced transaction costs, and created a tool so useful that every crypto exchange immediately copied it. Today, perpetual swaps account for most crypto trading volume worldwide. Hayes had essentially solved time, at least as it applied to derivatives contracts.

Explosive Growth and Scrutiny

BitMEX's XBTUSD contract quickly became the deepest Bitcoin derivatives market in the world. The exchange's sophisticated risk management, professional-grade tools, and high leverage attracted traders from traditional finance and crypto natives alike.

By 2018, BitMEX was trading over $1 billion in notional volume daily. The exchange moved into the 45th floor of Hong Kong's Cheung Kong Center, one of the city's most expensive office buildings. When BitMEX servers went down for scheduled maintenance that August, Bitcoin prices immediately jumped 4%, adding $10 billion to the total crypto market cap.

BitMEX nominally prohibited US customers, but critics argued the restrictions were easy to circumvent. The exchange's influence on Bitcoin pricing drew attention from academics, regulators, and politicians who were just beginning to understand cryptocurrency markets.

In July 2019, economist Nouriel Roubini published a report suggesting BitMEX was involved in "systemic illegality," arguing the exchange allowed excessive risk-taking and might profit from customer liquidations. The accusations prompted regulatory investigations and congressional hearings about crypto market structure.

By late 2019, Bitcoin derivatives were generating $5-10 billion in daily trading volume. More than ten times the volume of spot Bitcoin trading. BitMEX accounted for a significant portion of this activity, making Hayes and his partners central figures in global crypto markets.

On October 1, 2020, the other shoe dropped with the subtlety of a federal indictment. The CFTC filed civil complaints while the DOJ unsealed criminal charges, arguing that BitMEX had operated as an unregistered futures commission merchant while serving US customers and ignoring anti-money laundering requirements. Prosecutors suggested that Hayes and his partners had willfully ignored compliance while generating hundreds of millions in profits.

Hayes stepped down as CEO that day. Reed was arrested in Massachusetts. Hayes and Delo were listed as "at large," which is DOJ terminology for "we know where you are but haven't picked you up yet."

The legal proceedings stretched over two years, during which Hayes discovered he had a talent for writing about markets and monetary policy. His "Crypto Trader Digest" essays became required reading for anyone trying to understand how macro economics, Federal Reserve policy, and crypto prices connected. He built frameworks for understanding why central bank decisions would inevitably drive people toward Bitcoin.

In August 2021, BitMEX agreed to pay $100 million to settle civil charges. On February 24, 2022, Hayes pleaded guilty to one count of willfully failing to establish an anti-money laundering program. On May 20, 2022, he was sentenced to six months of home detention, two years of probation, and a $10 million fine.

During his legal proceedings, Hayes emerged as one of crypto's most insightful commentators. His analysis of Federal Reserve policy and Bitcoin price dynamics influenced how traders and institutions thought about crypto as a macro asset. He outlined concepts like the "NakaDollar" - a synthetic dollar created by combining long Bitcoin positions with short perpetual swaps, effectively creating dollar exposure without traditional banking infrastructure.

Hayes has also been vocal about Bitcoin's role as a hedge against monetary debasement.

"We're moving from an analog society in terms of money transfer to a digital one, that's going to be hugely disruptive," Hayes observed. "And I saw a chance with Bitcoin and crypto to actually create a company that could benefit from this hugely chaotic transformation."

On March 27, 2025, US President Trump granted pardons to Hayes and his BitMEX co-founders, officially closing the legal chapter. By then, Hayes had already built his post-BitMEX career as Chief Investment Officer of Maelstrom, his family office fund that invests across venture capital, liquid trading strategies, and crypto infrastructure.

The fund has supported Bitcoin development through grants ranging from $50,000 to $150,000 per developer, reflecting Hayes's belief that Bitcoin's open-source development needs sustainable funding. "Bitcoin is the bedrock asset in the crypto space and unlike other crypto projects, Bitcoin never conducted an offering to raise funds for its technical development," Maelstrom's website explains.

Recent Market Moves

Hayes's current investment strategy reflects his macro outlook. In August 2025, he made headlines by purchasing over $15 million in cryptocurrencies over five days, focusing on Ethereum and DeFi tokens rather than Bitcoin. His purchases included 1,750 ETH ($7.43 million), plus significant positions in HYPE, ENA, and LDO tokens. The allocation reflected his belief that certain altcoins were positioned to benefit from market conditions like institutional push towards ETH, growing adoption of stablecoins, and protocols earning revenue by filling specific gaps in the market.

Hayes has also emerged as one of the most vocal supporters of Ethena (ENA), a synthetic dollar protocol that builds on many of the same derivative concepts he pioneered at BitMEX. In August 2025, he purchased 3.1 million ENA tokens worth $2.48 million, becoming one of the project's largest individual holders. Hayes sees Ethena as the next evolution of his NakaDollar concept, using derivatives to create dollar-pegged assets without relying on traditional banking infrastructure. The investment represents Hayes betting on a new generation of projects that use perpetual swaps and funding mechanisms to reimagine how synthetic assets work.

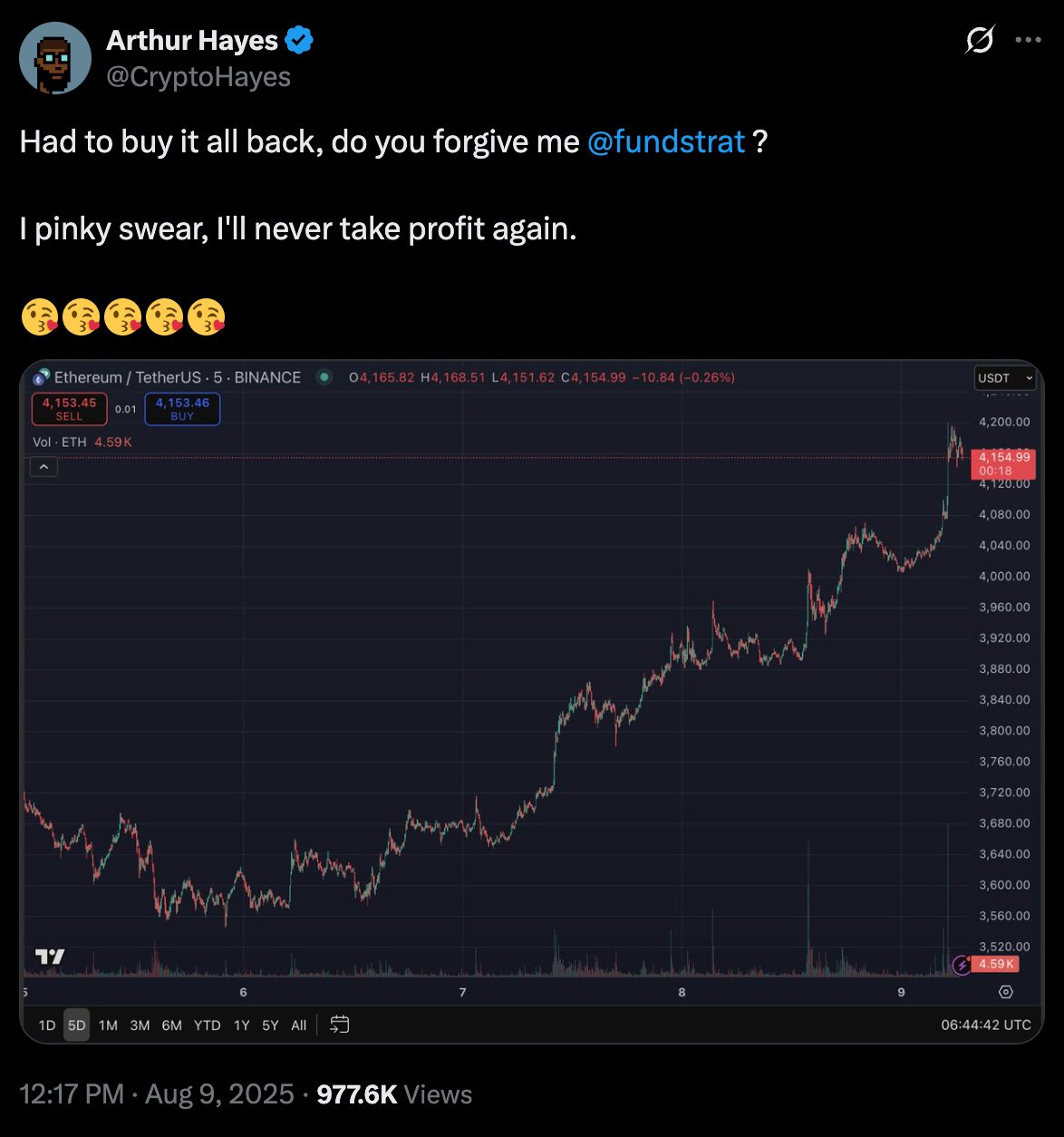

Earlier that month, he had sold $8.32 million worth of Ethereum near $3,500, citing macroeconomic concerns. When ETH rallied back above $4,150, he bought back in, admitting on social media: "Had to buy it all back. I pinky swear, I'll never take profit again."

Hayes's current macro thesis centers on what he sees as inevitable money printing by the Federal Reserve. He argues that structural problems including housing market stress, demographic shifts, and capital flight will force policymakers to inject approximately $9 trillion into the financial system. "If you don't print, you break the system," he says, focusing on debt burdens of entities like Fannie Mae and Freddie Mac.

If this scenario unfolds, Hayes predicts Bitcoin could reach $250,000 by end of the year as investors seek alternatives to debased fiat currencies. He also sees longer-term potential for Bitcoin to reach $1 million by 2028, based on his belief that the current monetary system is unsustainable and Bitcoin represents the most viable alternative store of value.

The perpetual swap fundamentally changed how crypto trades by providing a tool that eliminates many frictions that plagued early derivatives markets.

In 2025, even mainstream platforms like Robinhood and Coinbase are launching their own perpetual products, while new exchanges like Hyperliquid are building entire businesses around Hayes's original innovation.

The regulatory framework that emerged from the BitMEX cases also shaped industry standards. Requirements for proper anti-money laundering programmes, customer verification, and regulatory registration became table stakes for any exchange serving global markets.

At 40, Hayes occupies a unique position in the crypto ecosystem. He's old enough to remember traditional finance before Bitcoin existed, experienced enough to have built infrastructure that defined how crypto trades, and battle-tested enough to have survived both meteoric success and serious legal consequences.

His story demonstrates that in crypto, sustainable success requires understanding both technology and regulation, both innovation and compliance. The perpetual swap succeeded not just because it was technically elegant, but because it solved real problems for traders while operating within existing legal frameworks - at least until those frameworks caught up with the innovation.

"We didn't have to ask permission to build this, and what other industry could three guys go and try to build an exchange that does billions of dollars a day turnover?" Hayes reflected on the BitMEX experience.

The comment captures both the opportunity and responsibility that come with building financial infrastructure in a rapidly evolving regulatory environment.

Today, as Hayes continues analysing markets and making concentrated bets based on his macro outlook, his influence extends beyond any single trade or investment. Through his writing, his investments, and his continued participation in crypto markets, he remains one of the most thoughtful voices in an industry that often prioritises hype over analysis.

That’s it about Arthur Hayes, see ya next week with another profile.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.