Bitcoin is having an identity crisis.

Its struggle to defend its “digital gold” reputation from the storm of recession fears and Trump's tariff tantrums has finally given way. Gold - the good old physical one - has flipped crypto's flagship and reclaimed the ETF crown.

Read: The Day Bitcoin Flipped Gold 🤸🏼♀️

Gold hit a record $3,000 per ounce last Friday, up 15% this year. Bitcoin has shed 22% from its January peak of $109,000, now languishing around $82,000-$84,000.

The divergence couldn't be starker: one asset is fulfilling its millennia-old role as crisis insurance; the other is amplifying the very panic it was supposed to hedge against.

Where’s the Money Flowing

The numbers paint a brutal picture.

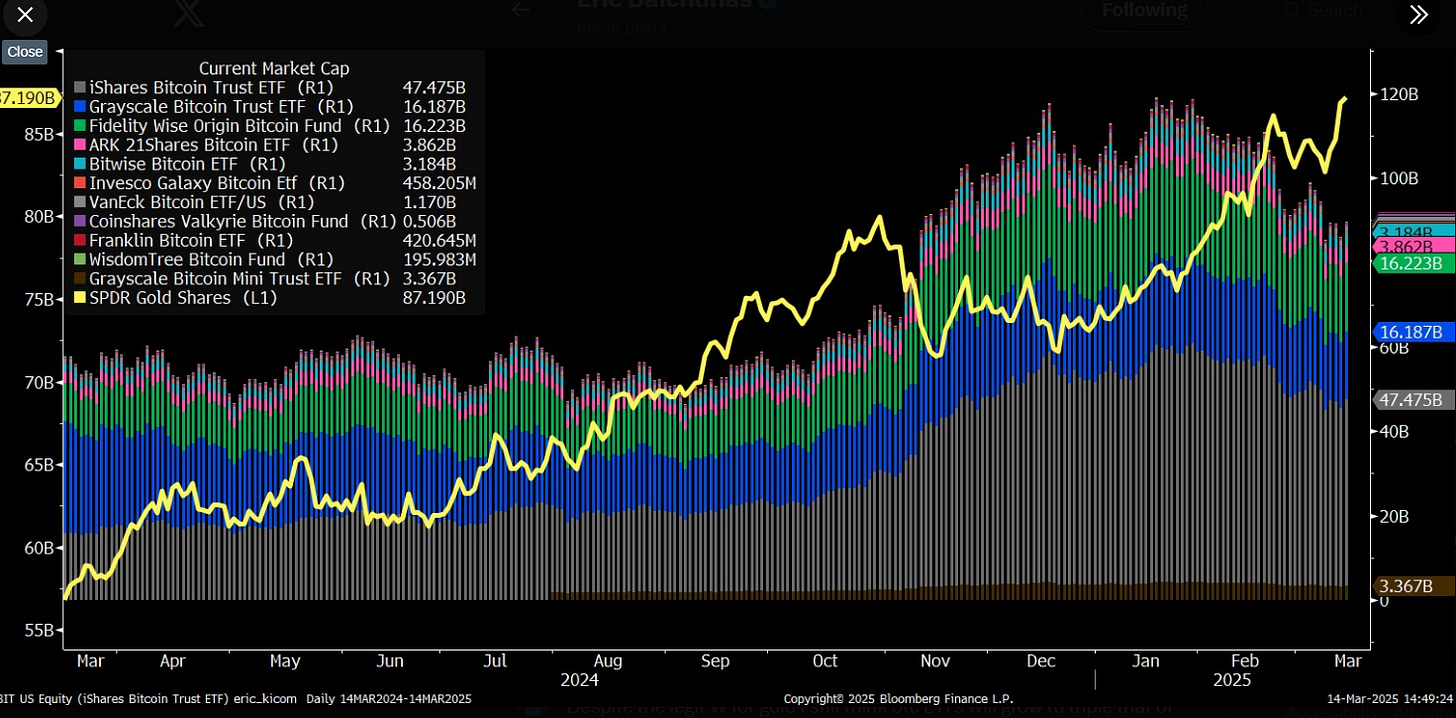

Gold ETFs: $10 billion in inflows over the past month

Bitcoin ETFs: $5 billion in outflows during the same period

Crypto market: Down 18% since Trump's inauguration

"If Bitcoin equals 'digital gold,' then time to act like it," Nate Geraci of The ETF Store posted on X last week. "Otherwise, it will reinforce the narrative that it's simply a high beta asset."

BlackRock CEO Larry Fink, who in 2017 dismissed Bitcoin as an "index of money laundering," now champions it as "digitalising gold." His firm's spot Bitcoin ETF was a watershed moment for institutional adoption.

MicroStrategy's Michael Saylor, perhaps Bitcoin's most zealous corporate advocate, has bet billions on the digital gold narrative — a bet now underwater as Bitcoin tracks the Nasdaq's 12% plunge rather than gold's ascent.

Why Isn't Bitcoin Acting Like Gold?

Several factors explain the disconnect.

At just 16 years of age, Bitcoin lacks gold's centuries of crisis performance.

The crypto market remains highly leveraged, amplifying downswings.

Despite growing institutional acceptance, Bitcoin is still viewed primarily as a speculative asset.

For Bitcoin to earn its "digital gold" moniker, it needs to decouple from equities during crises — precisely what it's failing to do now.

Canada's Foreign Minister Mélanie Joly described US trade policy as a "psychodrama," but the real drama might be playing out in the battle between Bitcoin and gold for safe-haven supremacy.

Some analysts remain optimistic.

Charlie Morris of ByTree predicts a reversal in ETF flows, noting that divergences between gold and Bitcoin tend to correct over time.

Others see a longer timeline: Bitcoin's safe-haven qualities — censorship resistance, perfect scarcity — may only shine during extreme scenarios like currency collapse or systemic financial failure.

For now, the "digital gold" narrative remains more aspiration than reality. Bitcoin is behaving exactly like what it is: a volatile, nascent asset class still finding its place in the financial ecosystem.

The question for investors: Is Bitcoin's correlation with tech stocks a permanent feature or a temporary growing pain on its journey toward true safe-haven status?

Until then, when markets tremble, the ancient metal still glitters brightest.