Hello

Markets and economies sometimes don’t move in sync, but crypto’s 2025 made that gap look glaring. You could look at some telling crypto metrics and conclude that this year, which many were hoping to be a landmark one, didn’t really take off. And you wouldn’t be wrong for thinking so. Despite the top two cryptocurrencies, BTC and ETH, registering their all-time highs this year, so little has changed when you look at their year-to-date price movement.

Yet the year also shows that the undercurrent beneath the noise of prices tells an entirely different story about how the space has evolved.

In this week’s quantitative analysis, I will explore how on-chain crypto revenue and fee data contrast with the price charts of leading cryptocurrencies, and what this tells us about the industry’s evolution.

On to the story now,

Prathik

Ready to Turn Predictions into Profit?

Limitless is a next-gen, on-chain platform letting creators launch custom prediction markets and share them with their communities. Trade on real-world events, crypto, macro, sports and earn fees when your market grows.

Create markets in minutes and own your community’s engagement

Built on Base, backed by top-tier investors like Coinbase Ventures and Maelstrom Capital with over $250M traded so far

Earn points now and position yourself ahead of the token launch

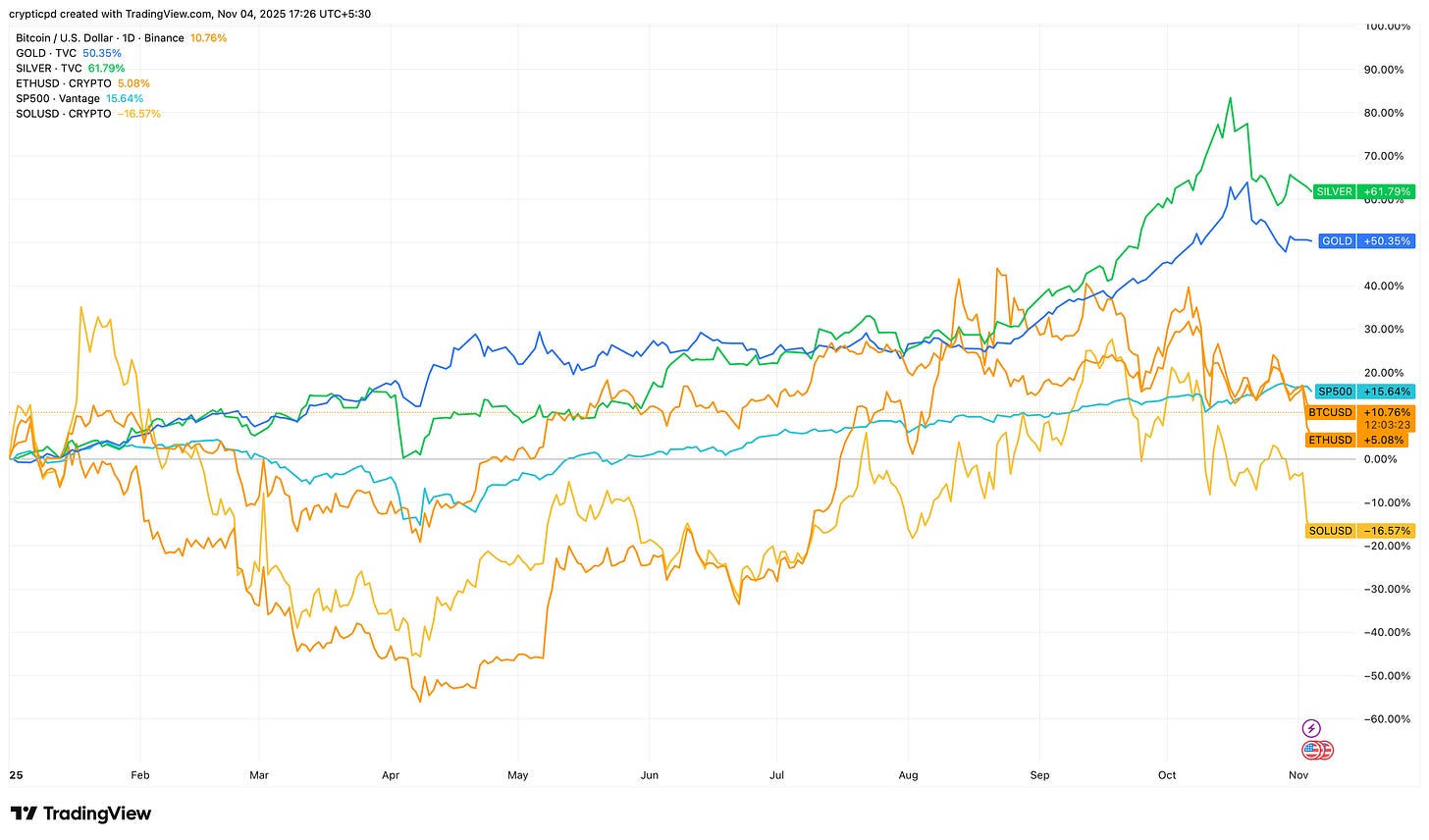

Bitcoin spent the year pacing between $93,000 and $126,000, and is trading roughly 10% up YTD, while Ethereum is up 5%, helped by a boost in institutional support from digital asset treasuries (DATs) and exchange-traded fund flows. On the other hand, Solana has dropped by ~16%.

Beyond crypto, other asset classes had a celebratory run, with gold, silver, and the S&P 500 recording all-time highs during the year.

The month that traders term as “Uptober”, for its near-clean record of green candles, finally broke its streak. Both BTC and ETH closed the month in the red for the first time since 2018. It was also BTC’s third-worst October performance in its history, despite trading at a record-high price above $125,000. The month witnessed the highest-ever single-day liquidations, with $19 billion in leveraged positions wiped out in a matter of hours after US President Donald Trump announced fresh trade tariffs against China.

While BTC and ETH closed October 4% and 7% down, other asset classes posted positive performance. Gold, Silver and the S&P 500 all recorded new all-time highs during the month.

These numbers might make it convincing to think of this year as a low-performance one for crypto. However, a closer look at the fundamentals tells a different story.

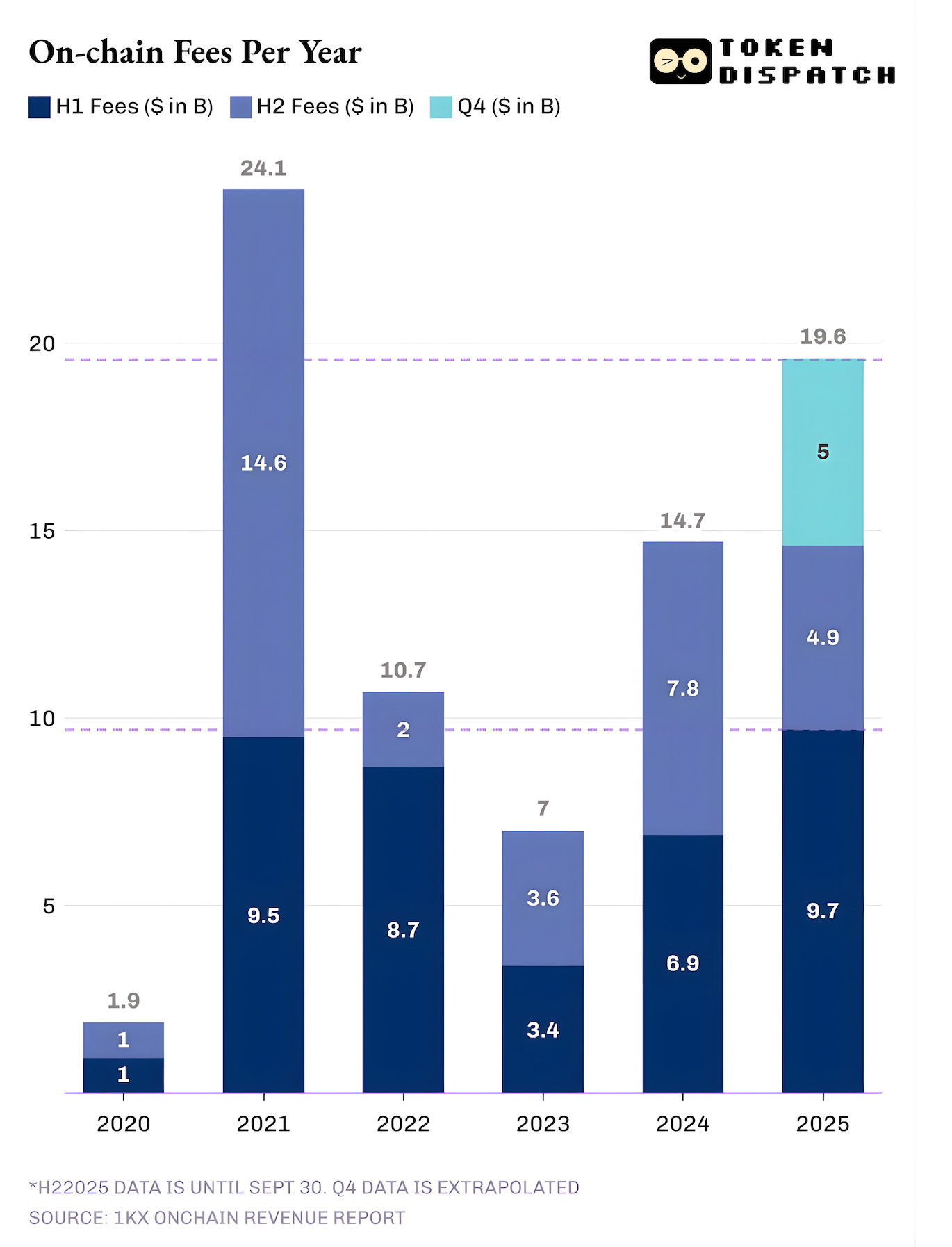

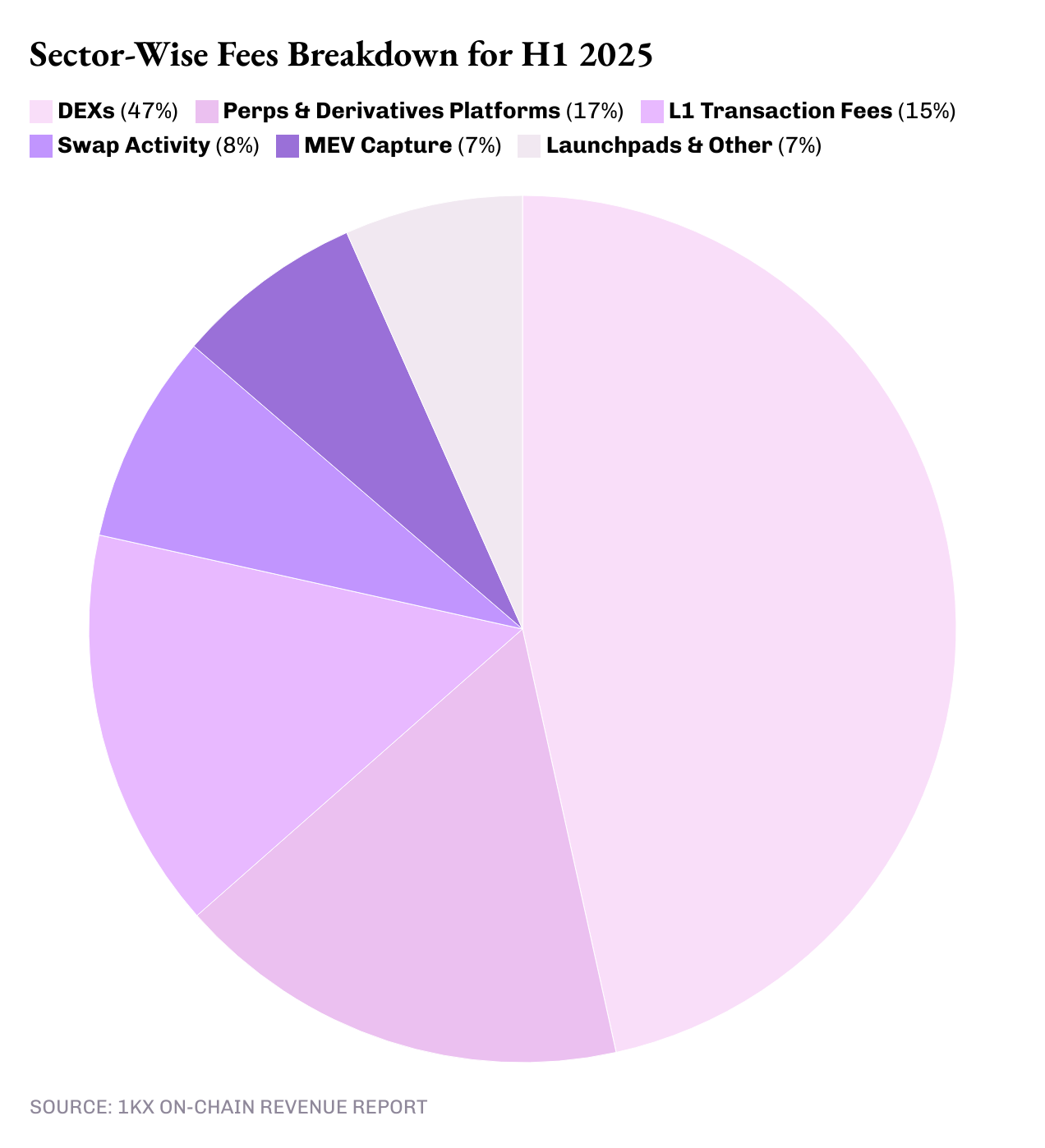

As of September 30, 2025, on-chain protocols had generated a record-high $15 billion in fees, surpassing 2024’s entire fees. In the first half of this year alone (H12025), on-chain users paid $9.7 billion in fees - marking the highest amount ever recorded for this period, showed a report by 1kx, a blockchain-focused investment firm.

The rise in fees matters because it reflects real adoption of the on-chain economy, including decentralised finance (DeFi) protocols, decentralised exchanges (DEXs), wallets, DePIN and other blockchain technologies. And unlike in 2021, when revenue spiked largely due to inflated gas costs, this year’s growth has come from broader participation at lower fees.

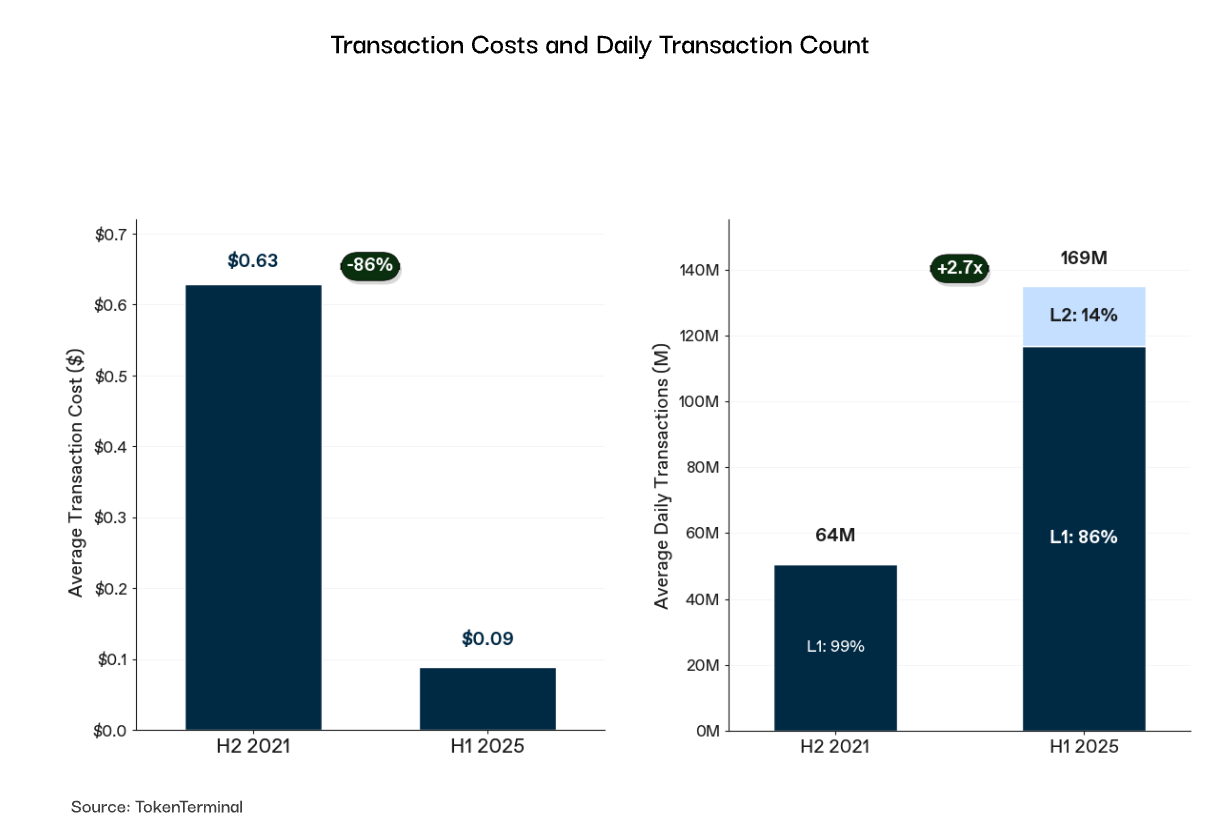

Average transaction costs across major networks have dropped nearly 90% since the 2021 peak, while the daily transaction count has increased 2.7x

This shows blockchains becoming more efficient over time. It means more people, apps, and systems are using blockspace, driving up genuine demand in the crypto economy.

Additionally, around 969 protocols generated fees in 2025, up from just 125 in 2021. For 389 protocols, 2025 was the first year of earning fees. During this period, the top-20’s share of total fees has shrunk from 94% to 69%, indicating that the ecosystem’s long tail is now becoming profitable with lower concentration.

The crypto space is also seeing new winners take the throne in relatively shorter periods.

In 2025, Solana’s Raydium and Meteora displaced Uniswap as top DEXs, while Hyperliquid crashed into the top five Perpetuals and Derivative platforms within a year of its launch.

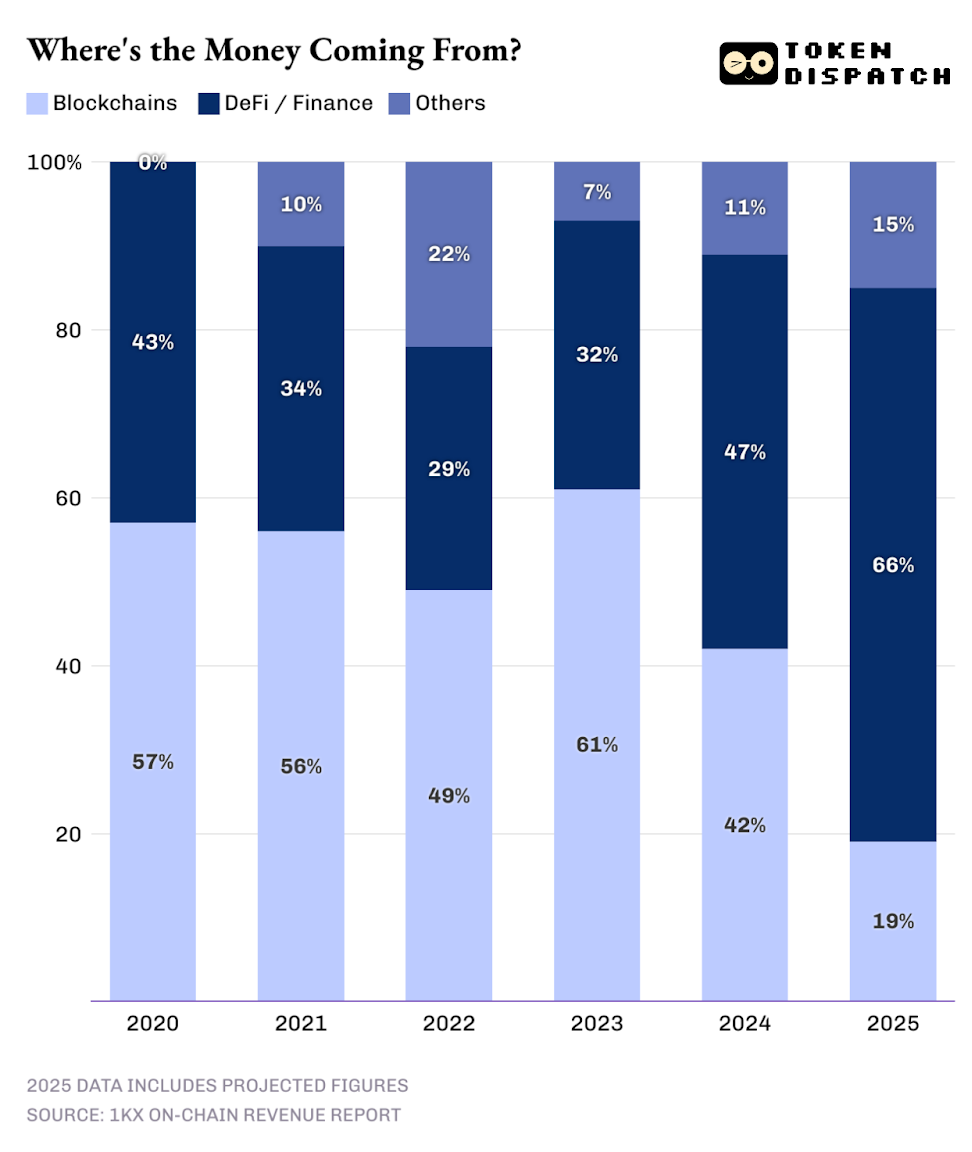

More than 6 in 10 dollars made in fees this year came from the DeFi sector, led primarily by DEXs and derivative platforms. The share of DeFi or finance-related apps in total on-chain fees almost doubled from 34% in 2021 to 66% in 2025.

What has also happened over the years is that the share of blockchains has shrunk from 57% in 2021 to 19% in 2025. This is a healthy sign that indicates value creation is moving up the stack from infrastructure to applications. As chains get cheaper and faster, what reflects their success is the amount of economic activity they enable above them.

There’s also another interesting observation. Despite H12025 collecting 33% fewer fees than H22021, the period saw protocols distribute 50% more value to their token holders.

Now, compare these metrics with the cryptocurrency prices that are often driven merely by speculation, and you begin to see the difference.

It is easy, and perhaps excusable, to dismiss 2025 as an uneventful year for crypto, considering prices barely moved. But the revenue numbers signal a robust economy in the making. It’s beginning to show all the ingredients that make a market look mature: blockchains seeing greater adoption, charging lower costs, and revenues coming from hundreds of protocols across the board rather than being concentrated in a select few.

The fact that on-chain fees and user activity reached all-time highs in a year that saw largely sideways price movements indicates that the crypto industry is transitioning towards more stable cash flows, moving beyond just speculation.

Crypto will continue to trade on stories and hypes, but these metrics are the first signs of a maturing industry. The growth of liquidity engines, automation protocols, launchpads, and wallets will help crypto evolve into an ecosystem resembling traditional, well-established industries.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.