Hello

It’s September 2025, and someone out there has already gone all-in on the Super Bowl 2026. Their Polymarket wallet shows a fat stack of “YES” tokens tied to a team that won’t take the field until February 2026. On paper, they are sitting on a smart call with the odds swung their way and their side now trading as one of the favourites.

But there’s an irony here: What if the bettor is in need of some extra cash but has gone all in on the prediction market trade? Polymarket lets traders sell their shares anytime before resolution to lock in profits or cut losses. Yet, many traders who believe in their big, long-dated bets like the Super Bowl, might not want to liquidate their positions just to get some extra cash.

In these cases, their conviction is virtually locked behind a token that’s either going to pay $1 or zero until the final whistle is blown in February next year in Santa Clara, California.

That the capital is virtually stuck there and the bettor is forced to choose between keeping the position and possibly winning the bet or liquidating it earlier for some extra cash is what some DeFi protocols want to address.

Calling the Next Generation of Web3 Startups

Crypto’s largest startup competition, NEXUS, is happening live at TOKEN2049 Singapore (Oct 1-2) and applications are about to close.

10 early-stage startups will be selected to pitch live on stage in front of 25,000+ attendees, a panel of expert judges, and the most influential voices in crypto.

You’ll receive:

Direct access to industry leaders at our exclusive Speaker networking events and lounges

Exposure to global media and VCs actively looking for their next investment

A dedicated startup stand at TOKEN2049 Singapore

If you’re building the next crypto unicorn, apply now.

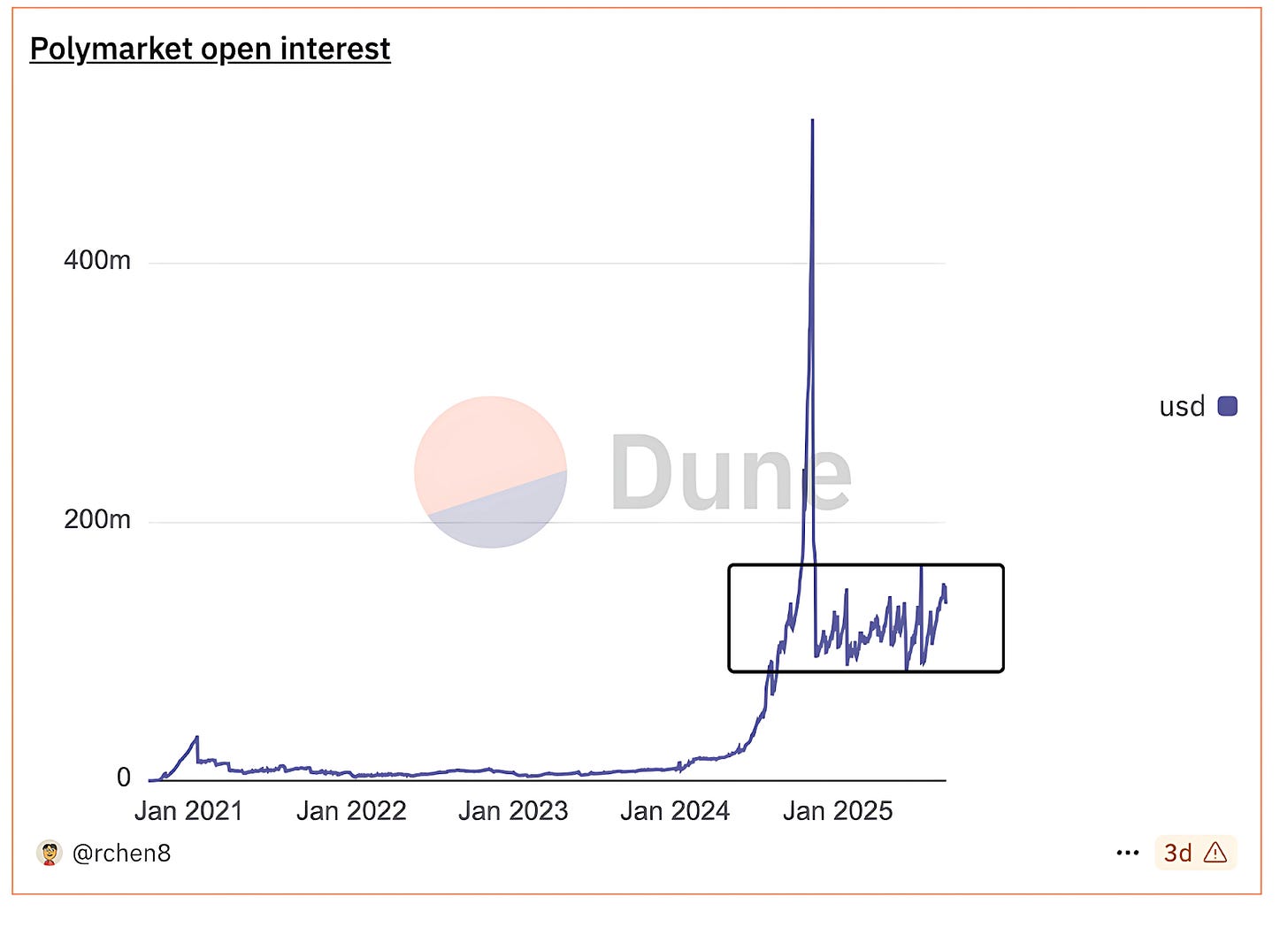

Prediction markets have turned into one of crypto’s most compelling playgrounds. Polymarket is the world’s largest prediction market. It processed more than $9 billion in trading volume in 2024, with the US presidential election alone drawing $3.2 billion in stakes.

For a few weeks last November, its open interest topped $510 million before sliding back to around $100–$120 million once ballots were counted. Even outside politics, millions are tied up in long-dated events.

New York’s 2025 mayoral race has already seen nearly $59 million in trades, and the Super Bowl 2026 market is at $38 million before pre-season has even begun. Every one of those tokens represents money locked until resolution or premature liquidation.

Technically, these tokens are like any other crypto asset. Polymarket’s “YES” and “NO” shares are standard ERC-1155 tokens built on Gnosis’s Conditional Tokens Framework and settled by UMA’s Optimistic Oracle.

We wrote more about this last month.

These tokens can be held in escrow, transferred, and redeemed by smart contracts once the oracle finalises an outcome. That makes them collateralisable in form.

In fact, Polymarket itself open-sourced a prototype called PolyLend to show how it might work. It looked more like NFT lending. A borrower escrowed their shares, a lender offered USDC at a fixed rate, and after a minimum term the lender could “call” the loan, triggering a Dutch auction to transfer it to another lender.

If nobody stepped in and the borrower didn’t repay, the lender simply seized the position and rode it to resolution. No oracle-based loan-to-value (LTV) ratios or continuous liquidations. Just peer-to-peer underwriting, where the lender either redeemed $1 at the end or ate a zero.

More projects have picked up this model now.

In August, GondorFi announced a funding round led by Maven11 Capital and Futuur.

Their pitch is to build a pooled version: conservative haircuts, programmatic risk controls, and one-click access from inside Polymarket. In theory, our Super Bowl bettor could unlock half their stake as liquid USDC today, without selling their position.

The problem is that prediction markets don’t always glide up and down in value like ETH or BTC. Sometimes they jump to all or nothing. If you’ve borrowed against “Yes, Trump wins 2028” and he suddenly withdraws, your collateral doesn’t move from $0.60 to $0.40. It can collapse to near zero overnight. For a lender holding collateral that may be worth $1 one moment and $0 the next, is a significant risk.

This makes liquidation mechanics critical. Traditional crypto loans use automatic price feeds to liquidate the moment your collateral asset falls in value, which doesn’t work here, because prediction bets can drop to zero instantly.

PolyLend’s approach is simpler: the lender already assumes this could happen. They lend you less than your tokens are worth (that’s the “haircut”), charge a higher interest rate, and know they might end up stuck with your bet if you don’t repay. GondorFi wants to make this less scary by pooling lots of lenders together. Yet the core problem remains: your collateral can still go straight to zero.

Why would anyone borrow against something this volatile?

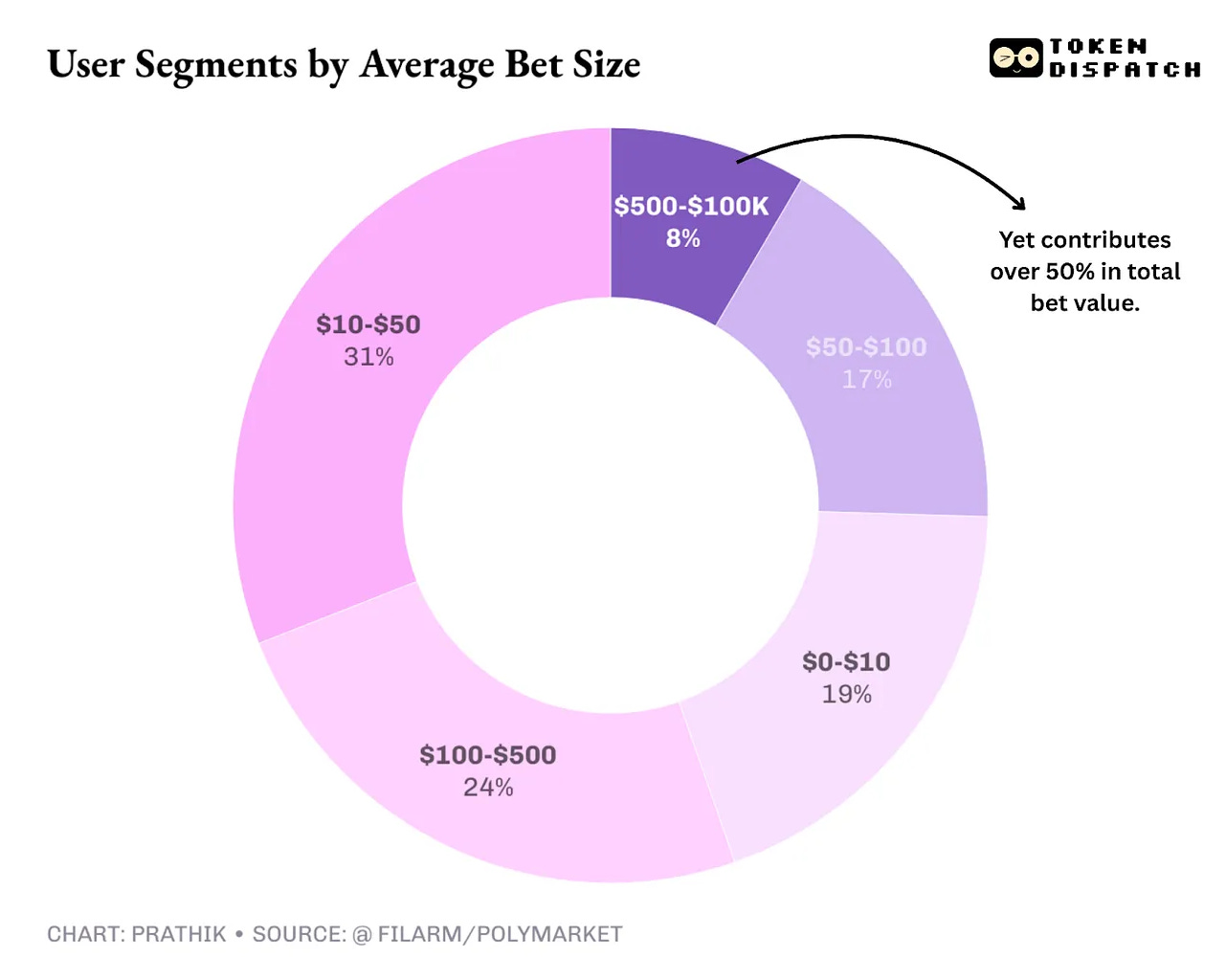

For most Polymarket users, who bet between $10 and $500, it’s pointless. The major demand comes from whales and market makers. Some want leverage without selling so that they can borrow USDC against existing stakes to double down on conviction. Others want liquidity to rebalance portfolios, keeping millions parked in long-term political bets while still playing short-dated events.

The data makes this split clear: over 30% of users place bets of just $10–50, but it’s the tiny 8% wagering between $500 and $100K that accounts for more than half of all value staked. That concentration means lending tools will live or die by whether the biggest players see them as useful.

Remember the French trader who cleared $85 million on Trump in 2024? He fits this profile perfectly and would be happy to pay a double-digit interest rate for short-term liquidity because the principal locked in the bet dwarfs the cost of borrowing. Market makers, meanwhile, might use loans to hedge exposures across multiple venues or arbitrage price discrepancies.

There’s one catch. If you have been tracking the prediction market activity, you’d know that a lot has changed since its peak during the US Presidential elections late last year. The resolution time of prediction markets have been turning shorter.

A three-day market like “Will Apple beat earnings this week?” doesn’t justify borrowing. The loan barely has time to accrue interest, and lenders haircut so heavily that it isn’t worth the trouble. But we still see some longer-duration bets come up.

Polymarket’s growth since the elections has skewed toward sports and culture bets. Some of these bets have a resolution time that runs into months. Take for instance the Super Bowl 2026 market we were talking about.

This comes at a time when the daily active traders have gone down to 226,000 in August, down 50% from the peak of 450,000 in January, while open interest has stabilised at around $100–120 million. This means fewer wallets are betting bigger sums — a perfect recipe for borrowing against the bets.

Polymarket’s 2026 Super Bowl winner market has over $38 million worth trades placed whose resolution is only expected to take place five months later. New York City’s Mayoral Election? Close to $60 million worth of trades waiting for resolution for the past four months until the result is out in early November.

That’s a lot of liquidity trapped for months across just two trades.

This makes prediction-markets lending look a lot like NFT-backed loans. Both deal with illiquid or jumpy collateral, both use peer-to-peer auctions and seize-on-default mechanics, and both attract a mix of sophisticated speculators and occasional thrill-seekers. Today, NFT loans have shrunk more than 90% since their peak in early 2024. Prediction tokens might face similar challenges: niche but addressing a real problem. The one difference is that prediction tokens have guaranteed redemption. A winning bet always pays $1. An NFT may never find a buyer. That certainty could help lenders stomach the risk, if they price it correctly.

The regulatory question hovers in the background.

Polymarket paid a $1.4 million CFTC fine in January 2022 before returning to the US under QCX, an approved derivatives clearing exchange. But lending may be treated differently. To a regulator, it looks like margin betting. And margin plus elections is the kind of combination that lights up Washington. Expect geo-fencing, disclaimers, and slow rollouts. Yet, legitimisation could flip the narrative. If prediction tokens are treated as derivatives, why shouldn’t they be collateral?

For long-dated markets, the problem is obvious: capital is trapped. For our Super Bowl bettor who has to choose between keeping the money stuck until February or choosing to forgo the possibility of winning the bet by liquidating the position early, unlocking half today would be a genuine relief. For short-term markets, the demand evaporates. No one is paying 15% APR to borrow against a weekend fight. The mechanics are possible, the need exists, but only in slices of the market.

That is where GondorFi’s bet lies. If it can win the whales, integrate seamlessly with Polymarket, and keep lenders comfortable with the cliff risk, it could become the margin layer for prediction markets.

If they make it work, soon the long-term bettor might be able to click a button and borrow against their bet without cashing out belief. How they design the underwriting rules for the instrument will dictate whether it will become a financial innovation or financial folly.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Wow

Solid one