Hello!

Today’s issue looks at how capital formation in crypto is evolving. Coinbase’s $400 million acquisition of Echo, along with experiments like Flying Tulip’s perpetual put, signals that fundraising is being re-architected from the ground up. The models may differ, but the common thread is the search for fairness, liquidity, and credibility in how new projects raise and deploy capital.

Saurabh, a research writer with our partners at Decentralised.co, unpacks these experiments — partly through market analysis and partly through design commentary — and what they tell us about crypto’s maturing relationship with risk, yield, and community trust.

On to the story,

The Token Dispatch team

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Coinbase recently acquired Echo, a community fundraising platform founded by Cobie, for ~$400 million. Within the same transaction sat a $25-million NFT purchase to revive a podcast by a binding obligation for hosts Cobie and Ledger Status to produce eight new episodes once the NFT was activated. Echo has helped raise over $200 million over 300 rounds.

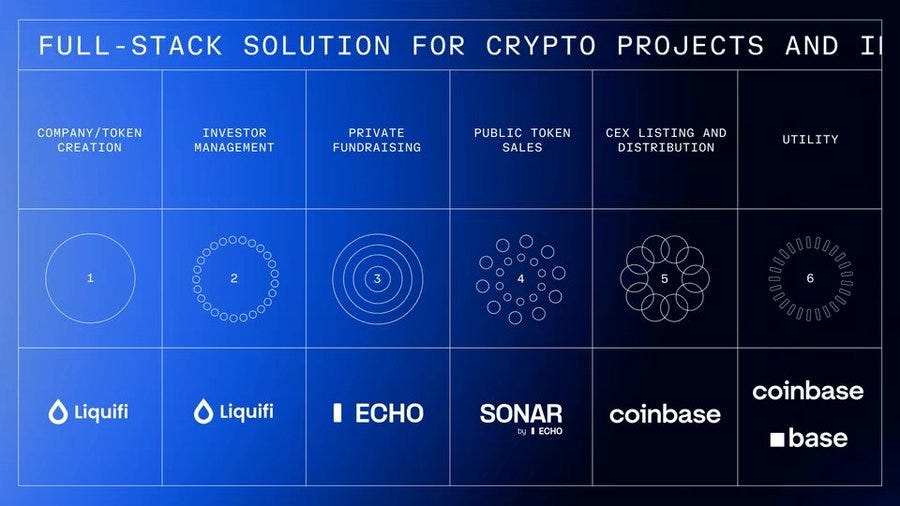

This follows Coinbase’s recent acquisition of Liquifi and completes the stack of crypto project tokens and investments.

Projects could use LiquiFi to create tokens and manage cap tables, raise capital through Echo’s private groups or Sonar’s public sales, and then list the tokens on Coinbase’s exchange for secondary trading. Each stage generated revenue opportunities. LiquiFi charges for token management services. Echo captures value through profit-sharing arrangements. Coinbase earns trading fees on listed tokens. This integrated stack allows Coinbase to monetise the entire project lifecycle rather than just the trading phase.

It’s a good deal for Echo because without an upward integration with an exchange, it will be challenging to generate sustainable revenue. Currently, the model is focused on performance fees, which could take years to monetise, as in the case of venture deals.

Why is Coinbase paying so much for a product that has helped raise only half the amount? Remember, $200 million is not Echo’s revenue; it’s simply the total value it facilitated in raising. Coinbase paid for association with Cobie, who is perceived as one of the long-standing good actors within crypto, Echo’s network effects, technical infrastructure, regulatory positioning, and its place in the emerging architecture of crypto capital formation.

Marquee projects like MegaETH and Plasma have raised capital through Echo, with MegaETH opting for a follow-on round via Echo’s public sale platform, Sonar.

The acquisition gave Coinbase credibility with founders sceptical of centralised exchanges, access to community-driven investing networks, and infrastructure to expand far beyond pure crypto into tokenised traditional assets.

Every project has three or four stakeholders: the team, users, private investors, and public investors. It’s been challenging to strike the right balance between incentives and token allocation. When the crypto space launched ICOs in 2015-17, we felt this was an honest model that ‘democratised’ access to early-stage deals. But some sales sold out even before you could connect to them with MetaMask, while private sales were whitelisted, thereby denying access to most retail buyers.

Of course, the model had to evolve due to regulatory concerns as well, but that’s a separate discussion. The story here is more than about Coinbase’s vertical integration, though. The focus is on how the fundraising mechanics are evolving.

The Perpetual Put of Flying Tulip

Andre Cronje’s Flying Tulip aims to build a full-stack on-chain exchange integrating spot trading, derivatives, lending, money markets, a native stablecoin (ftUSD), and on-chain insurance into a single cross-margin system. It aims to compete with Coinbase and Binance while rivalling Ethena, Hyperliquid, Aave, and Uniswap at the product level.

The funding raised for the project had an interesting mechanism with a perpetual put embedded. Investors contribute assets to receive FT tokens at $0.10 apiece (10 FT per $1 invested) with tokens locked. At any time, investors can burn FT tokens to redeem up to 100% of the original principal in the asset they contributed. If someone invested 10 ETH, they can redeem 10 ETH at any time, regardless of the FT market price.

The put option never expires, hence “perpetual”. Redemptions settle programmatically from a segregated on-chain reserve funded by capital raised, managed by audited smart contracts, with queue and rate-limit mechanisms preventing abuse while maintaining solvency. If reserves are temporarily insufficient, requests enter a transparent queue and are processed as capital replenishes.

The mechanism creates three investor choices with aligned incentives.

First, investors can hold tokens locked with redemption rights intact, maintaining downside protection while capturing any upside if the protocol succeeds.

Second, they can redeem by burning tokens to recover the original principal, after which the tokens are permanently destroyed.

Or they can withdraw by moving tokens to CEX/DEX, but the put option immediately expires upon withdrawal, releasing the original principal to Flying Tulip for operations and token buybacks. This creates a powerful deflationary pressure: selling tokens removes downside protection. Secondary market buyers do not receive redemption rights. The protection applies exclusively to primary sale participants, creating a two-tier token with different risk profiles.

The capital deployment strategy resolves an apparent paradox. Since there’s a perpetual put on all the capital raised, the team can’t really use it, so the effective raise is zero.

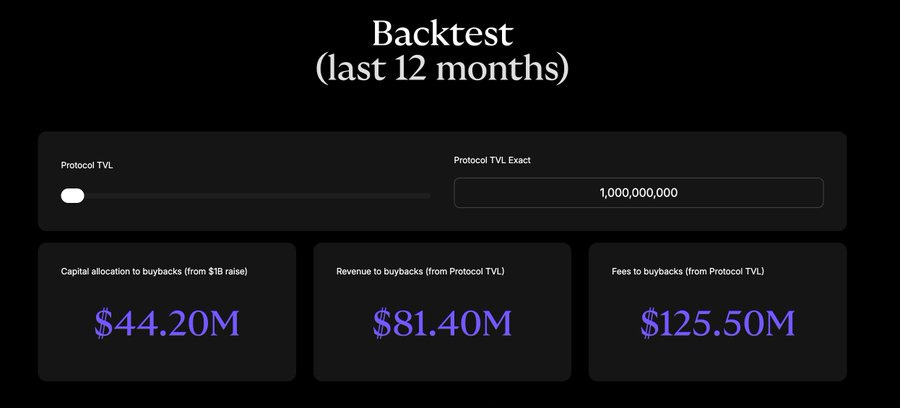

Instead, the $1 billion raised gets deployed into low-risk on-chain yield strategies targeting approximately 4% annually. This capital can be called on at any time. This generates approximately $40 million annually, split between operational expenses (development, team, infrastructure), FT token buybacks (creating buying pressure), and ecosystem incentives.

Over time, protocol fees from trading, lending, liquidations, and insurance add additional buyback streams. The economic trade-off for investors is to forego the 4% yield they could earn by deploying capital themselves, and instead receive FT tokens with potential upside and principal protection. Essentially, investors only exercise the put when FT trades below the $0.10 purchase price.

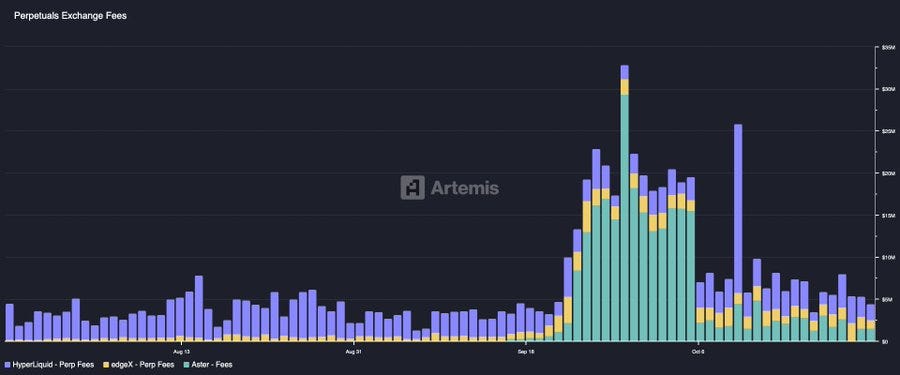

Yield is one component of the revenue stream. Beyond lending, the product suite contains Automated Market Makers (AMM), perpetuals, insurance, and a delta-neutral stablecoin that keeps earning yield. In addition to the $40 million in expected revenue from deploying the $1 billion across different low-risk DeFi strategies, other products can potentially also generate revenue. Top trading venues for perps like Hyperliquid have earned $100 million in fees in a month, which is almost double the potential revenue from DeFi lending at a 5-6% yield on a billion-dollar capital.

The token distribution model radically differs from all previous crypto fundraising. Traditional ICOs and VC-backed projects allocate 10-30% to team, 5-10% to advisors, 40-60% to investors, and 20-30% to foundation/ecosystem, often with vesting but guaranteed allocations. Flying Tulip allocates 100% of tokens to investors (private and public) at launch, with 0% to the team and 0% to the foundation initially. The team gains exposure only through open-market buybacks funded by protocol revenue share, subject to transparent published schedules. If the project fails, the team receives nothing. Supply starts at 100% with investors and shifts to the foundation over time through redemptions, with redeemed tokens burned permanently. The token supply remains capped based on actual funds raised. If $500 million is raised, only 5 billion FT tokens will be minted; the window caps at 10 billion FT for $1 billion raised.

The new mechanism addresses problems Cronje experienced firsthand across Yearn Finance and Sonic. As he explained in the pitch deck: “As a founder who has been involved in two large token projects; Yearn and Sonic, I know the pressures from a token. The token itself is a product. If the price ever dips below the where investors joined, this leads to short-term decision-making choices that might benefit the token at the cost of the protocol. Providing a mechanism where the team has comfort that there is a floor and ‘at worst’ investors exit what they put in, this dramatically reduces this stress and overhead.”

The perpetual put separates token mechanics from operational capital, removing the pressure to make protocol decisions based on token prices and allowing the team to focus on building sustainable products. Investors stay protected but incentivised to hold for upside, making the token less “make or break” for project survival.

The self-reinforcing growth flywheel described in Cronje’s pitch deck outlines the economic model: $40 million annual yield from $1 billion at 4% splits between operations and token buybacks; protocol launch generates additional fees from trading, lending, liquidations, and insurance; these revenues fund more buybacks.

Redemptions plus buybacks create deflationary supply pressure; reduced supply plus buying pressure drives price appreciation; higher token value attracts users and developers; more users generate more fees, funding more buybacks; the cycle repeats. The model succeeds if protocol revenues eventually exceed the initial yield, making the project self-sustaining beyond the endowment.

On the one hand, investors get downside protection and institutional-grade risk management. But on the other hand, they face a real opportunity cost of 4% foregone yield annually, plus capital efficiency loss from money locked earning below-market returns. The model only justifies itself if FT appreciates significantly above $0.10.

Treasury management risks include DeFi yields dropping below 4%, yield protocols failing (Aave, Ethena, Spark), and questions about whether $40 million annually can truly fund operations, competitive products, and meaningful buybacks. Plus, for Flying Tulip to outcompete peers like Hyperliquid, it really has to be a liquidity hub, an uphill battle given that established players have already had a head start and captured the market with incredible products.

Building a full DeFi stack that competes with established protocols having massive head starts, with a team of 15, has execution risks. Few teams have matched Hyperliquid’s execution, which has generated over $800 million in fees since November 2024.

Flying Tulip represents an evolution of lessons learned across Cronje’s previous projects. Yearn Finance (2020) pioneered fair launches with zero founder allocation (Andre had to farm his YFI) and went from $0 to $40,000+ in a matter of months, reaching a $1.1 billion+ market cap within one month. Flying Tulip adopts the same zero-team allocation but adds institutional backing ($200 million versus Yearn’s $0 in self-funding) and investor protections that Yearn lacked.

Keep3rV1’s surprise 2020 beta launch (token soared from $0 to $225 in hours) taught the dangers of unaudited, sudden releases; Flying Tulip implements audited contracts with clear documentation before the public sale. Fantom/Sonic experience with token price pressures directly shaped the put option model.

Flying Tulip seems to have combined the best elements — fair distribution, no team allocation, structured launch, and investor protection via a novel perpetual put mechanism. Its success depends on how good the product is and whether it can attract liquidity from power users who are comfortable with competitors like Hyperliquid and centralised exchanges.

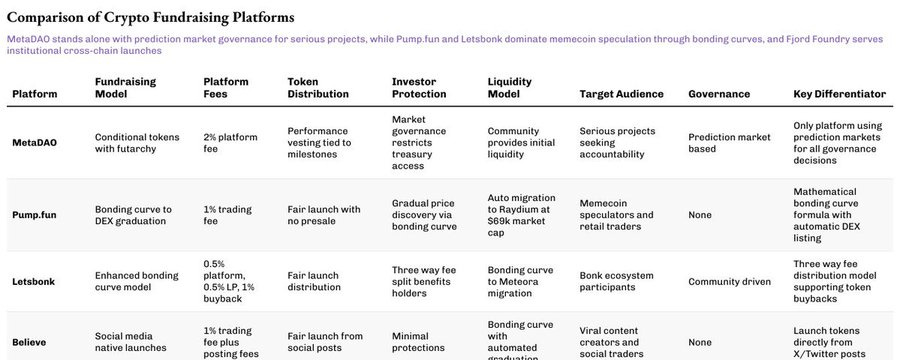

MetaDAO’s Fundraises Backed by Futarchy

If Flying Tulip reimagines investor protection, MetaDAO revisits the other half of the equation: accountability. Projects raising capital through MataDAO don’t actually receive the funds they raise. Instead, all capital sits in an on-chain treasury where conditional markets validate every expenditure. Teams must propose how they intend to spend, and tokenholders bet on whether those actions will create value. Only if the market agrees does the transaction go through. It’s fundraising rewritten as governance, a structure in which financial control is distributed and code replaces trust.

Umbra Privacy was the breakout example. The Solana-based privacy project saw over $150 million committed for a $3 million market cap, with allocations distributed pro rata and excess automatically refunded by smart contracts. All team tokens were locked behind price milestones, meaning founders could only realise value if the project genuinely grew. The result was a 7x post-launch performance, which also proved that even in a jaded market, investors still crave fairness, transparency, and structure.

MetaDAO’s model might not yet be mainstream, but it restores what crypto once promised: a system where markets, not managers, decide what deserves capital.

Crypto fundraising has entered a phase where major assumptions are being questioned. Echo proves distribution networks can command premium valuations even without exchange integration. Flying Tulip tests whether investor protection mechanisms can replace traditional tokenomics.

Whether these experiments succeed depends less on theoretical elegance and more on execution, user adoption, and whether the mechanisms hold up under market stress. The fundraising architecture keeps shifting because the underlying tension between teams, investors, and users remains unresolved. Each new model claims to balance these interests better, and each will face the same test of whether it survives contact with reality.

That’s it for this week. I will see you soon with the next one.

Until then … stay curious,

Saurabh

This write-up is an abridged version of what was first published with the Liminal Collective, an informal writing collective of independent investors and analysts interested in frontier markets, including crypto, AI, and robotics. You can read the whole piece here.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 180,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.