Can Polls Trigger Crypto Regulations? 🤔

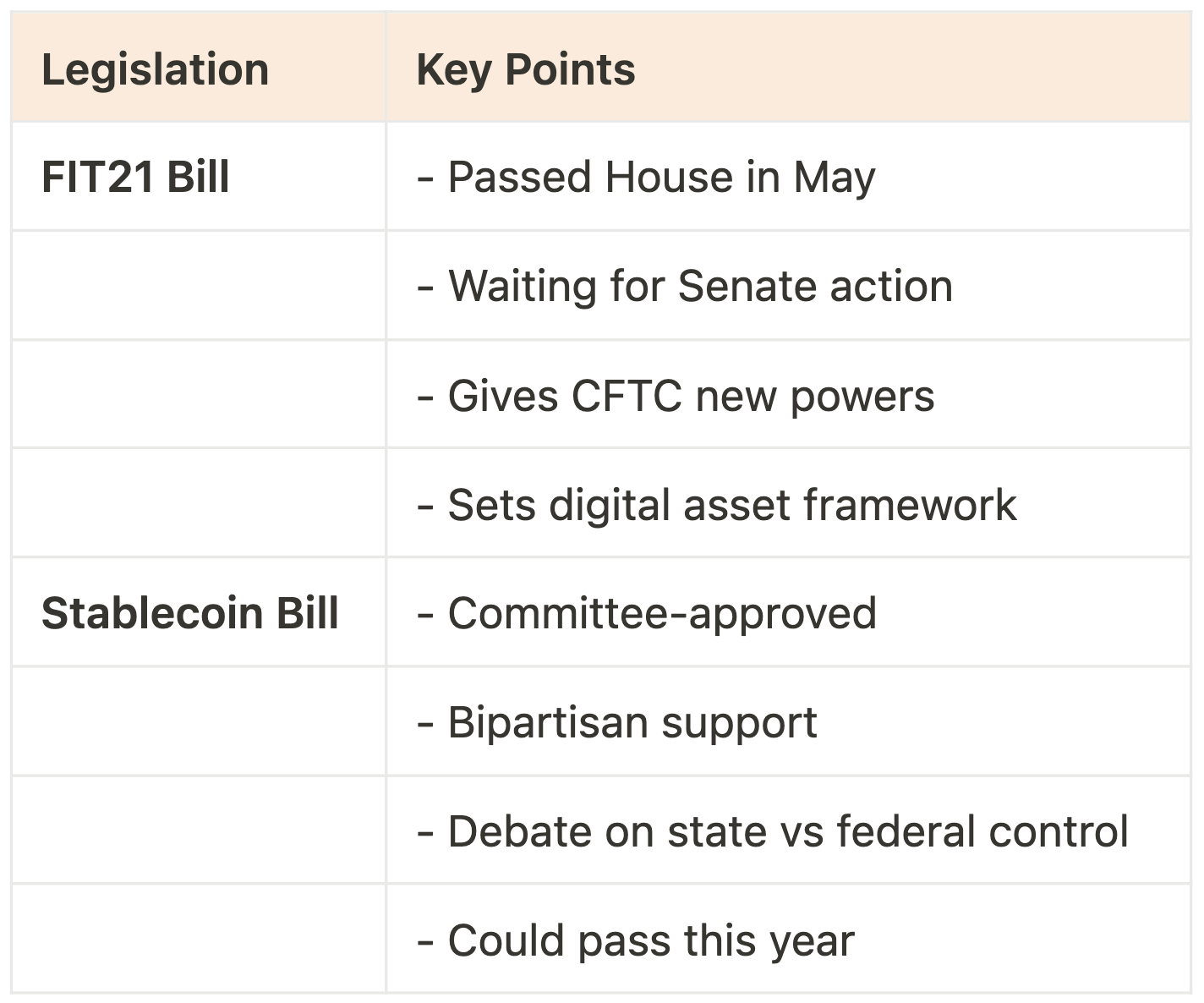

FIT21 and Stablecoin bills possible during 'lame duck'? Senators optimistic of passing crypto laws before year end; CFTC Boss feels that won't happen until 2025.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

It’s time to start the countdown.

US Presidential Elections are here and now.

Just a fortnight to go.

What do you fancy: A Trump triumph? A Harris hit?

Ask us? Well, we think it’s gonna be a crypto coup.

The industry is looking forward to some clarity around regulations for digital assets.

And it is a big deal.

How big? It’s got both Republicans and Democrats suddenly super eager to pass crypto laws before the year ends!

Why now?

Two words: "Lame duck”

Meaning, that sweet spot after the November election and before a new Congress steps in January when retiring lawmakers might just want to leave their mark.

Read: Will Crypto Cast its Vote in 2024? 🗳️

What’s at stake?

Industry’s got all its eyes on how this turns out.

Why? Well, the regulations around digital assets have been pretty muddled.

What’s the problem?

Lack of clarity. Overlapping oversight. Missing consensus.

Three regulatory bodies pulling from three different directions.

Securities and Exchange Commission (SEC) views cryptocurrencies as securities

CFTC classifies them as commodities

Internal Revenue Service (IRS) treats them as taxable assets

Is that all? Nah. Just started to get worse.

Within the US, each state has also adopted its own approach to cryptocurrency regulation.

More overlap and more complications in compliance for businesses.

So, it’s all going south with regulations?

Not yet, we got some hopefuls.

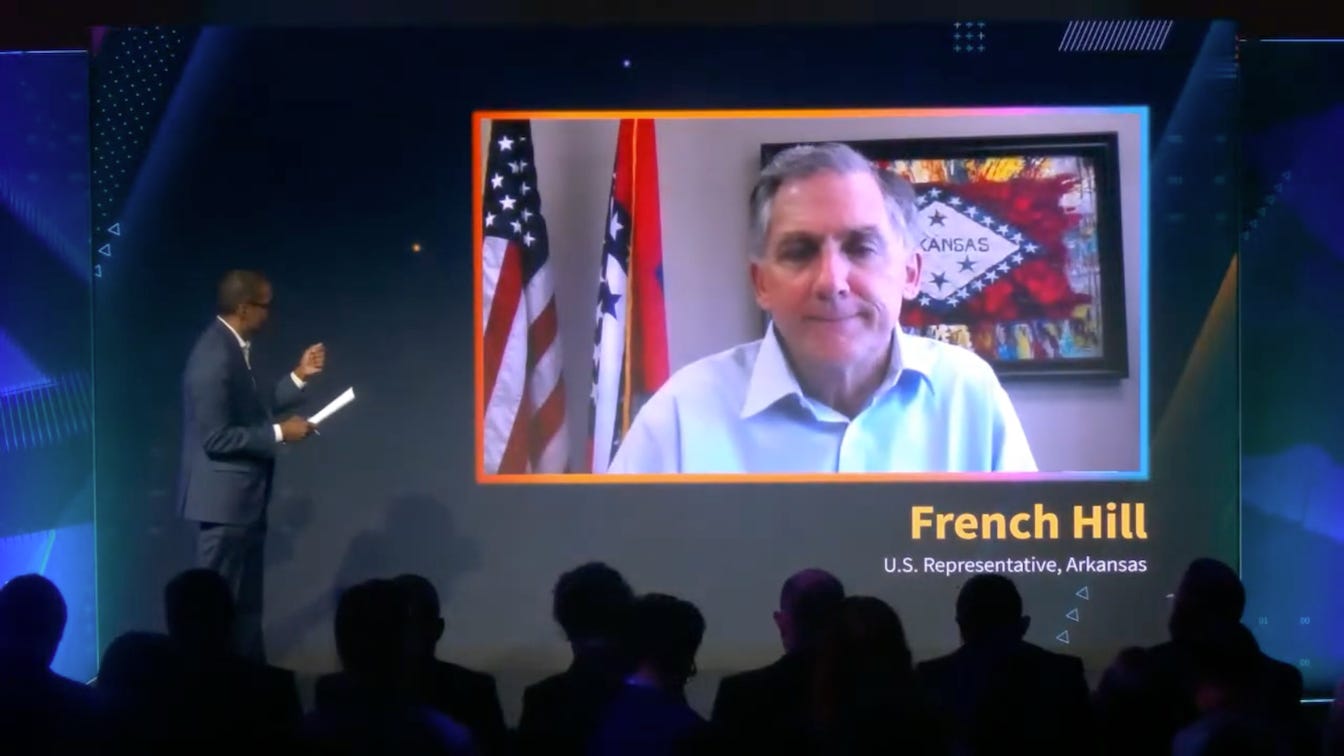

Rep. French Hill is one of them.

"I'm still optimistic that FIT21, which is the regulatory framework bill, and the stablecoin bill have possible consideration in the lame duck," the Arkansas Republican said.

We got believers on the other side too.

“I think a market structure bill would be wonderful, if we could get it done in the lame duck,” Democrat Kirsten Gillibrand said at the DC Fintech Week.

Not just the senators.

Industry is hopeful too.

US Will Catch Up: Tether CEO

Paolo Ardoino counting on sensible crypto regulations coming soon from the US.

"There is no place like the US. I think it's very, very important that sensible crypto regulations and stablecoin regulations will come to fruition in a way that will protect the end users."

Wants the regulations to be customer-friendly.

"I am very in favour – and we as a company are very in favour – of regulations, but regulation should help defend the customer."

He even threw a bone to please the US policymakers.

When the US comes with its rules, it will allow stablecoin innovations to continue to offer a "lifeline" to people in other parts of the world, those who "don't have the same opportunities as people in the US and Europe.”

First senators, now industry - heavy optimism, you’d think?

But not everyone’s optimistic.

Rostin Behnam is skeptical about seeing crypto laws in 2024.

Read on …

Block That Quote🎙️

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam

“... agency is really handcuffed when it comes to handling the crypto sector, leading to vulnerable customers and a really vulnerable market."

While speaking at SIFMA's annual meeting, the CFTC boss felt there’s a regulatory limbo.

Context? US crypto industry is awaiting regulatory clarity on digital assets for a while now.

Without any legislation, the agency is “really handcuffed” in “policing” the crypto market.

“That ends up leaving a really vulnerable market, leaving vulnerable customers, leaving institutional money on the sidelines and ultimately not really helping support technology as it wants to integrate into traditional finance.”

So, when is it expected? Well, nobody knows.

It has been long due and the outlook looks bleak.

Not at least in 2024.

"I'm not betting on anything happening at the end of the year, but there's a unique appetite that this election, I think, has changed around digital assets and technology."

Some hope in 2025? He's surely optimistic about it.

"I think as we look into 2025 – a new congress, a new president – that you're likely going to see some legislation."

Meanwhile, there's growing frustration in the industry.

Firms are wondering if business can progress without running into enforcement actions.

Or if the logjam in regulation is going to be a constant pain.

Is it "just going to be a constant liability?" SIFMA President Kenneth Bentsen asked Behnam.

CFTC can’t wait for 2025 to come already!

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

In The Numbers 🔢

$2.3 Billion

Amount bet on Polymarket around the outcome of the US presidential elections winner.

Over the past couple of weeks, Trump’s chances have shot up to 64% in his favour.

But billionaire investor doesn’t buy this.

For obvious reasons though.

He dismissed the usefulness of the decentralised prediction market Polymarket when it comes to predicting the 2024 US presidential election winner.

Why? Foreign influence.

“From all indications, most of the money coming into Polymarket is foreign money, so I don’t think it’s an indication of anything,” he said in an interview with CNBC Squawk Box.

Polymarket doesn't allow US citizens to place bets on the election due to a 2022 decision by the Commodity Futures Trading Commission (CFTC).

And, Cuban is not alone in pointing this issue.

The Wall Street Journal also speculated that Trump’s strong odds on the platform “might be a mirage manufactured by a group of four Polymarket accounts that have collectively pumped about $30 million of crypto into bets that Trump will win.”

Can’t wait enough for November 5? Neither can we.

The Surfer 🏄

Tesla likely still holds $780M in Bitcoin despite recent wallet transfers, according to Arkham Intelligence. On Oct. 15, Tesla moved 11,509 BTC to seven wallets, sparking fears of a market dump, but the assets remain under Tesla's control.

Buenos Aires has launched blockchain-based digital IDs for 3.6 million residents. The decentralised identities are accessible via the miBA digital platform, integrating QuarkID technology.

Decentralised exchanges (DEXs) are on the rise, with trading volumes surpassing $250 billion monthly and accounting for 13.6% of trading relative to centralised exchanges (CEXs). Despite the shifts, the top 22 centralised exchanges processed a total of $54 trillion in trading volume, with Binance alone contributing over $22.5 trillion.

Liminal challenges WazirX's accusations regarding a $235 million security breach, claiming misinformation from the exchange. Despite blaming Liminal for the breach, WazirX has kept over $175 million in assets with Liminal 75 days post-hack.

Michael Saylor, co-founder of MicroStrategy, plans to donate his Bitcoin wealth to benefit humanity. He aims to leave a lasting legacy, drawing inspiration from Bitcoin's anonymous creator, Satoshi Nakamoto.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

“Loved the angle on polls influencing regulations. I argue that narrative and ecosystem effects are now beating pure tech—see the Aster vs. Hyperliquid DEX battle. Are we heading for crowd-driven, intent-based compliance? My piece might spark some debate! https://beyondthecoin.substack.com/p/the-162b-wipeout-dex-wars-explode”

With Trump and Harris leading the polls, I wonder how either presidency will shape the future of crypto regulations. Both candidates need to address this head-on, given how critical digital assets are becoming to the economy. The industry can’t afford more years of regulatory uncertainty.