Bitcoin's 'whodunnit' 👀

What led to Bitcoin's flash crash? A 7.5% tumble. El Salvador's Volcano Bonds. Trump's NFT collection. The IRS has impressive stats. Meta's AI for Ray-Ban and Microsoft's Phi-2.

Hello, y'all. If you think you know your music, then this is for you frens 👇

Guess-the-song quiz on the artist you pick.

Leaderboard to share your scores with other fans.

Bragging rights to take home.

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

While Bitcoin has still gained over 150% this year. All good.

But it shed close to 10% in the last few days.

Check out this wreck 👇

On Monday, 7.5% tumble in a single morning.

Bitcoin slid below $41,000.

At the time of writing, bitcoin is trading around - $41,000.

Before we dive into the "whodunnit" of Bitcoin's flash crash, let's rewind and understand why it was soaring in the first place.

Here are some key plot points

1. Binance's Billion-Dollar Drama: Binance agreed to cough up a colossal $4.3 billion as a fine to US authorities.

This also gave a better light to the SEC's legal tussle with US-based exchanges like Coinbase and Kraken.

2. Regulatory Calmness: The US crypto regulatory landscape appears to be simmering down.

3. Upcoming Halving: Bitcoin's scheduled "halving" next year is on the horizon.

4. The ETF Enigma: The potential approval of a bitcoin ETF by the SEC is a major driving force behind Bitcoin's recent price movements.

5. Macroeconomic Factors: Bitcoin, often dubbed "digital gold," has danced alongside its metallic counterpart, gold. Factors like record-high gold futures and concerns about inflation have fueled Bitcoin's rally.

Enter the 'Flash Crash'

The 'Flash Crash' began with a market correction on Sunday night.

Now, let's get to the heart of the mystery.

Why did Bitcoin suddenly nosedive?

This correction is mostly due to an increase in circulating Bitcoin that is currently in a profitable position.

Macroeconomic Forces: A strong jobs report and Federal Reserve rate cut predictions.

Anti-crypto army: Five more US senators have agreed to cosponsor Senator Elizabeth Warren's Digital Asset Anti-Money Laundering Act.

Profit-Taking: Many short-term holders of Bitcoin decided to cash in on their profits, causing a sell-off. This was particularly evident among those who held Bitcoin for less than 155 days.

According to Glassnode, Bitcoin experienced the third sharpest selling-off of 2023.

Overheated Derivatives: Crypto derivatives' overheated funding rates contributed.

Net Outflows from Crypto Funds: Crypto asset exchange-traded products experienced net outflows. Bitcoin ETPs saw net outflows of $13.1 million, while Ether ETPs attracted $5.8 million in inflows.

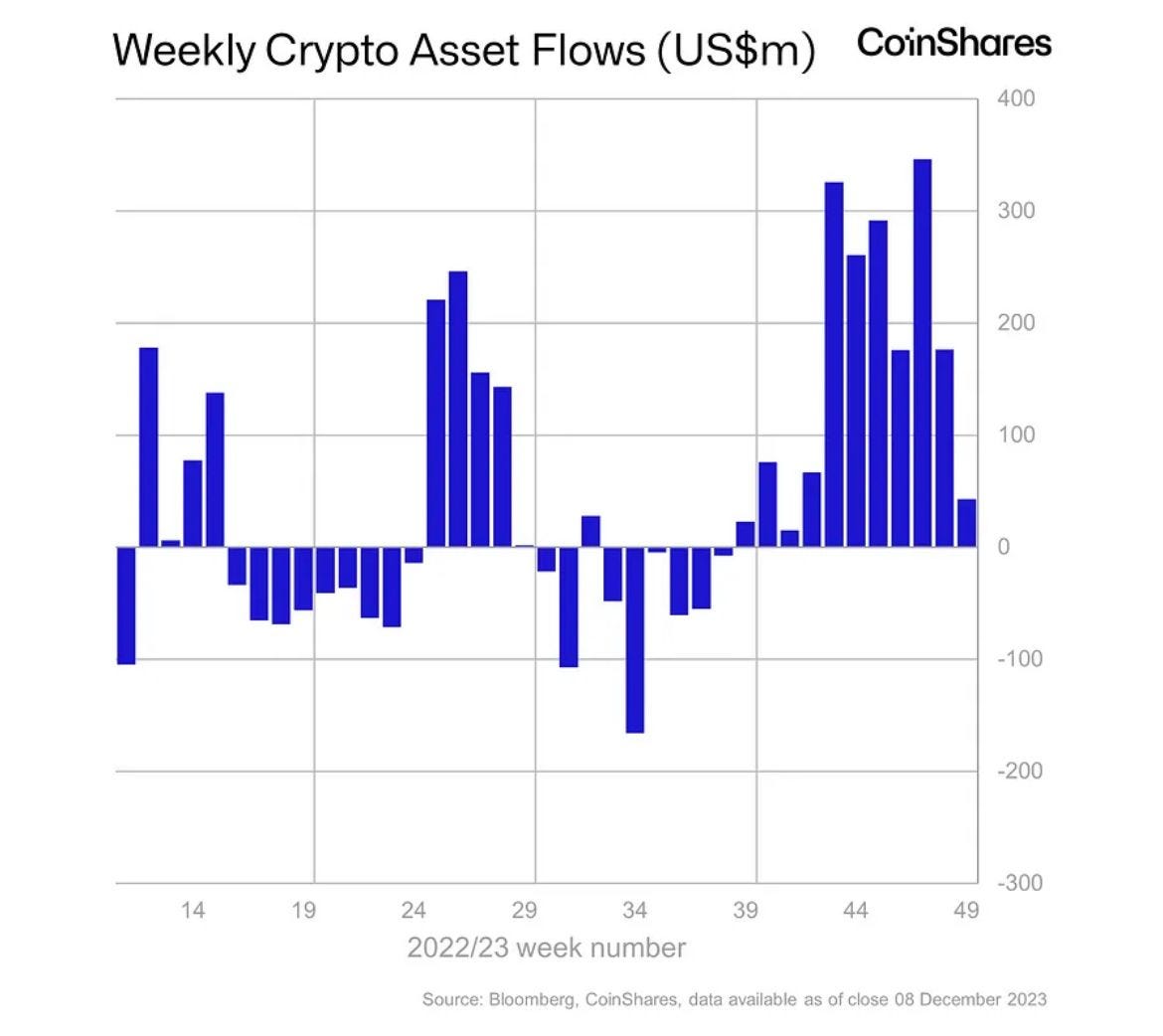

Institutional Appetite for Crypto: Institutional interest in crypto remains robust. CoinShares' latest report highlighted 11 consecutive weeks of accumulation by large entities.

Digital asset investment products: 11th consecutive week of inflows at $43 million.

So why did it happen?

Profit booking. Simple.

People got to take the dosh home, and that's exactly what it seems like.

Is the bull-run over?

The bulls have got to take a breather.

After eight weeks of positive run, hand it over to the bears for some time.

We good, right?

TTD Numbers 🔢

$1 billion

El Salvador loves Bitcoin and holds Bitcoin investments worth $120 million.

Now, President Nayib Bukele plans to launch $1 billion Volcano Bonds, a key component of his ambitious "Bitcoin City" project.

The Digital Assets Commission has given the green light, and the bonds are set to debut in early 2024.

Volcano and BTC?

The government aims to utilise geothermal energy from volcanoes for Bitcoin mining.

The bonds are denominated in dollars, but they have a unique twist.

Half of the bond proceeds will fund volcano-powered Bitcoin mining operations.

Long-Term Strategy: The remaining funds will be invested in Bitcoin, with a five-year holding period before gradual market entry over the next five years.

When and where?

Originally scheduled for a March 2022 launch with a $100 minimum investment. Postponed due to Bitcoin price fluctuations and regulatory hurdles.

Volcano Bonds will be available on Bitfinex's centralised crypto exchange, licensed in Kazakhstan and El Salvador.

TTD NFTs 🐝

Donald J. Trump: You might know him as the former President of the United States, but now he's also trying his hand at the latest trend in digital fashion—phygital NFTs.

Yes, Trump's third set of NFT collection is here.

It is his largest NFT collection yet.

It's called Trump Digital Trading Cards: MugShot Edition.

From horseback rides through fields to interstellar escapades as a cyborg it's much interesting.

This one has 100,000 NFT collectibles: Each card will set you back $99.

The first set had 45,000 NFTs, and the second had 47,000.

The perks?

Exclusive Fabric Swatches: Buyers of at least 47 Trump NFT trading cards (priced at $99 each) will receive a real piece of the navy suit he wore during his Georgia mugshot.

Limited Mugshot Edition: For those who collect over 100 "Mugshot Edition" Trump cards, there are 225 additional pieces of "suit and tie" from the same outfit available.

Ultimate Collector's Item: To own Trump's complete mugshot-day suit, you'd need to acquire nearly all 100,000 of the latest NFTs, which would amount to around $10 million.

Everything aside, listen to trump calling himself "your favorite president."

Where’s ETF?🚨

BlackRock's Bitcoin ETF application aims to shift risk to crypto market makers rather than banks, according to an SEC memo👇🏻

TTD IRS 🧿

The United States IRS has been on the trail of crypto criminals, and they've unveiled their top cases for 2023.

Here's the high-profile investigations:

Karl Sebastian Greenwood - The OneCoin Mastermind 🎩

Co-founder of OneCoin.

Sentenced to 20 years in prison for promoting a fraudulent crypto asset.

A pyramid scheme that crumbled under IRS scrutiny.

Ian Freeman - The Bitcoin Kiosk Kingpin 💰

Operated a money laundering scheme using Bitcoin kiosks.

Skipped tax payments from 2016 to 2019.

Facing an 8-year prison sentence.

Amir Elmaani (AKA Bruno Block) - The Pearl Token Minter 🪙

Founder of Oyster Protocol.

Investigated for tax evasion related to minting and selling Pearl tokens.

Caught in the IRS's web of justice.

James Zhong - The Silk Road Crypto Thief 🕵️♂️

Stole BTC from the infamous Silk Road marketplace in 2012.

Evaded authorities for nearly a decade.

Crypto stash worth over $3 billion discovered in a floor safe and popcorn tin.

IRS's Crime-Fighting Stats

In their relentless pursuit of crypto wrongdoers, the IRS's criminal investigation unit has been busy:

Initiated more than 2,676 cases in the 2023 fiscal year.

Over $37 billion related to tax and financial crimes under investigation.

Impressive record of seizing more than $10 billion in cryptocurrency since 2015.

TTD AI📍

Meta’s AI for Ray-Ban smart glasses

Meta is introducing its AI features for Ray-Ban smart glasses.

Here's what you need to know:

"Hey Meta" - A simple phrase while wearing Ray-Ban smart glasses summons a virtual assistant.

This virtual assistant utilises the glasses' cameras and microphones to perceive your surroundings.

The early access trial is exclusive to a select group of users in the US who opt in.

The AI assistant can help caption photos and provide translation and summarisation services.

In an Instagram reel, Mark Zuckerberg showcased its skills by asking it for fashion advice.

Microsoft Unveils Phi-2

Microsoft Research has introduced Phi-2, a small language model (SLM) that defies its compact size with impressive capabilities.

Phi-2 boasts 2.7 billion parameters, demonstrating exceptional reasoning and language understanding.

It rivals models up to 25 times its size, thanks to high-quality training data and advanced scaling techniques.

Outperforms predecessors in math, coding, and common-sense reasoning benchmarks.

Phi-2 competes with Google's Gemini Nano 2, despite being significantly smaller.

TTD Surfer 🏄

KuCoin has settled with the New York Attorney General's office for $22 million and will be exiting the New York market.

Grammy-nominated electronic music duo Disclosure is releasing 1,000 unique NFTs on Beatport's NFT marketplace.

The OKX DEX, a decentralised exchange, was hacked for $2.7 million after the private key of the proxy admin owner was leaked.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋