Bitcoin: So Close, Yet So Far? 🍁

The most dominant cryptocurrency just got more significant. Approaches all-time high. Analysts expect more volatility ahead due to elections. BTC Open Interest touches ATH. Markets are feeling FOMO.

Howdy! Today’s crypto dose packaged fresh for you and brought to you by Token Dispatch. How agonising is it when you have it in sight and fall just short of it? Ask Bitcoin.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

$73,562

That's how close we got to history today.

Agonisingly close to the all-time high of $73,737.

Just $175 away from a new ATH.

Is this the moment of truth for Bitcoin?

Will it breakout of its months-long strangle to move finally towards the $80K magical figure?

The post-halving rise may have finally begun.

Says who? Veteran analyst Peter Brandt.

So, ready for a flight to the sky? Yes and no.

Bitcoin has indeed crossed a psychological mark by coming out of the range.

But a rally may not happen immediately.

At least not before the elections.

Bitcoin may test another support price before it kicks start its new bull rally.

Keith Alan, co-founder of trading resource Material Indicators, said in a post on X.

“A move above $72k may send bears into hibernation, but be prepared for a retest of support before going after an ATH.”

But with more than a 4% jump in 24 hours on Tuesday, it most likely is just around the corner.

Then where's the crypto Twitter euphoria? Where are the rocket emojis? Where's retail FOMO?

Retail investors are still sleeping on this rally.

Who tells us this? Google Trends.

Bitcoin search interest? Just 23/100 compared to the May 2021 peak

"AI" is still getting more attention than BTC

Coinbase sitting at #308 on App Store (usually hits top 50 during retail FOMO)

Oh, don’t feel low. Not just yet.

This might actually be a good sign. Maybe.

CryptoQuant's analysis suggests low retail activity "often precedes Bitcoin price rallies."

But wait, there's more drama ahead.

Volatility isn’t totally behind us.

The US elections are just a week away and markets are bracing for impact.

What's coming?

Option premiums expected to spike between Nov 6-8

Bitcoin volatility likely higher than other risk assets

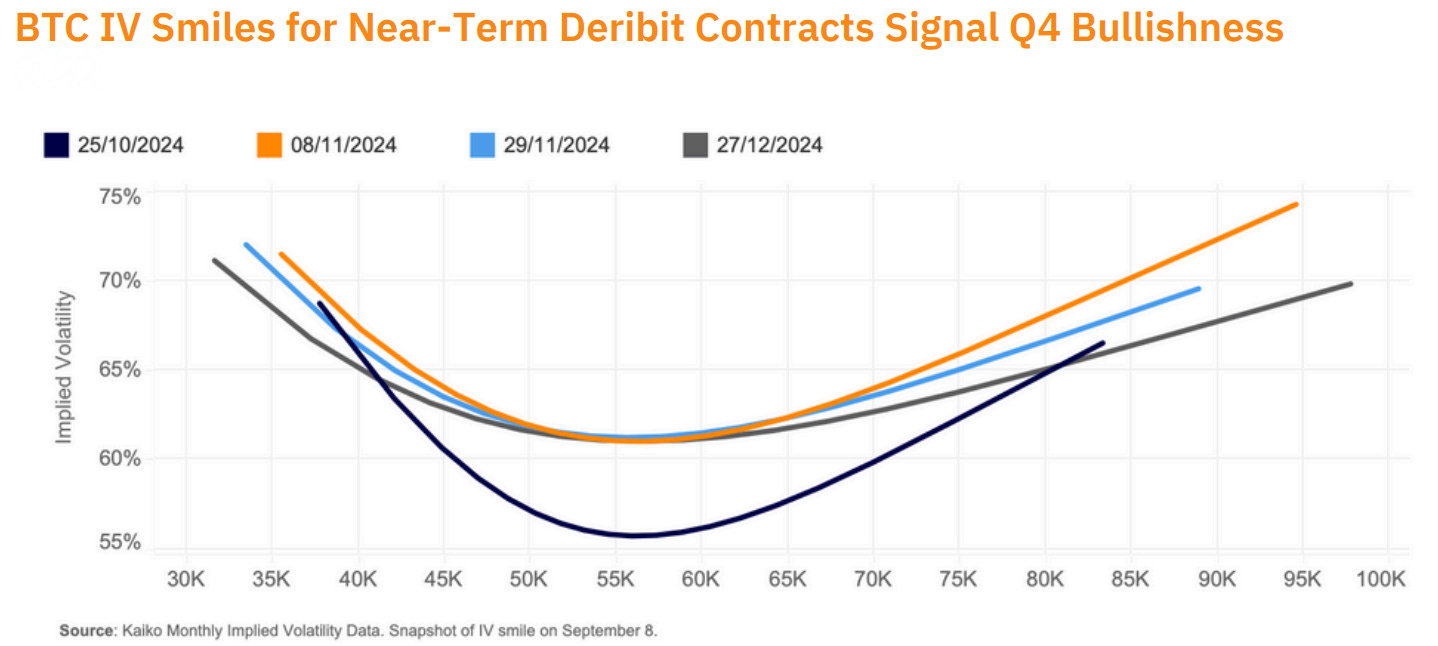

“A steeper right skew on the November 8 expiry (orange) suggests increased demand for call options and expectations of rising prices,” Kaiko analysts.

So, how far are we from a take-off towards $80K?

At least a two-day close above $73,000 for real fireworks.

After that? Rapid move towards $80,000, says John Glover from Ledn.

One week till elections. One week till peak volatility.

Buckle up. 🎢

In The Numbers 🔢

$43.6 billion

That’s the record-high open interest in Bitcoin.

A new all-time high.

What does this mean?

High open interest suggests that new capital is entering the market, indicating strong bullish sentiment and potential continuation of a price rally.

Good days ahead for Bitcoin?

Sure looks like that.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Bitcoin Just Got Bigger

The most significant cryptocurrency just got more dominant.

BTC just hit 60% market dominance.

Long time no see. Finally hitting that mark.

First time since March 2021.

What does this mean?

Bitcoin's eating up more of the crypto pie

Altcoins taking a backseat

Market's betting big on BTC

And some traders are seeing dollar signs.

Why? History lesson time.

When Bitcoin's dominance rises along with its price, it's usually a sign of something bigger brewing.

"There can be an impending BTC bull run when Bitcoin's dominance and price assume an upward trend," says CoinGecko.

Translation? The king might just be warming up 👀

Block That Quote🎙️

Bloomberg's ETF analyst, Eric Balchunas

“FOMO confirmed.”

The ETF analyst said the outsized trading volume across BlackRock's spot Bitcoin ETF is proof that investors are panic-buying Bitcoin as the asset nears an all-time high.

And boy, was he right

IBIT's trading volume hit $3.35B

BlackRock's daily inflows: $599.8M

Total spot Bitcoin ETF inflows: $827M

12 straight days of inflows

$3.2B new money since Oct 10

"IBIT not alone - although by far the most - as all the main BTC ETFs saw elevated volume past two days. If this is a FOMO Frenzy we'll see it show up in the flows next few nights.. if not it means its due to HF (high-frequency) arb trading or something like that.”

Wall Street's getting that FOMO feeling. Are you, too?

The Surfer 🏄

Real-world asset (RWA) tokenisation is projected to reach $600 billion in assets under management by 2030, according to research from Boston Consulting Group (BCG) and others.

dYdX has laid off 35% of its workforce, coinciding with Consensys cutting 20% of its staff. CEO Antonio Juliano, who recently returned to the role, emphasised the need for a new direction for the company. dYdX Trading operates the dYdX Chain, a layer-1 blockchain, and its dYdX v4 is a leading decentralised perpetual futures exchange.

Brazil's crypto imports soared by 40% in September 2024, reaching $1.4 billion, up from $1 billion in September 2023. Exports of digital assets remained stable at $44 million, resulting in a net trade of $1.385 billion, a significant increase from $987 million last year.

Visa and Coinbase have partnered to enable instant crypto transactions for users with eligible Visa debit cards. Customers in the US and EU can now instantly deposit, withdraw, and buy crypto on Coinbase using their Visa debit cards.

Bitcoin miners are cutting costs and adopting AI technologies following the April halving, according to CoinShares. Cormint and TeraWulf are highlighted as the lowest-cost producers, with electricity costs of approximately $15,000 and $19,000 per BTC mined, respectively.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

With Bitcoin’s dominance hitting 60%, altcoins could be facing a tough road ahead. Historically, when BTC takes the lead like this, it often marks the beginning of a more focused bull run for Bitcoin rather than the broader market.

The election impact on BTC is real, and it’s exciting yet nerve-wracking. Increased options premiums and high open interest show that big players are preparing for any outcome. November 6-8 might end up being the true test for this rally.