Bitcoin Is Breaking Up With "Crypto"? 💔

Money is whatever we agree it is, until suddenly, it isn’t anymore.

You know by now that I talk about this a lot - the philosophy of it, the history of it, the messy human agreement that makes a piece of paper valuable or a number on a screen worth something. And every time we dig into it, we arrive at the same unsatisfying truth: the definition keeps shifting beneath our feet.

For most of human history, people used all sorts of things as money: salt, shells, cattle, precious metals, and pieces of paper with promises written on them. The question of what makes something “money” versus what makes something “just a valuable object” has never been cleanly resolved. We know it when we see it, except when we don’t.

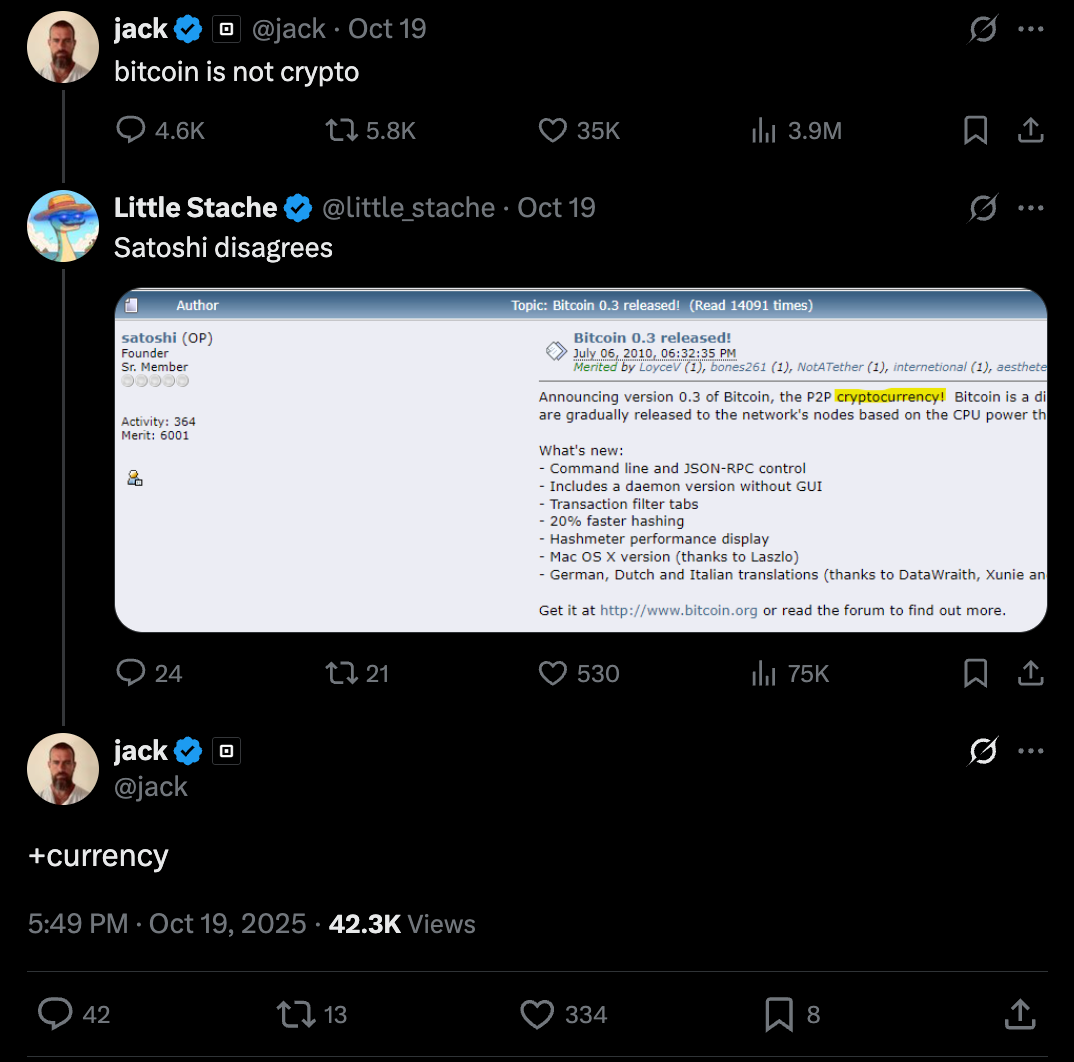

When Jack Dorsey tweeted, “bitcoin is not crypto,” he touched something raw in that old debate. Because if bitcoin isn’t crypto, then what is it? And if crypto isn’t bitcoin, then what is crypto? More importantly: why does it matter?

The easy answer is that this is just tribalism. Maximalists drawing lines. Teams picking sides. The kind of tedious argument that makes normal people stay away from the whole space because everyone involved seems slightly unhinged.

But I think something else is happening, something that matters beyond tribal warfare. I think the market is slowly, painfully figuring out that bitcoin and crypto were never the same thing, even though they lived at the same address for fifteen years. And the process of separating them isn’t a breakup. It’s specialisation.

This distinction matters because specialisation isn’t about conflict. It’s about function. The heart and the lungs don’t compete. They do different jobs. And if you tried to make your heart also do respiration, you wouldn’t have a more efficient organism. You’d have a dead one.

Bitcoin and crypto are diverging not because they hate each other, but because they’re designed to do fundamentally different things. One wants to be money. The other wants to be everything else. And both can succeed precisely because they’re not trying to be each other anymore.

The argument sounds like a war. But wars are about winning. This is about sorting.

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Why am I even bringing back this conversation?

Look, when Jack Dorsey tweets “bitcoin is not crypto,” you have to stop and think about what’s actually happening here. This is the guy who co-founded Twitter and Square (now Block), who has been so publicly, almost religiously devoted to bitcoin that he once described the Bitcoin whitepaper as “poetry.” He’s a Bitcoin maximalist in the truest sense: he thinks bitcoin is the only digital asset that matters, and everything else is noise at best, fraud at worst.

So when Dorsey makes this declaration, it feels significant. It feels like a breakup announcement. The maximalists cheer. The crypto builders roll their eyes. Everyone picks a side.

On the other side, the Czech Republic just added bitcoin to its national balance sheet. Not much. Not a game-changing amount. But it follows the US’s establishment of a strategic bitcoin reserve in March, which pushed 45 states to introduce their own reserve bills, with Arizona, New Hampshire, and Texas already enacting theirs. Luxembourg’s sovereign wealth fund went bitcoin-only.

They looked at the entire digital asset space and picked one thing. Why?

For years, bitcoin and “crypto” have been packaged together as a single category. Journalists write about “the crypto market” and mean everything from bitcoin to Dogecoin to whatever new token launched this morning. Regulators talk about “digital assets” and lump them all into one bucket. Asset managers create “crypto allocations” in portfolios. The industry tracks “bitcoin dominance” as a percentage of total crypto market cap, which implies they’re all competing for the same pie.

But that framing is starting to crack. Not because of ideology or tribalism, but because of how institutions actually treat these things, how markets actually price them, and how people actually use them.

When Fidelity publishes research on bitcoin, they don’t call it a “crypto asset.” They call it a “monetary asset.” BlackRock describes it as “digital gold” and a “non-sovereign store of value.” This isn’t just marketing language. It’s a fundamental categorisation that separates bitcoin from everything else in the space. They’re not comparing Bitcoin to Ethereum the way you’d compare Coke to Pepsi. They’re treating bitcoin as its own asset class entirely.

And this happened before Dorsey tweeted anything. Hardcore bitcoiners separated bitcoin from crypto in their minds years ago. They just didn’t announce it with a press release.

What Bitcoin Wants

Bitcoin is designed around a very narrow set of priorities: security, predictability, decentralisation, and monetary credibility. These features make it slow to change. Bitcoin’s development culture is famously conservative. Upgrades undergo years of debate. The whole system is built to be resistant to modification.

You could call this a bug. A lot of people do. They point out that bitcoin’s ten-minute block times are laughably slow compared to newer chains. They note that bitcoin can’t run smart contracts or decentralised applications or any of the fancy programmable stuff that Ethereum does. They’re right about all of this.

But here’s the other way to look at it: bitcoin is not trying to do everything. It’s trying to do one thing exceptionally well, which is to be credible, predictable, censorship-resistant money.

The predictability part is important. Bitcoin has a hard cap of 21 million coins. That cap is written into the protocol. Changing it would require convincing serious mining power and it will very likely be a hard fork. For many, 21 million hard cap is what represents bitcoin and is a distinguishing feature over fiat and crypto currencies. So the cap holds. It’s held for 16 years. The same monetary policy, over and over, no surprises.

Compare this to basically any other cryptocurrency. Ethereum gone from proof-of-work to proof-of-stake. It’s planning to make Ether deflationary via ERC 1559. These are all interesting technical decisions, but they’re the opposite of predictability. Every change is a reminder that the rules can change again.

And yes, I will tell you these changes make the system better. But you can ask “better” for what? If you’re trying to build a neutral, long-term store of value, changing the rules is not an advantage. It’s a liability. If you’re trying to build an application platform that can iterate quickly and serve developers, then changing the rules is great. You should change the rules all the time. Ship fast and break things.

The point is that these are different goals.

What Crypto Wants

The broader crypto ecosystem, everything that isn’t bitcoin, looks a lot more like a technology sector than a monetary system. It optimises for speed, programmability, and innovation. There are new Layer 2 scaling solutions every few months. There’s decentralised finance with lending protocols and derivatives and yield farming. There’s decentralised physical infrastructure. There’s gaming. There’s NFTs. There’s whatever comes next.

The pace is fast. The cycles are short. The ambition is broad.

Crypto operates more or less like Silicon Valley. Venture capital pours in. Founders raise money, ship products, pivot when things don’t work, ship again. Some projects succeed spectacularly. Most fail. There are hype cycles and crashes, and narratives that change every quarter. DeFi summer gives way to NFT mania, which gives way to Layer 2 season, which gives way to whatever’s happening now.

This is not how monetary systems work. You don’t want your money supply to pivot based on what’s trending. You don’t want foundation members voting on whether to change the issuance schedule. You don’t want rapid iteration on your unit of account.

So crypto and bitcoin have different jobs. Crypto wants to be a technology industry. Bitcoin wants to be money. These aren’t competing visions. They’re different roles in the same economy.

Why This Looks Like A Breakup

From the outside, the separation looks hostile. Bitcoin maximalists dismiss altcoins as scams or distractions. They’ll tell you that every cryptocurrency other than bitcoin is either a security, a centralised database with extra steps, or a solution in search of a problem. Crypto developers, meanwhile, call bitcoin inflexible and outdated. They point to its limited functionality and argue that maximalists are stuck in 2009.

Markets treat them differently, too. Bitcoin has its own cycles, its own narrative, its own institutional buyers. When MicroStrategy (sorry, ‘’Strategy’’) buys billions of dollars of bitcoin, they’re not buying a little Ethereum on the side for diversification. When El Salvador made bitcoin legal tender, they didn’t include a basket of top-ten coins.

Regulators also increasingly separate them. Bitcoin is generally treated as a commodity. Most other tokens are in a gray area, where they might be securities, depending on how they were issued and who controls them. This creates different regulatory frameworks, different compliance requirements, and different risk profiles.

So yes, it looks like a breakup. Different treatment, different communities, different use cases.

But what if the separation isn’t adversarial? What if they’re just doing different things?

The Asymmetric Dependency

Crypto needs bitcoin more than bitcoin needs crypto.

Bitcoin provides legitimacy for the entire space. It’s the entry point for institutions, the reference asset for new adopters, and the benchmark by which all digital assets are compared. When someone says “blockchain technology,” they’re really talking about the thing Bitcoin invented. When regulators decide how to think about digital assets, they start with bitcoin and then figure out how everything else is different.

Bitcoin also sets the liquidity cycle. Bull markets typically start with bitcoin. Money flows into bitcoin first, then rotates into higher-risk crypto assets. This pattern has held for multiple cycles. Without bitcoin’s liquidity and mindshare, the broader crypto market would be structurally weaker.

And bitcoin functions as a kind of reserve asset for crypto. Even as these ecosystems diverge, bitcoin remains the dominant asset for large-scale settlement, long-term storage, and cross-border value transfer. It’s the closest thing to digital gold.

The reverse isn’t really true. Bitcoin doesn’t need the innovation happening in crypto. It doesn’t need smart contracts, DeFi, NFTs, any of it. Bitcoin can just sit there, slowly processing transactions, maintaining its monetary policy, and being exactly what it’s always been. That’s kind of the whole point.

This creates an interesting dynamic. Crypto orbits bitcoin. Bitcoin is the sun. The planets can spin wildly, try new things, crash into each other, but the gravitational center holds.

The Practical Problem

If bitcoin wants to be money, it has a problem: people don’t spend it.

Every bitcoin holder knows the Laszlo pizza story. And that story does something to your brain. It makes you terrified to spend bitcoin because what if it goes up? What if you’re buying the next billion-dollar pizza?

This is not a quirk of early adopters. This is basic human behaviour. When you hold an asset that appreciates, you don’t spend it. You hoard it. You spend your worst-performing assets first and save your best-performing assets last. This is called Gresham’s Law: bad money drives out good money. If you have some currency that might go up 100% next year and some currency that definitely won’t, you’re going to spend the one that won’t and save the one that might.

So bitcoin, by being so successful as a store of value, has made itself bad at being a medium of exchange. People treat it like digital gold because it acts like gold: scarce, valuable, and something you definitely don’t want to spend on coffee.

There’s also the unit of account problem. Money is supposed to serve three functions: store of value, medium of exchange, and unit of account. Bitcoin arguably does the first one well. It struggles with the second. But the third is where it really falls apart.

Nobody prices things in bitcoin. Salaries are in dollars, euros, or rupees. Rent is in fiat. Corporate accounting is in fiat. Even bitcoin conferences usually price tickets in dollars. You might be able to pay in bitcoin, but the price is set in fiat and then converted.

Why? Because bitcoin is too volatile to quote prices in. You can’t walk into a coffee shop and see a sign that says “Coffee: 0.0001 BTC” because tomorrow that number might be 0.00008 BTC or 0.00015 BTC depending on what the market did overnight. A money that isn’t used to price goods isn’t functioning as a medium of exchange. It’s functioning as an asset you exchange for actual money right before you buy things.

And even when merchants do “accept Bitcoin,” what actually happens is more revealing: the Bitcoin gets instantly converted to fiat at the point of sale. The merchant receives dollars or euros, not Bitcoin. So you’re essentially using Bitcoin as an unnecessary middleman - converting your appreciating asset into the money you could have just used in the first place.

This works in a few specific cases. If you’re in Turkey or Venezuela or Argentina, where your local currency is inflating faster than Bitcoin is volatile, then sure, Bitcoin becomes the more stable option. But that’s not a story about Bitcoin being good money. That’s a story about fiat being terrible money in those specific places.

This is why, when Jack Dorsey’s Cash App announced it would support stablecoins this week, it chose to build on Solana. Not bitcoin. Solana. For a Bitcoin maximalist, this is like a vegan opening a steakhouse. But it makes perfect sense if you understand what each thing is actually for.

Stablecoins are what people use for payments. They’re pegged to dollars, so they don’t have the spending problem bitcoin has. Nobody’s worried that their USDC is going to 10x next year, so they’re fine spending it. Stablecoins are boring, stable, and actually useful for moving money around.

Bitcoin is what people use for storing value. It’s scarce, hard to inflate, and outside any government’s control. But you don’t buy coffee with your 401(k), and you probably shouldn’t buy coffee with your bitcoin either.

The Layered Model

So maybe the digital asset economy isn’t fragmenting. Maybe it’s organising itself into layers, with each layer doing what it’s good at:

Layer 1: Bitcoin - The Monetary Base

A non-sovereign store of value with predictable issuance and global neutrality. It’s slow, conservative, and built to last decades. Institutions treat it like digital gold. People hoard it. This is fine. This is the whole point.

Layer 2: Stablecoins - The Medium of Exchange

Digital representations of fiat currencies that people actually spend. They’re fast, cheap, and boring. They don’t appreciate, so you don’t feel bad spending them. They live on various blockchains, including bitcoin’s Lightning Network but also Ethereum, Solana, Tron, wherever works best for the use case.

Layer 3: Crypto Networks - The Application Layer

Platforms enabling financial markets, decentralised applications, tokenised assets, and whatever comes next. This is where innovation happens. This is the technology sector. It’s fast-moving, venture-backed, and sometimes very stupid, but occasionally brilliant.

This model mirrors how traditional economies work. Gold is a store of value. Fiat currencies are media of exchange. Financial markets and technology companies build applications on top. Nobody expects gold to also be a payment rail and a smart contract platform. Different things serve different functions.

These aren’t competing investments.

Bitcoin isn’t breaking up with crypto. It’s just settling into its role. Crypto is doing the same. And stablecoins are filling the gap that neither one can address.

Not separating. Specialising.

And in that specialisation lies the future architecture of digital money - one where bitcoin provides the foundation on which a complex, diverse, and rapidly evolving ecosystem can grow.

The question was never whether bitcoin or crypto would win. The real question is how they work together in a system where each does what it does best.

That system is taking shape now. The breakup narrative misses it entirely.

That’s it for today. See you again next week.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.