Bitcoin Believer Is Finally Free 🕊️

Julian Assange's release, a huge victory for crypto. Could Gensler's war hurt Biden? Ethereum ETFs only a week away? Blast's 17B tokens airdrop. Tax payments in Bitcoin? Solana aims for mainstream.

Hello, y'all. Are you a believer?

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

We’ve been brewing this for some time now.

It’s a big deal, for both - freedom and crypto.

Freedom for Assange

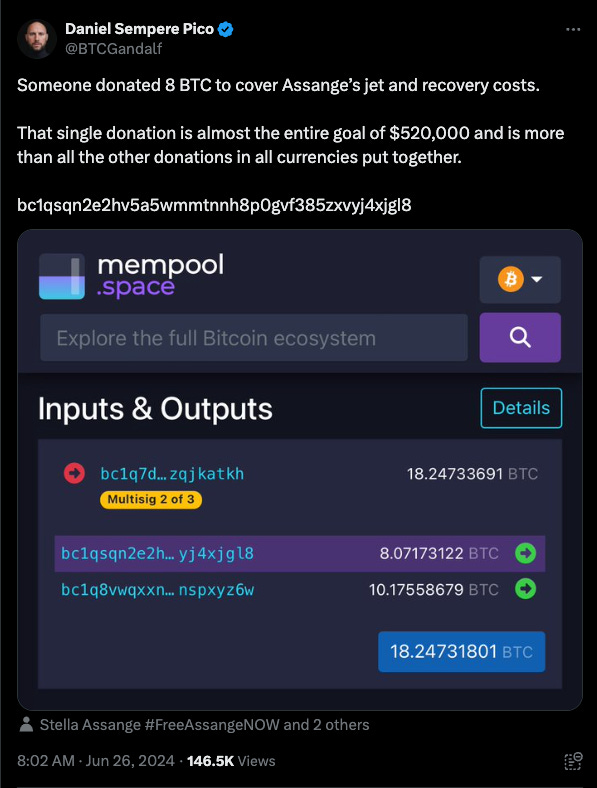

WikiLeaks founder Julian Assange finally heads to his home country, Australia.

14 years after seeking asylum at the Ecuadorian embassy in London.

Spending the last five years in a UK prison.

Assange accepted a plea deal.

Admitted to leaking US national security secrets.

Fined $500,000 but no prison time.

So he set off ✈️

What’s the back story?

In 2010 and 2011, WikiLeaks published around 750,000 classified documents from an army intelligence analyst - Chelsea Manning.

One of the largest breaches of state secrets in US history.

Bitcoin came in. When banks failed.

After the release of ‘cablegate’ files, WikiLeaks was hit with a ‘banking blockade’ by PayPal, Mastercard, Visa, Western Union and Bank of America.

Destroyed 95% of revenue.

WikiLeaks turned to Bitcoin and began accepting donations in the cryptocurrency.

Satoshi Nakamoto warning: Bitcoin’s pseudonymous creator warned WikiLeaks against using bitcoin.

Nakamoto was responding to a PCWorld post on the BitcoinTalk forum.

According to security researcher John Bambenek, reported by the Times of London.

WikiLeaks is thought to have raised 4,000 bitcoin in donations.

It was back in 2014, and the price of bitcoin was $300.

Assange called Bitcoin "the most interesting thing on the internet."

It’s value now is almost $250 million.

In 2017, Assange claimed he had made a 50,000% return on bitcoin.

AssangeDAO to rescue

Member Silke Noa posted on X that out of 16,593 Ether, an estimated 11,000 ETH worth $37 million has been spent on legal defense and campaigning by AssangeDAO’s The Clock.

“Arguably, there were security reasons that prevented full transparency on the fund allocation to not prejudice Julian’s case in the past. But now it is time for Wau Holland Foundation to provide a detailed accounting of how the funds were allocated, as I have previously urged repeatedly.”

Harry Halpin, AssangeDAO co-founder and CEO of Nym Technologies, told DLNews.

“[It’s] a huge victory for crypto … I do not believe Julian would be free if the US government did not know that Julian had enough censorship-resistant cryptocurrency to basically fund his legal battles indefinitely.”

After Julian Assange was released from the UK's high-security Belmarsh prison on June 24, after spending 1,901 days there.

AssangeDAO's token [JUSTICE] gained over 80% on June 25.

Fast forward to June 26, it has cooled down.

Block That Quote 🎙️

Securities and Exchange Commission (SEC) Chair, Gary Gensler.

"I don't speak about elections."

Sure he doesn’t, but he does speak about crypto.

What about the Ethereum ETFs? Gensler declined to say when the staff would complete the document review.

The review of plans for a US ETF that invests directly in Ethereum is progressing smoothly.

The rules do not have any inconsistencies in cryptocurrencies and securities laws.

SEC Chairman Gensler interview at the Bloomberg Investment Summit 👇

Crypto didn’t take this well. Not at all.

Where’s Ethereum ETF?

A new regulatory filing from VanEck suggest that the US Ethereum ETFs could only be a week away from launch.

VanEck waives fees for Ethereum ETF: Will be waiving the fees until 2025 or until the fund reaches $1.5 billion in assets, whichever comes first.

After this initial fee-free period, the fund will charge a 0.20% management fee.

Comparison to VanEck's Bitcoin ETF: Employed a similar fee-waiving approach with its spot Bitcoin ETF, which is currently the sixth-largest in the market with $614 million in assets.

The firm is waiving fees entirely on the Bitcoin ETF until it reaches $1.5 billion or March 31, 2025, whichever comes first.

Matthew Sigel, the firm’s head of digital-assets research.

Crypto ETFs fee war: Out of nine prospective issuers, VanEck and Franklin Templeton are the only two that have disclosed their Ethereum ETF fees.

Franklin Templeton will be offering 0.19% fees on its ETF - the same as for its Bitcoin ETF.

Firms don’t need to disclose their fees until very late in the ETF launch process, and issuers are likely waiting for BlackRock to make a move - according to Bloomberg Intelligence ETF analyst Eric Balchunas.

What about the fund flows?

Bitwise CIO Matt Hougan in a note sent to clients said that US spot Ethereum ETFs could attract $15 billion worth of net inflows in their first 18 months.

Logic? Allocation proportional to the market cap of Bitcoin ($1.2 trillion) and Ethereum ($405 billion). Weightage of around 75% for the spot Bitcoin ETFs and 25% for their Ethereum counterparts.

More than $50 billion in assets under management via the spot Bitcoin ETFs, Hougan expects this to reach at least $100 billion by the end of 2025.

This will be as the products mature and are approved on platforms like Morgan Stanley and Merrill Lynch.

Everyone is not bullish: Ether could fall to as low as $2,400 after the launch of spot Ether exchange-traded funds (ETFs), says Andrew Kang, a founder and partner at crypto-focused venture capital firm Mechanism Capital.

Read: The Impact of the Ethereum ETF ETF - An analysis

In The Numbers 🔢

17 billion

Number of tokens Blast Foundation plans to Airdrop, as part of phase 1 of the airdrop. It’s live for claim.

Airdrop distribution

The 17 billion BLAST tokens allocation.

7% to users who helped bootstrap the protocol's liquidity by bridging ETH or Blast's stablecoin USDB.

7% to users earning Blast Gold from participating in decentralised applications.

3% to the Blur Foundation to distribute to the Blur community for retroactive and future airdrops.

Blast tokenomics

Blast has allocated 50% of the 100 billion total token supply for the community, with additional airdrops planned over the next three years.

Blast's tokenomics report.

Other token allocations.

25.5% to core contributors

16.5% to investors

8% to the Blast Foundation

About Blast: Created by Tieshun Roquerre, the founder of the NFT marketplace Blur.

The platform seeks to create a native yield model for Ethereum and stablecoins, and its mainnet launched on February 29th.

As of the time of writing, Blast maintains over $1.5 billion in total value locked, according to DeFiLlama.

Bill To Allow Federal Tax Payments In Bitcoin

Florida Republican Matt Gaetz has introduced legislation that would enable taxpayers to use Bitcoin to pay their federal income taxes.

Why Bitcoin tax payments? Gaetz believes that allowing Bitcoin payments for federal taxes will "promote innovation, increase efficiency, and offer more flexibility to American citizens."

Comparison to state-level crypto tax payments: Only Colorado's Department of Revenue began accepting crypto as a form of payment for business income tax and individual tax in September 2022.

Challenges and disagreements in congress: Lawmakers in Washington have made some progress on bills that would regulate stablecoins and the crypto industry at large. The House and Senate have shown differing levels of interest in crypto legislation.

In May, the US House passed a Republican-led Financial Innovation and Technology for the 21st Century Act (FIT21), which is unlikely to become law this year due to a lack of a companion bill in the Senate.

Read: President Joe Vetoes 🆑

Lawmakers have moved ahead on stablecoin legislation in the House and Senate, led by few senators. But, there has been disagreement in the House on who should be the primary regulator of stablecoins.

The Surfer 🏄

Solana Foundation launched "Solana Actions" and "Solana Blinks" to enable seamless on-site blockchain transactions on social media. Allows users to connect and send transactions without leaving the website they are on, aiming to "put the crypto back into Crypto Twitter".

Metallica's X account was hacked to promote a Solana token called "METAL", claiming partnership with Ticketmaster and MoonPay. The token reached $3.37M market cap but crashed as Metallica regained control and deleted posts.

Canadian rapper Drake has lost over $1 million in Bitcoin betting on the Stanley Cup and NBA Finals. His high-stakes wagers on the Dallas Mavericks and Edmonton Oilers, have both ended in losses.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋