Celeb Crypto Handler Gone Rogue? 🐗

Celebrity memecoin schemes and rug pulls. Who is Sahil Arora? Mastercard simplifies sending Bitcoin. Gemini to distribute $2.18B in crypto back to Earn users. Ripple's pro-crypto political donations.

Hello, y'all. Wild world … Now that I've lost everything to you 🎸

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Remember "JENNER"?

No, this isn't a Keeping Up With The Kardashians flashback.

It's the name of a recent memecoin launched by Caitlyn Jenner, and it's just one example of a celebrity crypto craze gone wrong.

What's the Tea (on this crypto fiasco?)

Several celebrities, including Jenner and American rapper “Rich the Kid” were approached by a facilitator who convinced them to promote these memecoins.

Cryptocurrency sleuth Roxo connects the alleged scammer, Sahil Arora, to both token launches and claims he socially engineered Jenner's team.

It is alleged that Arora dumped all the tokens from the deployer wallet after getting Jenner to promote the coin.

Jenner claims Arora "scammed" her regarding the launch of the JENNER token (she will continue promoting the coin though).

Rich the Kid alleges his X account was hacked by Arora to promote the "RICH" token.

Who is Sahil Arora?

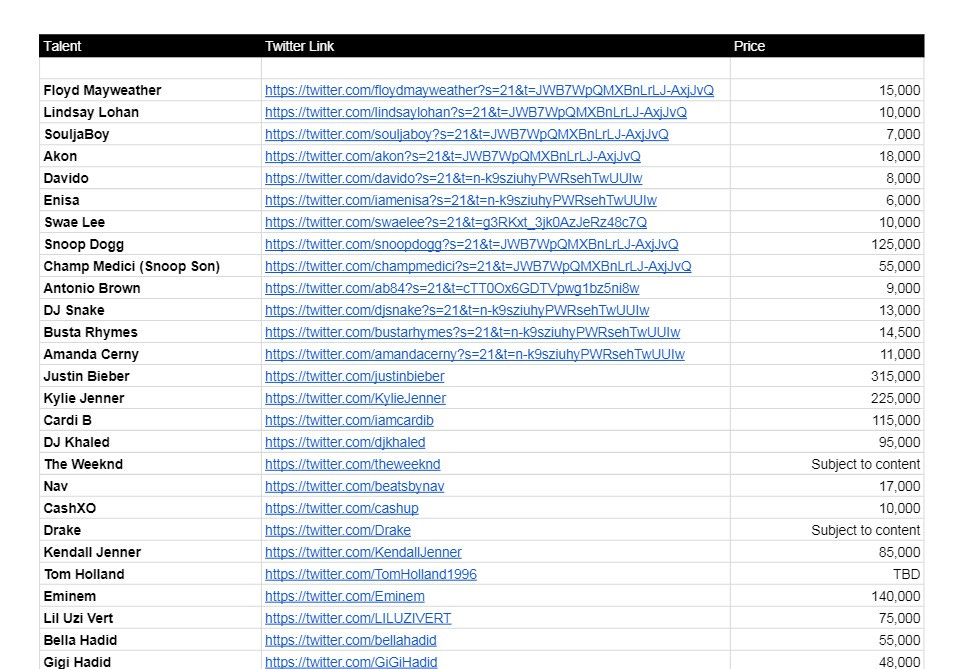

Sahil Arora, a young Indian entrepreneur, is facing a wave of accusations after a leaked list revealed he allegedly offered celebrity endorsements for exorbitant prices.

The Accusations

Celebrity memecoin schemes: Arora is accused of creating meme coins around celebrities like Caitlyn Jenner and Rich the Kid, who claim they were scammed.

Fake endorsements: A leaked list shows celebrities like Justin Bieber, Kim Kardashian, and Eminem with price tags for endorsements, though there's no evidence they agreed.

Investors allege Arora promotes coins, then quickly removes liquidity, crashing their value (rug pull).

Former employees claim Arora didn't pay them for their work on his crypto projects.

Arora allegedly used a network of celebrities to build trust and secure investments.

His projects

He reportedly founded a taxi app.

Partnered with actor Sahil Khan to launch Tabverts.

Founded the iris scanner Eye-D.

A crypto project in Dubai called ZelaaPayAE.

Reportedly distributed Bitcoin ATMs “across the world” as the owner of Vuzelaa Group.

A History of Controversy

2017 Allegations: Paytm, a major Indian payment company, accused Arora of impersonation for fundraising.

Failed Projects: Several of Arora's ventures, like ZelaaPay and Vuzelaa Group, are no longer operational.

Arora's defense: Denies the accusations, claiming disgruntled investors lost money trading and that many profited from his tokens.

He maintains his celebrity network is real, though how he obtained it remains unclear.

Arora now targets Azalea

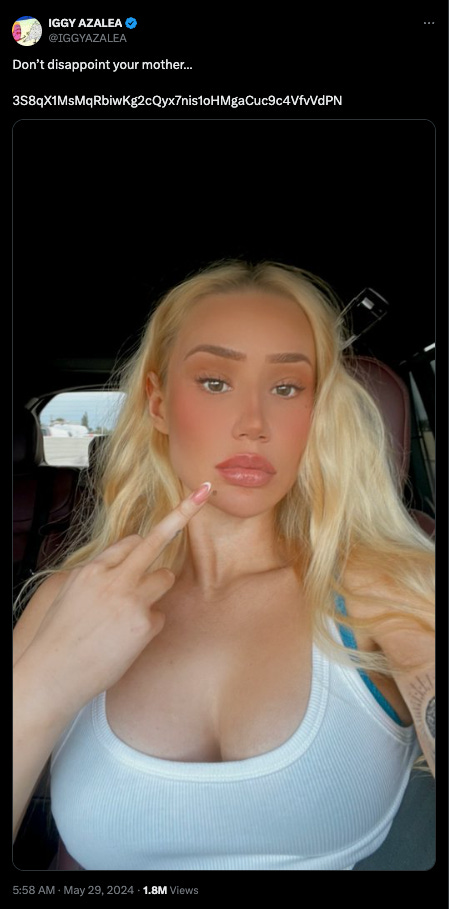

Following the Jenner drama, Arora set his sights on Iggy Azalea, teasing a collaborative meme coin launch through Pump.fun.

He even convinced some to send Solana (SOL) to a presale address for the upcoming "IGGY" token.

Instead of partnering with Arora, Azalea surprised everyone by launching her own Solana token, MOTHER, on Tuesday.

She publicly denounced Arora in a series of tweets, leaving those who invested in the presale confused and empty-handed.

But …

Damage control: Faced with backlash, Arora teased another token launch and flaunted his wealth online.

Block That Quote 🎙️

Minnesota Rep. Tom Emmer.

“Gary Gensler making great use of Americans’ taxpayer dollars.”

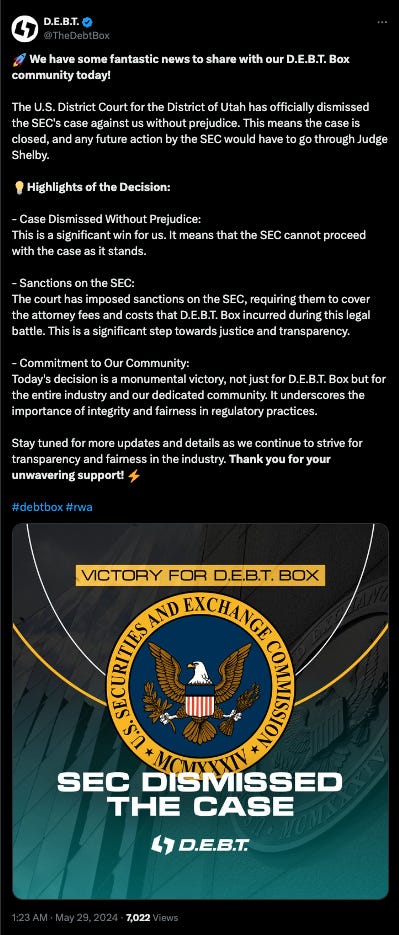

The context? The SEC's efforts to regulate crypto hit a snag after a judge ordered them to pay a hefty $1.8 million for their failed case against DEBT Box.

Judge Slams SEC, DEBT Box Declares Victory

Utah Judge Robert Shelby heavily criticised the SEC's actions, calling them an "outrageous misuse of power."

He ruled in favour of DEBT Box, forcing the regulator to cover the company's legal fees incurred during the lawsuit.

DEBT Box celebrated the decision as a win not just for them, but for the entire Web3 industry.

The lawsuit, filed in August 2023, accused DEBT Box of defrauding investors through unregistered securities sales.

The SEC even froze the company's assets with a special court order.

Judge Shelby ruled in March that the SEC obtained this order using "false and misleading statements," essentially accusing them of bad faith tactics.

Mastercard Simplifies Sending Bitcoin

Forget fumbling with cryptic wallet addresses – Mastercard's got your back.

Mastercard is testing a new program to simplify sending and receiving crypto.

Launched in 2026, the pilot program aims to make crypto transactions smoother and less prone to user error.

Focus on User Experience

Collaborating with crypto exchanges and wallet providers, Mastercard hopes to eliminate the need for long, complex wallet addresses.

Instead, users would receive easy-to-remember aliases verified by Mastercard for secure transactions.

This reduces the risk of sending funds to the wrong address, potentially saving users from financial losses.

In The Numbers 🔢

$2.18 billion

Gemini repayment to Earn users.

After an agonising 18-month wait marked by a withdrawal freeze, Gemini has finally started reimbursing users in digital assets.

Users are getting back 97% of what they deposited. Even better, thanks to asset appreciation, they're receiving a 232% return overall.

So, that loaned Bitcoin? You're getting it back, plus any gains it made while in the program.

The Cause of the Freeze? It all goes back to Genesis, Gemini's former lending partner. A liquidity crisis in November 2022 forced Genesis to freeze withdrawals, impacting Gemini's Earn program.

Thankfully, a settlement with Genesis and creditors unlocked the funds for user repayments.

This payout is a big deal.

It's considered an unprecedented recovery in crypto bankruptcies. Gemini points the finger at "old-fashioned financial fraud" at Genesis, not inherent problems with crypto itself, and emphasizes the need for clearer regulations.

Ripple’s Pro-Crypto Political Donations

Ripple has made a hefty $25 million donation to Fairshake, the pro-crypto super PAC, marking its second consecutive annual contribution of the same amount.

This solidifies Fairshake as one of the powerhouses in the 2024 election cycle, with funds now ranging between $102 million and $110 million.

CEO Brad Garlinghouse: "Our contributions to Fairshake are just one of the many ways Ripple will actively invest in educating voters on the role crypto will play in the future and the dangers of the anti-crypto stance some policymakers are clinging to in Washington."

Big Names, Big Impact: Fairshake isn't just any PAC; it's a crypto champion on a mission to ensure the U.S. remains a hub for digital innovators.

Its list of contributors reads like a Who’s Who of the crypto elite, including heavyweights from companies like Xapo Bank, Paradigm, and ARK Invest.

Coinbase was Fairshake's largest contributor in 2023, donating $46.5 million.

Read: How a crypto super PAC is trying to swing 2024

With its substantial war chest, Fairshake supports candidates who favour progressive crypto policies.

Interestingly, while it positions itself as nonpartisan, its spending has skewed towards opposing Democratic candidates more than Republicans.

The Surfer 🏄

Telegram Wallet is implementing new KYC rules and changing its service provider. Users will now have to provide their name, phone number, and date of birth to use all features except withdrawals. The limits for the basic level are 3,500 euros per day and 35,000 euros per month, depending on exchange rates.

Chinese national Yunhe Wang arrested for running a $130M botnet scam. Wang allegedly hijacked over 19 million private IP addresses and sold them to cybercriminals.

Robinhood has released its crypto trading API for US traders. The API allows users to set up automated trading strategies and react to market movements. Users can trade crypto and interact with real-time markets without opening the Robinhood app.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋