Artists Sue US SEC 🤦

Artists sue SEC over NFTs classified as securities. Ethereum's 9th birthday. Tragic murder of a Bitcoiner in Kyiv. Russia embraces crypto to dodge global sanctions. $20B - BTC mining hardware market?

Hello, y'all. Free Bitcoin with Donuts. Who is coming to South Korea with us?

If you will, play the quiz👇 and tell us what your score, okay?

Taylor Swift concerts.

She promotes it? Yes.

The tickets expensive? Yes.

Is it sold in secondary markets? Yes.

Are we attending? Yes (JK, we broke).

Is the SEC gonna call the tickets Securities? Not in hell.

So why NFTs?

That’s exactly what Jonathan Mann and Brian Frye argue.

And then? They sued SEC.

Who are they?

Jonathan Mann is a musician and artist best known for his "Song a Day" project, where he consistently creates and shares a new song daily.

This endeavour, known as "Song A Day," has garnered significant attention, leading to a world record for the most consecutive days writing a song, which he achieved in November 2014.

This guy 👇

Brian Frye is a law professor at the University of Kentucky with a focus on intellectual property and technology law.

He's also an NFT and security law expert.

The artists' attorneys want to know under what circumstances creating and selling NFT art could trigger US securities laws.

They are represented by Jason Gottlieb, a lawyer with experience in battling the SEC.

The lawsuit questions whether artists need to register NFT art before selling it and if they must disclose "risks" to buyers.

The TS analogy

These creative types are comparing their NFTs to Taylor Swift concert tickets.

SEC telling Swift she needs to register her tickets as securities?

That's like saying a slice of pizza is a stock.

Plus, just because Swifties can resell their tickets doesn't mean they're investing in Swift's career, right?

“While Jonathan Mann and Brian Frye differ from Taylor Swift in many ways, in the context of this lawsuit, they are in exactly the same position.

They are artists, and they want to create and sell their digital art, without the SEC investigating them or filing a lawsuit.

The SEC’s approach threatens the livelihoods of artists and creators that are simply experimenting with a novel, fast-growing technology or have chosen it as their preferred medium."

The artists are seeking a court order to prevent the SEC from taking enforcement actions against their NFT projects.

Why the lawsuit?

Mann and Frye's frustration stems from the SEC's recent crackdowns on NFT projects like Stoner Cats and Impact Theory.

Impact Theory? SEC’s first NFT case.

SEC accused Impact Theory, a media and entertainment company, of conducting unregistered securities sales through its NFT offerings.

Impact Theory raised around $30 million by selling NFTs called "Founder's Keys" between October and December 2021.

The SEC determined that these NFTs were investment contracts, therefore classifying them as securities.

By selling these NFTs without registering them, Impact Theory violated the Securities Act of 1933.

Penalties? Impact Theory agreed to pay over $6.1 million in penalties, including disgorgement and a civil penalty.

Stoner Cats? An animated web series backed by Mila Kunis and Ashton Kutcher that sold Ethereum NFT access passes but faced SEC charges, leading to bans on trading.

Solana knows the trouble

Don't be fooled by the SEC's latest move.

While the regulator has recently backed down from seeking a court ruling on whether Solana and other tokens are securities, don't think for a second that they've changed their tune.

Crypto industry insiders like Jake Chervinsky and Miles Jennings believe the SEC is simply playing a strategic game.

By dropping this particular battle, they're hoping to focus their energy on other fronts, like the Coinbase lawsuit where the judge seems more sympathetic to their stance.

The list of tokens

The SEC considered securities includes big names like Solana, BNB, Cardano, and more. This means the crypto industry is still in a state of uncertainty, with the threat of regulation looming large.

Block That Quote 🎙️

Ethereum co-founder, Vitalik Buterin

“Happy 9th birthday, Ethereum!”

Buterin celebrated Ethereum's 9th birthday on July 30, 2024.

This marks the official launch of the Ethereum network.

However, there's disagreement on Ethereum's "birthday".

Some argue for the date the whitepaper was published, while others point to the initial coin offering (ICO).

Multiple versions of the Ethereum whitepaper exist, further complicating the issue.

Despite the debate, many in the Ethereum community agree that July 30, 2024, marks the true anniversary.

This is the day the network went live and the first block was mined.

Key dates

Late 2013: Vitalik Buterin is believed to have first conceived of the Ethereum concept and shared early ideas with a small group.

Early 2014: A more formal "proto-whitepaper" was circulated among potential contributors.

December 2014: A more polished version of the whitepaper was published on GitHub.

The Tragic Murder of a Bitcoiner in Kyiv

29-year-old Moroccan Bitcoiner.

Kidnapped and murdered in Kyiv, Ukraine.

What was stolen? ~$170,000 worth of Bitcoin (around 2.55 BTC).

The four male suspects, aged 24 to 29, premeditated the attack.

How? Followed victim from a cryptocurrency meet-up.

Assault occurred around midnight on July 29, 2024.

After the abduction, victim was taken to an abandoned building

There he was coerced into transferring his Bitcoin to the suspects' wallets.

Suspects strangled the victim after the transfer.

Buried body in a nearby forest, attempted to conceal crime.

A swift police operation led to the arrest of the four suspects.

The local news video report - WATCH.

Facing charges: Murder, robbery and illegal deprivation of liberty.

The authorities are working to recover the stolen Bitcoin.

In The Numbers 🔢

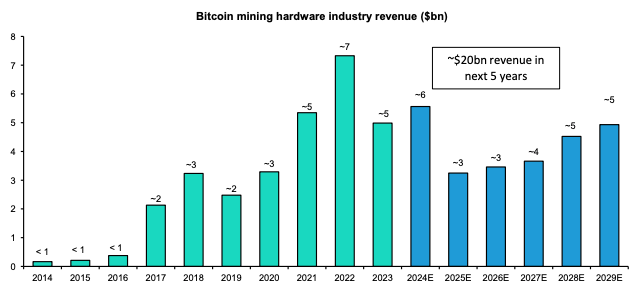

$20 billion

That’s how much Bernstein is betting on the Bitcoin mining hardware market.

Big. Pegged its potential value over the next five years.

This is largely due to the increasing demand.

For what? More efficient mining equipment to keep up with the growing Bitcoin network and the push by the US to become a mining superpower.

Historically, the mining hardware market has been dominated by Chinese giants like Bitmain.

The landscape is changing.

US companies like Block and Auradine are developing advanced mining chips.

Their focus on energy efficiency and potential access to cutting-edge chip manufacturing technology could reshape the industry.

“We expect 15-30% growth in annual mining equipment demand led by increasing network hashrate (supported by our bitcoin price conviction) and replacement / upgrading of existing capacity to make mining more efficient after rewards are cut in half in bitcoin terms after halving.”

Trump helps too.

“In view of US election season and Trump’s recent push to make Bitcoin in America, we believe this could be an important tailwind for the mining sector.”

Crypto to Dodge International Sanctions

That’s Russia.

That’s what brings the shift in their crypto stance?

Passed two bills.

1/Russia has officially legalised cryptocurrency mining, with the law coming into effect on November 1, 2024.

What that means?

Registered legal entities and individual entrepreneurs can engage in mining.

Unregistered individuals can mine only if they adhere to energy consumption limits.

Strict oversight by the Bank of Russia and other government agencies.

Ban on cryptocurrency advertising and public offerings.

A dual approach. Cautious, but strategic.

2/A new law allows the Bank of Russia to authorise selected companies for cross-border crypto settlements and trading.

What that means?

This experimental regime starts on September 1, 2024.

Companies must apply to the central bank to participate.

The Bank of Russia aims to test the waters for crypto usage in foreign trade and exchange trading.

The Surfer 🏄

California DMV digitizes 42 million car titles on the Avalanche network to modernise title transfers. Users can transfer vehicle titles in minutes instead of the traditional two-week timeframe.

Blackbird has launched a new app feature allowing users to pay for meals with cryptocurrency at top NYC restaurants, including the Michelin-starred Semma.

UAE residents can now trade cryptocurrencies directly using their bank accounts. M2 exchange enables direct conversion of UAE dirhams into Bitcoin (BTC) and Ether (ETH).

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋