Seven years ago, Apple pulled off a financial move that dwarfed its grandest creation. In April 2017, Apple opened its $5 billion Apple Park campus in Cupertino, California. A year later, in May 2018, it announced a $100 billion share buyback program. That was twenty times the money it had invested in the 360-acre headquarters, aka “the spaceship”. It was Apple’s message to the world that it had another product that was as important, if not more, as its iPhone.

It was the largest repurchase programme ever announced at that time, and part of a decade-long spree that would see Apple spend over $725 billion buying back its own shares. Exactly six years later, in May 2024, the iPhone maker beat its own record by announcing a $110 billion buyback programme. It showed how to create scarcity not just in devices, but in equity itself.

Crypto is employing a similar strategy, but on a faster and larger scale.

Two of its biggest revenue engines – Hyperliquid, a perpetual futures exchange, and Pump.fun, a memecoin launchpad – are recycling nearly every dollar of their fees into buying back their own tokens.

TOKEN2049 Happy Bird Ends TOMORROW

In less than a week, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore. You can still save US$400 off your tickets.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Don’t miss your chance to be part of the defining crypto event of the year.

Use code ‘TOKENDISPATCH15’ for an exclusive discount.

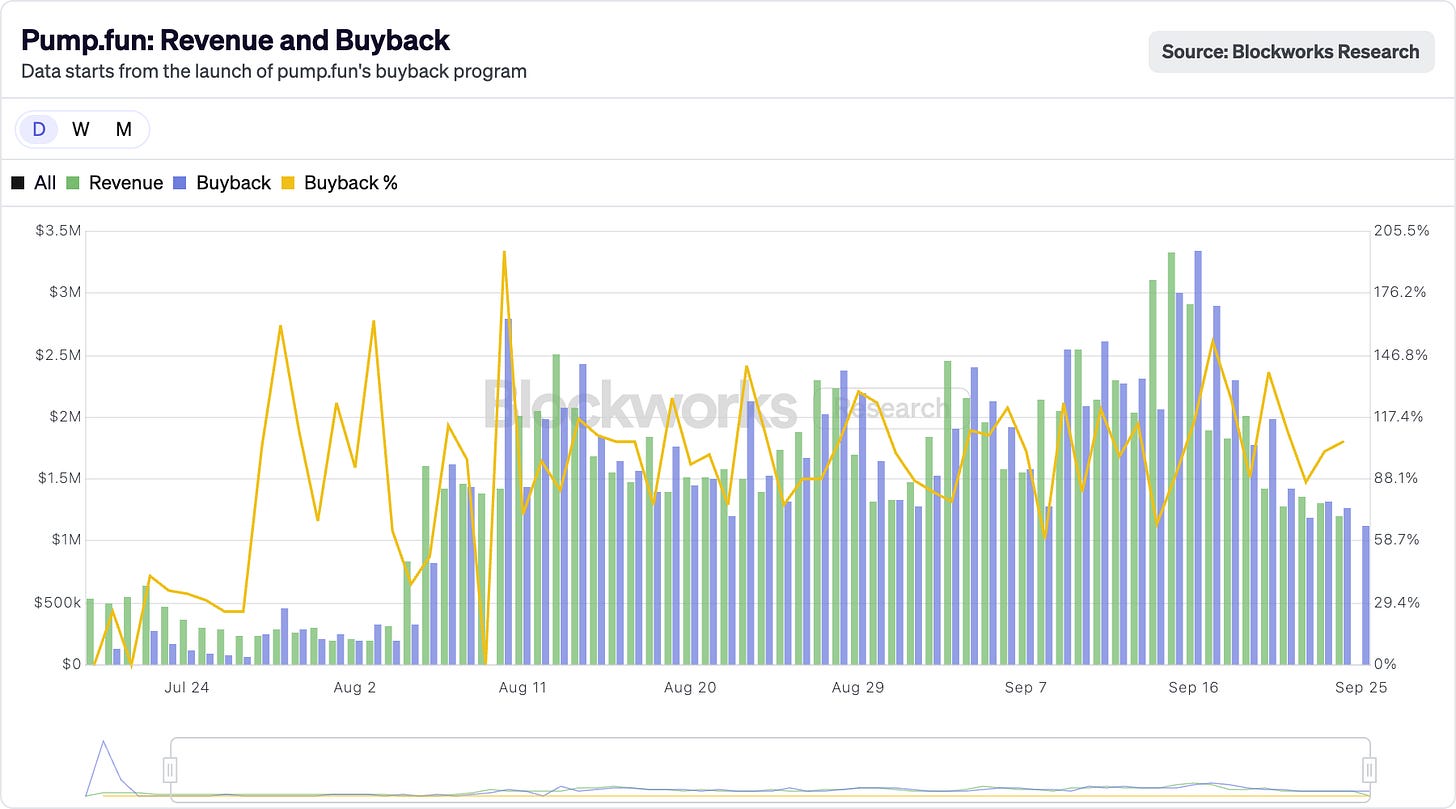

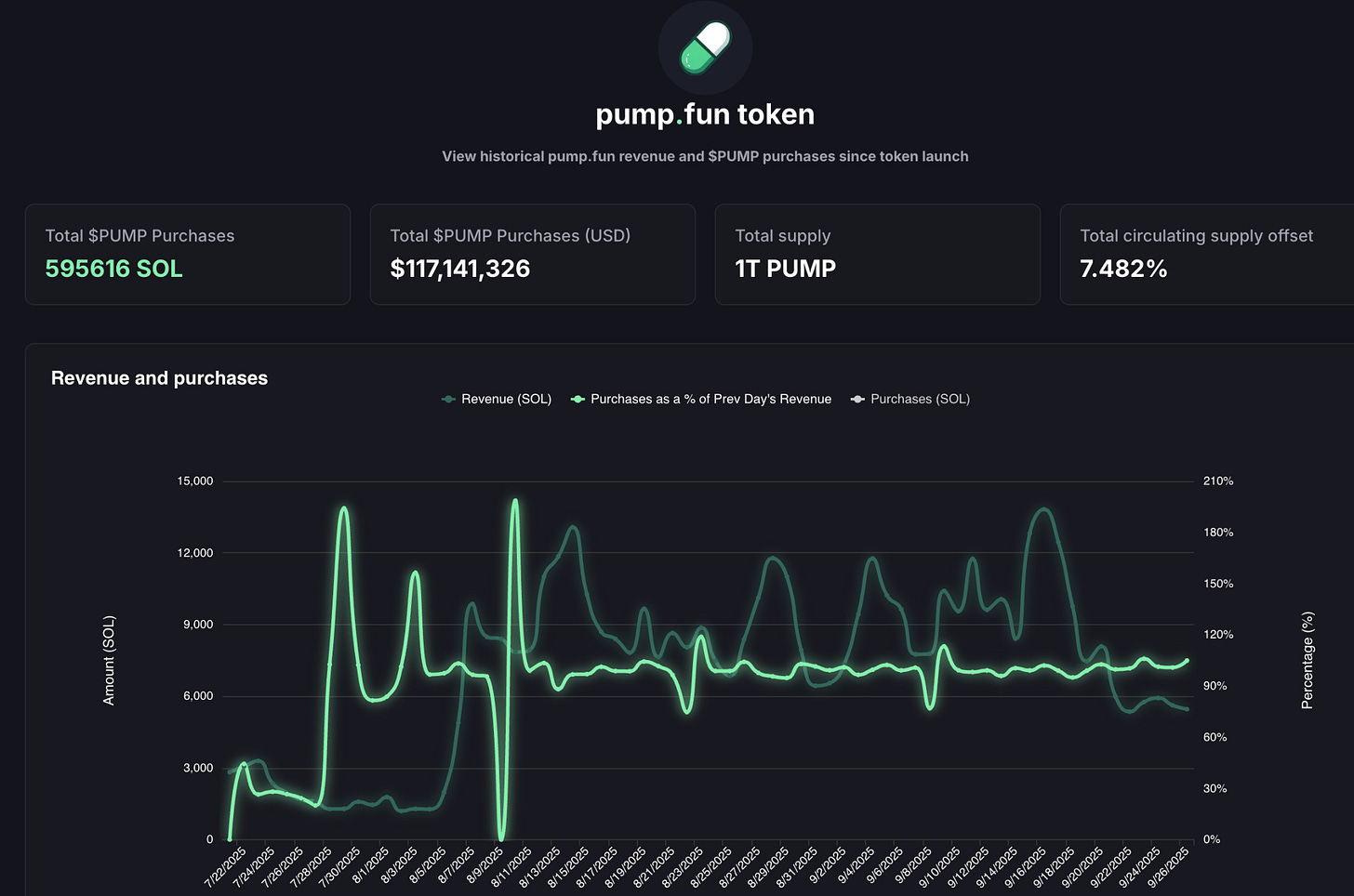

Over 90% of Hyperliquid’s $106-million record fees in August were ploughed back to repurchase HYPE tokens on the open market. Meanwhile, pump.fun briefly overtook Hyperliquid’s daily revenues, raking in $3.38 million in a single day in September. What did it do with all the money? 100% of it is used to buy back PUMP tokens. In fact, it has been doing that for over two months now.

The behaviour makes tokens resemble shareholder proxies. This is a rare feat in the world of crypto, where tokens are often dumped on investors at the first opportunity.

That’s because it attempts to replicate what the dividend aristocrats of Wall Street — such as Apple, Procter & Gamble, and Coca-Cola — have achieved for a long time. These companies spend heavily to reward their shareholders, either through steady cash dividends or share buybacks. Apple spent $104 billion repurchasing stock in 2024. That’s roughly 3-4% of its market cap at that time returned to its investors. Compare that with Hyperliquid’s 9% supply offset.

Even by equity standards, these numbers are absurd. Within the crypto landscape, they are unheard of.

Hyperliquid’s pitch is straightforward.

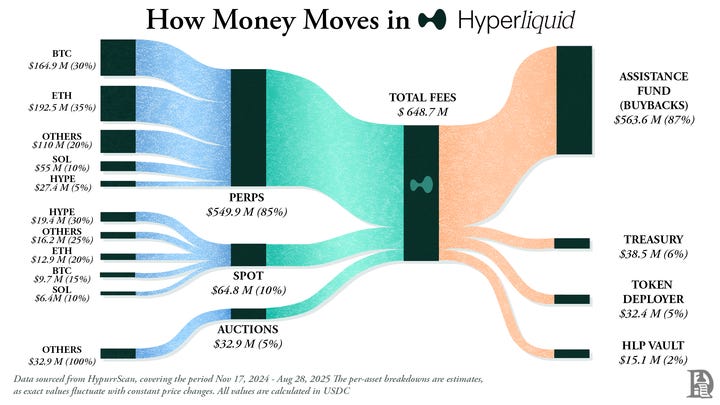

It built a decentralised exchange for perpetual futures that feels as slick as a centralised exchange (think Binance) but lives fully on-chain. Zero gas fees, high leverage, and an L1 centred around perps. By the middle of 2025, it was generating over $400 billion in monthly trading volume and controlling roughly 70% of DeFi’s perpetual market.

What makes Hyperliquid different is how it utilises the cash.

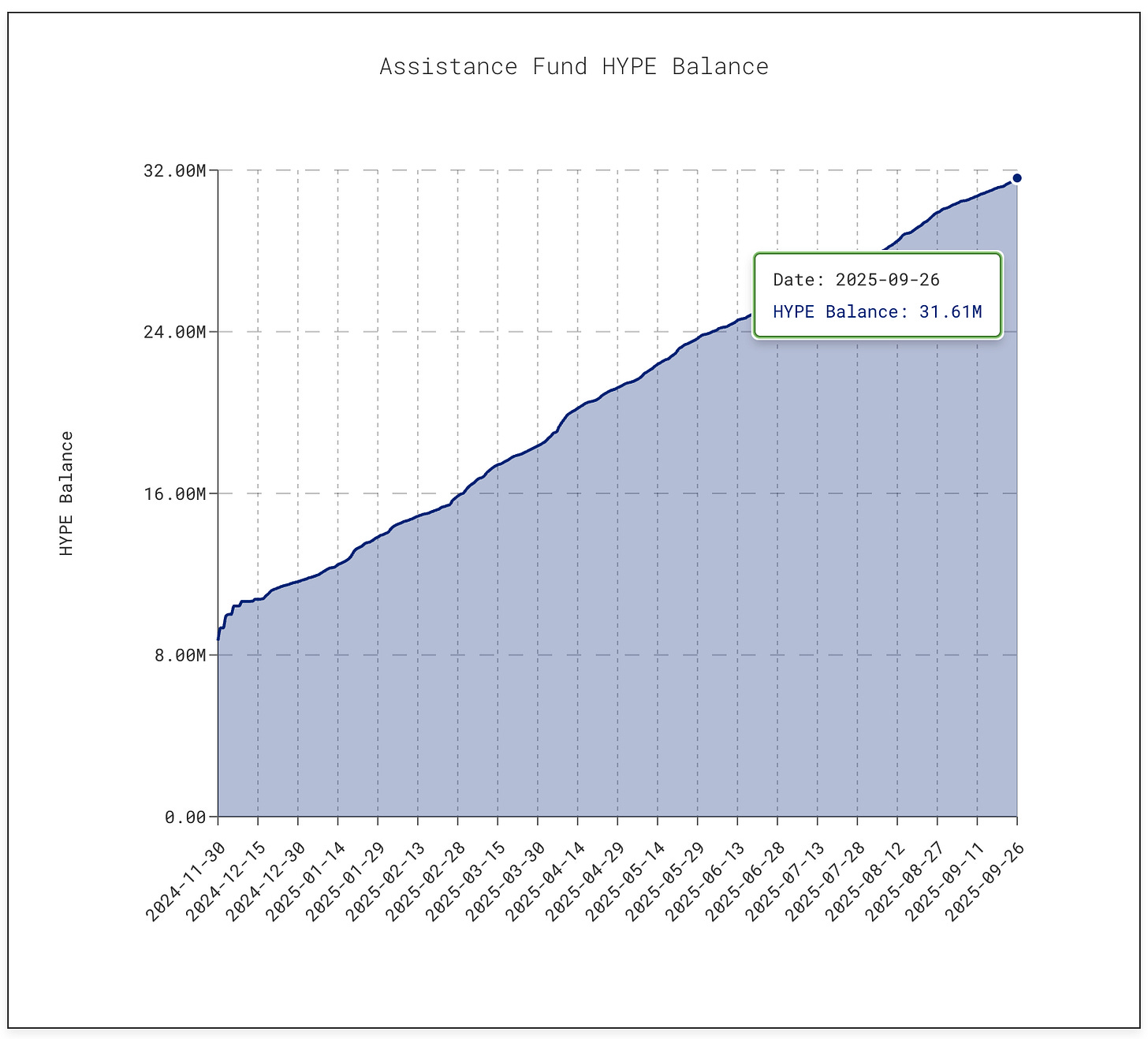

Every day, over 90 cents of every dollar in fees is swept into what they call the Assistance Fund. That fund goes straight into the open market and buys HYPE.

As of the time of writing, the fund had accumulated over 31.61 million HYPE tokens, worth roughly $1.4 billion. This is 10x up from the three million tokens it held in January.

This buy-back spree has sucked out about 9% of the circulating supply, driving HYPE token price to a peak of $60 in the middle of September.

Meanwhile, pump.fun has reduced its supply by about 7.5% through buybacks.

The platform turned memecoin mania into a business model for a fraction of a fee. Anyone can launch a token, spin up a bonding curve, and let the crowd go wild. What started as a joke tool has become a factory for speculative assets.

But there’s instability.

Its revenues are cyclical since they are tied to the traffic in memecoin launches. In July, the revenue slumped to $17.11 million, the lowest since April 2024. With that, the buybacks fell too. By August, revenues had jumped back above $41.05 million for the month.

Yet the question of sustainability lingers. When the meme season cools, which it has and will, so will the token burns. And on the horizon sits a $5.5 billion lawsuit alleging that the whole thing looks like unlicensed gambling.

What’s currently ticking both Hyperliquid and pump.fun is their willingness to give it back to the communities.

Apple has, in some years, returned close to 90% of its profits to shareholders through buybacks and dividends. But those are episodic decisions, announced in lumps. Hyperliquid and Pump.fun are recycling almost 100% of their revenue back to token holders on an ongoing basis, every single day.

Of course, they aren’t the same. A dividend is cash in hand, taxable but reliable. Whereas a buyback is at best a price support that’s useless if revenues fall or unlocks overwhelm the sink. Hyperliquid faces the test with its looming cliffs. pump.fun faces it whenever the memecoin crowd moves on. Compared to Johnson & Johnson’s 63 years of steady dividend hikes or Apple’s consistent buybacks, these are high-wire acts.

But maybe that’s alright.

Crypto is still a maturing landscape and is yet to find consistency. It has found velocity, for now. Buybacks have the ingredients to drive velocity: they are flexible, tax-efficient, and deflationary. They align with a market where speculation is the motivating factor. So far, it has transformed two very different projects into top revenue-generating machines.

We are yet to find out if this will be sustainable in the long term. It is clear, though, that the approach has, for the first time in crypto, made tokens behave less like casino chips and more like shares in companies that return value at a pace that could even give Apple a run for its money.

I see a bigger lesson at play here. Apple figured this out long before crypto, that it doesn’t sell just iPhones, but also sells its stock. Since 2012, it has spent close to a trillion dollars on buybacks, which is larger than the GDP of most countries, and has reduced its float by more than 40%.

The company’s market cap still sits north of $3.8 trillion, but part of that is because Apple treats its equity like a product that has to be marketed, polished, and scarce. It doesn’t need to issue more stock to raise money; its balance sheet is fat. This is where the shares become their products, and shareholders are their customers.

The same language is extending into crypto.

Both Hyperliquid and pump.fun are acing the trick by taking the cash the business generates, and instead of ploughing it back into business or hoarding it, they are turning it back into buying pressure on their own equity.

This also alters the way investors perceive the asset.

iPhone sales matter, surely, but those bullish on Apple know that the stock has another engine: scarcity. With HYPE and PUMP, too, traders are starting to view the tokens the same way. What they see are assets backed by a promise that every spend or trade on the token has over a 95% probability of translating into a buyback and burn from the market.

Apple also shows the flip side.

Buybacks can only be as strong as the cash flows behind them. What happens when the revenue dips? If iPhone and MacBook sales slow, Apple’s legacy balance sheet allows it to issue debt and honour its repurchase arrangement. Hyperliquid and pump.fun don’t have that luxury. If volumes dry up, so will the buybacks. And unlike Apple, which can pivot to dividends, services or new products, these protocols are yet to find their Plan B.

In the case of crypto, it also carries the risk of dilution.

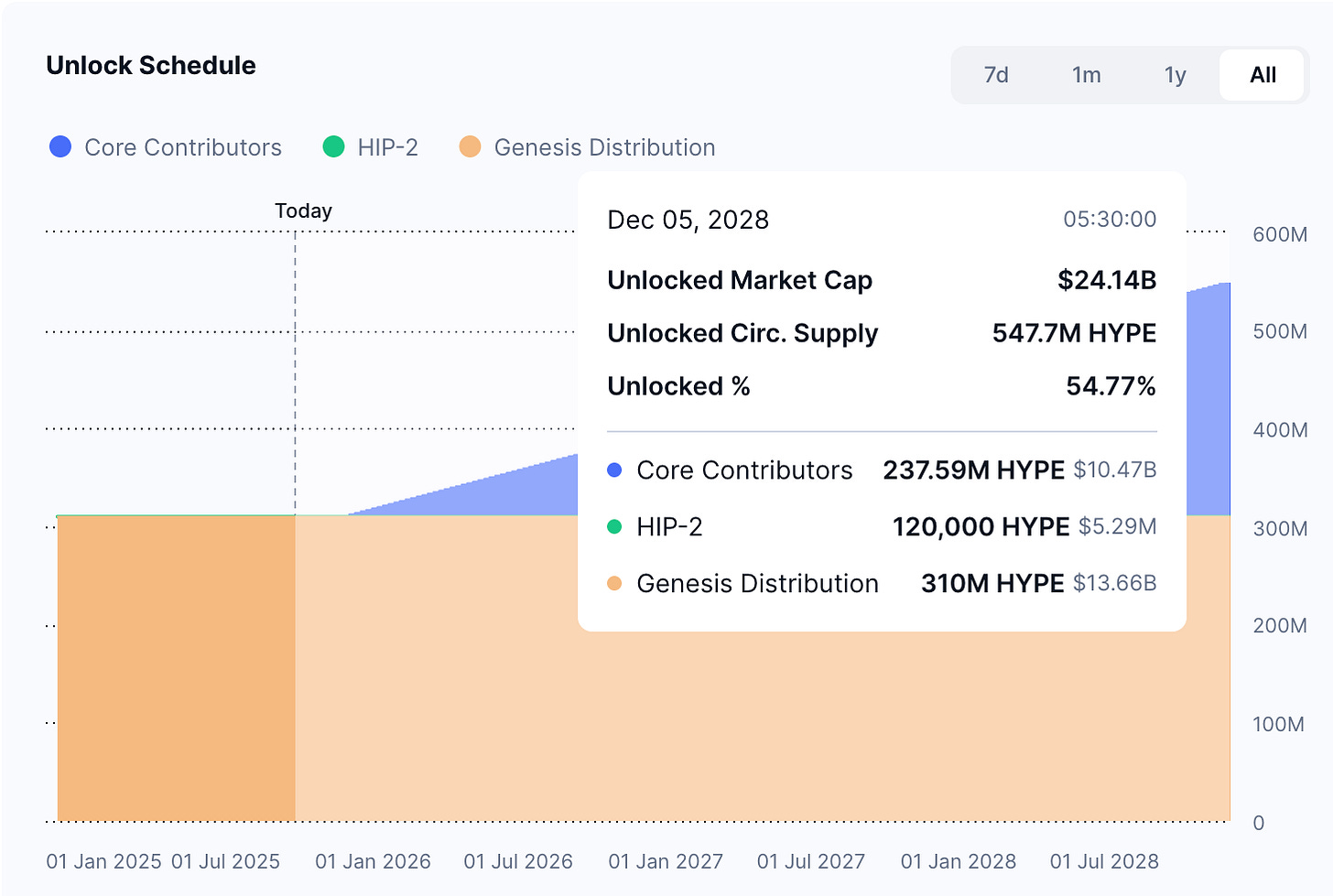

Apple doesn’t have to worry about 200 million new shares hitting the market overnight. Hyperliquid does. Starting this November, nearly $12 billion worth of HYPE will begin vesting for insiders, dwarfing the daily set of buybacks.

Apple can control its float, but crypto protocols are battling vesting calendars written in ink years ago.

Yet, investors see a story here and want to be a part of it. The Apple playbook is hard to miss, especially for those who are familiar with its story spanning decades. Apple engineered shareholder loyalty by turning its equity into a financial product. Hyperliquid and pump.fun are attempting to carve a path for those in crypto, except it’s faster, louder and riskier.

That’s it for this week’s deep dive.

I’ll see you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

I'm surprised.. there is no comments! Brilliant read and many thanks for sharing it! : ) Is Substack usually that quiet? Maybe.. it's just crypto.. people start loosing interest and long outlook with all that market manipulation downtrend..