Hello

On October 10, the crypto market experienced its largest single-day liquidation in history after US President Donald Trump threatened China with new trade tariffs. Over $19 billion was wiped out across exchanges, erasing weeks of leverage in major cryptocurrencies and altcoins alike. Bitcoin alone saw $4.6 billion in long liquidations, while Ethereum lost $3.8 billion, according to Coinglass data.

For many traders, the single wick that dipped to the abyss was the only thing that mattered. Yet, for those with a long-term perspective, the underlying flows reveal deeper insights.

In this week’s quants piece, I delve into on-chain data to explore what it tells us about who sold the news, who is buying the dip, and where Bitcoin and Ethereum might be headed from here.

On to the story now,

Prathik

Polymarket: Where Your Predictions Carry Weight.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

👉 Explore Polymarket

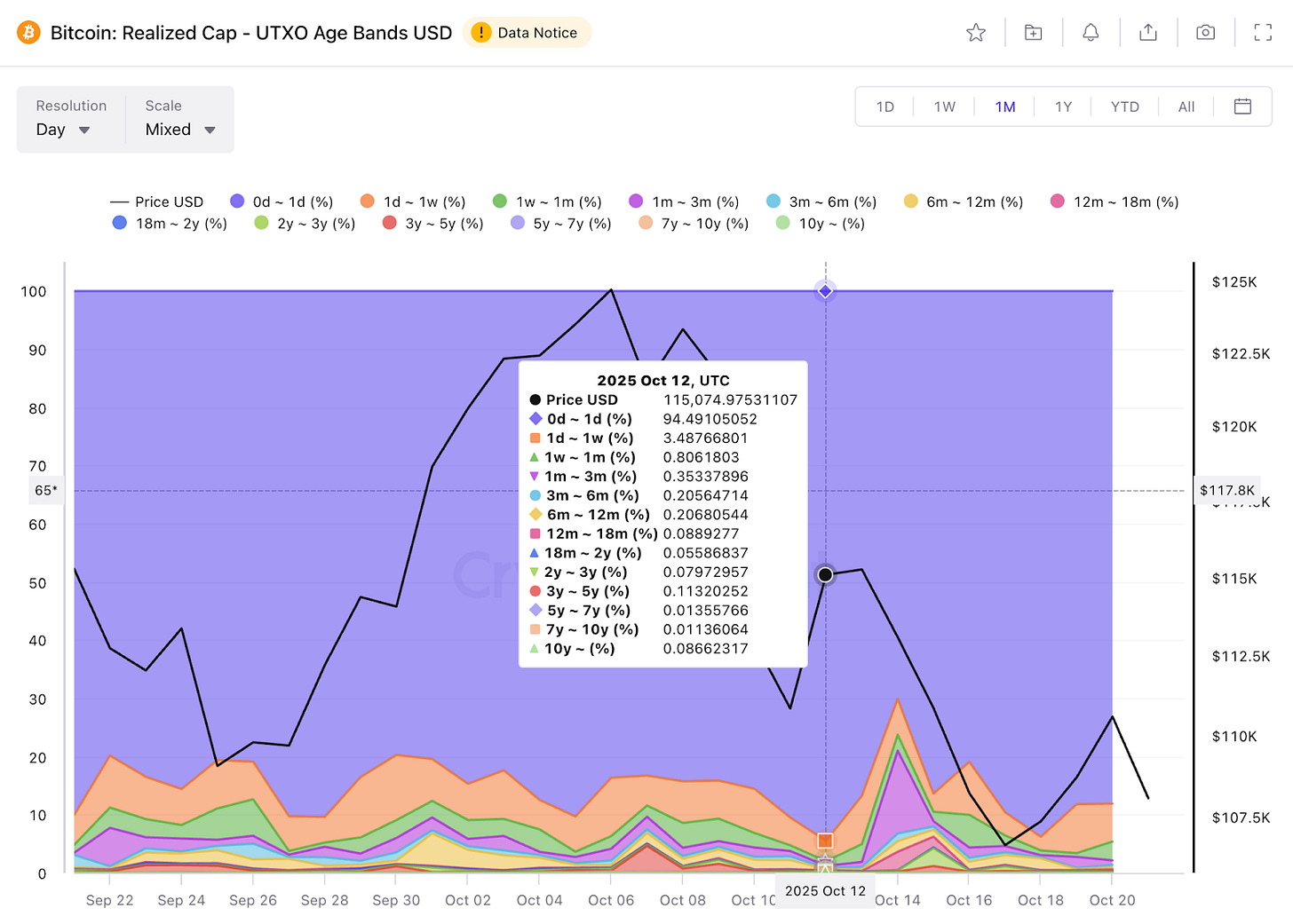

Let’s begin with who actually sold. During a time when the crypto industry was experiencing its worst decline in the shortest period, long-term holders barely moved and helped steady the ship.

CryptoQuant’s Spent Output Age Bands show that over 90% of BTC sold between October 10 and 11 came from coins held for less than a week.

The 0–1d and 1d–1w bands accounted for almost 98% of the sell-side. The share of realised value from long-term holders (6m–2y bands) didn’t shrink either, confirming that the sell-off was typical of what one sees during a liquidation cascade and not a case where conviction in the asset was unwinding.

The exchange inflow data reinforces this point. Although the 7-day Simple Moving Average (SMA) of BTC balances on exchanges shot up to the highest level since July 25, it shrank rapidly in the following week.

Even the Exchange Whale Ratio, which measures the ratio of top 10 inflows to the total inflows to exchanges, didn’t show a disproportionate shift and remained below 0.55 throughout. This suggests that whales who are the only cohort with the patience to withstand such volatility, did not resort to distribution during the mass liquidations.

Ethereum also followed a similar, though more complex, trajectory.

Just before the crash, CryptoQuant’s Exchange Inflow Mean for ETH shot up to 63.26, the highest in over seven months, showing that Ethereum was being moved to the exchanges. That didn’t last long. Right after the liquidation event on October 11, ETH was withdrawn from exchanges, with over 234,000 ETH pulled on October 15.

The exchange supply ratio, which is calculated by dividing the exchange reserve by the total ETH supply, has been steadily falling despite the liquidation event.

This suggests that more ETH was withdrawn than deposited, reinforcing that long-term holders were not shaken out.

Even Ethereum’s staking commitment in Ethereum remains resilient in the aftermath of the liquidation event.

For a market often accused of being sentiment-driven, the crypto market rarely appeared structured. Yet, October’s liquidation event showed some orderly behaviour despite the violent bloodbath some sections of investors witnessed. In under 24 hours, about $20 billion in overleveraged capital was flushed from the system. However, the broader conviction in the assets remained unshaken - at least not to the extent seen in previous cycles.

Institutional flows in exchange-traded funds for both BTC and ETH did turn negative after the liquidation event. But the flows were not disproportionately large compared to past reactions to other crypto-unfavourable events.

The charts show that what broke was the positioning of the select few, not their conviction.

I don’t view this as a sign of risk-off panic. There’s still no mass flight from spot, no stress on long–term holders, and no collapse in staking commitment. What we are witnessing is the reset of leverage into the hands of the players who can afford to wait: whales, stakers, and funds.

This doesn’t mean crypto is immune to macro shocks, but such events reveal that these structural flows will matter most in deciding the trajectory of BTC and ETH. This episode serves as a masterclass for retail traders to observe.

Although the crypto industry experienced the pain of liquidations, the impact was narrow and concentrated among a few sections. Positions were flushed, but the buyers on the other side were waiting and ready to cash in on buying the dip.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.