BlackRock Rises 🌡️ Grayscale Slows Down 💨

BlackRock's Bitcoin ETF shines, Fidelity's fund follows suit. Miner sell-off hits $1 billion. MicroStrategy keeps buying BTC. Solana faces outage. Ronin rebounds post-hack.

Hello, y'all. If you think you know your music, then this is for you frens👇

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

BlackRock's iShares spot Bitcoin ETF is killing it.

With $3.19 billion flows, it's top five US ETFs in year-to-date flows.

Bitcoin ETFs flow as of February 6, 2023

Bitcoin ETF Tracker

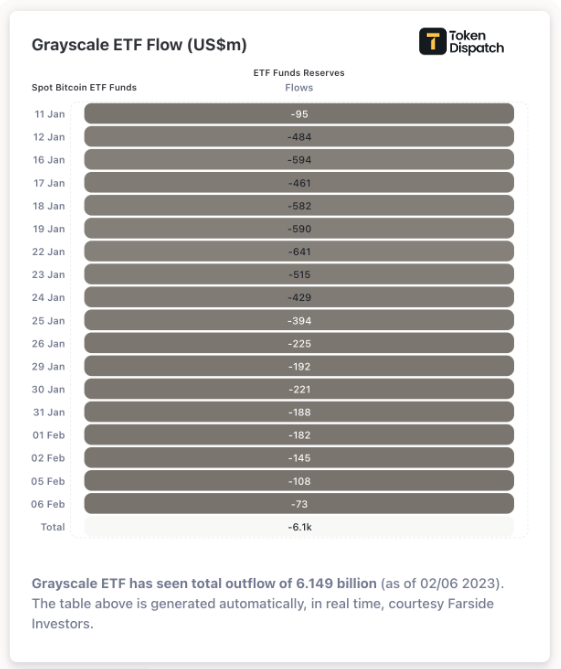

Grayscale slows down

Grayscale's spot Bitcoin ETF has seen a significant reduction in outflows, decreasing by 88% from its peak day on January 22.

Major Miner BTC Sell-Off

The debut of Bitcoin ETFs in the US has swung the miners in action.

Moved over $1 billion of BTC to exchanges in just 48 hours, a six-year high.

Why the Sell-Off? The report suggests miners might be selling for operational liquidity or taking advantage of the post-ETF approval price surge.

Miner Bitcoin reserves dropped to their lowest since June 2021, indicating a significant release of held BTC into the market.

Despite miner movements, on-chain data shows long-term investors are not rushing to sell, even with the market shifts.

FTX and Alameda Moving Millions

FTX exchange and Alameda Research have transferred over $38.8 million in digital assets to various exchanges since the start of January 2024.

On Jan 31, FTX said in a US court hearing that its restructuring plans will not involve a re-launch of the exchange but focused on repaying its customers in full.

FTX attorney Andy Dietderich said that repaying customers was an objective, but not guaranteed.

Following the hearing, criticism was hurled toward the restructuring plan, pointing out the legal team’s profits over the ordeal.

On Feb.4, former United States Securities and Exchange Commission official John Reed Stark described the plan as a “highway robbery of highway robbers.”

Buying more 💸

MicroStrategy has added 850 BTC to its stash this January.

Total Bitcoin holdings = 190,000 BTC, valued at $8.1 billion.

2023 Acquisitions: Throughout 2023, the firm scooped up 56,650 BTC, averaging a buy price of $33,580 per coin.

Financial Update: For Q4 2023, MicroStrategy reported a net income of $89.1 million, turning around from a loss the previous year, despite a 6.1% dip in revenue to $124.5 million.

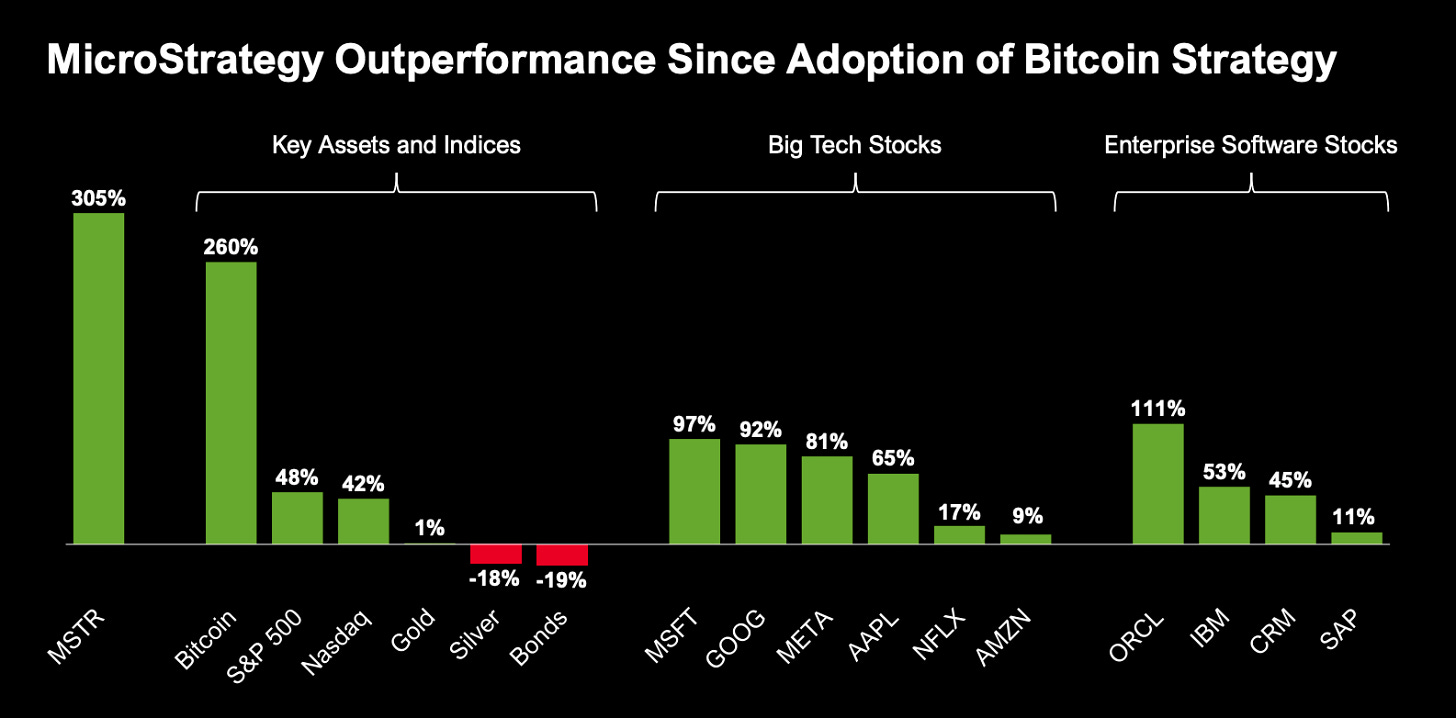

Since diving into Bitcoin in December 2020, MicroStrategy led the charge as the first publicly traded firm to back Bitcoin big time. Fast forward, its shares soared over 300%, outshining tech giants like Microsoft and Google, which saw a growth of about 95% in the same period.

Michael Saylor credited the firm's performance to the digital transformation of assets, predicting a bright, regulated future for Bitcoin as an institutional-grade asset class.

Where’s ETF?🚨

GBTC outflows keep dropping👇

Solana goes out❕

Solana successfully restarted after a five-hour outage.

Solana first acknowledged the network issue at 10:22 UTC, noting that transaction processing had halted.

Engineers and validators collaborated on a new software release to address the issue, leading to the eventual network restart.

Upgrade Details: The network's return followed an upgrade to version 1.17.20, with validators playing a key role in the restart process. Continuous monitoring is underway to ensure stable operations.

Engineers are investigating the outage's root cause, promising a detailed report once it's complete.

The issue might be linked to the "Berkley Packet Filter" mechanism?

But, Solana's DeFi sector continued to show resilience and growth. The Total Value Locked (TVL) in Solana's DeFi protocols has soared from $260 million in February 2023 to over $1.6 billion now.

Welcomes back 🔙

Remember when Ronin got hit with that massive $624 million hack back in March 2022? Yeah, that was a tough time for Axie Infinity's blockchain.

Fast forward two years and Ronin's not just back.

It's booming.

Trading volume's up by 54% this week.

Total value locked (TVL) has seen a 28% bump this month.

New games like Pixels and veteran projects like Cyberkongz hopping over to Ronin.

Binance just listed its RON token, and it's trading higher than pre-hack levels.

Ronin, the blockchain from Axie Infinity creators, experienced a wild ride with its RON token dipping over 40% post-Binance listing, only to recover slightly to $2.63.

There were concerns about insider trading, fueled by visible token accumulation and leaked Binance communications.

In response to the fiasco, Binance's Yi He announced stricter internal measures to prevent future leaks, promising cancellations for any leaks detected.

While RON's price has somewhat stabilized since its October low, Ronin's TVL hasn't fully rebounded from the 2022 $600 million heist, currently standing at $161 million.

The Surfer 🏄

The Hong Kong General Chamber of Commerce calls for yuan stablecoin issuance in budget suggestions.

Lawmakers in Virginia have proposed a bill to create a work group that will study blockchain technology, digital asset mining, and cryptocurrency.

The European Commission is considering criminalizing AI-generated imagery and deepfakes depicting child sexual abuse.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋