Buy backs 😳 Short sellers 🤔 Bitcoin sellers 🧐

Robinhood buys back SBF's $600M shares. Coinbase short sellers rake in $480M in August. Bitcoin miners sell BTC Worth $100M in 7days. Tech takes centre court at the US Open. $100M token unlocks.

Hello, y'all. Some things are just 🙌

Make sure you've claimed your collectible on Asset. Give your books a »» Muzify «« spin? Now catch ya feeling in a song 👇

This is The Token Dispatch, you can hit us on telegram 🤟

Robinhood's $606 million share buyback

Robinhood repurchased $606 million worth of shares previously owned by FTX founder Sam Bankman-Fried after court approval.

Initial valuation and legal troubles: The shares were valued at $450 million when seized by the DOJ in January. Bankman-Fried faces multiple charges related to FTX's collapse and awaits trial.

Corporate funds used for repurchase: Robinhood used its own cash reserves for the buyback.

Court oversight and approval: Judge Kaplan oversaw the case and allowed the buyback, stating the DOJ could reject it if it benefited those associated with Bankman-Fried's alleged crimes.

Market response and CEO announcement: Robinhood's stock price rose 3% after the buyback. CEO Tenev had previously announced board approval, resulting in a 5% after-hours stock increase.

Origin of shares and financial transactions: Bankman-Fried and FTX co-founder Wang acquired Robinhood shares through Emergent Fidelity Technologies using a loan from FTX's sister company, Alameda.

BlockFi's legal claim: BlockFi sued for ownership of the shares, listing as a notified party if the Robinhood deal fell through.

Request to retain shares for defense: Bankman-Fried's legal team requested to keep the shares for his defense, but Kaplan approved the sale with net proceeds going to the DOJ's seized asset deposit fund.

Coinbase's recent stock slump offers short sellers a breather

The recent fall in Coinbase's stock price provided short sellers with gains of nearly $480 million, offering a temporary respite for bearish investors. However, despite this gain, short sellers are still facing significant year-to-date losses of nearly $2 billion, leaving them down 84%.

Short squeeze impact: Coinbase's stock fell approximately 15% in August, causing short sellers to incur paper losses of $1.3 billion. This came after a surge of over 34% in Coinbase shares in a week, leading to year-to-date losses reaching almost $2.9 billion. This situation can be attributed to a short squeeze, forcing short sellers to close their positions by repurchasing the stock.

Reduced short interest: Over the past six weeks, short sellers have been reducing their positions. Short interest, which represents the number of shares sold short by investors, accounted for about 15% of the outstanding stock, down from 20% in mid-July. Despite this reduction, there is still substantial short interest amounting to $2 billion.

Impact on bearish investors: The recent drop in Coinbase's stock price has alleviated some pressure on short sellers, temporarily reducing the urgency to cover their bets. However, their year-to-date losses remain substantial, leaving them in a challenging position.

Prominent Coinbase bear: One notable bearish investor is Jim Chanos of Kynikos Associates, who has held a short position on Coinbase since the first quarter of 2022, when the stock was trading at around $250. Currently, Coinbase shares are trading at approximately $78.

Bitcoin miners sell off 4,000 BTC amid price volatility

Bitcoin miners have been actively selling their BTC holdings in the past week. This behavior began when Bitcoin's price dropped below $26,000 on August 26. The total BTC held by miners decreased from 1.831 million on August 25 to 1.827 million on August 31, marking a reduction of over 4,000 BTC in just seven days. This selling trend raises concerns about the potential for Bitcoin to drop below the $25,000 support level.

Miners reserves reflect selling pressure: The Miners Reserves data, which tracks the wallet balances of recognised miners and mining pools, provides real-time insights into miners' trading activities. A decrease in this metric indicates that miners are actively selling their BTC holdings, potentially creating additional selling pressure in the market. Currently, miners control approximately 9.4% of the total BTC in circulation, making their trading patterns of great interest to strategic investors.

Bitcoin's price and miner sales: As of the time of writing, Bitcoin is trading around $25,850. During the past week, miners have sold approximately $103 million worth of BTC. The concern is that without sufficient demand to counter the selling pressure from miners, Bitcoin's price could drop below the critical $25,000 support level.

Market dynamics and price predictions: Bitcoin traders have taken action to prevent a significant price drop. They have placed substantial buy orders, totaling 5.6 million BTC, within 5% of the current price of $25,850. In contrast, bearish traders have only put up 3.7 million BTC for sale. This dynamic is reflected in the Exchange On-chain Market Depth chart, which indicates that current market demand for BTC exceeds supply by 1.9 million coins at current prices.

The battle for $25,000 support: The data suggests that despite the selling pressure from miners, the demand for Bitcoin remains strong, potentially allowing strategic traders to absorb the BTC offloaded by miners. If successful, this could help Bitcoin maintain its critical support level of $25,000 and prevent a more significant price drop.

TTD Unlocks 🔓

In September, three prominent cryptocurrency projects - ApeCoin, Optimism, and Aptos, are scheduled to unlock tokens collectively valued at over $100 million.

ApeCoin's Noteworthy Token Unlock

Date: September 17th

Circulating Supply Increase: 11%

Value: $58.1 million

ApeCoin, the governance token of ApeCoin DAO and associated with the Bored Ape Yacht Club NFT community, is set to unlock 40.6 million APE tokens. This represents 11% of its circulating supply, with a total value of $58.1 million. The allocation breakdown includes $38 million for launch contributors, $10.5 million for the treasury, $6 million for developer Yuga Labs, $3.2 million for the founder, and $397,000 designated for charity.

Optimism's Token Unlock

Date: September 30th

Circulating Supply Increase: 3%

Value: $33.3 million

Optimism, an Ethereum Layer 2 solution, will release 24.2 million OP tokens, equivalent to 3% of its circulating supply, valued at $33.3 million. Of this, $17.6 million will go to core contributors, while $15.7 million will be distributed to investors. It's worth noting that Optimism experienced a 12% price drop to $1.37 following its last unlock on August 30th, which released the same number of tokens. This previous unlock also led to a doubling of OP's circulating supply in May, causing a 25% price drop before a recovery.

Aptos' Token Unlock

Date: September 12th

Circulating Supply Increase: 2%

Value: $25.2 million

Aptos, a Layer 1 blockchain, is releasing 4.5 million tokens on September 12th, equivalent to 2% of its circulating supply, valued at $25.2 million. Out of this, $17.8 million will be allocated to the community, while $7.4 million will go to the Aptos Foundation. Notably, a previous unlock in August led to a 23% drop in the APT token's price, from $7.20 to $5.51. As of now, APT is trading at $5.54.

Overall token releases in September

In total, September will witness token unlocks worth more than $175 million across various projects. Besides ApeCoin, Optimism, and Aptos, other notable unlocks include Sui ($17.4 million), dYdX ($14 million), and ImmutableX ($10.2 million). These token releases will likely impact their respective markets, and investors should closely monitor their effects.

Where’s ETF?🚨

Former SEC chair, Jay Clayton, says spot Bitcoin ETF approval is ‘inevitable’ despite delaysThe commission has another 45 days to approve, deny or delay spot Bitcoin exchange-traded fund applications from seven major firms👇🏻

TTD US Open 🎾

The US Open tennis tournament in New York City is not just about thrilling matches; it's also a showcase for major brands embracing technology to enhance the fan experience. This year, Tiffany & Co, American Express, Snap, and Wilson are bringing augmented reality (AR), NFTs, and virtual reality (VR) to the forefront.

Tech takes centre court

Tiffany's augmented reality experience with Snap: Digital Bling on the Court

Luxury brand Tiffany & Co teams up with Snapchat for an immersive AR booth at the US Open.

Visitors can interact with virtual diamond-studded tennis racquets and a championship trophy using an advanced AR mirror.

It's a first for Tiffany, as they leverage Snap's AR technology to offer a unique fan experience.

No controllers or sensors required; you can hold and photograph these digital creations, blurring the line between the real and virtual world.

American Express' NFT integration: Crypto collectibles for cardholders

American Express introduces NFTs for the first time, allowing cardholders to connect their accounts to a crypto wallet of their choice.

This "Member Collectibles" experience lets attendees collect commemorative NFTs at specific on-site locations to verify their attendance.

What's different this time? US Open visitors can use these NFTs to unlock financial perks in their Amex accounts, including discounts on partner products and statement credits.

Illustrated by Vero Escalante and issued in partnership with Ethereum NFT badge service POAP, attendees can collect three NFTs throughout the tournament.

Wilson's dive into virtual tennis: VR Tennis for everyone

Sports equipment giant Wilson takes a leap into virtual reality (VR) tennis.

They partnered with Tennis Esports to launch a VR tennis tournament in August, with participants competing globally using Meta Quest headsets.

The grand prize? An all-expenses-paid trip to the US Open and a one-year sponsorship deal from Wilson.

Now, at the US Open, visitors can experience this VR game firsthand at Wilson's booth.

This initiative isn't just a one-time fan experience; Wilson aims to pioneer the merging of sports and virtual reality to broaden tennis's appeal to a wider audience.

TTD Consumption ⚖️

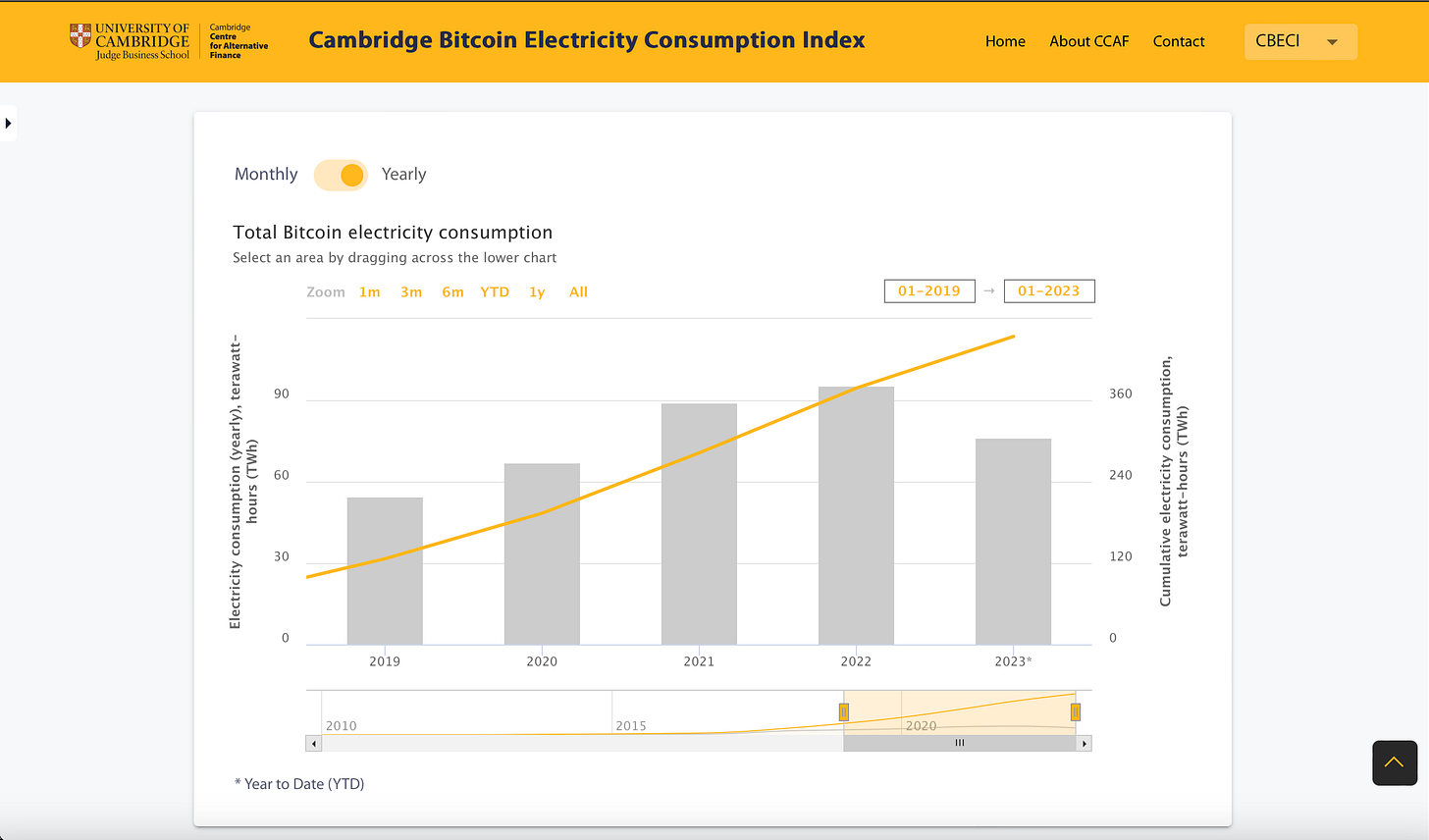

The University of Cambridge has recently updated its Bitcoin Electricity Consumption Index (CBECI) after three years, leading to significant revisions in its estimates of Bitcoin's energy consumption.

The revised findings indicate that previous estimates were considerably overestimated.

Revised Estimates: The revised CBECI model showed a substantial reduction in estimated Bitcoin electricity consumption. In 2021, the previous estimate was 104 terawatt-hours (TWh), while the updated estimate is 89.0 TWh, a difference of 15.0 TWh.

2022 Power Estimate: The 2022 power estimate was adjusted down by 9.8 TWh, from 105.3 TWh to 95.5 TWh, placing Bitcoin's electricity consumption that year in a range similar to that of U.S. tumble dryers (108 TWh).

2023 Estimate: As of 2023, Cambridge's estimate puts Bitcoin's energy consumption at 70.4 TWh, reflecting the ongoing scrutiny and adjustments made to assess the cryptocurrency's environmental impact.

Why the methodology revision?

The need for revision arose from the university's previous methodology, which assumed that every profitable hardware model released within the past five years equally contributed to the network hashrate. This approach started showing shortcomings in 2021, particularly after China's mining ban.

What is Terawatt-Hour (TWh)?

A terawatt-hour is a unit of energy equivalent to outputting one trillion watts for one hour. To put it in perspective, an average incandescent lightbulb consumes 21,900 watthours in a year if used for one hour per day.

TTD Surfer 🏄

US August job adds of 187K vs estimates for 170K; unemployment rate rises to 3.8% versus forecasts for 3.5% and last month's 3.5%.

Cryptocurrency exchange OKX is planning to enter India and hire local staff despite regulatory uncertainties.

Colorado Department of Motor Vehicles (DMV) to accept payments for driver’s licenses, vehicle registrations, and other services in crypto assets supported by PayPal.

Trading volume for Ethereum NFT fell to $407M in August, 32% decline from July’s $599M. The lowest trading volume since June 2021.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋