Welcome to our weekly Bitcoin macro and news analysis: Mempool.

We're looking at Week 31 of 2025 (July 28-August 03)

Jobs data disappointment triggers price slump

Crypto stocks battered after Q2 earnings

Bitcoin tests $112K support on tariff uncertainties

American CFOs eyeing crypto exposure

Future of Web3 Won’t Look Like Web3

Seed phrases. Chain switching. Wallet confusion. These aren’t features—they’re roadblocks.

NEAR Foundation is building the infrastructure to fix that.

They’re backing the tools and protocols that make Web3 usable for everyone—not just devs and crypto-natives.

Here’s what that looks like:

Login with email, self-custody included

One account across chains and apps

Gasless transactions and smooth onboarding

Abstracted chains, no more switching networks

If you're tired of UX getting in the way of adoption, NEAR is already building the fix.

👉Explore what NEAR Foundation is backing

Week That Was

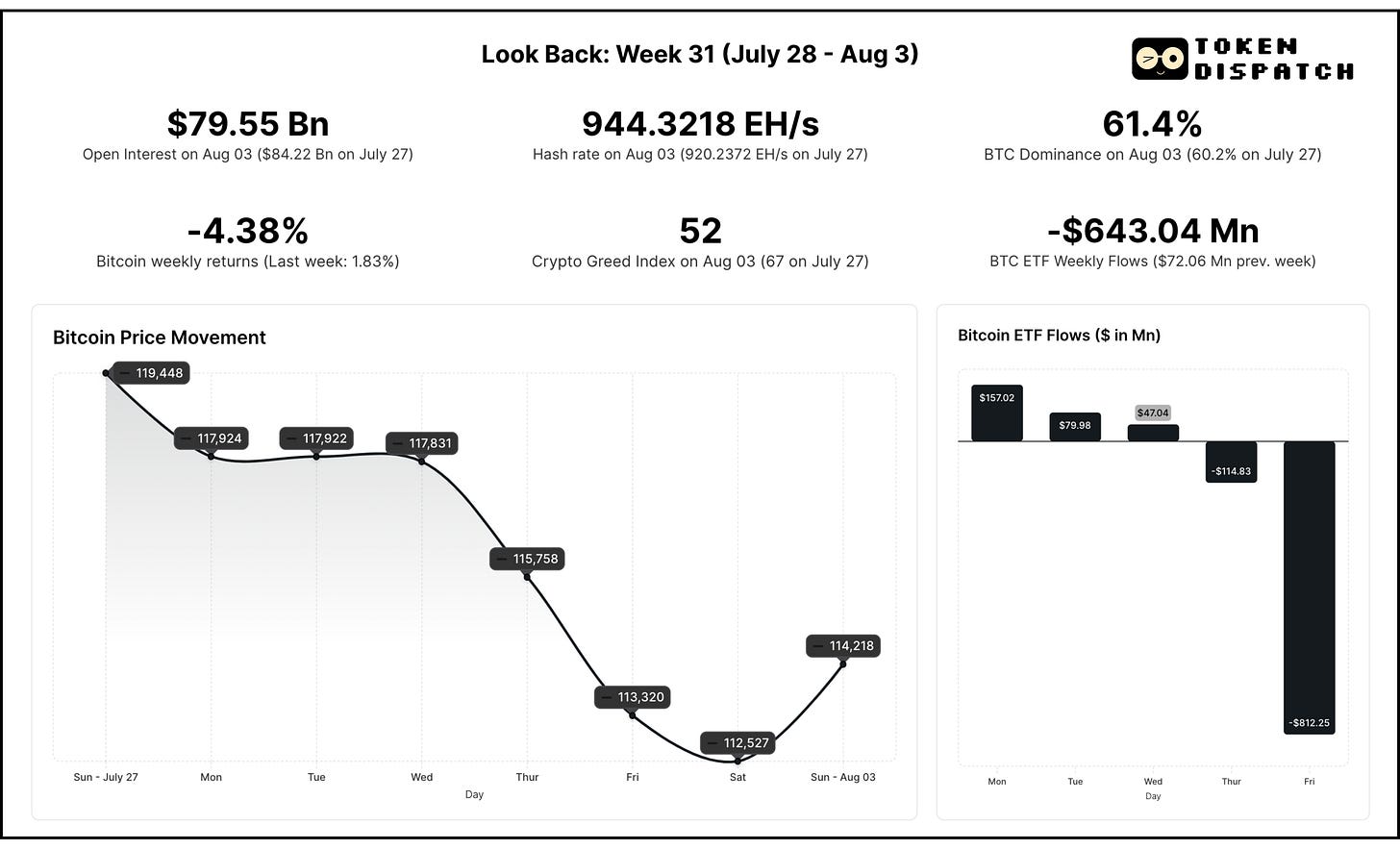

Bitcoin closed the week at $114,218, down 4.38% as macro headwinds caught up with the cryptocurrency's resilience. After weeks of defying broader market weakness, Bitcoin succumbed to unimpressive economic data and escalating trade tensions.

The week began with Bitcoin trading around $119,400, testing the $117,000 mark multiple times during the week before finally crashing below it in the second half of the week. The blow came when the US Labor Department released a weaker-than-expected jobs report on Friday, showing only 73,000 jobs added in July against estimates of 110,000. The unemployment rate ticked up to 4.2%, while massive downward revisions wiped away 258,000 previously reported jobs from May and June.

This labour market deterioration, combined with US President Donald Trump's aggressive tariff stance, stirred risk assets.

Bitcoin futures open interest dropped over 5% to $79.55 billion as the entire crypto industry saw over $900 million in liquidations in a matter of hours on Friday. During the week, Bitcoin’s MVRV ratio (market value-to-realised value) also has come down moderately from 2.411 to 2.222 signalling further upside. But risks remain for downside as long as the MVRV stays above 1.5.

Interestingly, Bitcoin dominance rose to 61.4% from 60.2% the previous week, suggesting that despite Bitcoin's steep fall, altcoins suffered even greater losses. The Crypto Greed Index plunged to 52, moving back toward neutral territory after three weeks in "greed" mode.

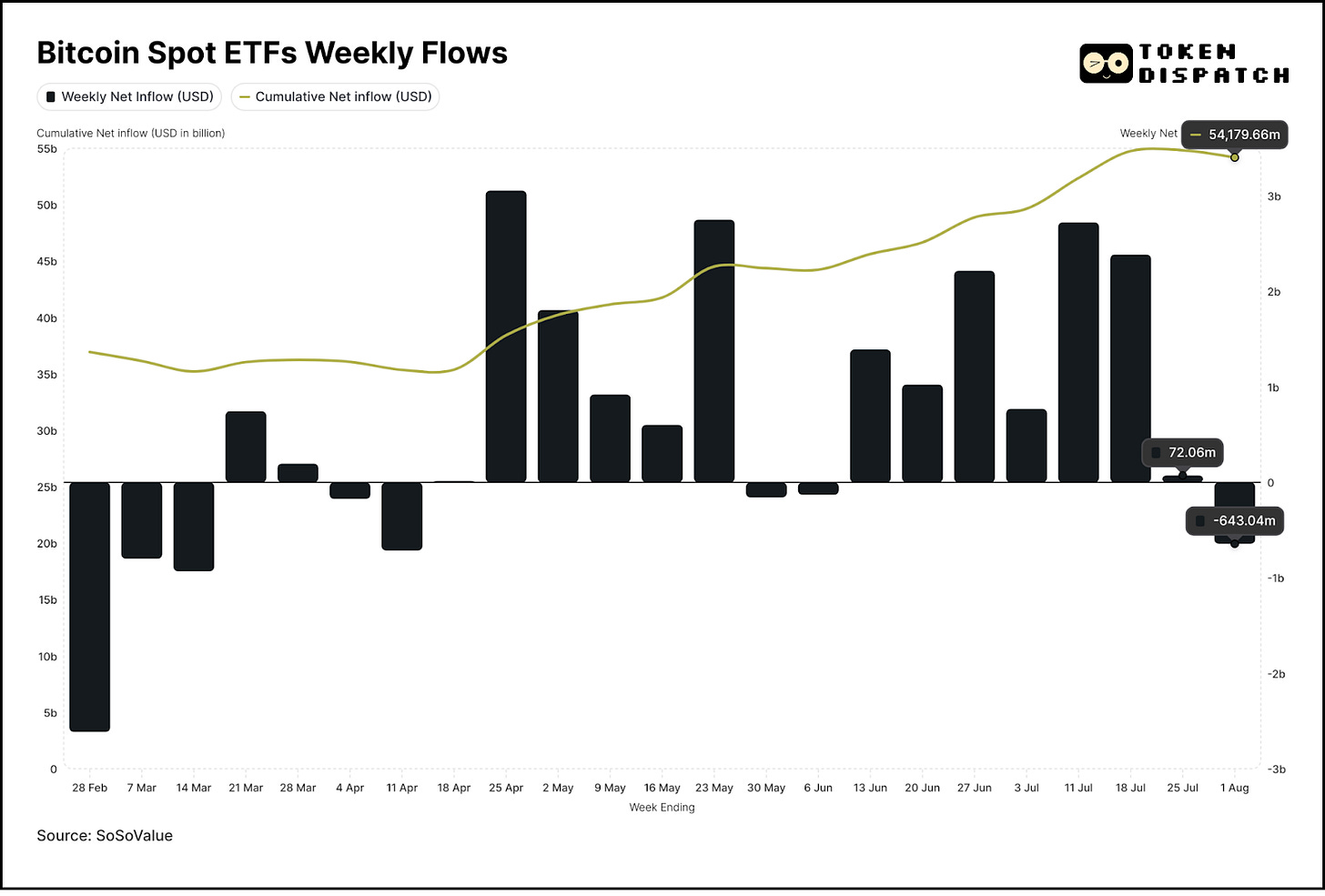

Institutional sentiment during the week, with Bitcoin ETFs recording massive outflows of $643.04 million for the week. This was the largest weekly outflow since the week ending April 11 and the fourth largest outflow in 2025. BlackRock's IBIT maintained its dominance with net inflows on all days of the week barring Friday even while other issuers experienced significant redemptions.

This was the first week of net outflows after seven straight weeks in the green.

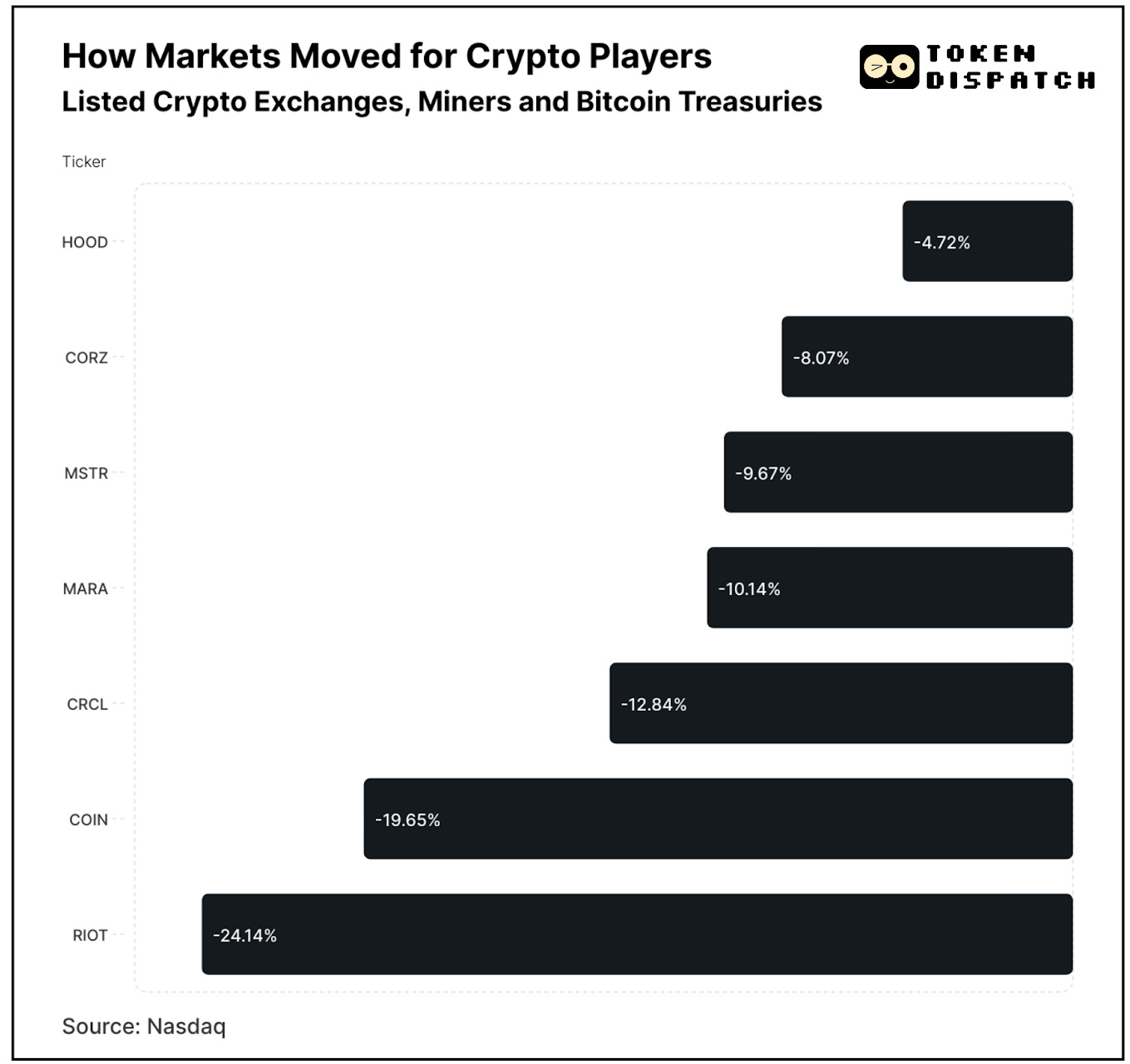

Crypto Stocks Battered after Q2 Results

The crypto equity space endured a bruising week as all major players closed the week in the red as many of them reported unimpressive quarterly earnings.

Coinbase stock declined 19.65% after missing Q2 revenue estimates with $1.5 billion versus the $1.59 billion expected. Analysts are bullish, though, betting on Coinbase's strategic JPMorgan partnership that will enable Chase customers to link accounts directly to Coinbase and unlock a huge adoption.

The mining sector reflected a contradiction with strong fundamentals but disappointing stock performance. MARA dropped 10.14% while Riot Platforms suffered the worst decline at 24.14%, despite both reporting solid earnings. MARA’s Q2 revenue jumped 64%, while Riot Platforms turned $300 million net loss in Q1 into a net income of $219.5 million in Q2.

All this despite July being miners' strongest month since the April 2024 halving, with average daily block reward revenue hitting $57,400 per EH/s.

Strategy (formerly known as MicroStrategy) fell 9.67% despite posting $10 billion (this predominantly includes unrecognised gain on the BTC position ) in Q2 net income from its $71 billion Bitcoin holdings. Obviously, given the volatility of BTC, this doesn’t mean much since the company has not sold its position. Strategy’s revenue from operations was $78.7 million, as against $80 million in the corresponding quarter of the last year. CEO Phong Le's audacious goal of building the world's largest corporate treasury, eventually surpassing Berkshire Hathaway's $410 billion in cash and cash equivalents, failed to inspire amid broader selloffs.

Robinhood’s stock suffered the least with 4.72% loss, despite the sector-wide rout. The platform reported a revenue that was up 46% year-over-year and EBITDA margins hitting 56%.

Where’s BTC Headed

From a technical perspective, Bitcoin's breach of $115,000 opened the door to further downside toward the $112,000 range, which coincides with previous highs and could provide psychological support.

After holding $114,400 for three weeks since it first crossed the level on July 11, Bitcoin fell below the level on August 1. The cryptocurrency further slid below to test the $112,000 mark, which was the all-time high between May 22 and July 9. It has managed to hold the level for now, as it inched above to regain lost ground toward the $114,000 mark on Saturday and Sunday.

However, the weak jobs data has boosted rate cut expectations, with the probability of Polymarket traders expecting a rate cut in September shooting up to ~80%, up from 37% before the data. This dovish pivot could provide eventual support for risk assets, though the focus still remains on trade tariff negotiations.

As we move into August, historically a volatile month for Bitcoin, traders should prepare for continued range-bound action between $112,000-$118,000 until either macro conditions stabilise.

Surfer 🏄🏾♂️

Arthur Hayes, CIO of Maelstrom Fund, warns that challenging macroeconomic pressures could send Bitcoin back to $100,000, driven by weak job growth, slowing credit, and renewed tariff fears. Hayes has already sold over $13 million in crypto, anticipating further declines amid broader market volatility.

Bitcoin treasury firm Strategy has doubled its STRC offering in just two weeks, now seeking up to $4.2 billion to buy more BTC through hybrid securities. Meanwhile, class action lawsuits against the company are mounting, with plaintiffs alleging misrepresentation of Bitcoin’s volatility and profits via deceptive alternative financial metrics.

ARK Invest purchased $30 million in Coinbase and $17 million in BitMine shares on Friday, capitalising on sharp declines in both stocks. The move comes as ARK boosts its crypto exposure during a volatile trading week.

The Boardroom BTC Buzz

Corporate America is quietly warming up to crypto with nearly 1 in 4 North American CFOs saying their treasury departments will be dabbling in digital currency within two years. For the big leagues — companies with $10+ billion in revenue — that number jumps to almost 40%.

Only 1% of surveyed CFOs said they don't envision using cryptocurrency for business functions in the long term. That's a 99% acknowledgment that crypto isn't going anywhere, even if they're not yet ready to dive in headfirst.

Among the corporate giants, 24% plan to add cryptocurrencies like Bitcoin to their investment portfolios within 24 months.

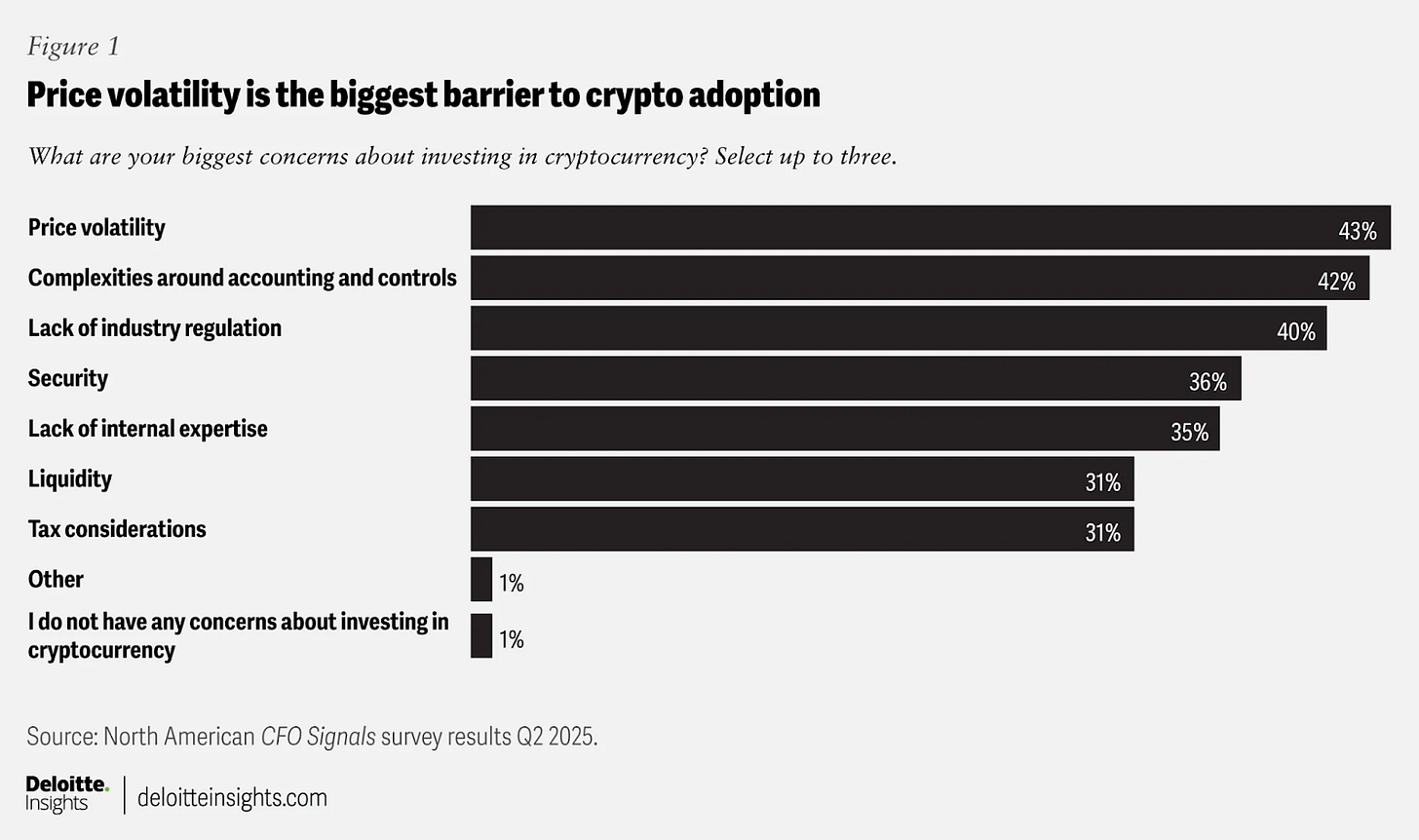

Despite the growing interest, 43% of CFOs still cite price volatility as their biggest crypto concern, hardly surprising given Bitcoin's 28% drop over 10 weeks earlier this year.

About 98% of CFOs have already discussed cryptocurrency with key stakeholders, whether it's their boards, CIOs, or bankers.

It’s likely we might be witnessing the early stages of institutional FOMO, which might lead to corporates queueing up for building crypto treasuries.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.