Happy Sunday dispatchers!

Bitcoin is way above the $100K dream.

Trump and family is launching memecoins.

Elon Musk is proposing blockchain solutions.

All going good. Do we still have to talk about Quantum Computing and spoil the good times.

A little reality check wouldn’t hurt maybe. Are we still calling it a threat? Or are we planning to use it for the good - to evolve?

Is it key to the ultimate strengthening?

Let’s find out.

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Google’s Willow Chip

This was back in December 2024, which feels like a lifetime ago even though we are just about a month old in 2025.

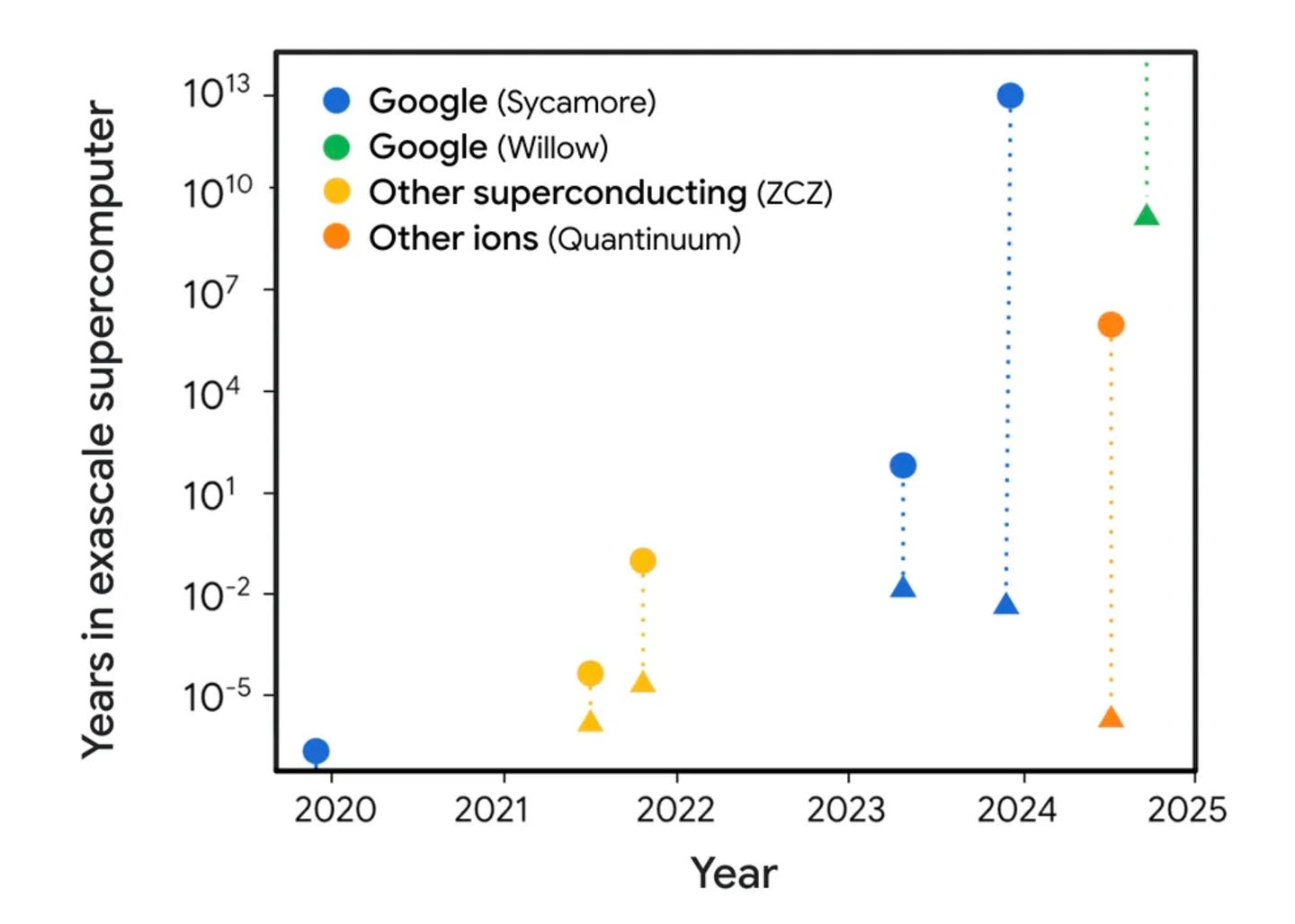

Their new Willow quantum chip accomplished in five minutes what would take the world's fastest supercomputers approximately 10 septillion years.

We're talking about a number with 24 zeroes, longer than the age of our universe.

Naturally, this sent shockwaves through the crypto community.

Bitcoin dropped below $100,000, spooked traders dumped $1.6 billion in positions, and social media lit up with doomsday predictions about quantum computers cracking Bitcoin's cryptography.

While Google's breakthrough is remarkable, Willow's 105 qubits are still laughably far from the millions needed to threaten Bitcoin. It's like saying a toddler's first steps are threatening Usain Bolt's world record.

Yet the quantum threat to Bitcoin isn't merely about today's capabilities — it's about tomorrow's possibilities. And more importantly, about the $107 billion sitting in Satoshi's vulnerable old wallets.

The implications are staggering. If quantum computing could crack Bitcoin's cryptography, we're not just talking about the potential theft of billions in digital assets.

We're looking at the potential unraveling of the entire cryptographic foundation that makes Bitcoin, well, Bitcoin.

But before we dive into the existential threats and potential solutions, we need to understand what we're really dealing with. Because the reality of quantum computing's threat to Bitcoin is both more complex and more fascinating than the headlines suggest.

Upgrade to paid to get full access to our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

We first need to grasp what makes quantum computers so fundamentally different from the machines we use today.

Classical computers — the ones in your pocket and on your desk — think in bits, simple binary units that are either 0 or 1. Like a light switch that's either on or off, there's no in-between. This binary nature is why traditional computers are great at straightforward calculations but struggle with certain complex problems.

Quantum computers — operate on an entirely different plane of reality. They use quantum bits, or qubits, which thanks to a phenomenon called superposition, can exist in multiple states simultaneously. Imagine a coin that's not just heads or tails, but somehow both at once until you observe it.

But that's not even the weird part. Qubits can also be "entangled" with each other, meaning the state of one instantly affects another, no matter how far apart they are. Einstein called this "spooky action at a distance," and it's what gives quantum computers their mind-bending potential.

This isn't just theoretical physics — it's why Google's Willow chip could perform in five minutes what would take classical computers ten septillion years.

By leveraging these quantum properties, these machines can explore multiple solutions simultaneously, making them potentially devastating for cryptographic systems built on the assumption that certain mathematical problems are too time-consuming to solve.

Let's start with the fundamentals: Bitcoin's security relies on two critical cryptographic pillars — the SHA-256 hash function used in mining, and the Elliptic Curve Digital Signature Algorithm (ECDSA) protecting your private keys. Not random choices—the result of decades of cryptographic evolution.

That’s two critical vulnerabilities for Bitcoin.

First, quantum computers running Shor's algorithm could theoretically factor the large prime numbers that secure your private keys, essentially picking the most sophisticated locks we've ever created at an exponentially faster speed.

Second, Grover's algorithm could give quantum computers a massive advantage in mining, potentially centralising Bitcoin's decentralised consensus mechanism.

The good news? The computational power needed is still astronomical.

According to Universal Quantum's research, you'd need a quantum computer with 13 million qubits to crack a Bitcoin private key in just one day.

Google's groundbreaking Willow chip, impressive as it is, has just 105 qubits.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Can Willow Really Crack Bitcoin?

Before we panic about quantum apocalypse, let's examine what the experts are actually saying about the timeline and severity of this threat.

According to Bernstein analysts led by Gautam Chhugani, any practical quantum threat to Bitcoin remains "decades away."

IBM's quantum roadmap supports this view, projecting only a few thousand qubits by 2033 — still far short of the millions needed to crack Bitcoin's cryptography. But not everyone shares this optimistic timeline.

Chamath Palihapitiya, CEO of Social Capital, warns we're in a "2-5 year shot clock" before quantum computers could potentially crack SHA-256.

His estimate? We need about 8,000 chips to break Bitcoin's cryptographic foundation. Meanwhile, Capriole Investments' Charles Edwards suggests a 50% probability of a quantum threat emerging within 5-10 years, arguing that as few as 2,500 logical qubits could potentially break SHA-256.

Ki Young Ju, founder of CryptoQuant says: Bitcoin is unlikely to be compromised within this decade.

Cornell University researchers noted that breaking a 160-bit elliptic curve cryptographic key would require around 1,000 qubits.

That is far more than what's currently available.

The most pressing concern isn't actually about the entire Bitcoin network. Then?

It's about Satoshi's coins

Avalanche founder Emin Gün Sirer highlighted a critical vulnerability: Satoshi's 1.1 million bitcoins (worth approximately $107 billion) sit in early wallets using an outdated Pay-To-Public-Key (P2PK) format.

These wallets are particularly vulnerable to quantum attacks because they expose their public keys, giving potential attackers more time to work on cracking them.

"As QC gets threatening … the Bitcoin community might want to look into freezing Satoshi's coins, or more generally, provide a sunset date and freeze all coins at P2PK UTXOs" - Sirer warns.

This isn't just about Satoshi's fortune. According to Deloitte's research, about 4 million Bitcoin — roughly 20% of all coins in circulation — still reside in these vulnerable P2PK addresses.

What’s Satoshi got to say about this threat?

Back in June 2010, Bitcoin's creator showed remarkable foresight about quantum computing risks.

On the BitcoinTalk forum, Satoshi outlined a practical approach: if SHA-256 became compromised, the community could agree on the last valid blockchain state before the breach and continue from there with a new hash function.

More importantly, Satoshi suggested that if the quantum threat emerged gradually, Bitcoin could transition to a new hash in an organised way.

"The software would be programmed to start using a new hash after a certain block number. Everyone would have to upgrade by that time."

This brings us to the most crucial question: What are the actual solutions being developed?

Way Forward

Let's dive into the current solutions and developments being worked on across different blockchain platforms.

Bitcoin's Defense Strategy

The most prominent proposal is QuBit, a draft Bitcoin Improvement Proposal (BIP) by the pseudonymous Hunter Beast.

QuBit introduces a new address type called Pay to Quantum Resistant Hash (P2QRH), which uses various quantum-resistant signature schemes to protect against Shor's algorithm attacks.

What makes QuBit particularly clever is its economic incentive structure — it offers a 16x discount in block space costs for users who move to quantum-resistant addresses, similar to how Segregated Witness adoption was encouraged.

The implementation follows four stages.

Quantum-resistant address standard

Taproot-compatible quantum-resistant address standard

Soft fork implementation

Quantum-secure address standard

QuBit doesn't commit to a single quantum-resistant hashing algorithm.

Instead, it supports multiple standards including SPHINCS+-256f and FALCON-1024, providing flexibility as the technology evolves.

Alternative Bitcoin Solutions

OP_CAT Resurrection

Blockstream's Jonas Nick has developed experimental tools for quantum-resistant signatures using potentially reactivated opcodes

However, Hunter Beast notes this would be "horribly inefficient from a transaction size perspective"

STARK-based Protection

Scalable Transparent Arguments of Knowledge (STARKs) offer another route with added privacy and scalability benefits

Ethereum creator Vitalik Buterin has previously suggested STARKs as a quantum emergency solution

Could be enabled via OP_CAT or a specific opcode for verifying ZK-proofs

Cryptographer Juan Garay at Texas A&M is researching their implementation within Bitcoin

These one-time signatures would provide quantum resistance but require larger transaction sizes

Solana's Pioneering Move

Solana has become the first major blockchain to implement quantum resistance through its Winternitz Vault. This system, developed by Dean Little, uses a decades-old cryptographic technique called Winternitz One-Time Signatures.

The vault's clever mechanism

Generates 32 private key scalars

Hashes each one 256 times to create a public key

Stores only a hash for verification

Creates new keys after each transaction

Provides optional quantum protection without requiring a network-wide upgrade

This implementation is particularly elegant because, as Little notes, "While nobody can hash backwards, anyone can hash forwards from a previous value." This creates a one-way security system that even quantum computers can't reverse.

Ethereum's Approach

Vitalik Buterin has outlined a comprehensive strategy for Ethereum's quantum resistance.

Development of hash-based or quantum-resistant replacements for elliptic curve components

Conservative assumptions about proof-of-stake performance

Proactive development of quantum-resistant alternatives

Implementation Challenges

The transition to quantum-resistant cryptography isn't without hurdles.

Storage Trade-offs: Quantum-resistant signatures are significantly larger, potentially impacting blockchain scalability

Processing Overhead: New signature schemes require more computational resources

Migration Complexity: Moving funds from vulnerable addresses requires coordinated user action

Consensus Challenges: Any major cryptographic change requires broad community agreement

What is the timeline of the quantum computing threat to Bitcoin?

The quantum threat won't materialise overnight, but preparation needs to start now.

Three key considerations emerge.

Immediate Protection: Users should move funds from vulnerable P2PK addresses to newer address formats

Development Priority: Continue work on quantum-resistant solutions before they become critically necessary

Community Consensus: Begin discussions about handling Satoshi's coins and other vulnerable addresses

Token Dispatch View 🔍

The greatest paradox of Bitcoin's quantum challenge is about time. Not about technology.

Think about it: Satoshi Nakamoto, who foresaw and planned for countless attack vectors, left us with a billion-dollar quantum vulnerability in their own wallet.

Not by accident, but by necessity. Those early P2PK addresses were the only option available when Bitcoin was born.

What if this isn't a bug, but a feature?

Consider the possibility that Satoshi's vulnerable wallet, holding over $107 billion in Bitcoin, is a deadman's switch, a final test for the network. A built-in forcing function that ensures Bitcoin must evolve or die.

Just as Bitcoin reaches mainstream adoption, quantum computing emerges to challenge its fundamental assumptions.

And at the exact centre of this storm sits Satoshi's fortune, like a tempting target for any quantum-capable actor.

This creates a perfect game theory scenario: The first entity to achieve quantum supremacy could choose any of these options.

Attack Bitcoin and potentially destabilise the entire crypto economy

Protect their Bitcoin holdings by helping implement quantum resistance

Race to claim Satoshi's coins before someone else does

Each path leads to the same destination: Bitcoin's quantum evolution.

Whether through defense or attack, the network must adapt.

And perhaps that's the genius of it all.

Satoshi's vulnerable billions are actively driving innovation, forcing the community to solve quantum resistance before it becomes an emergency, and ensuring Bitcoin's next evolutionary leap happens exactly when it needs to.

In a beautiful twist of complexity worthy of both quantum mechanics and Bitcoin itself, the very weakness that threatens the network might be the key to its ultimate strengthening.

The butterfly effect of Satoshi's quantum vulnerability could be the very thing that secures Bitcoin's future.

After all, what better way to ensure your creation evolves than by leaving it with a challenge it must overcome to survive?

Week That Was 📆

Saturday: Bitcoin Miners' New Lease of Life💫

Friday: The Ross Ulbricht Story 🕊️

Thursday: When Code Can't Be Controlled 🆓

Wednesday: Ethereum's Leadership Crisis 🥶

Tuesday: Day 1: Cryptic Silence🤫

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Would have been helpful to have a blurb about hybrid already deployed in the wild where classical computing quantum interface already.