Bitcoin’s Sleeping Capital Is Finally Waking Up

The tools that turn Bitcoin from passive value into active economic capital

Hello,

Most people today buy Bitcoin, and then do absolutely nothing with it.

They hold it, call it digital gold, and proudly talk about how they’re “in it for the long term.” And that’s fine, after all, Bitcoin earned that reputation.

But all that holding has created one of the largest pools of idle capital in the entire crypto ecosystem today. About 61% of all Bitcoin hasn’t moved in over a year, and nearly 14% hasn’t moved in more than a decade. And despite a $2T+ market cap, only 0.8% of Bitcoin’s supply participates in any form of DeFi activity today.

In other words, Bitcoin is the most valuable asset in crypto, and also the least used.

Now compare that to literally every other corner of crypto:

- Stablecoins settle payments globally at scale.

- ETH powers smart contracts, DAOs, wallets, and entire economic layers.

- L2s run ecosystems with lending, trading, gaming, and thousands of applications.

Meanwhile, Bitcoin, the biggest, most secure, most widely held asset, can’t natively do any of this.

By contrast, it has trillions in value sitting idle, generating no yield, creating no liquidity, and contributing nothing to the broader economy beyond security and price appreciation.

When people tried to fix that, the solutions came with their own problems. Wrapped BTC became popular, but it required trusting a custodian. Bridges let you move BTC to another chain, but they introduced security risks. Bitcoin holders want to use their BTC, but the infrastructure has never given them a secure and native way to do it.

But this is finally changing, and over the past few years, a completely new ecosystem has been forming around Bitcoin, one that tries to unlock all this “sleeping capital” without forcing people to wrap their BTC, trust a middleman, or move it into someone else’s custody.

Let’s explore!

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Why Bitcoin Ended Up Here

Bitcoin didn’t become a passive asset by accident. Its entire architecture pushes it in that direction. Long before DeFi existed, Bitcoin made a deliberate trade-off: prioritise security above everything else. That decision shaped its culture, its developer environment, and, ultimately, the kind of economic activity that could thrive around it.

The result is an incredibly immutable chain, which is great for moving money, but terrible for innovation. Most people only see the surface symptoms, low mobility, high dormancy, and wrapped BTC dominance, but the roots go much deeper.

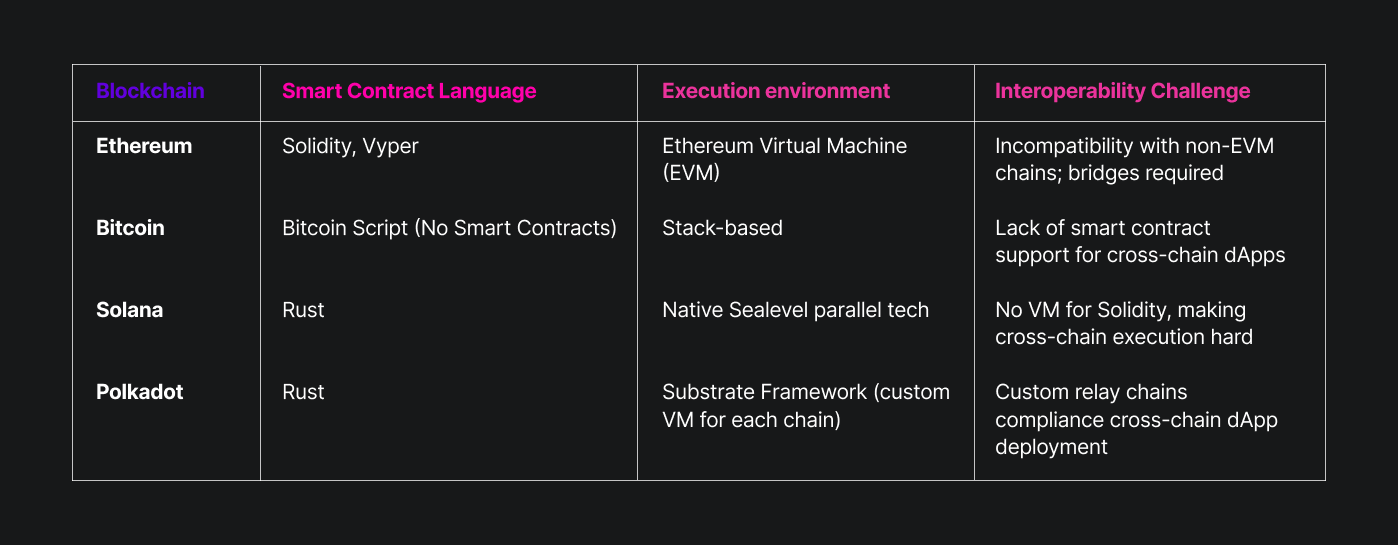

The first constraint is Bitcoin’s scripting model. It deliberately avoids complexity, so the base layer remains predictable and hard to exploit. That means no general-purpose computation, no native financial logic, no on-chain automation. Ethereum, Solana, and every modern L1 were built on the assumption that developers would want to build. Bitcoin was built with the assumption that they shouldn’t.

The second constraint is Bitcoin’s upgrade path. Changing anything, even small features, requires ecosystem-wide alignment. Hard forks are almost impossible socially, and soft forks take years. So while the rest of crypto iterated through entire design paradigms (AMMs, account abstraction, L2s, modular blockchains), Bitcoin essentially stayed frozen in time. It became the settlement layer without ever becoming the execution layer.

A third nuance is the cultural one. Bitcoin’s developer ecosystem is conservative by design. That conservatism protects the network, but it also discourages experimentation. Any proposal that introduces complexity is treated with suspicion. That mindset is healthy for protecting the base layer, but it also ensures that new financial primitives cannot emerge on Bitcoin in the same way they did elsewhere.

There’s also a structural nuance: Bitcoin’s value grew faster than its surrounding infrastructure. ETH had smart contracts from day one; Solana had a high-throughput design from day one. Bitcoin’s value ballooned into an asset class long before its “usable surface area” expanded. So the ecosystem ended up with a paradox: you have trillions in capital but almost no surface to deploy that capital on.

The final nuance is interoperability. Bitcoin is uniquely isolated. It isn’t interoperable with other chains. It doesn’t have native bridges. And until very recently, there were no trust-minimised ways to connect Bitcoin to external execution environments. So every attempt to make BTC usable required leaving Bitcoin’s security model entirely, wrapping, bridging, custodial minting, multisigs, and federations. For an asset built on distrust of intermediaries, that was never going to scale.

The First Workarounds: Wrappers, Sidechains & Bridges

Once it became clear that Bitcoin couldn’t support meaningful activity on its own base layer, the industry did what it always does: it built workarounds. At first, these solutions looked like progress. They allowed BTC to move into environments where DeFi activity was actually happening. But when you examine them closely, they all shared the same flaw: you had to give up part of Bitcoin’s trust model to use them.

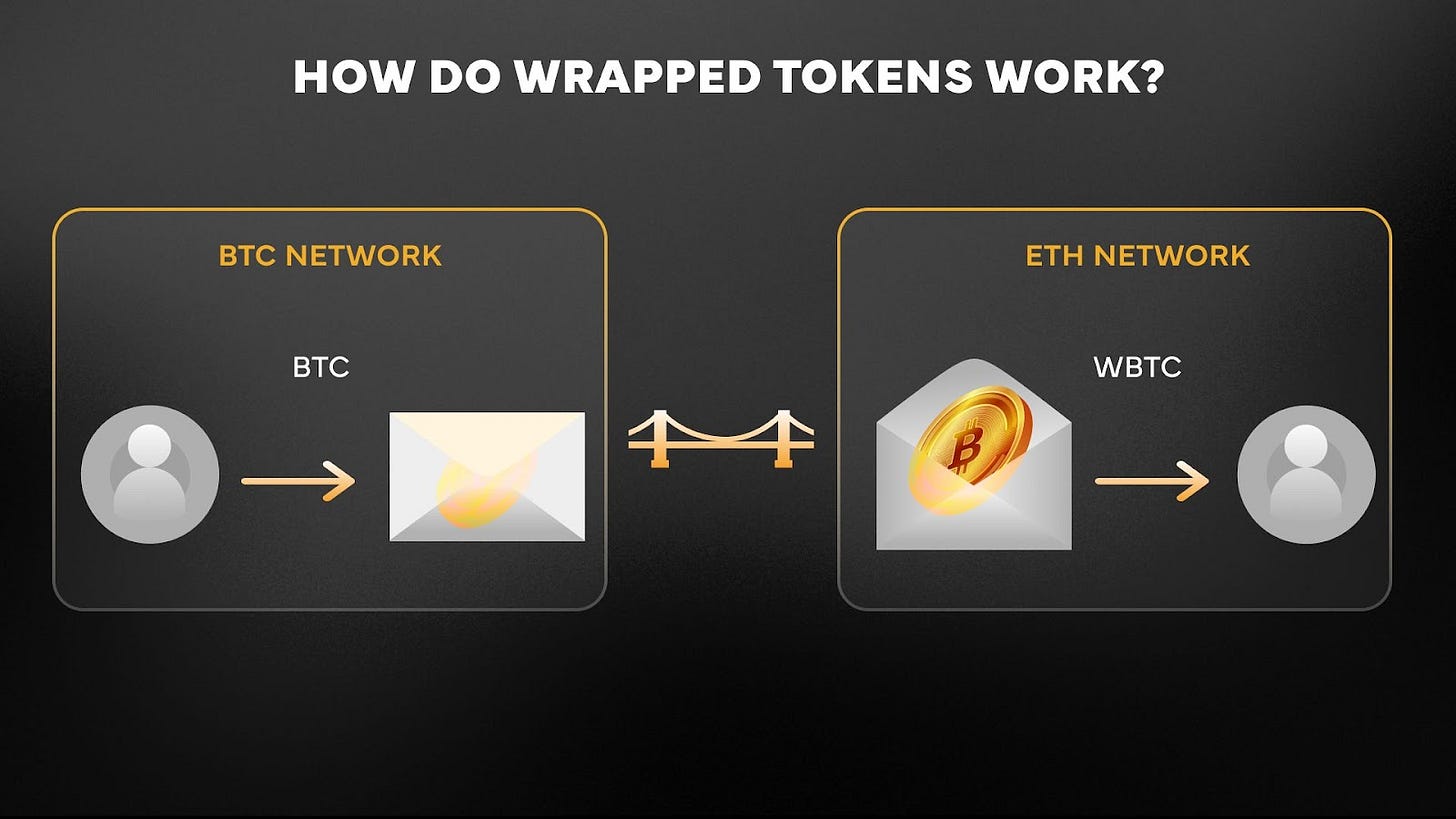

The most visible example was wrapped Bitcoin. It became the default bridge from Bitcoin into Ethereum, and for a while, it looked like the model worked. It unlocked liquidity and let BTC be used as collateral, traded in AMMs, borrowed against, looped, rehypothecated, basically everything Bitcoin itself couldn’t do. But the trade-off was, wrapped BTC only exists if someone else is holding the real BTC. That means custody, reliance on external institutions, operational risk, and a guarantee system that has nothing to do with Bitcoin’s base-layer security.

Federated systems tried to reduce this trust burden by splitting control across multiple entities. Instead of a single custodian, a group collectively held the BTC backing the wrapped asset. It was better, but not close to trust-minimised. You still relied on a coordinated set of operators, and the peg was only as strong as their incentives and honesty. For a community that prefers trustless systems, this was not a perfect solution.

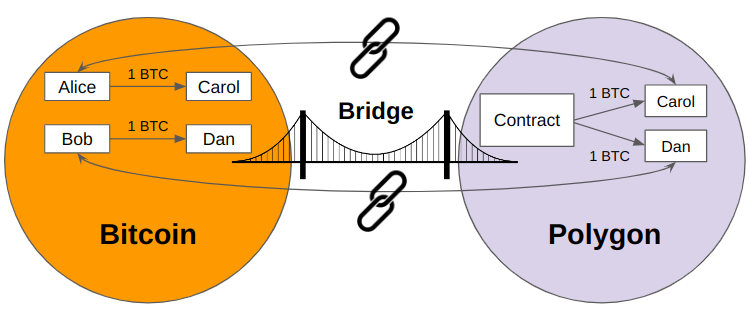

Bridges introduced another set of problems. Instead of custody, you now depend on an external validator set, often with weaker security guarantees than the chain you were leaving. Bridges made it possible to move BTC across chains, but they also became one of the largest failure points in crypto. Several analyses point to bridge exploits as some of the largest sources of capital loss in crypto.

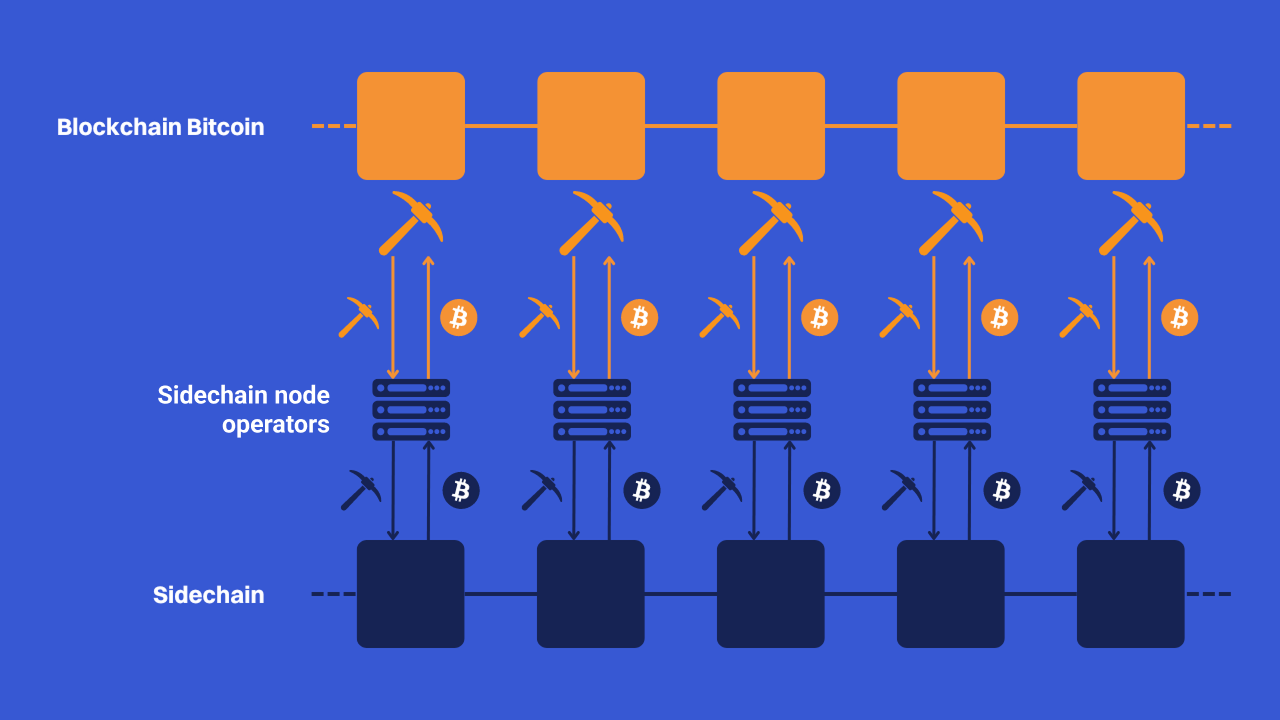

Sidechains added even more nuance. They were independent chains connected to Bitcoin through various peg mechanisms. Some used multi-signature control, others used SPV proofs. But none of them inherited Bitcoin’s security. They ran their own consensus, their own validator sets, and their own risk profiles. The “Bitcoin layer” label was often more marketing than reality. Liquidity moved, but the guarantees didn’t.

What all of these approaches have in common is that they pushed Bitcoin outward, away from its base layer and into environments where someone else enforced the rules. That solved the usability problem in the short term, but it created a larger issue, Bitcoin suddenly operated under trust models that Bitcoin itself was created to avoid.

You can see the shortcomings clearly:

- Wrapped BTC grew, but only because people tolerated custodians as a temporary fix.

- Sidechains existed, but remained niche because they didn’t inherit Bitcoin’s security.

- Bridges connected Bitcoin to other chains, but introduced entirely new attack vectors.

Each workaround solved one problem and created another.

The Breakthrough: Bitcoin Finally Gets New Primitives

For a long enough time, Bitcoin’s limitations were accepted as permanent. The base layer wouldn’t change, upgrades were slow, and every proposal for more expressiveness was dismissed as unnecessary risk.

But the assumption started breaking in the last few years.

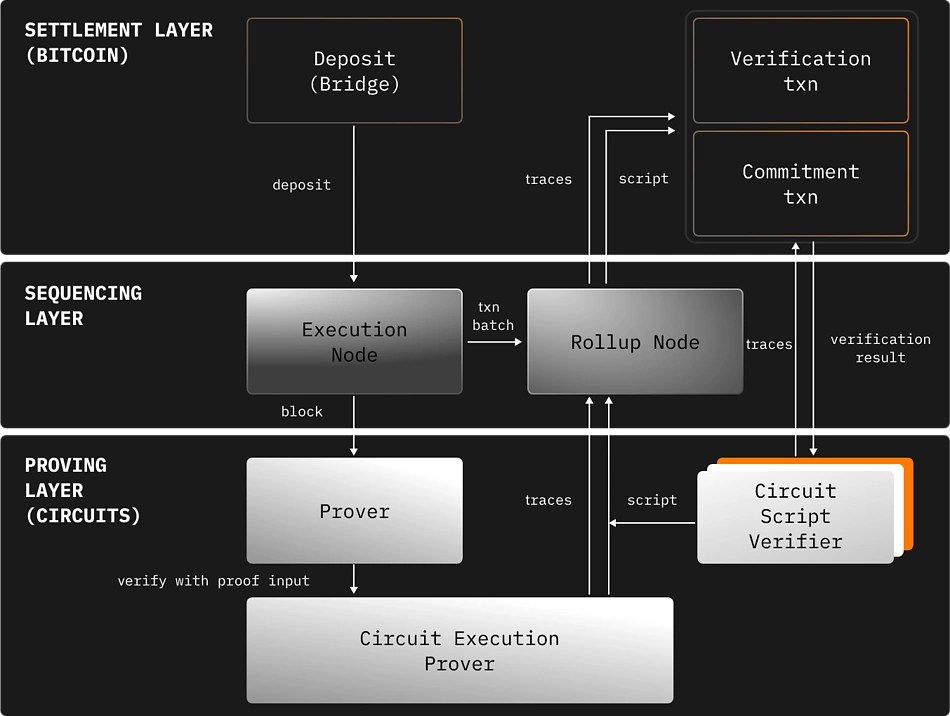

1. Bitcoin gained a way to verify things it doesn’t execute: The most important unlock was a new class of verification models that let Bitcoin check outcomes of computations done elsewhere, without running the computations itself.

This was the breakthrough that made BitVM and later BitVM-like systems possible. Instead of changing Bitcoin’s functionality, these systems take advantage of Bitcoin’s ability to enforce outcomes through fraud proofs.

It means you can build logic, applications, and even full execution environments outside Bitcoin, and still have Bitcoin enforce correctness. That was a very different direction from Ethereum’s “execute everything on L1.” Bitcoin could now finally adjudicate. This is what finally opened the door for:

Bitcoin-secured rollups

trust-minimised bridges

programmable Bitcoin vaults

off-chain computation verified on-chain

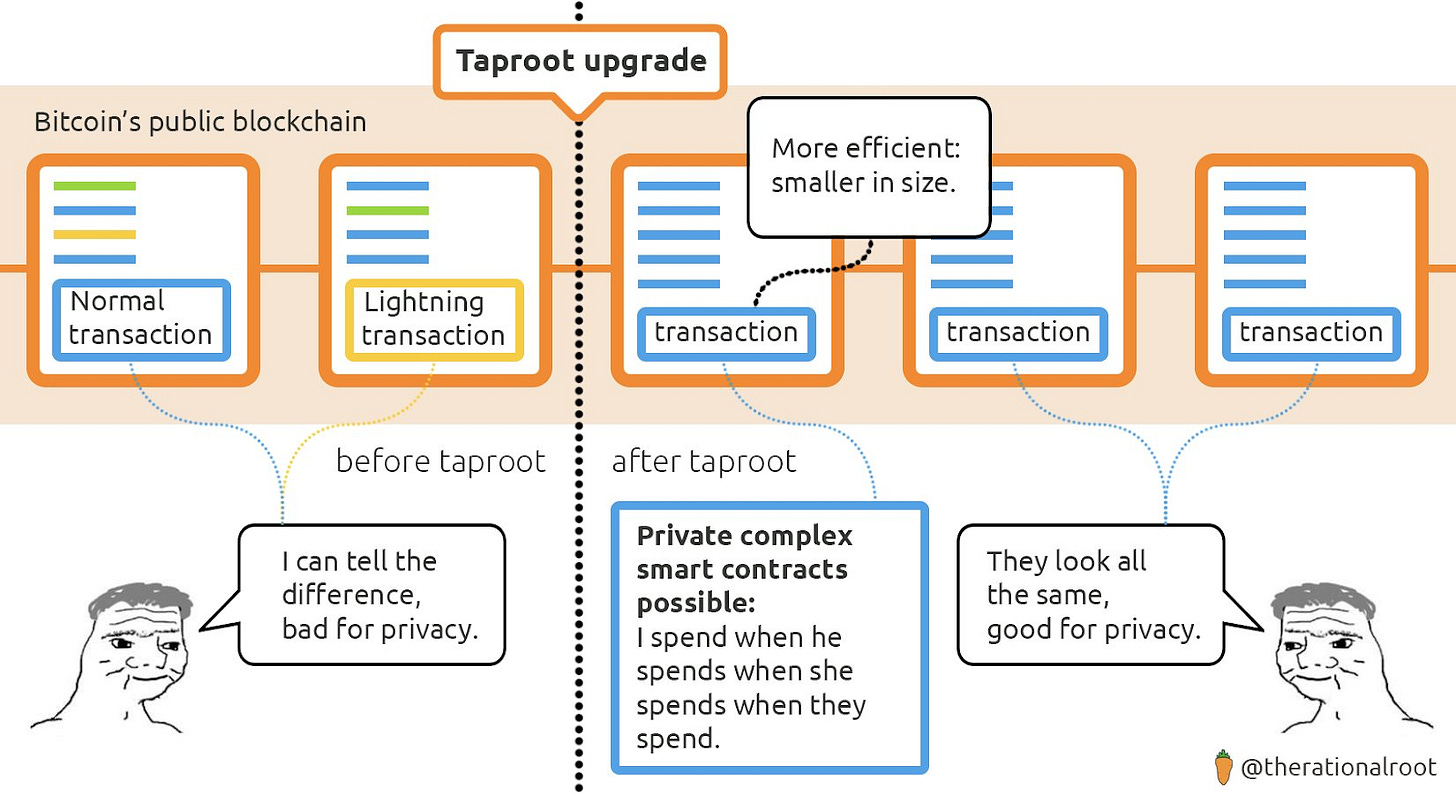

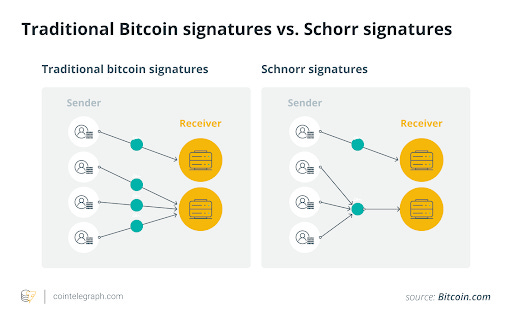

2. Upgrades like Taproot quietly expanded Bitcoin’s surface area: Taproot wasn’t marketed as a DeFi upgrade, but it enabled the exact cryptographic foundations needed for BTCFi: cheaper multisigs, flexible key-path spending, and better privacy. More importantly, it made constructions like Taproot Assets (for stablecoins) and more advanced vault systems feasible.

3. The emergence of Bitcoin-native assets: Once Taproot and newer proof systems were available, projects began introducing assets that live on Bitcoin or derive their security from Bitcoin without needing to wrap BTC.

With the combination of Taproot, Schnorr signatures, and new off-chain verification techniques, developers could now build assets on Bitcoin itself or assets that inherit Bitcoin’s security directly.

This includes things like:

Taproot Assets (Tether minting USDT directly on the Bitcoin/Lightning stack)

Bitcoin-native stablecoins that don’t require Ethereum, Solana, or Cosmos

BTC-backed synthetic assets that don’t rely on custodial pegs

Programmable vaults and multisig constructions that previously weren’t feasible

For the first time, assets issued on Bitcoin don’t need to leave Bitcoin to be used. And assets issued for Bitcoin don’t require Bitcoin to leave self-custody.

4. Yield on Bitcoin becomes possible: Bitcoin has never had a native yield. The only way to “earn” on BTC historically was to either wrap it, send it to a custodian, or lend it out on a centralised platform, or bridge it to another chain. And all of these carried risks entirely outside Bitcoin’s security model.

BTCFi introduced a fundamentally new way to generate yield on Bitcoin. How? By creating systems where BTC contributes to the security of a network. Three categories emerged:

Bitcoin staking (for other networks): BTC can now secure PoS networks or appchains without leaving the Bitcoin chain.

Bitcoin restaking: Similar to how ETH can secure multiple protocols through shared security, BTC can now be used as collateral to support external chains, oracles, DA layers, etc.

Lightning-based yield systems: Protocols like Stroom allow BTC used in Lightning channels to earn yield from providing liquidity, again without wrapping or relying on custodial bridges.

Before BTCFi, none of this was possible.

5. Bitcoin finally gets an execution layer: The recent progress in off-chain verification made it possible for Bitcoin to enforce the results of computations it doesn’t execute itself. This allows developers to build rollups, bridges, and contract systems around Bitcoin that rely on Bitcoin for validation rather than for computation. The base layer remains unchanged, but external layers can now run logic and prove correctness back to Bitcoin when needed.

This gives Bitcoin something it never had: a way to support applications, contract-like behaviour, and new financial primitives without moving BTC into custodial systems or rewriting the protocol. It’s not “smart contracts on Bitcoin”, it’s a verification model that lets Bitcoin stay simple while still enabling more complex systems to exist around it.

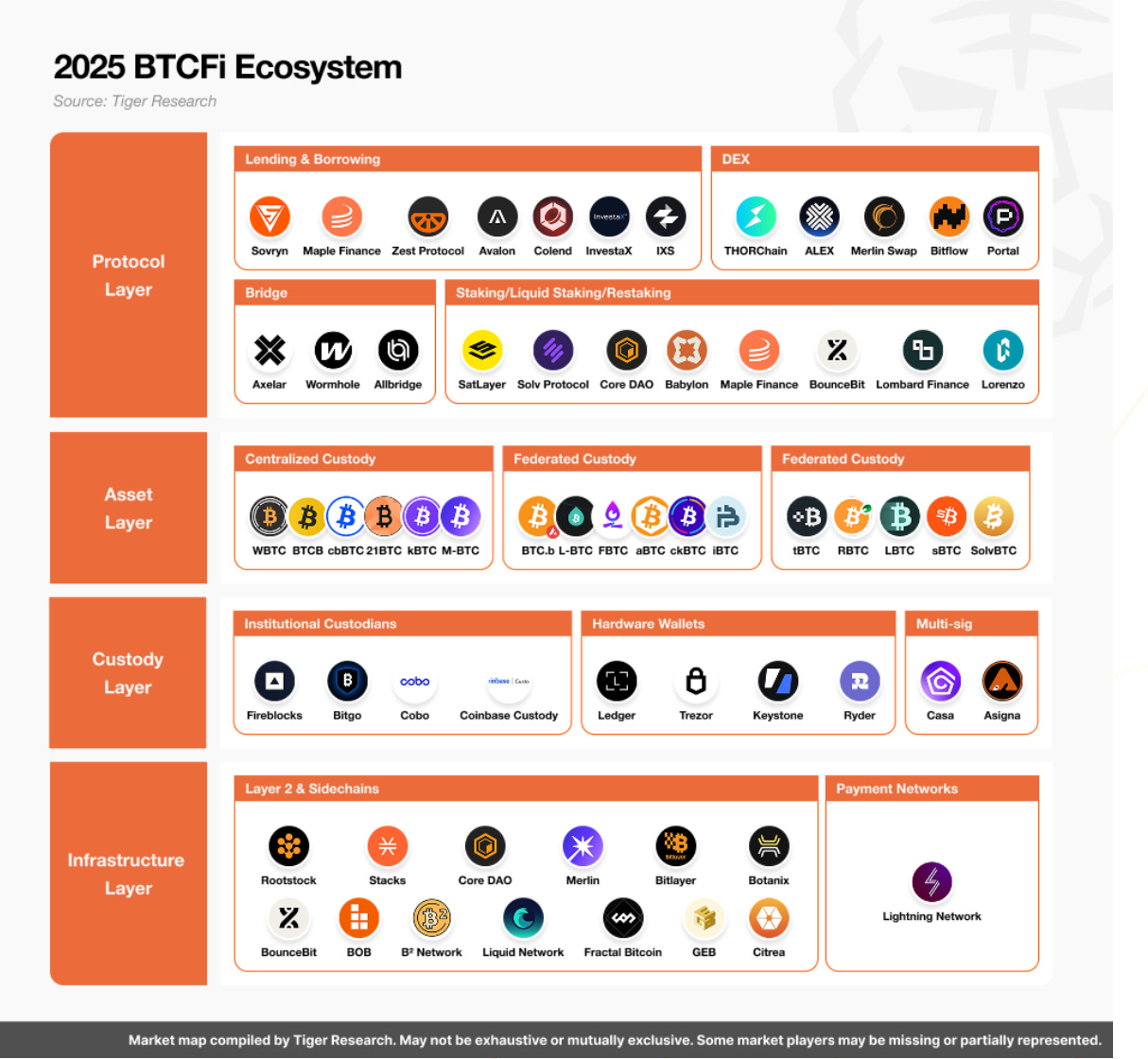

The BTCFi Landscape: What’s Actually Being Built

As the underlying tools for verification and portability matured, the Bitcoin ecosystem finally began to expand in ways that weren’t dependent on custodians or wrapped assets. What’s emerging now is not a single product or category, but a set of interconnected layers that give Bitcoin a functional economy for the first time. The easiest way to understand this is to look at how these pieces complement each other.

Infrastructure Layer: The first noticeable shift is the arrival of Bitcoin-secured execution environments. These aren’t L1 competitors or attempts to turn Bitcoin into a smart contract platform. They’re external systems that handle computation and rely on Bitcoin only for validation. That separation matters. It creates a space where lending, trading, collateral management, or even more complex primitives can exist without requiring Bitcoin’s base layer to change at all. It also avoids the failures of older models, where using BTC meant handing it to a custodian or trusting a multisig. Here, Bitcoin stays where it is; the computation moves around it.

Asset & Custody Layer: Alongside this, a new generation of bridges began forming, not the custodian-based, trust-heavy versions from the last cycle, but bridges built around verifiable outcomes. Instead of asking users to trust a group of operators, these systems use challenge mechanisms and fraud proofs so that incorrect state transitions get rejected automatically. The result is a safer way to move BTC into external environments without relying on the same weak trust assumptions that broke earlier designs. And more importantly, this kind of bridge aligns with how Bitcoin holders already think about security: minimal trust, minimal dependencies.

Protocol Layer: Once mobility became safer, the next layer of innovation focused on what Bitcoin could actually do once it reached these environments. That’s where yield and security markets come in. For most of Bitcoin’s history, earning anything on BTC meant handing it to an exchange or wrapping it into another chain. Now, staking and restaking models allow BTC to contribute to the security of external networks without leaving Bitcoin’s control. The return isn’t generated by credit risk or rehypothecation; it comes from the economic value of securing consensus or verifying computation.

In parallel, Bitcoin-native assets started to appear. Instead of wrapping BTC or pushing it into Ethereum, developers began using Taproot, Schnorr signatures, and off-chain verification to issue assets on Bitcoin or anchored to Bitcoin’s security. This includes stablecoins minted directly on Bitcoin infrastructure, synthetic assets that don’t depend on custodians, and vault structures that allow more flexible spending conditions. All of these expand Bitcoin’s utility without pushing it into a different trust model.

Individually, these developments would be interesting. Together, they mark the creation of the first coherent Bitcoin financial stack. Computation can happen off-chain and be enforced on Bitcoin. BTC can move safely without custodians. It can earn yield without leaving self-custody. And assets can exist natively without relying on another ecosystem’s security guarantees. Each piece addresses a different part of the liquidity trap that kept Bitcoin idle for over a decade.

What do I think?

I think the simplest way to look at BTCFi is that Bitcoin finally has an ecosystem that matches its scale. For years, people tried building around Bitcoin using tools that were never meant to support trillions in liquidity. No serious holder was going to gamble their BTC on custodial pegs, unproven bridges, or makeshift sidechains, and they didn’t.

This new wave is different because it meets Bitcoin on Bitcoin’s terms. The security model stays intact, self-custody stays intact, and the systems around it are finally robust enough for meaningful capital. If even a small share of dormant BTC starts moving because the infrastructure finally deserves it, the impact will be significant enough.

See you next Sunday, Until then, stay curious!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Hey, love the deep dive into BTC's "sleeping capital" finally stirring—feels like Bitcoin's been napping through the DeFi party while ETH L2s have been raging. The BTCFi angle is spot on; it's wild how we're only now seeing real yield on sats without selling them. That comparison to ETH's composability hits hard—BTC's like that reliable grandpa who won't touch a smartphone, but hey, with stuff like Babylon and Core, it might finally join the family dinner.

Question: Do you think BTCFi could pull off something like EigenLayer's restaking without fragmenting liquidity too much? Curious on your take.

Great read—subbed! 🚀