Last week, the U.S. Securities and Exchange Commission (SEC) closed its investigation into Ondo Finance.

The central reason for the investigation was primarily to assess whether their tokenised real-world asset products, such as OUSG (Ondo Short-Term U.S. Treasuries Fund), were compliant with regulations.

The SEC’s decision to close the probe without taking action gives Ondo meaningful regulatory clarity. Ondo is already a major player in tokenised real-world assets (RWAs), with about $1.8B in tokenised assets - $1.5B of that in tokenised Treasuries, making it the second-largest issuer after Securitize’s $1.9B.

The removal of charges has effectively legitimised Ondo and its assets for institutional access.

Ondo was amongst the first companies to launch tokenised MMFs on-chain back in January 2023. Their flagship product, OUSG, allowed institutional investors in the U.S. to get the yield equivalent of a Money Market Fund (MMF) on-chain, with lower friction to settlement and ownership, as any tokenised asset allows.

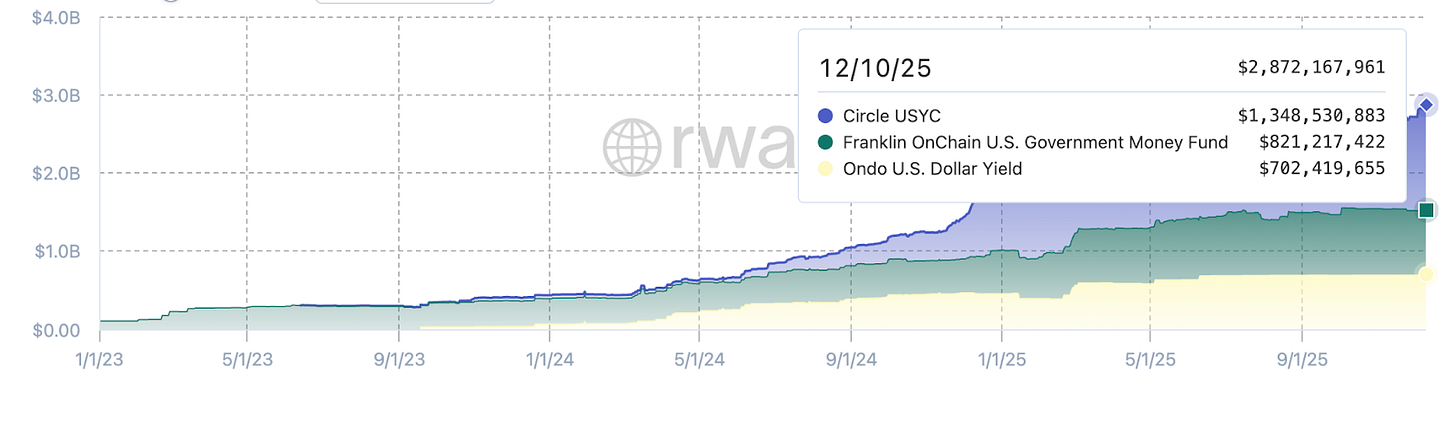

However, it’s no secret that the tokenised MMF space is dominated by TradFi giants like Franklin Templeton and BUIDL by BlackRock. In a market dominated by incumbents, Ondo needs defensibility.

The question is: How? We’ll explore that in our story today.

Stable: The stablecoin chain for the real world

If you’re done juggling volatile tokens just to move value, Stable is your platform.

Pay fees in USDT – no extra tokens, no surprises.

Free peer-to-peer transfers, sub-second finality.

Native USDT settlement + enterprise-grade throughput (10,000+ TPS on roadmap).

EVM compatible so developers already familiar with Ethereum tooling can build faster.

Whether you’re a dev, business, or crypto user, Stable gives you rails that actually feel like digital dollars, not blocked rails.

Almost two quarters after launching OUSG, Ondo launched USDY (Ondo US Dollar Yield Token) in August 2023. The launch was a move to build a moat through regulatory diversification.

While OUSG is an offering to institutional clients around the globe, including the U.S., USDY is a yieldcoin accessible to non-U.S. individuals and institutional investors. This internationally available yieldcoin has a holder base of 16k+ users compared to 1000 with Franklin Templeton and 100 with Circle’s USYC - two other internationally available yieldcoins.

However, this is still a competitive market. Franklin Templeton sits at $820 million and USYC at $1.35 billion TVL, compared to $700 million for USDY. While a competitive product, the moat seems to be missing.

The recent product launches signal an urge to build a personal moat and double down on their strengths. Instead of competing, the team seems to be charting new avenues of growth to ensure they get a larger share of an untouched market, rather than scraps from the bear’s meal.

Ondo’s two new launches include Nexus and Global Markets.

Nexus was launched in February 2025, an initiative designed to unlock instant liquidity for third-party issuers of tokenised Treasuries. With Nexus, Ondo doubles down on the novel parts of its OUSG infrastructure.

Currently, if a user holds a tokenised MMF share from Company A, redeeming it can be slow or restricted, and it is often not available for 24/7 exchange. With Nexus, all partner-issued tokens are instantly redeemable and interchangeable, increasing composability (the ability to use the token in other DeFi protocols) for the entire asset class.

With this, Ondo opens doors for partnerships with clients and institutions that choose to launch their own yieldcoins backed by MMFs in a market poised to grow to a whopping $600 billion by 2030, as per BCG.

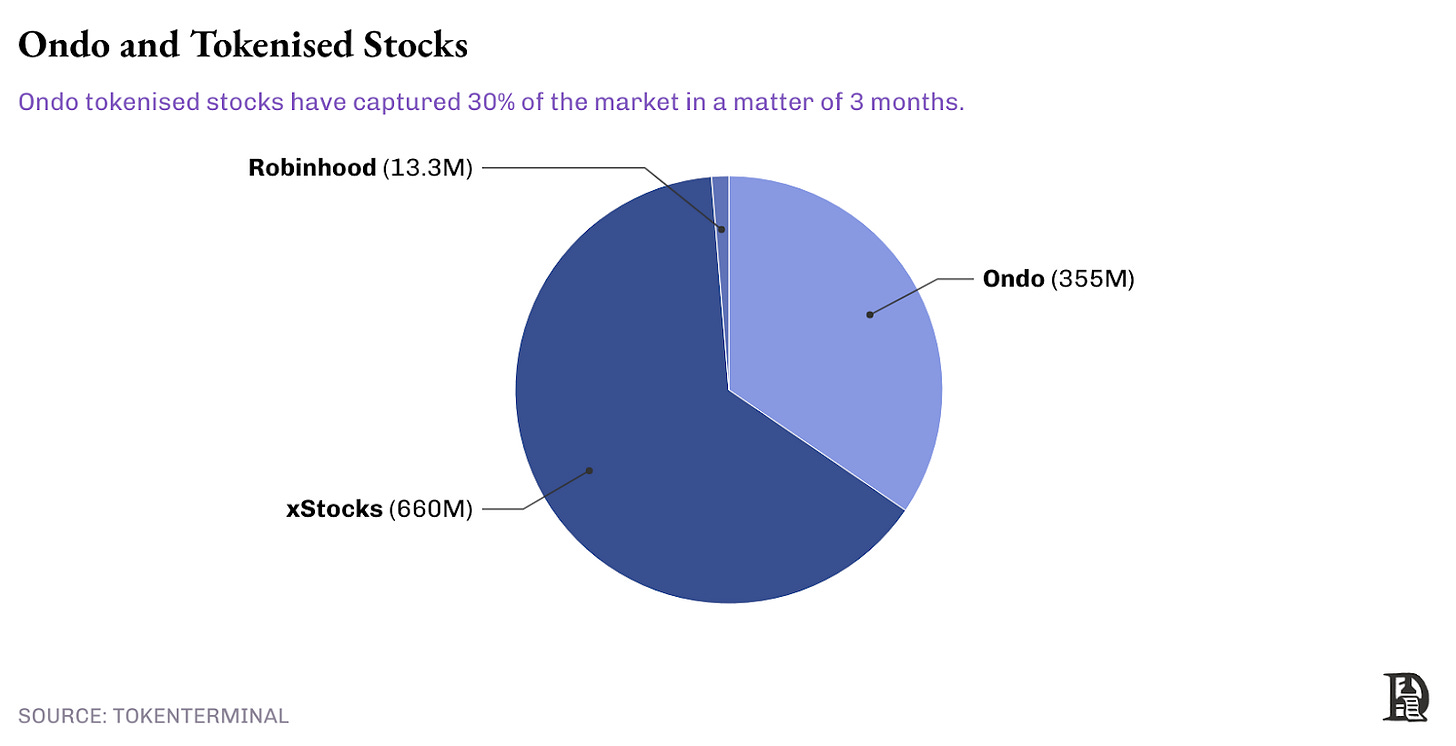

The second new product for defensibility - Global Markets. Launched around the same time as Nexus, in February 2025, this initiative aims to tokenise equity markets and bring them on-chain for global investors outside the U.S. Global Markets charts a way for Ondo to tap into a new, growing market segment, with only two more competitors in the space.

Three months in, Ondo has issued about 103 stocks, ETFs and indexes on-chain. The total TVL of these tokens is a whopping $355 million - approximately 30% of the total tokenised equity market.

In a scenario where tokenised equities capture 1% of the global equity market by 2030, it could reach as large as $1.3 trillion. Ondo seems to be positioning itself to gain a slice of this pie. With an early mover advantage and an RWA ecosystem to support distribution, it might succeed.

We’ve discussed the two defensibility shields. Ondo also has another Swiss knife up its sleeve. The company has a $250M fund, called Catalyst, launched in support of Pantera Capital. The fund aims to back RWA projects being built across the Ondo ecosystem. The investments can, in turn, support the usage and distribution of Ondo’s infrastructure engine. Which primarily comprises the Ondo RWA chain and the Nexus program.

Ondo has a wide range of products that cater to a single mission: bringing traditional finance on-chain and making it accessible globally. With a total of $1.8B in tokenised assets on-chain, the adoption is already visible for the ecosystem. However, if the company is to compete against TradFi giants like BlackRock, Franklin Templeton, or Robinhood, it needs a moat within the product and its distribution channels.

While Nexus is strategically a good positioning in a growing market, success depends on the clients and partnerships that the company can bring in. And so far, we have not seen any major ones. I believe the SEC clearing should change that.

As for Global Markets and tokenised stocks, the early momentum seems to be strong. If the team can maintain this, this might very well grow into the most valuable cash cow on their farm.

However, tokenised stocks are an early experiment in themselves. How these are pegged to the real value of the stocks and how the settlement works is something I am thinking about these days. I might report back as I learn more.

Until then, keep an eye out for U.S. finance coming on-chain. It’s a big wave, and it keeps on getting bigger as it approaches.

You’d better ride it, or it might crash on you.

Until next time,

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.