Welcome to our weekly Bitcoin macro and news analysis: Mempool.

We're looking at Week 30 of 2025 (July 21-July 27)

Trade deals help BTC regain lost ground

Open interest holds steady above $84 billion

ETF flows breaks 12-day positive trend

Crypto stocks witness correction

Build the Skillset Crypto Teams Are Hiring For

Safary Certification is a 4‑week bootcamp taught by the very people behind growth at Kraken, Stargate, EigenLayer, and others.

In this bootcamp, you’ll learn:

How to position a crypto brand using narrative-first frameworks.

Funnel-building from acquisition to retention using onchain data.

Partnership strategies & token launch playbooks.

Building a personal brand that gets you hired in web3 growth.

Cohort 1 had 170 students. Cohort 2 kicks off August 1 with only 100 seats.

Week That Was

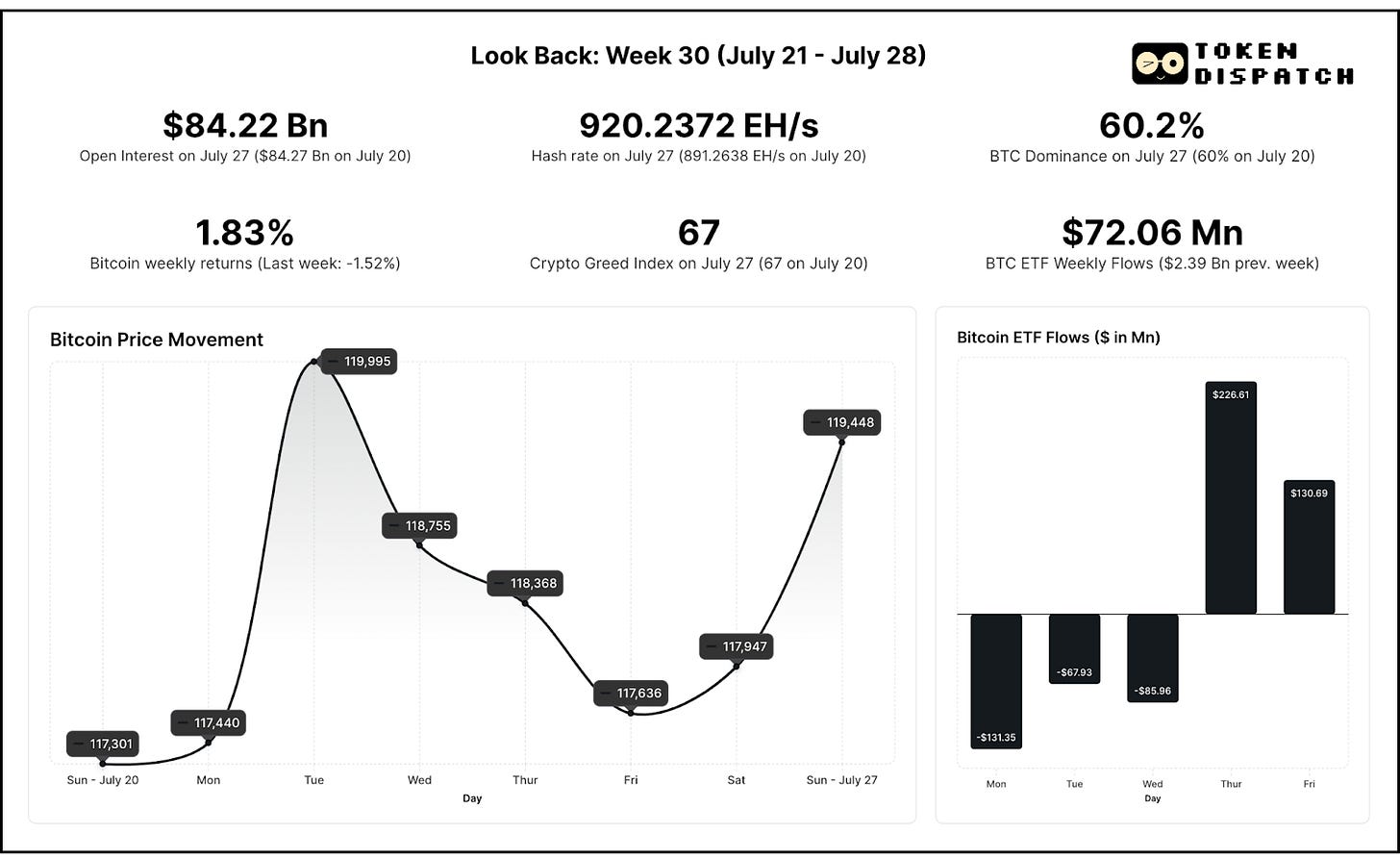

It was another week of dabbling between key support and resistance levels for Bitcoin, after the euphoric climb to the current all-time high of $122,050, two weeks back. Bitcoin closed at $119,448, up 1.83% for the week, as it failed to hold above the psychological barrier of $120,000 despite crossing it momentarily on Tuesday.

Bitcoin closed at a lower price level on each of the days between Wednesday and Friday amid profit-taking and price discovery.

It regained all the lost ground on the weekend, though, when US President Donald Trump and European Commission President Ursula von der Leyen announced a framework trade agreement. The agreement sets a 15% US import tariff on EU goods, significantly lower than the previously threatened 30% rate.

The deal, which includes $600 billion in investment by the EU in US energy and defence over the next three years, helped ease global trade tensions that had been weighing on risk assets.

Upcoming talks between the US and China to further delay the introduction of reciprocal trade tariffs also helped Bitcoin regain its footing.

The biggest takeaway from this consolidation phase is that Bitcoin is holding well above $112,000, which was the all-time high between May 22 and July 9. This suggests that the structural shift to a new price regime remains intact, although retracement to the level can’t be ruled out.

On-chain metrics reflected this cautious optimism.

The Crypto Fear & Greed Index stayed firmly in "greed" territory for over two weeks now. Bitcoin's dominance also gained by two basis points after slipping to 60% in the preceding week. Open interest remained elevated at $84.22 billion, down only marginally from previous weeks' highs, indicating that traders remain positioned for significant moves in either direction.

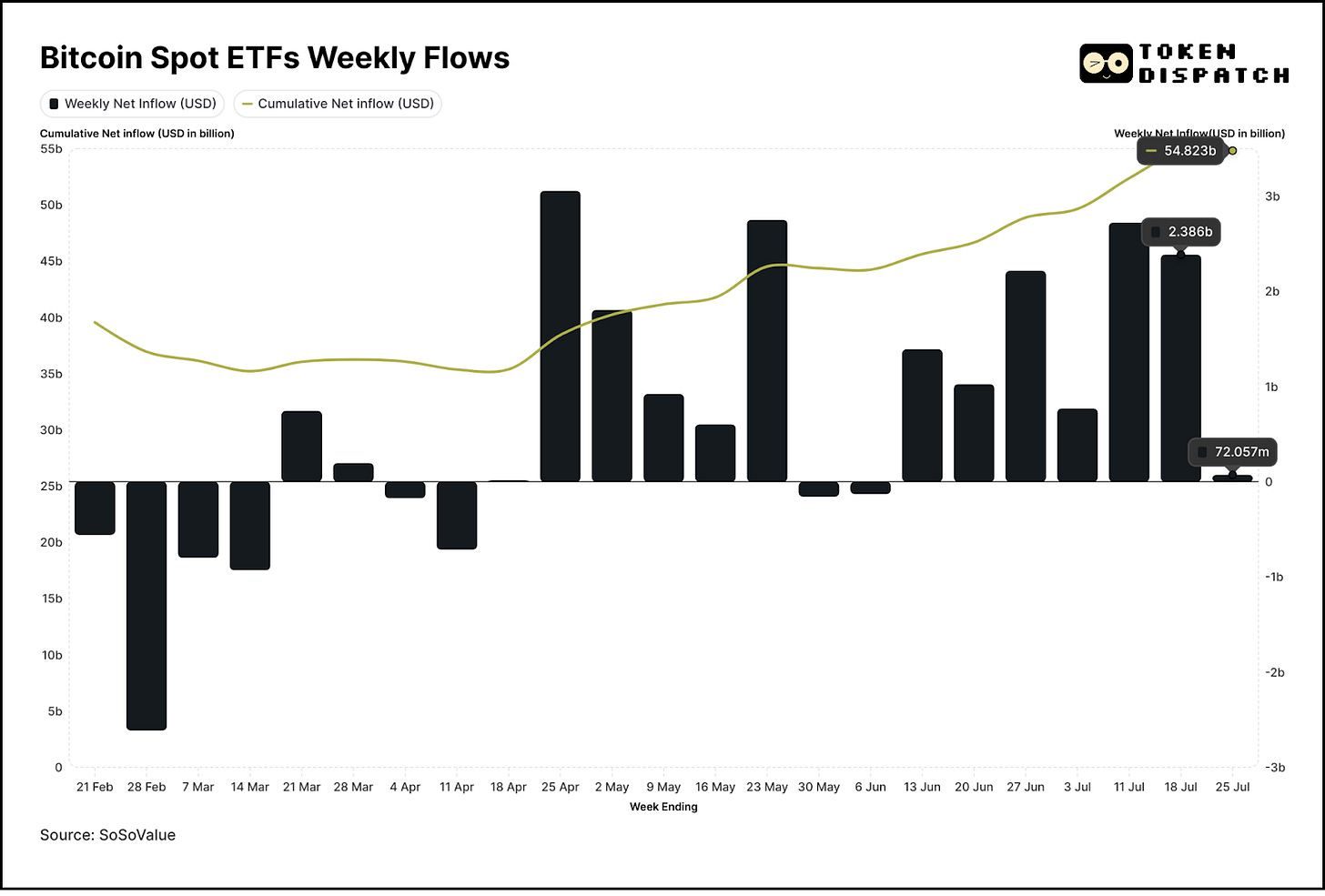

Institutional flows slowed down, yet were marginally positive at $72 million.

While modest compared to the preceding multi-billion dollar weeks, the week closed with consecutive days of inflow after starting with three days of outflow.

The crypto equity space saw widespread correction as all the shares we track, barring Riot Platforms and Core Science, closed the week in red. Circle led the decline with 13.82%, while Marathon Holdings (MARA) slipped 11.58% during the week.

Coinbase and Robinhood shares slipped 6.7% and 4.46% as Cathie Wood’s ARK Invest divested their stake worth $12 million and $1.1 million, respectively, during the week to buy a stake in Ethereum (ETH) treasury firm Bitmine Immersion Technologies (BMNR).

Expect crypto stocks to see major movement this week as both Coinbase and Robinhood are likely to announce their quarterly earnings. Zacks Equity Research estimates Robinhood’s earnings for the period to jump 47% year-on-year (YoY), while revenue is forecast to be $915.2 million, up 34.2% YoY.

Meanwhile, the analysts expect Coinbase’s quarterly earnings to fall 22.4% for the quarter, while revenues are expected to be $1.51 billion, up 4.3% from the year-ago quarter.

What’s Next for Bitcoin

Technical indicators paint a picture of controlled momentum for Bitcoin. The RSI has cooled from overbought territories above 80, now sitting in more sustainable ranges that could support the next leg higher.

Key Levels to Watch Out

The resistance currently sits around the $120,000-$120,500 range while Bitcoin is still figuring out a solid support after it briefly breached $116,000 level last week. Bitcoin’s current consolidation phase can help here, as the cryptocurrency tries to digest gains, establish new support levels, and prepare for the next leg of bull run.

As August approaches with its typically lower liquidity and increased volatility, traders should prepare for larger price swings that could either validate the new support structure or test it more severely.

Whether this attempt at establishing sustainable demand above $115,000 succeeds will largely determine Bitcoin's trajectory through the remainder of the summer and into the third quarter of 2025.

Surfer 🏄🏾♂️

Strategy (formerly called MicroStrategy) has priced its STRC perpetual preferred stock offering at $2.474 billion net proceeds, up from the initially planned $500 million. The offering of 28,011,111 shares at $90 per share is being conducted under the company's automatic shelf registration statement effective January 27, 2025.

On-chain data shows demand for Bitcoin is outpacing supply, with long-term holders selling over 210,000 BTC while short-term buyers scooped up around 250,000 BTC this month. Bitcoin has gained about 8% in July, but August typically brings quieter, less liquid trading conditions.

Citi forecasts Bitcoin will hit $135,000 by year-end, with its bull case seeing BTC as high as $199,000, driven by ETF inflows, user growth, and macro factors. In a bearish scenario, if equities falter and ETF demand slows, Citi projects Bitcoin could fall to $64,000.

A Trillion-Dollar Milestone 📈

Last week also saw Bitcoin's realised cap crossing $1 trillion for the first time in history.

Unlike market cap, which simply multiplies current price by total supply, realised cap measures the cumulative USD value of all Bitcoin based on when each coin last moved on-chain. Think of it as the total amount of capital that has actually flowed into Bitcoin throughout its entire existence. It’s the cumulative USD value of every Unspent Transaction Output (UTXO) based on the price at the time it last moved. For example, imagine there are two UTXOs worth 1 BTC each. One last moved a month ago, when BTC was priced at $90k, and the other moved just yesterday, when BTC was at $118k. The realised cap, in this case, would be $208k, reflecting the sum of those historical values. The market cap, by contrast, is based on current prices, so it would be $236k.

This $1 trillion figure represents real money that real people and institutions have committed to Bitcoin over the past 16 years. It's the actual liquidity footprint of the world's largest cryptocurrency. To put this in perspective, it exceeds the GDP of countries like Indonesia, Netherlands, or Saudi Arabia.

The milestone also reflects Bitcoin's evolution from a speculative digital experiment to a legitimate store of value with deep institutional adoption.

"The larger Bitcoin becomes, the more capital can be stored within it, and the larger transactions it can settle," Glassnode wrote in its weekly report.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.