BSV Seeks Damages For Binance Delisting

BSV Investors pursued $13 billion in damages against Binance in 2024 UK appeal, asserting delisting halted its ascent to top cryptocurrency status

A group of Bitcoin SV (BSV) investors has escalated their battle with Binance to the UK Court of Appeal, seeking to reinstate claims that the exchange's 2019 delisting decision cost them billions in potential gains.

The class action, representing approximately 243,000 UK-based BSV holders, is pursuing damages exceeding $13 billion against several cryptocurrency exchanges including Binance, Kraken, ShapeShift, and Bittylicious.

The lawsuit alleges these platforms colluded to delist BSV between April and June 2019, violating UK competition law.

It is based on what lawyers call a "forgone growth effect," meaning that BSV was allegedly denied the chance to grow in value like Bitcoin due to simultaneous removals from major exchanges.

"Because of the delisting, there has been damage which continues to this day. If it hadn't been for the delisting, BSV would be a first-tier currency like Bitcoin," lead counsel John Wardell KC argued.

The appeal follows a July 2024 ruling by the UK Competition Appeal Tribunal that applied the "market mitigation rule," suggesting BSV holders could have reasonably minimised their losses by trading on alternative platforms.

BSV's legal team counters that many investors lacked the financial capacity to mitigate these losses - a claim vigorously contested by Binance.

"BSV could have been exchanged for Bitcoin or other cryptocurrencies. BSV is and was, at all relevant times, a readily marketable asset," Binance's counsel Brian Kennelly KC asserted.

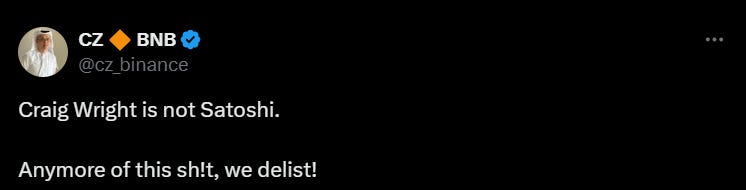

The case unfolds against a backdrop of controversy.

BSV, created in 2018 as a fork of Bitcoin Cash (itself a Bitcoin fork), has been led by Craig Wright, who claimed to be Bitcoin's pseudonymous creator Satoshi Nakamoto.

These claims prompted the initial delistings after a UK court definitively ruled in March 2024 that Wright had perpetrated fraud through his Satoshi claims.

"Last year, in an unprecedented case, the English High Court found that Dr. Craig Wright was not Satoshi and that he had orchestrated a fraud," noted Ashley Fairbrother, partner at Edmonds Marshall McMahon, representing Binance.

News of the appeal drove a 15% price surge for BSV to approximately $42, though the token continues to trade far below its historical peaks.

Since its delisting, BSV has weathered multiple 51% network attacks that further undermined its security and valuation. Despite these challenges, plaintiffs maintain that Binance's actions, not technical vulnerabilities, caused BSV's failure to achieve mainstream adoption.

The case has significant implications for the cryptocurrency marketplace and exchange governance.

A ruling favouring BSV holders could establish precedent for exchange liability regarding delisting decisions, potentially constraining platforms' ability to self-regulate.

Conversely, affirming exchanges' delisting authority could strengthen their position as market gatekeepers, particularly against projects associated with fraudulent activities.

The case represents a test of the balance between decentralisation ideals that underpin cryptocurrency philosophy and the practical reality that centralised exchanges remain critical infrastructure for most digital assets.

The hearing continues this week with a decision expected later this year.