Today’s edition is brought to you by Infinity Hash. Transparent and reliable system to own part of a real mining farm.

Sign-up here and get 10% bonus shares on the first purchase👇

Happy Sunday explorers 🍻 In today’s Rabbit hole we scratch our heads as to how BlackRock's footnote sparked a fundamental debate about Bitcoin's future.

It’s a question that cuts to the heart of the debate: What happens when traditional finance's immense resources meet crypto's decentralised governance?

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 190,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

In the world of Bitcoin, some things are meant to be immutable.

Yet a seemingly innocuous disclaimer in BlackRock's recent three-minute Bitcoin explainer video has sparked an existential debate about one of crypto's most sacred tenets: the 21 million supply cap.

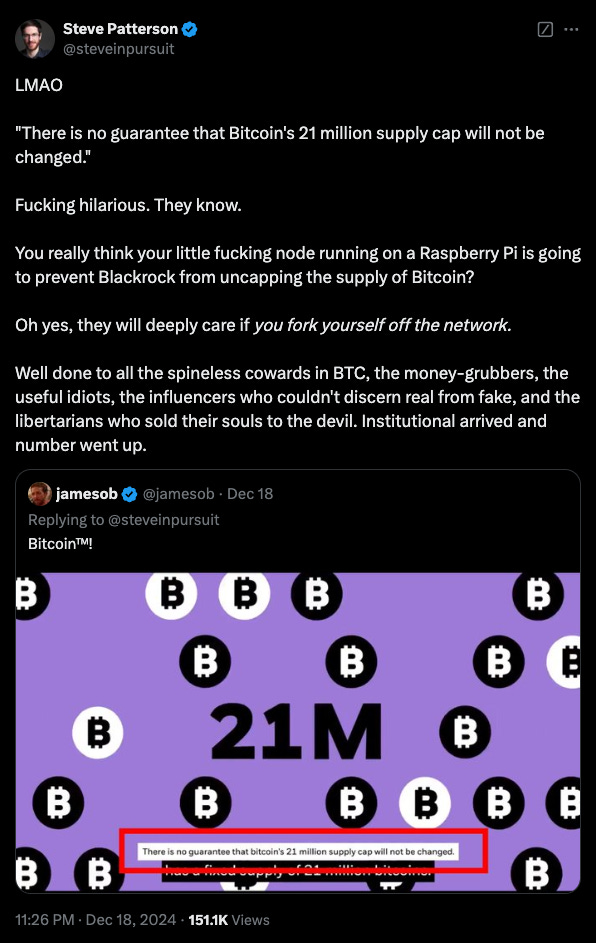

"There is no guarantee that Bitcoin's 21 million supply cap will not be changed," read the footnote, causing a swift backlash from the crypto community.

For traditionalists, it was like suggesting the rules of chess might suddenly allow pawns to move backwards.

Technically possible, but fundamentally against the game's nature.

Wall Street's New Power Play

The timing couldn't be more pointed.

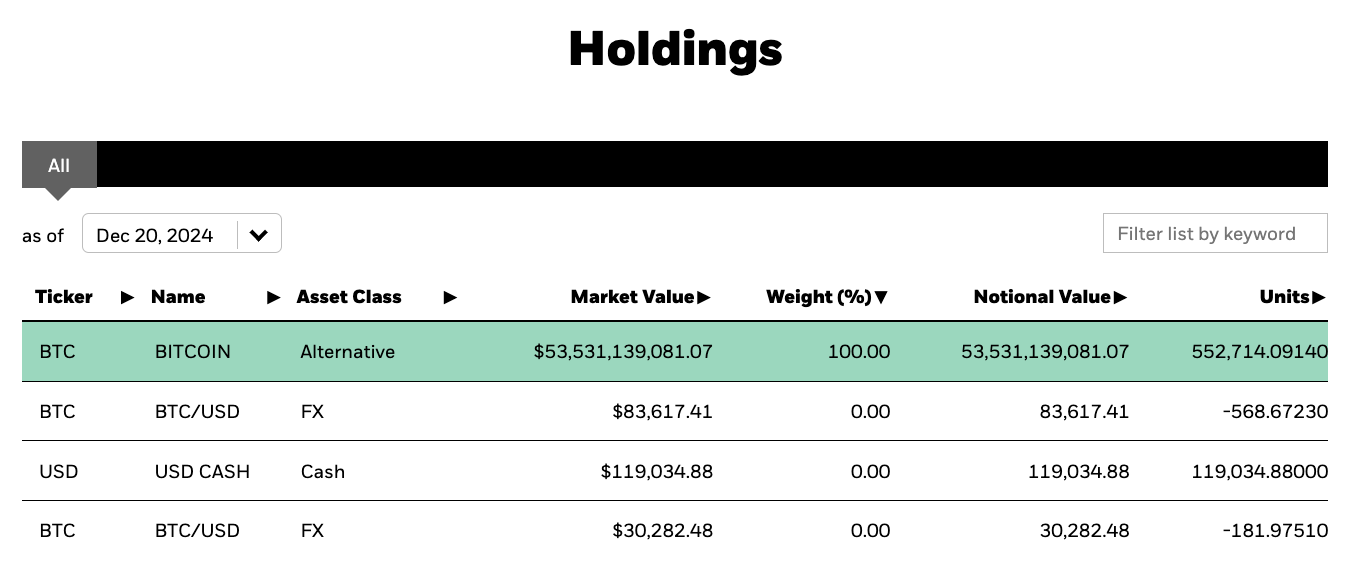

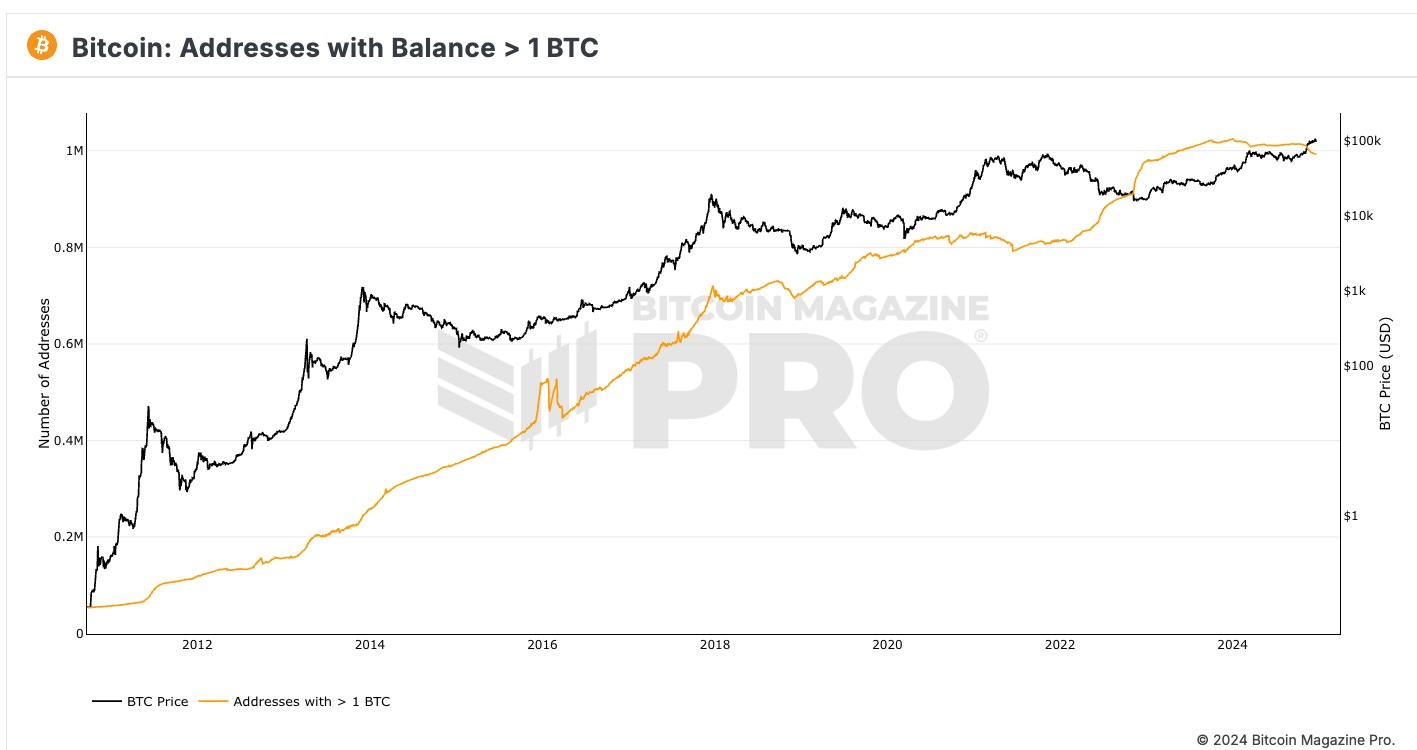

BlackRock with over 550,000 Bitcoin (worth approximately $53 billion) through its ETF, has an powerful influence over the asset.

Its disclaimer — in line with the similar language from its June 2023 ETF filing — has led to questions about the potential for institutional pressure on Bitcoin's fundamental properties.

Steve Patterson, the author of book Hijacking Bitcoin.

Technical Possibility vs Social Reality

The technical reality is both simple and complex.

Whether Bitcoin’s supply cap can be changed or not depends on how one defines “Bitcoin,” Super Testnet, pseudonymous Bitcoin developer behind BitVM, told Cointelegraph.

Yes, Bitcoin's supply cap could theoretically be changed through a hard fork.

Citing Satoshi Nakamoto’s Bitcoin whitepaper, Super Testnet reckons that the resulting network would be "Bitcoin" in name only.

"The inflation cap is definitional to Bitcoin … eliminate that, and whatever you have isn't Bitcoin anymore. You might as well ask what it would take to turn Bitcoin into PayPal."

An uncapped supply version of “Bitcoin” wouldn’t be Satoshi Nakamoto’s Bitcoin.

This perspective highlights a crucial distinction: while code can be changed, consensus is another matter entirely.

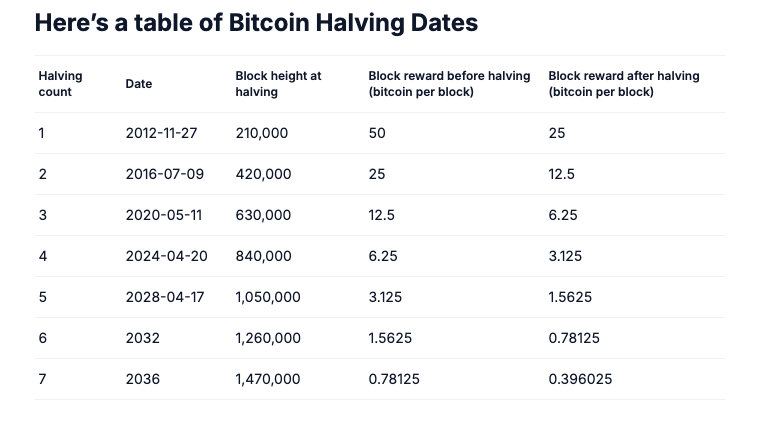

This difference has played out before — during the 2015-2017 Blocksize War.

The Blocksize War was the battle between Big and Small Blockers centred around the debate over increasing the blocksize limit, which determines how many transactions can be processed in each block of the blockchain.

Approximately 95% of Bitcoin miners supported increasing the block size limit. The proposal failed because node operators and investors refused to adopt the change.

The Security Budget Conundrum

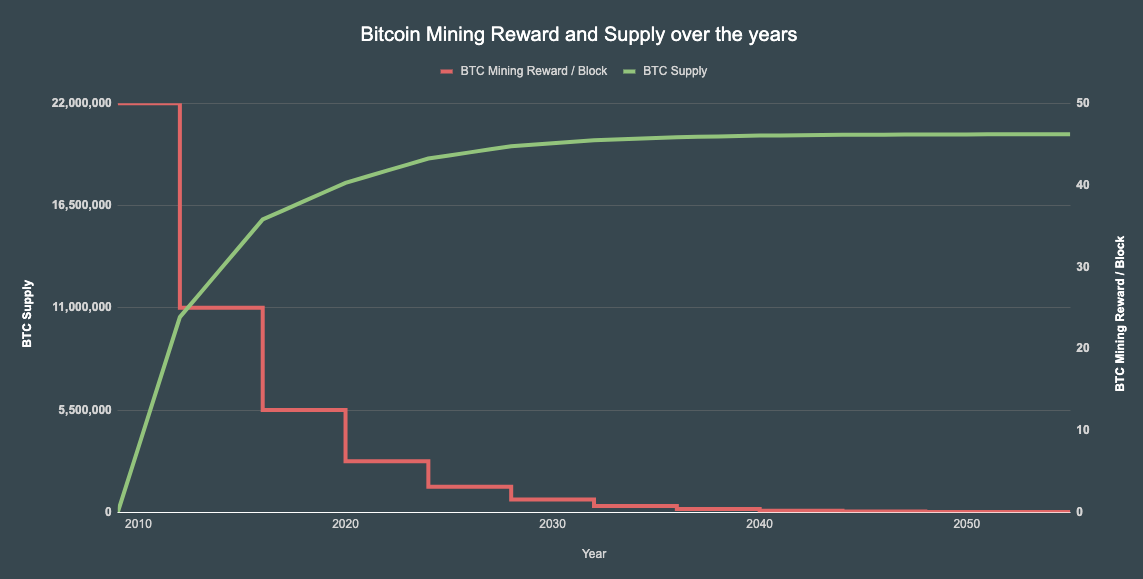

The most pressing concern isn't the supply cap itself, but what happens as block rewards diminish.

Bitcoin's security model relies on miners being economically incentivised to maintain the network.

As rewards halve every 210,000 blocks, the system faces a crucial question: Will transaction fees alone be sufficient to maintain network security?

Some, like Bitcoin developer Nikita Zhavoronkov, argue that "large sustainable fees aren't happening, the 1 MB limit has to go."

Others, like Casa's CTO Jameson Lopp, view the future security budget as "Schrödinger's cat" — operating under philosophical, not provable, assumptions.

Are we going to see another Blocksize war in the future?

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Life-long contracts via Infinity Hash Shares

Daily payouts in Bitcoin and other coins

A fully transparent community project

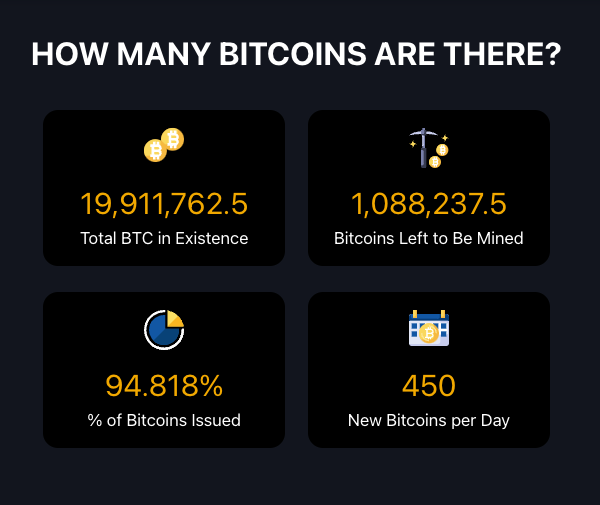

The Shrinking Supply Reality

While we debate the sanctity of the 21 million cap, research suggests the effective supply might be significantly lower.

Analysts David Puell and James Check in their research report Cointime Economics estimate between 3.89 and 4.87 million coins could be considered permanently lost, including Satoshi's untouched Bitcoin stash and the zombie coins.

Quantifying the number of lost coins can be ambiguous, but if we take the lower base of the estimate it is still 3.89 million Bitcoin lost forever. That's an 18% supply cut.

When you factor in lost coins, institutional demand is competing for a much smaller pie. We're fighting over 17.11 million, not 21 million.

Add to this the growing "hodler" phenomenon by MicroStrategy's Michael Saylor, who has declared that he's "gonna be buying the top forever" whilst sitting on 439,000 Bitcoin.

The effective supply could be closer to 16 and half million — and shrinking.

Read: Bitcoin’s 21 million limit is a boomer myth

A Matter of Perspective: The Satoshi Solution?

Amidst this supply debate, a fascinating proposal has emerged to redefine Bitcoin's unit of measurement entirely.

John Carvalho's Bitcoin Improvement Proposal suggests making the satoshi — currently Bitcoin's smallest unit — the primary reference point.

Under this system, what we now call 0.00010000 BTC would become 10,000 bitcoins.

It's an elegant solution to the unit bias problem, but also a paradox.

Do we need to stop counting whole coins?

While Bitcoin may be capped at 21 million coins, each one splits into 100 million satoshis (sats).

Dollars can divide out to 100 physical cents, two decimal places, or at most, 1,000 mills to three decimal places.

Do the math: That's around 1.99 quadrillion sats in circulation right now.

The base money supply of the US dollar is currently less than $5.6 trillion.

The much broader M3 is under $20.8 trillion.

A quadrillion has 15 zeros, a trillion has 12.

A quadrillion is rather larger than a trillion.

If bitcoin is scarce, then so is the US dollar.

The reality? We are missing the point. We're suffering from fiat brain — that peculiar affliction that makes us fixate on whole units.

It's time to stop obsessing over whole bitcoins and start thinking in sats.

After all, there are plenty to go around, if you're counting.

So much for scarcity?

Read: If you still think bitcoin is scarce, you’re suffering from fiat brain

The Token Dispatch View 🔍

We're all missing the forest for the trees.

The fixation on Bitcoin's 21 million supply cap — whether it's technically changeable, effectively lower due to lost coins, or conceptually different when measured in satoshis — obscures a more fundamental truth.

A decentralised monetary system where changes require overwhelming consensus, not just technical possibility.

The real fixed supply: Trust.

What's truly fixed about Bitcoin isn't the number in the code, but the social contract it represents.

Think about it: BlackRock's lawyers didn't add their disclaimer because they genuinely believe Bitcoin's supply cap might change.

They added it because they're required to acknowledge every theoretical possibility, no matter how remote — rather like warning that your coffee might be hot or that past performance doesn't guarantee future results.

The reality is that Bitcoin's immutability comes from something far more powerful than code: collective belief.

It's a bit like the fiat debate. Governments could vote tomorrow to print a quadrillion dollars, but they won't because the social and economic consequences would be catastrophic.

The difference is that Bitcoin's decentralised nature makes such changes even more implausible.

What we're really seeing here is the clash between two worldviews: traditional finance's need to acknowledge every contingency, and crypto's conviction in the power of social consensus.

As Bitcoin continues its mainstream journey — with ETFs now holding more BTC than Satoshi — this tension will only grow more apparent.

But perhaps that's exactly the point.

Bitcoin's true innovation isn't just technical — it's social.

The fixed supply cap isn't just a number in the code; it's a shared belief, a collective agreement, a fundamental principle that gives Bitcoin its value proposition.

And that's something no disclaimer can change.

After all, in a world of endless fiat printing and financial engineering, maybe what's truly scarce isn't the number of coins or satoshis — it's trust in a system that refuses to bend its rules, no matter how powerful the interests arguing for "flexibility" become.

Week That Was 📆

Saturday: The Billion-Dollar Fartcoin 💨

Friday: Santa's Not Coming? 🎄

Thursday: Markets Do Market Things 📉

Wednesday: The Day Bitcoin Flipped Gold 🤸🏼♀️

Tuesday: Can ETH Sustain This $4K Breakout? ✊

Monday: Bitcoin's Empire Strikes Back 🚀

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Less bitcoin is actually available than you think about 4 million coins are lost forever and big companies like micro strategy are holding tight to theirs and not selling

Don't worry about Blackrock's warning about Bitcoin's 21M cap changing it's just legal stuff they have to say, like warning that coffee is hot