Hello!

Perpetual futures eat crypto trading alive. Professional traders live on them. Regular people can't touch them. The platforms make it impossible. Lootbase is taking an alternative approach.

Check out Sunday’s edition to know more.

Welcome to Mempool - your weekly market and news insights on Bitcoin.

We're looking at Week 24 of 2025 (Jun 09-Jun 15)

Bitcoin finds stability despite Middle East crisis

Circle's 3x post-IPO surge sparks Wall Street appetite for crypto

ETF inflows hit five-day streak after two sub-zero weeks

“Wholecoiners” becomes the new American Dream

The Week That Was

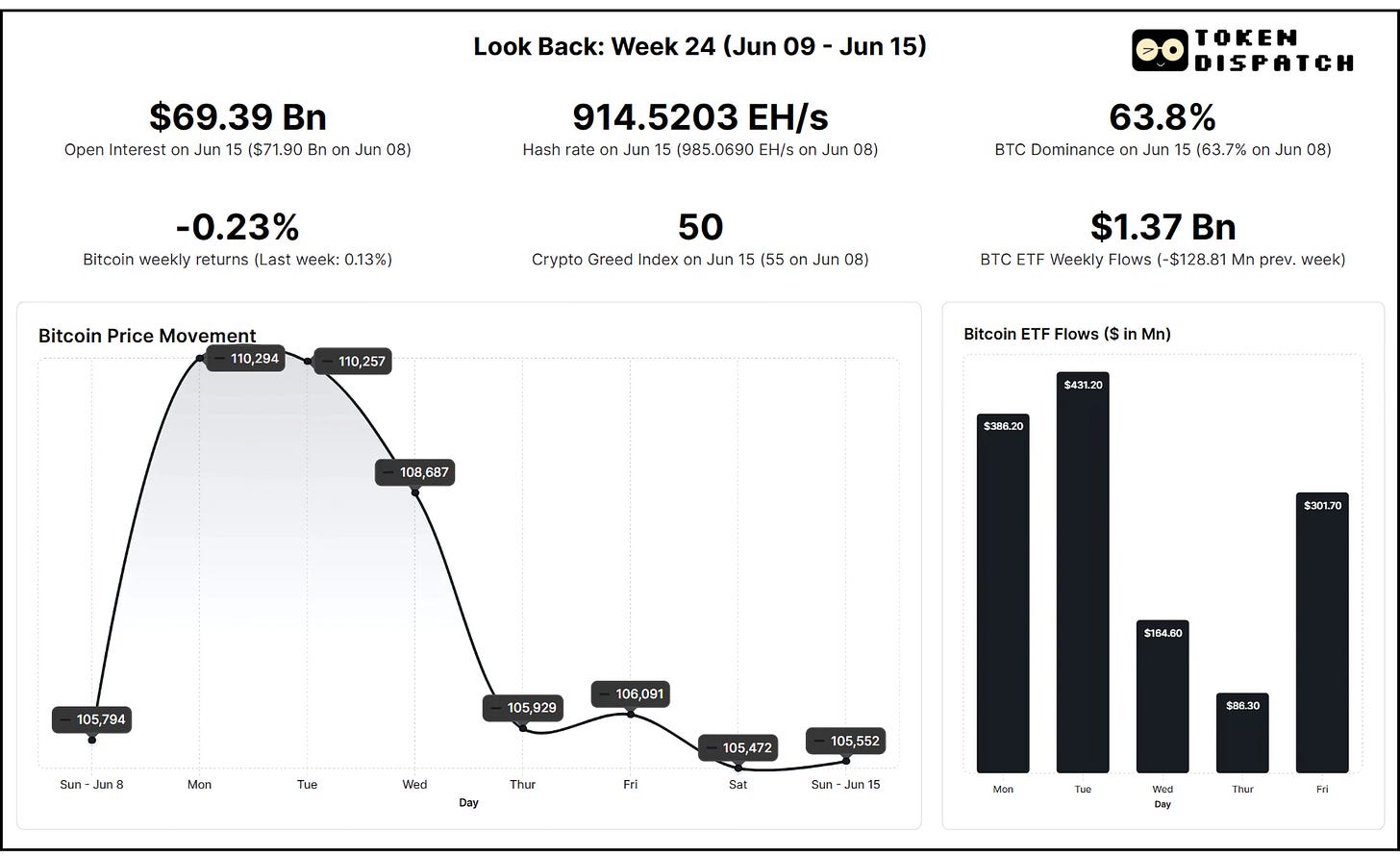

Bitcoin recorded another marginal weekly change, this time dropping 0.23%, closing at $105,552 after a week dominated by geopolitical tensions and resilient institutional flows.

The escalating conflict between Israel and Iran triggered significant volatility during the week. Bitcoin closed on Thursday at $105,929 after peaking above $110,000 on Tuesday. It recovered over the weekend.

Open Interest declined marginally reflecting reduced leveraged positioning as traders adopted a more cautious stance amid Middle Eastern tensions.

The Crypto Greed Index retreated five points slipping back into neutral territory after a three-day period in the greed territory. Hash rate slipped to 914.5203 exahashes per second.

Bitcoin dominance edged one basis point higher, reinforcing its position as the preferred cryptocurrency during periods of heightened uncertainty. This increase occurred despite Bitcoin's flat weekly performance, suggesting altcoins faced even greater selling pressure during the risk-off environment.

ETF flows recorded $1.37 billion in weekly inflows, despite the geopolitical tension, compared to the previous week's outflows. The positive institutional demand helped cushion Bitcoin's price action.

Price Chart Analysis

Bitcoin started the week at $105,794 and peaked at $110,294 in a day, coming within striking distance of its all-time high of $111,970 set in May. It reflected growing optimism around renewed US-China trade negotiations at Lancaster House in London.

The rally was cut short as escalating Middle East tensions derailed Bitcoin's ascent. Israel's airstrikes on Iran pushed BTC to $102,750 on Thursday, from above $108,000 in less than 12 hours.

The geopolitical shock triggered over $1.1 billion in crypto liquidations across the market.

Bitcoin found buyers on dips, recovering to $106,000 by Friday's close before consolidating through the weekend. It reclaimed $107,000 in the early hours of Monday (June 16).

Key Technical Levels

Resistance: $110,000-$111,000 (near all-time highs)

Critical Support: $102,750 (Friday's intraday low)

The week's price action shows Bitcoin's evolving character: while still sensitive to geopolitical developments, it was more stable compared to previous crisis episodes. Bitcoin slipped less than 5% on the Israel-Iran conflict this time, versus an 8-10% slide during the 2024 conflict between the two nations.

The swift recovery from Thursday's lows and maintenance of six-figure pricing suggests institutional accumulation continues to provide a stabilising floor.

Wall Street

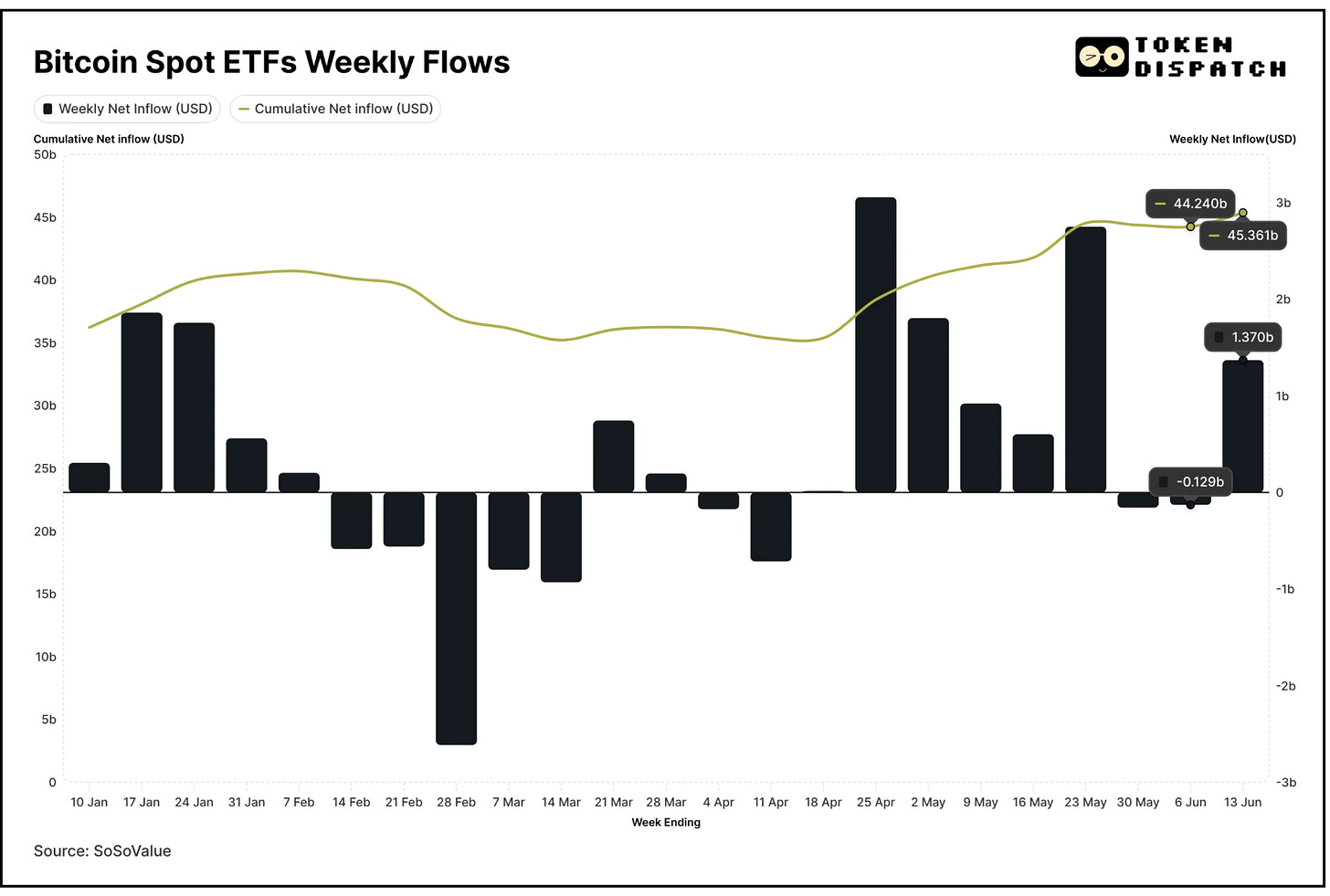

Bitcoin ETFs bounced back with a record five consecutive days of inflows totalling $1.37 billion despite Middle Eastern tensions. This was a sharp reversal from two back-to-back weeks of negative flows.

BlackRock's IBIT made headlines by becoming the fastest ETF in history to reach $70 billion in assets, achieving the milestone in just 341 days, five times faster than the previous record holder, gold ETF GLD.

Cumulative ETF inflows now stand at $45.36 billion.

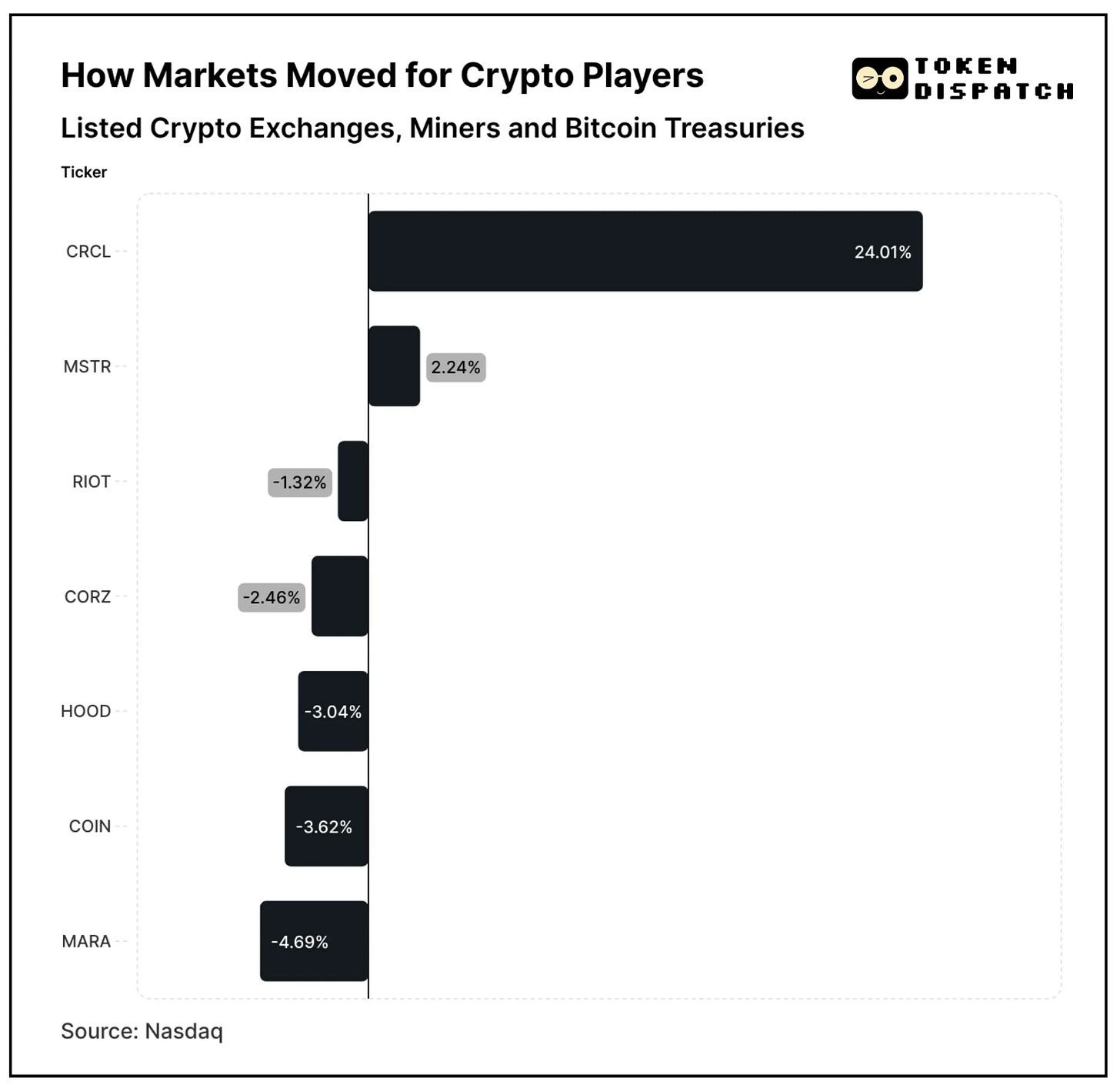

Most of the crypto equities saw a week in red barring Wall Street newcomer Circle (CRCL) and Strategy (formerly known as MicroStrategy).

Circle dominated the headlines following its explosive NYSE debut. The USDC issuer surged 24.01% for the week, driven by reports that retail giants Amazon and Walmart are considering launching their own stablecoins. Circle's stock reached new highs near $133.56, more than 4x its IPO issue price of $31 per share.

Traditional crypto stocks faced headwinds despite Bitcoin's relative stability. Each of Marathon Digital (MARA), Coinbase (COIN) and Robinhood (HOOD) dropped more than 3%, while mining stocks Riot Platforms (RIOT) and Core Scientific (CORZ), also posted modest losses.

Fun Factoid

Owning one Bitcoin has become the new American Dream, said Jeff Park, Head of Alpha Strategies at BitwiseInvest, in an interview on the Unchained podcast.

Park who argues that younger generations are abandoning traditional wealth aspirations in favour of becoming "wholecoiners."

Park explained that many young people no longer aspire to own suburban homes or pursue the white-picket-fence ideal. Instead, they're focused on accumulating at least one full Bitcoin as a modern symbol of prestige and long-term financial security.

The cultural shift goes beyond personal wealth building.

Park noted that some investors now aim to "retire their bloodline" through Bitcoin accumulation, viewing the cryptocurrency as a generational wealth vehicle that can provide financial independence across multiple generations.

This generational pivot reflects Bitcoin's evolution from speculative asset to what Park describes as a "social signal of financial independence and self-sovereignty."

Surfer 🏄🏾♂️

Bitwise CEO Hunter Horsley claims Bitcoin could absorb the $30 trillion US Treasury market, positioning it as a store-of-value rival not just to gold but to all major savings instruments. Rising geopolitical tensions and surging US debt are fuelling investor interest in Bitcoin as an alternative safe haven amid elevated Treasury yields and market uncertainty.

Financial advisors remain cautious about recommending bitcoin and crypto to clients, citing concerns over volatility, energy use, and criminal activity. Growing interest in stablecoins and smart contract platforms in the past few months signal a shifting narrative. Experts predict that as education continues and the digital asset ecosystem matures, more advisors will embrace crypto allocations by year-end.

NYDIG research highlights that Trump Media and Semler Scientific could be among the cheapest Bitcoin treasury companies by equity premium to NAV, despite both having mNAV metrics above 1.1. This suggests a more nuanced valuation approach is needed beyond the common mNAV metric to assess Bitcoin treasury firms effectively.

Token Dispatch View 🔍

Bitcoin's resilience during this week's geopolitical shock reveals a cryptocurrency reaching institutional maturity. The swift recovery from Thursday's Iran-Israel conflict selloff, coupled with record ETF inflows, shows that investors now view crisis-driven dips as accumulation opportunities rather than exit signals.

The contrast between Bitcoin's response to last week’s Israel-Iran conflict versus the 8-10% drops seen during previous episodes between the two nations highlights the stabilising effect of institutional adoption. BlackRock's IBIT becoming the fastest fund to hit $70 billion in assets is a testimony to Bitcoin’s maturity as an asset class .

Circle's explosive NYSE debut and 300%+ post-IPO surge signals Wall Street's growing appetite for regulated crypto infrastructure plays. The filing of CRCL-based ETFs within days of its public listing, combined with reports of Amazon and Walmart exploring stablecoins, suggests traditional finance is rapidly embracing digital asset infrastructure as a legitimate investment category.

However, Bitcoin remains vulnerable to escalating geopolitical tensions. The $102,750 support level tested during Friday's selloff represents a critical threshold—a decisive break below could trigger broader liquidations and challenge the six-figure narrative that has dominated 2025.

What This Means for Investors

Monitor the $102,750 support level closely - this zone proved crucial during the Iran-Israel crisis and a fall below this could speed its slide toward the $100,000 mark

Track ongoing Middle East developments - any escalation affecting oil supply routes could trigger broader risk-off sentiment across all assets

Watch ETF flow sustainability - five consecutive days of inflows during crisis suggests institutional conviction, but prolonged geopolitical uncertainty could test this resolve

Consider the infrastructure play divergence - Circle's success versus traditional crypto stocks' weakness indicates investors favour regulated, revenue-generating crypto businesses over direct Bitcoin exposure during uncertain times

That's it for this week's Mempool edition.

See ya, next Monday.

Until then … stay sharp,

Prathik

P.s. Forward this dispatch to fellow investors who need edge in their crypto portfolio. They'll thank you when our next call plays out.

Don't forget to whitelist thetokendispatch+mempool@substack.com to ensure you’ve got me each week in your primary inbox.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.