Bitcoin vs Everyone 🌍

Bitcoin breaks $50K. Eyes Meta's market cap. Beats banks hands down. ETF fuels crypto inflows. Miners enjoy gains. DCG's Q4 report is out and up. Franklin Templeton wants Ethereum ETF.

Hello, y'all. Always believe in your soul … You've got the power to know 👇

If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Big and better things are happening for Bitcoin again.

After more than two years.

Winter is officially gone (🤞🏿🤞🏿)

Bitcoin hits $50K

Market cap - $981.86 billion.

Ranks in the top 10 most valuable assets.

Aiming to surpass Meta's $1.214 t cap.

Wait what?

A sustained bullish trend could elevate Bitcoin above Meta and towards major tech giants and precious metals.

Which will bring Bitcoin closer to the trillion-dollar asset club.

Once BTC surpass Meta, next up?

Silver at $1.28T, then Amazon, Nvidia, and Alphabet ($1.8T).

The ultimate goal? Gold at dominant $13.65 trillion.

Where's Ethereum? Number 34 with $316 billion marketcap.

Ahead of Adobe and Oracle.

It's different when it comes to Banks: There is no competition.

Where's Ethereum? Number 3. Tailing JPMorgan with $321 billion market cap.

Why is Bitcoin surging?

Increased institutional demand.

Anticipated Federal Reserve cuts in 2024.

The upcoming halving in April.

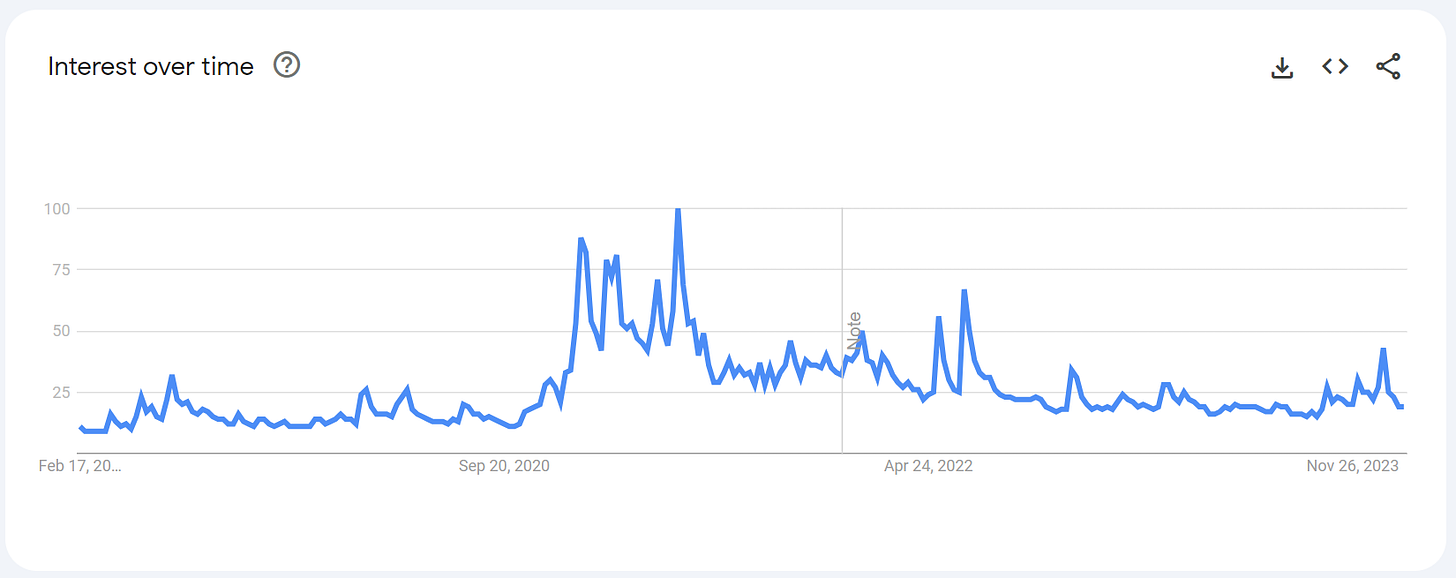

But Google Trends data shows relatively low retail interest in Bitcoin.

Selling pressure

As Bitcoin neared $50,000, sell orders indicated significant profit-taking.

Binance saw an 800 BTC sell order at $50,000, while Coinbase had a 330 BTC order.

The accumulation of sell orders at the $50,000 threshold suggests a temporary pause in Bitcoin's uptrend due to profit-taking.

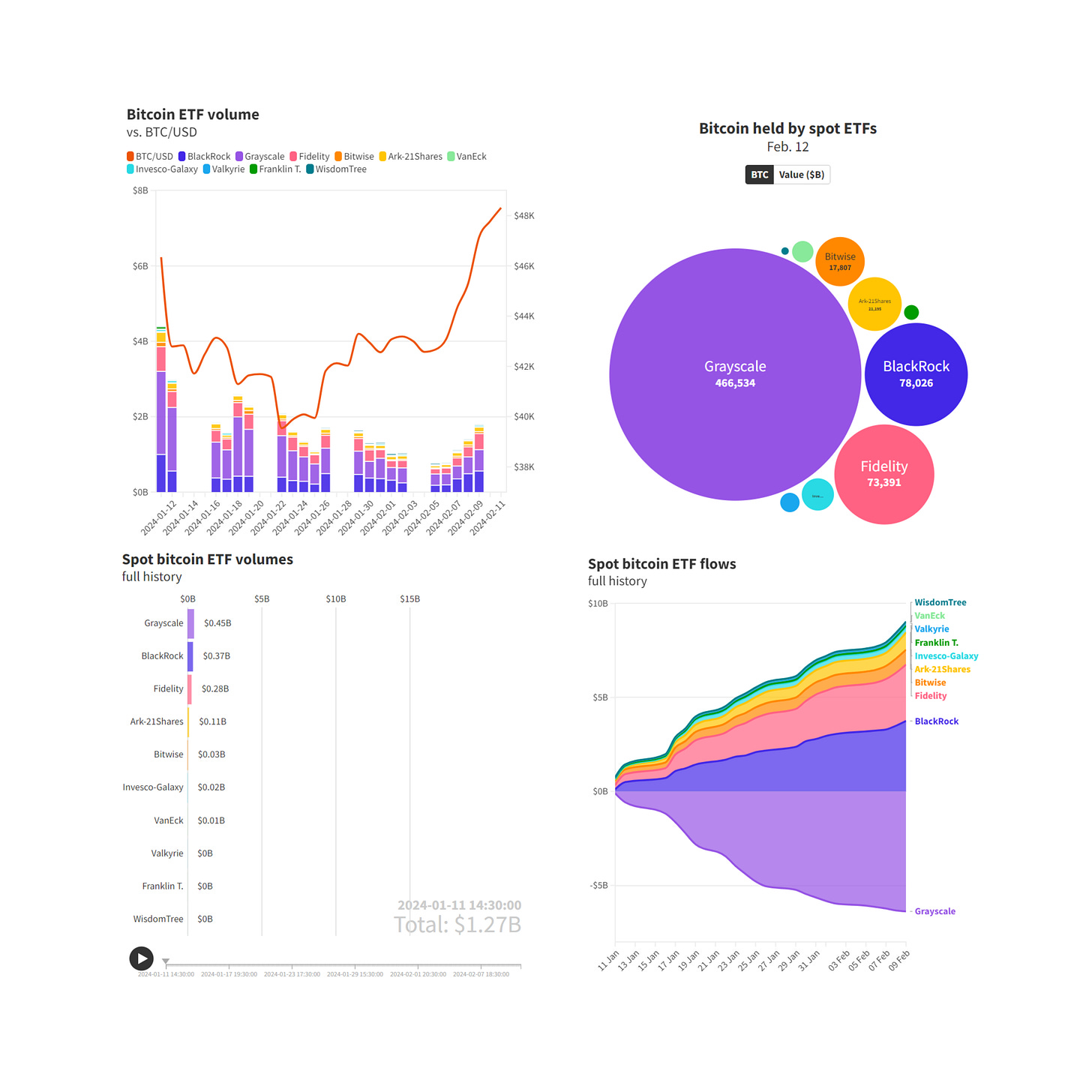

Bitcoin ETF effect ⛏️

BlackRock's and Fidelity's Bitcoin ETFs set a new record:

In their first month, $4.2 billion and $3.5 billion in assets.

Stand out among 5,535 launches over 30 years, capturing 72% of all ETF inflows last week.

Prior records set by BlackRock's Climate Conscious fund and a gold ETF launched in 2004? shattered.

Grayscale's Outflows: Grayscale faced nearly $6.4 billion in outflows. More expected, thanks to Genesis' bankruptcy proceedings.

With all this Inflows to ETFs, crypto inflows are going up:

Crypto investment product market saw $1.1 billion in inflows last week. The highest AUM since early 2022.

Bitcoin saw almost 98% of the inflows:

Where’s ETF?🚨

Billions of dollars have piled into spot bitcoin ETFs in their first month … these charts tell the story👇

Bitcoin Halving effect ✂️

How do Bitcoin miners react to the BTC rally?

Bitcoin mining companies like Riot Platforms and Marathon Digital Holdings saw substantial gains.

Riot up by 55% and Marathon by 60% over the past week.

Shares of MicroStrategy (MSTR) rose by 11% in 24 hours - 33% increase over the past week.

MSTR-BTC Correlation: A strong correlation exists between MSTR's share price and BTC's value, with a correlation coefficient of 0.94 indicating their price movements are closely linked.

Mining Difficulty and Profitability: Bitcoin's mining difficulty reached an all-time high, indicating a robust and maturing network.

The Quarterly Reports ✍🏻

Digital Currency Group’s Q4 report is out.

What do we know?

Revenue surged 59% to $210 million in Q4 2023.

Q4 EBITDA jumped to $99 million.

The company's EBITDA for Q4 soared to $99 million, a stark contrast to a negative $7 million in Q4 of 2022.

Fiscal year 2023 saw DCG hitting $749 million in revenue and $275 million EBITDA.

Portfolio Value: By year-end, DCG's investments were valued at approximately $975 million.

Stock Valuation Increase: The annual 409A valuation estimated DCG's common equity at $4.4 billion by the end of 2023, doubling from the previous year's $2.2 billion.

DCG's ongoing legal battles include an amended lawsuit from the New York Attorney General seeking $3 billion.

Meanwhile outflows from the Grayscale GBTC fund is diminishing.

Ethereum ETF buzz ⏰

Another reason why Ethereum is up.

Franklin Templeton enters the spot Ethereum ETF Arena.

Applied for a spot Ether ETF.

Submitted on Feb 12, the ETF, if approved, will be listed as “Franklin Ethereum ETF” on the Chicago Board Options Exchange.

Staking Plans: Plans to stake a portion of the ETF’s Ether through trusted providers, potentially including an affiliate, to generate staking rewards treated as income.

Competitors: Joins other applicants like BlackRock, VanEck, Fidelity, and Grayscale in the race for SEC approval.

The Surfer 🏄

South Korea is facing a crypto scandal involving celebrities and YouTubers promoting a fraudulent scheme.

Com2uS collaboration with Oasys to roll out web3 games on the blockchain network.

CEO of SafeMoon, has been released on bail but may have to rely on a public defender due to a lack of funds to pay for private counsel.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋