Avery Ching: The Systems Thinker 🧠

From Facebook's social graph to blockchain's financial infrastructure.

The Facebook graph has a trillion edges.

That number sits in Avery Ching’s mind like a benchmark, a proof point for what distributed systems can accomplish when designed correctly. A trillion connections between people, photos, posts, and places. All analysable in under four minutes using commodity hardware that any company could buy.

Ching knows this because he built the system that made it possible.

In 2007, fresh out of his PhD program at Northwestern University, Ching co-founded Apache Giraph at Yahoo. The project started as an experiment in distributed graph processing. It ended up powering Facebook’s Graph Search and fundamentally changed how tech companies think about analysing social networks at scale.

But Ching didn’t pivot to crypto because it was trendy, or because venture capital was flowing in that direction. He spent a decade at Meta, building the infrastructure that was supposed to power Diem, the company’s ambitious attempt to create a global digital currency.

When Diem collapsed under regulatory pressure in 2021, Ching and his team doubled down. Within months, they founded Aptos Labs with a clear thesis to build a blockchain that could actually handle institutional finance at global scale.

Today, Aptos processes transactions for BlackRock, Franklin Templeton, and Apollo. The blockchain now holds over $1.2 billion in tokenised real-world assets.

Ching has gone from building systems that analyse how billions of people connect on social media to building systems that could change how trillions of dollars move through the global economy.

WhiteBIT: Where Crypto Trading Meets Power and Simplicity

Whether you’re new or seasoned, you get:

300+ cryptocurrencies & 780+ trading pairs to diversify your portfolio

0.1% maker & taker fees, trade more, waste less

96% assets in cold wallets & audited by Hacken security you can trust

WhiteBIT Nova Card, auto-invest, margin/futures, and quick send transfers all in one platform

VIP program with up to 100% trading fee discounts and priority features for high-volume traders

Join millions who trade confidently with WhiteBIT.

Avery Ching grew up in Honolulu, attending Punahou School from kindergarten through high school. The same school that produced Barack Obama.

He left Hawaii for Evanston, Illinois, enrolling at Northwestern University to study computer engineering. The transition from island life to Midwestern winters might have been jarring, but Ching found his element in Northwestern’s computer science labs.

His undergraduate focus was learning how to build systems that could handle complex computations across multiple machines simultaneously. But it was during his PhD work, defended in October 2007, that Ching developed the expertise that could define his career.

His dissertation specialised in supercomputing, parallel computing frameworks, and high-performance file systems. These are the foundation for every large-scale system that powers modern internet services.

Ching’s PhD advisor, Professor Alok Choudhary, was working on problems that companies like Google and Facebook were beginning to confront: how do you process massive amounts of data when that data is spread across thousands of machines?

The answer was about designing systems that could coordinate work across distributed infrastructure without bottlenecks or single points of failure.

This insight, developed in academic labs, would become Ching’s secret weapon when he entered the industry.

Building the System That Mapped Facebook’s Universe

In October 2007, the same month Ching defended his PhD, he joined Yahoo as a Principal Software Engineer. At the time, Yahoo was still a key player in tech, grappling with how to process the vast amounts of data generated by hundreds of millions of users.

Ching saw an opportunity. Social networks generate a specific kind of data structure: graphs. Every user is a node. Every friendship, every message, every interaction is an edge connecting nodes. The question was how to analyse these graphs when they grew to billions of nodes and trillions of edges.

His answer was Apache Giraph, an open-source distributed graph processing system. The project took inspiration from Google’s Pregel paper but made the technology accessible to any company that wanted to analyse graph data at scale.

Rather than trying to load an entire graph into the memory of a single machine (which was impossible at Facebook’s scale), Giraph distributed the graph across many machines. Each machine processed its portion of the graph, then communicated with other machines to coordinate results.

The system worked. Facebook adopted Giraph and used it to power Graph Search, a feature that lets users search their social network for things like “photos of my friends in Paris” or “restaurants my friends like in New York.”

More importantly, Giraph could analyse Facebook’s entire social graph in under four minutes using commodity hardware.

The Diem Detour

In 2011, Ching left Yahoo for Facebook (later Meta), where he spent the next decade building the infrastructure that powered the company’s analytics capabilities. He led teams working on Apache Spark, Hadoop, distributed scheduling, and the unified programming models that let Meta’s engineers analyse data across hundreds of thousands of machines.

Then, Meta announced plans for Libra, a digital currency project (later known as Diem).

The vision was to create a blockchain-based payment system that could serve billions of people worldwide, particularly those without access to traditional banking. Meta would provide the distribution through Facebook, WhatsApp, and Instagram. The blockchain would provide the infrastructure for cheap, fast, global payments.

Ching was appointed Tech Lead for Meta’s crypto platform, where his team was responsible for building the blockchain itself, the wallet infrastructure, and the strategy for ecosystem development.

Unlike Bitcoin or Ethereum, which sacrifice speed for decentralisation, Diem was designed to handle thousands of transactions per second while maintaining security and regulatory compliance. The team developed the Move programming language specifically for Diem, with built-in safeguards that made certain types of smart contract bugs impossible by design.

However, Diem faced problems that engineering couldn’t solve. Regulators around the world worried about Facebook’s power and influence. If billions of people adopted a Facebook-backed currency, what would that mean for monetary policy? For financial stability? For privacy?

The regulatory pressure became insurmountable. By early 2022, Meta dissolved the Diem project. Years of work disappeared as the company retreated from its crypto ambitions.

Ching and his core team faced a choice: return to traditional infrastructure work at Meta, or take what they’d built and launch it independently.

They chose independence.

Building Aptos

In December 2021, Avery Ching co-founded Aptos Labs with Mo Shaikh, who had led partnerships and strategy for Diem.

Crypto prices were beginning their long descent into what would become the 2022 bear market. FTX hadn’t collapsed yet - no one saw that coming.

Ching and Shaikh didn’t care about market timing. They had built a blockchain they believed was technically better than anything else available. With the Move programming language, the parallel execution engine called BlockSTM, and the Byzantine Fault Tolerant consensus mechanism, Aptos could process transactions faster than existing proof-of-stake systems.

The challenge, however, was whether anyone would care about technical quality when the entire crypto market was on the brink of collapse

In the early days of Aptos, Ching and his team had to convince skeptical investors why the world needed another layer-1 blockchain. Ethereum existed. So did Solana, Avalanche, Cosmos, and a host of other competitors vying for developers and users.

Ching’s pitch was different from typical crypto founders. He didn’t promise decentralisation utopia or revolutionary financial inclusion. He talked about what he knew, which was building scalable infrastructure.

“At Aptos, we think that our approach of being focused on upgradeability is actually the most important thing,” he explained. “The fact that you can start on a journey, and that journey can end up in a very different place because of the fact that you can continue to move the network forward.”

The focus on upgradeability came from hard-won experience at Meta. Systems that couldn’t adapt died. The ability to improve infrastructure without breaking existing applications was essential for long-term success.

Aptos launched its mainnet in October 2022, right as the crypto bear market deepened. FTX collapsed the following month, taking much of the industry’s credibility with it.

While retail investors fled crypto, institutions became more interested. The FTX disaster showed what happened when crypto infrastructure was built poorly. Companies like BlackRock and Franklin Templeton started looking for blockchain platforms that met institutional standards for security, compliance, and reliability.

Aptos’s enterprise pedigree suddenly became an advantage.

The Tokenisation Bet That’s Paying Off

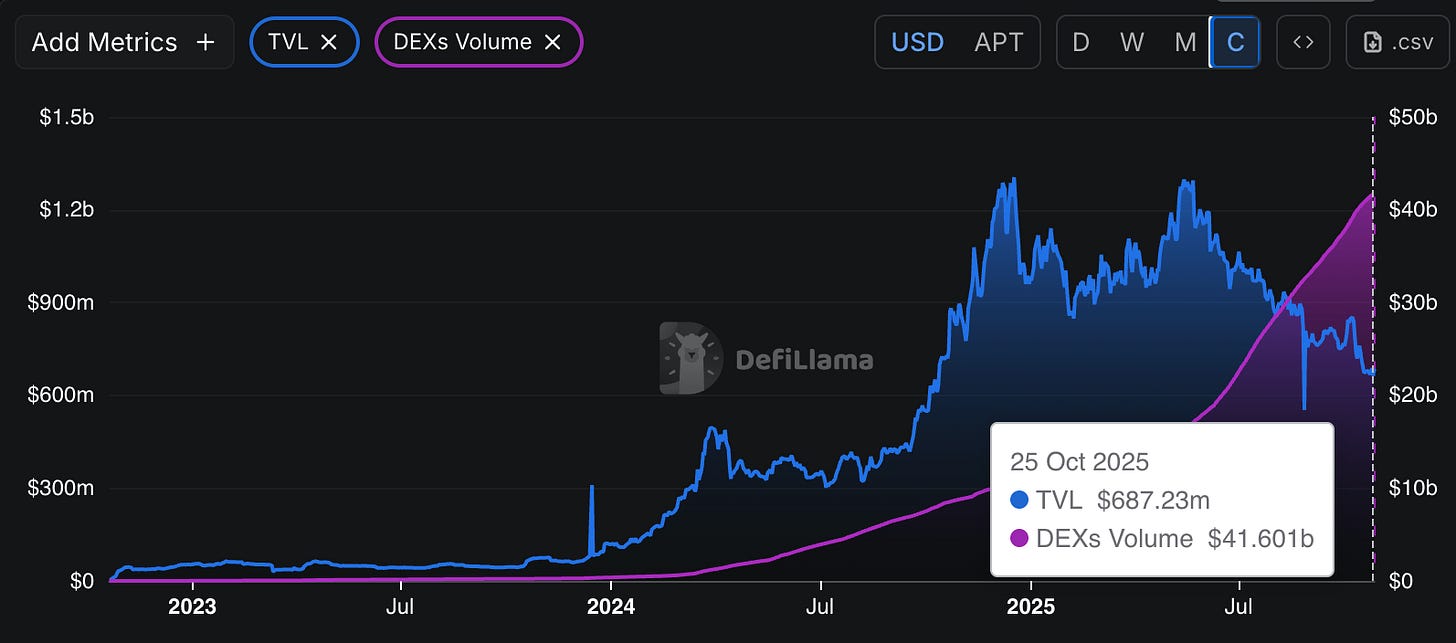

By 2023, Ching had narrowed Aptos’s focus considerably. Rather than trying to be everything to everyone, he positioned the blockchain as “the global trading engine” for tokenised real-world assets.

Traditional finance suffers from too much friction. Settlement takes days. Cross-border transactions are expensive. Trading hours are limited. Custody requires multiple intermediaries.

Blockchain, on the other hand, could eliminate much of that friction. By putting real-world assets on a blockchain, you can trade them 24/7, settle instantly, and drastically reduce custody costs.

But tokenisation required more than just technology. It required partnerships with institutions that had the assets, the regulatory relationships, and the capital to make tokenisation real.

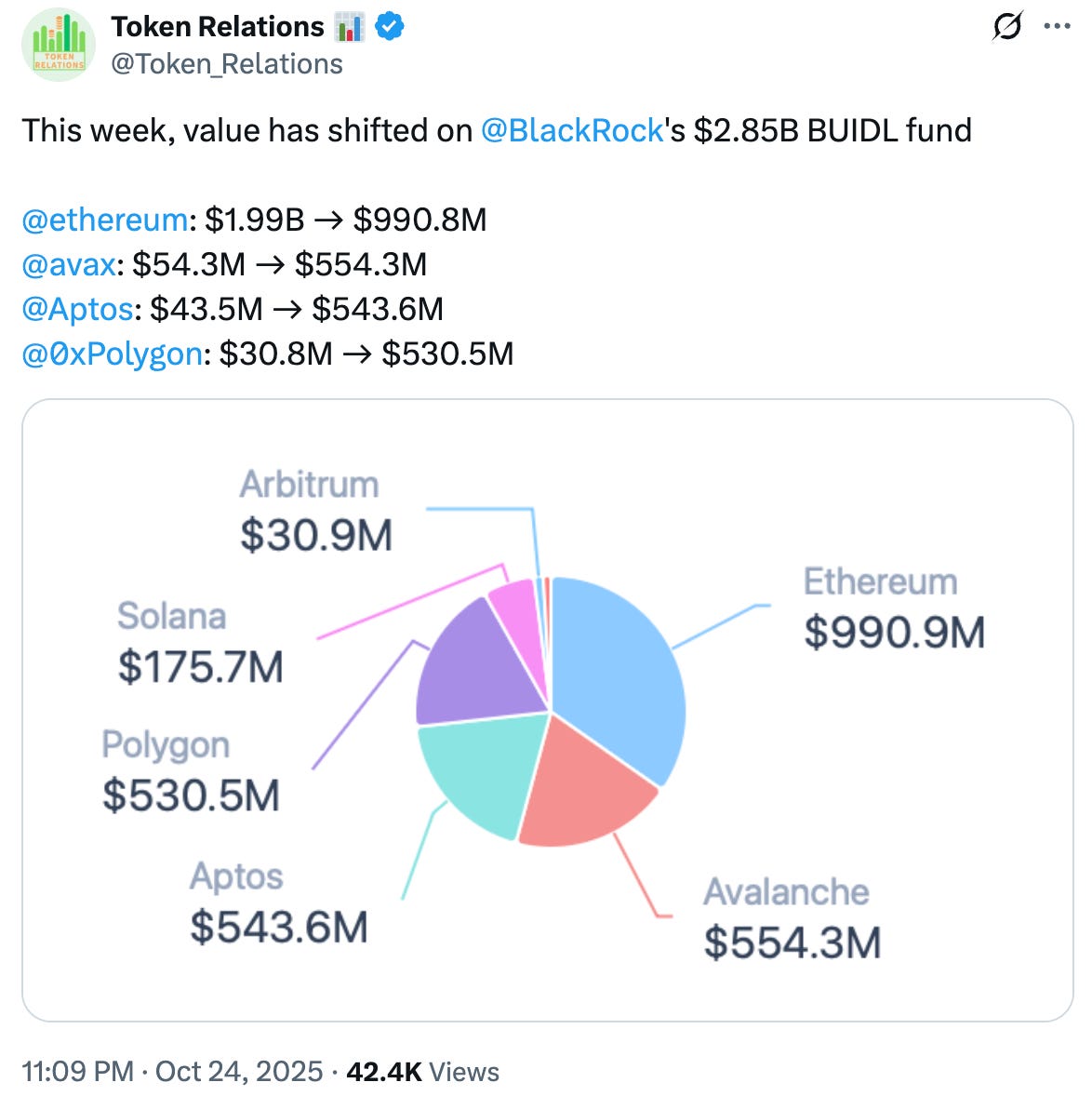

Ching started signing those partnerships. BlackRock brought its BUIDL fund to Aptos, contributing $500 million in tokenised assets. Franklin Templeton launched tokenised money market funds on the platform. Apollo began exploring tokenised credit products.

By mid-2025, Aptos was hosting over $1.2 billion in tokenised real-world assets.

The Korean market became another area of focus. Korea has high trading volumes, a large retail investor base, and cultural acceptance of digital assets. Ching established partnerships with Lotte Group, one of Korea’s largest retailers, which used Aptos to issue mobile vouchers.

“As we start to work with larger retailers and engage with banks and large payment corporations, we’re seeing interest from Korea pick up rapidly,” Ching said in late 2024. “The new government seems very supportive of crypto. I expect a very fast acceleration in Korea.”

The Korean partnerships validated Ching’s strategy: find real-world use cases where blockchain provides clear benefits, then scale up quickly.

In December 2024, Mo Shaikh stepped down from his leadership role at Aptos. Ching, who had served as CTO, took over as CEO.

As CTO, Ching had overseen technical development. As CEO, he would be responsible for the strategic direction and the partnerships that would determine whether Aptos succeeded or failed.

Ching’s first nine months as CEO have been spent sharpening Aptos’s positioning. Rather than competing with every other blockchain for developers and retail users, he’s focused on becoming the infrastructure that institutions use to tokenise and trade real-world assets.

But Ching isn’t just focused on building technology. He’s also engaging with regulators to help shape the rules that will govern tokenised assets.

In June 2025, he was appointed to the Commodity Futures Trading Commission’s Digital Asset Markets Subcommittee. The role gives him a voice in shaping U.S. regulations around digital assets.

“Avery will collaborate with other leaders from web3 and financial services to help shape digital asset regulations,” Aptos Labs announced when the appointment was made public.

For Ching, this regulatory work is essential. Institutional adoption of blockchain requires clear regulatory frameworks. Without such clarity, institutions can’t commit capital at scale.

The Builder’s Approach to Crypto

Ching doesn’t talk about decentralisation as an end goal. He doesn’t promise to overthrow traditional finance or create a new economic system. Instead, he focuses on solving practical problems: making transactions faster, reducing costs, improving security, and enabling new types of financial products.

This pragmatism comes from his background building infrastructure at Yahoo and Meta. Those companies weren’t concerned with theoretical elegance. They cared about systems that worked reliably for billions of users.

Ching’s focus on practical applications has attracted institutions that would never consider more ideological crypto projects. BlackRock and Franklin Templeton, for example, aren’t interested in disrupting central banks or creating parallel financial systems. They want infrastructure that allows them to offer better products to their clients.

Aptos gives them that infrastructure.

This is the engineer’s faith that better tools lead to better outcomes. That efficiency has its own morality. That making something work for a billion people is its own form of idealism.

He’s not trying to change human nature. He’s accepting it and building accordingly. In the end, that might be the most radical position of all.

That’s all for today. See you next week with another crypto profile.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.