Bitcoin FTW? 💪

Bitcoin exposure reduces risks in traditional portfolios? $3.1 M transaction fee tragedy. Cool Cats high in Macy's skies. Bollywood Metaverse? South Korea's CBDC pilot. X bots corner CZ's account.

Hello, y'all. Music fans can now discover new and unique sounds from up-and-coming artists. Check out 👉 Asset - Your Music Stats.

Happy Thanksgiving👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Options are bullish, Hodlers are on it.

Hash rate is doin ATH and Predictions are right on.

Bitcoin FTW?

To everyone who called Bitcoin a risk asset:

Allocating just 1% to Bitcoin in investment portfolios might be the secret sauce for outperformance and risk mitigation.

K33 Research's recent report approves.

Key Takeaways:

1% Magic: Adding a mere 1% of Bitcoin to a classic 60/40 equities-bonds portfolio can lead to a 3.16% outperformance, says K33 Research.

Risk Mitigation: Surprisingly, Bitcoin doesn't just play offense; it excels at defense too. The blend weathers market storms and gives them with a performance boost.

Sizing Matters: While a splash of Bitcoin adds flavour, diving in too deep can make the portfolio stew too spicy.

Liquidity Play: The liquidity of Bitcoin markets, slowly recovering post-FTX collapse, is crucial. More liquidity, less market drama.

Bitcoin's been grooving independently, breaking correlation ties with traditional assets.

“Bitcoin has [returned] to a somewhat unpredictable path, independent of macroeconomic factors. This has implications as Bitcoin again shines as a powerful portfolio diversifier.”

Bitcoin ETFs are poised to hit the stage, attracting conservative investors. SEC approvals are expected soon, making it an entry point for traditional allocators.

Industry experts, including Fidelity Digital Assets, see Bitcoin as a crucial entry point for traditional allocators. The return profile of Bitcoin, driven by global digital asset growth and macroeconomic instability, positions it as a safer bet compared to other cryptocurrencies.

A recent Coinbase Institutional survey reveals that over two-thirds of institutional investors plan to increase crypto allocations in the next three years.

Bullish Bets Take the Spotlight

Options data unveils an intriguing scenario: out of the $4 billion Bitcoin options set to expire, over $2.2 billion are bullish calls.

Gearing up for a potential rally.?

October witnessed a record-breaking $24 billion in Bitcoin options trading volume, propelled by optimism surrounding the approval of Bitcoin spot exchange-traded funds (ETFs).

Read This: Bitcoin's October glow-up🌟

November didn't take a back seat, with options volume hitting an all-time high of $25 billion, showcasing growing sophistication in the crypto market.

HODLers Unite

The percentage of BTC's circulating supply inactive for over a year has soared to a record-breaking 70.35%, surpassing the previous peak in July.

Binance's Setback vs. Bitcoin's Set-Up

Even amid the shadows of Binance's regulatory setback, the market sentiment remains remarkably bullish.

Binance's $4.3 billion fine, although a significant event, is seen by some as a positive step forward, clearing regulatory uncertainties for the exchange.

Matrixport Analyst Predicts Bitcoin Surge Beyond $40,000:

Bitcoin is gearing up for a grand comeback, and Matrixport analyst Markus Thielen attributes it to the Binance legal tussle.

Bitcoin's quick rebound from $36,000 showcases resilience, with Thielen deeming a surge past $40,000 "inevitable."

Predicts Bitcoin hitting $38,000 by November end (80% probability) and surpassing $40,000 in December (90% probability). Seasonality and Tether's $5 billion rise play into the optimism.

Hash Rate Milestone

Bitcoin's hash rate reaches an all-time high at 491 exahashes per second, indicating increased network strength. The fourth Bitcoin halving, expected in April, contributes to the hash rate surge.

Miners invest in efficient machines ahead of the event, which reduces the reward for miners but is considered a bullish market indicator.

Read this: Bitcoin's 2024 Bash 🎉

TTD Numbers 🔢

$3 Million

A Bitcoin user unintentionally paid a transaction fee of over $3.1 million.

The user overpaid by a whopping 120,528 times, turning a routine transaction into a financial fiasco.

The Unfortunate Transaction: At 9:59 a.m. UTC, 83.65 BTC (that's $3.1 million) was sent to transfer 55.77 BTC ($2.1 million).

The payment address in question had been activated earlier that day, making three transactions before the costly fourth one.

The receiving address, relatively new, dates back to October 16.

Déjà Vu: A previous $500,000 fee paid in September was chalked up to a "fat finger" mistake by Paxos. F2Pool, the miner involved, agreed to reimburse the fee.

Will history repeat itself?

The transaction was mined by AntPool in block 818,087. AntPool is yet to respond.

The user might not be aware of RBF's non-cancellation policy.

RBF allows users to replace an unconfirmed transaction with a higher-fee version to expedite approval.

TTD Adoption 🫂

Purr-fect Thanksgiving

Cool Cats, the iconic NFT collection featuring the lovable Blue Cat and Chugs the milk carton, has taken a float in the prestigious Macy's Thanksgiving Day Parade, joining the ranks of beloved characters like Pikachu and Ronald McDonald.

The Cool Cats balloon, a visual delight for parade-goers, celebrates the launch of a new YouTube Shorts series titled "The Milk Chug."

Adding a touch of fashion flair to the festivities, a limited-edition Cool Cats hoodie, featuring NFC technology linking to an Azuki physical backed token, will be available at Macy's Herald Square.

Bollywood Metaverse?

Shemaroo Entertainment, an Indian media and entertainment giant, has teamed up with The Sandbox to bring Bollywood magic to the metaverse through its cultural hub, "BharatBox."

The partnership will infuse iconic Bollywood Intellectual Properties (IPs) into the metaverse, including classics like "Jab We Met," "The Great Gambler," "Disco Dancer," "Khuda Gawah," and more.

Fans can expect a virtual rendezvous with beloved characters from these cinematic masterpieces.

Shemaroo's venture into the metaverse extends beyond virtual events. The company is delving into the realm of Digital Collectibles and Non-Fungible Tokens (NFTs), exploring blockchain-based assets within the metaverse.

Where’s ETF? 🚨

The race to launch bitcoin ETFs has gained mainstream attention, and if someone brings it up at Thanksgiving, here's what you can say👇🏻

TTD South Korea 🇰🇷

South Korea has come up with a new CBDC pilot program.

Starting in the fourth quarter of 2024, the Bank of Korea (BOK), in collaboration with financial regulators, the Financial Services Commission (FSC), and the Financial Supervisory Service (FSS), will launch a CBDC pilot involving 100,000 citizens.

Token Triumph: The project will empower approximately 0.2% of the country's population to make purchases using tokens issued by commercial banks in the form of a CBDC.

Participants can make purchases using "deposit tokens" issued by commercial banks, akin to using vouchers at a store.

While the pilot will be initially limited to buying goods, the broader applications, such as remittances, will not be part of the trial phase.

As part of the broader exploration, the BOK plans to conduct technological experiments, including integrating the CBDC into a simulation system for carbon emissions trading.

The BOK outlined that the pilot project is set to kick off in the fourth quarter of 2024. The selection and recruitment of participants will take place between September and October 2024.

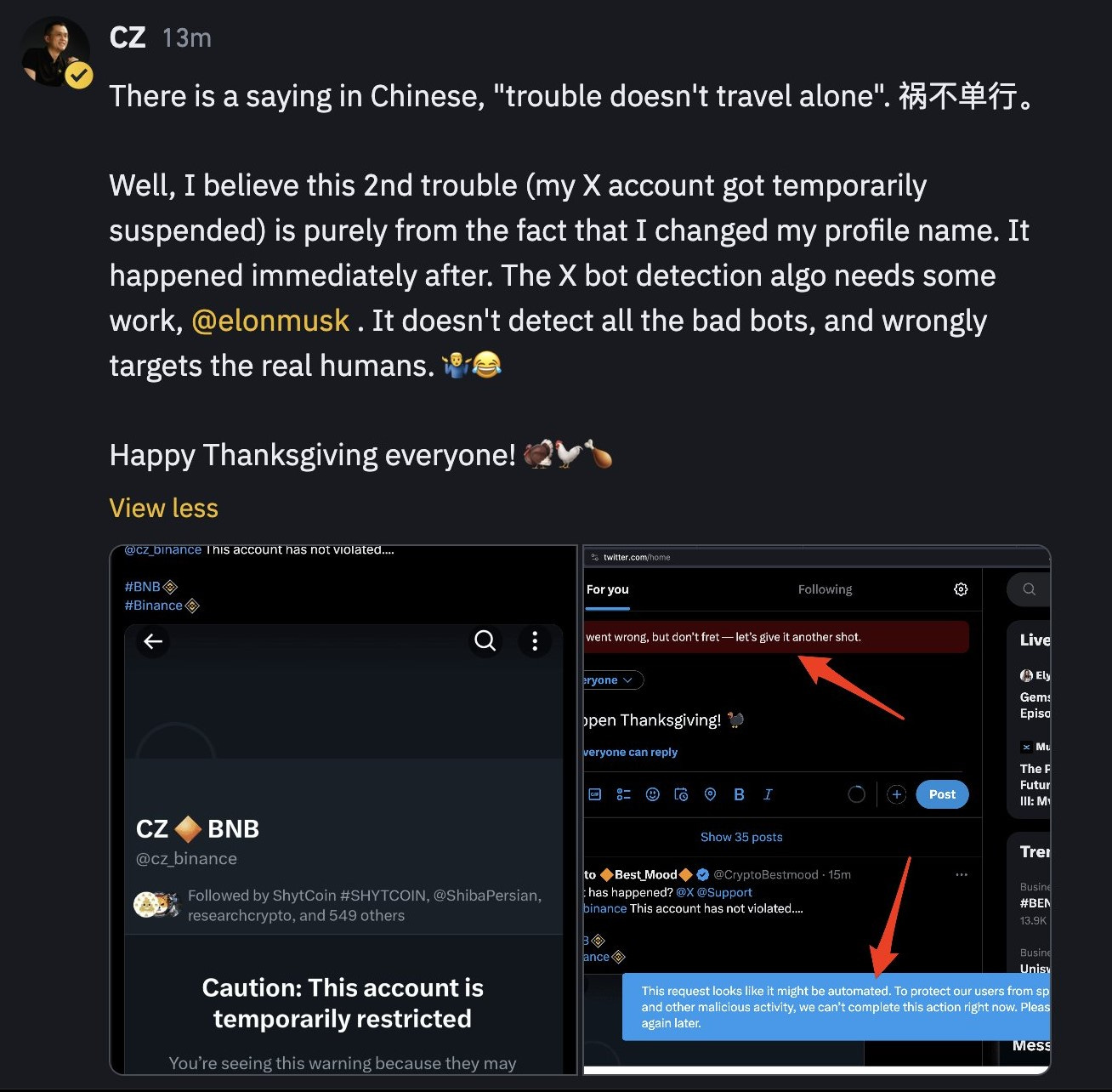

TTD CZ 🔶

CZ, the ex-Binance maestro, faced X (formerly Twitter) restrictions after swapping "CZ Binance" for "CZ BNB."

The bots got twitchy, accusing him of violation of X rules.

He responded:

The incident sheds light on potential challenges in distinguishing between automated bots and authentic user behaviour, as Zhao playfully nudges Elon Musk.

With CZ stepping down as Binance CEO following a $4.3 billion settlement with the U.S. Department of Justice, it remains uncertain how active Zhao will be on social media.

Richard Teng has assumed the leadership role at Binance, though Zhao's X following far surpasses that of his successor.

TTD Surfer 🏄

ARK Invest, the investment firm led by Cathie Wood, has sold 700,000 shares of the Grayscale Bitcoin Trust (GBTC) over the past month.

Do Kwon, the founder of Terra, has had his extradition approved by a court in Montenegro.

The recent attack on KyberSwap was carried out using an "infinite money glitch," according to DeFi expert Doug Colkitt.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋