Charlie Lee and the Silver Coin That Wouldn't Die 🩶

"If I could do it over, I'd just stack bitcoin and disappear."

Sometimes you read about someone’s life choices and think ‘that’s either genius or insane’ and you genuinely can’t tell which. That’s been my week.

There is a guy who created the second-oldest cryptocurrency that still matters, sold all of it near the top of a bull market, and then spent the next seven years working on it anyway. This is objectively weird. Most people who sell their entire stake in something they created are either (a) getting out because they think it’s doomed, or (b) moving on to something more exciting. Charlie Lee did neither. He sold his Litecoin in December 2017 because holding it while tweeting about it was a “conflict of interest,” and then kept showing up to work on Litecoin every day like nothing had happened.

This creates some interesting dynamics. If you’re a crypto founder with a big bag, people accuse you of pumping whenever you say anything positive.

If you sell everything, people accuse you of abandoning ship. Lee chose the second problem over the first, which is perhaps the most Charlie Lee thing possible: solving one issue by creating a different, arguably worse issue, and then just dealing with it.

Your Shortcut To Crypto’s Inner Circle

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

Charlie Lee was born in 1977 in the Ivory Coast, which is not where you typically expect cryptocurrency founders to come from, but then again, there isn’t really a typical origin story for cryptocurrency founders. His family moved to New Jersey when he was 13. He attended a prep school, then went to MIT, where he earned both a bachelor’s and a master’s in computer science. This is a pretty standard trajectory for someone who would eventually work at Google, which he did from 2007 to 2013, contributing to things like Chrome OS and YouTube Mobile.

In 2011, while still at Google, Lee read an article about Silk Road. For those who weren’t around back then, Silk Road was an online marketplace for drugs and other illegal things, and it only accepted Bitcoin. This was how a lot of people found out about Bitcoin in 2011. You would read some article about how criminals were using magic internet money to buy drugs, and you would think “Wait, what is this magic internet money?” and then you’d fall down the rabbit hole.

Lee went down the rabbit hole. He had always been skeptical of the Federal Reserve and had been trading gold as an alternative investment. Bitcoin made sense to him. He bought some at $30 per coin. The problem was that buying Bitcoin in 2011 was extremely difficult. There was one major exchange, Mt. Gox, located in Japan, and the process of getting your money there and then extracting Bitcoin was complicated and sketchy.

So, Lee, like many early Bitcoin users, used LocalBitcoins to meet strangers in person and trade cash for coins. He’d sit at a McDonald’s or Starbucks, wait for a Bitcoin transaction to confirm (which takes an average of 10 minutes, but can sometimes take over an hour), and then hand over cash. He describes this process as feeling “like a drug deal,” which is accurate. The problem was the waiting. Sitting in a McDonald’s for an hour with a stranger you just met on the internet, waiting for a blockchain confirmation, is not fun.

The Fairbix Failure and the Litecoin Launch

Lee’s first attempt at creating a cryptocurrency was called Fairbix. It was a clone of another early cryptocurrency called Tenebrix. Fairbix died within weeks due to a bug related to transactions, which Lee decided not to fix because he was already working on something else: Litecoin.

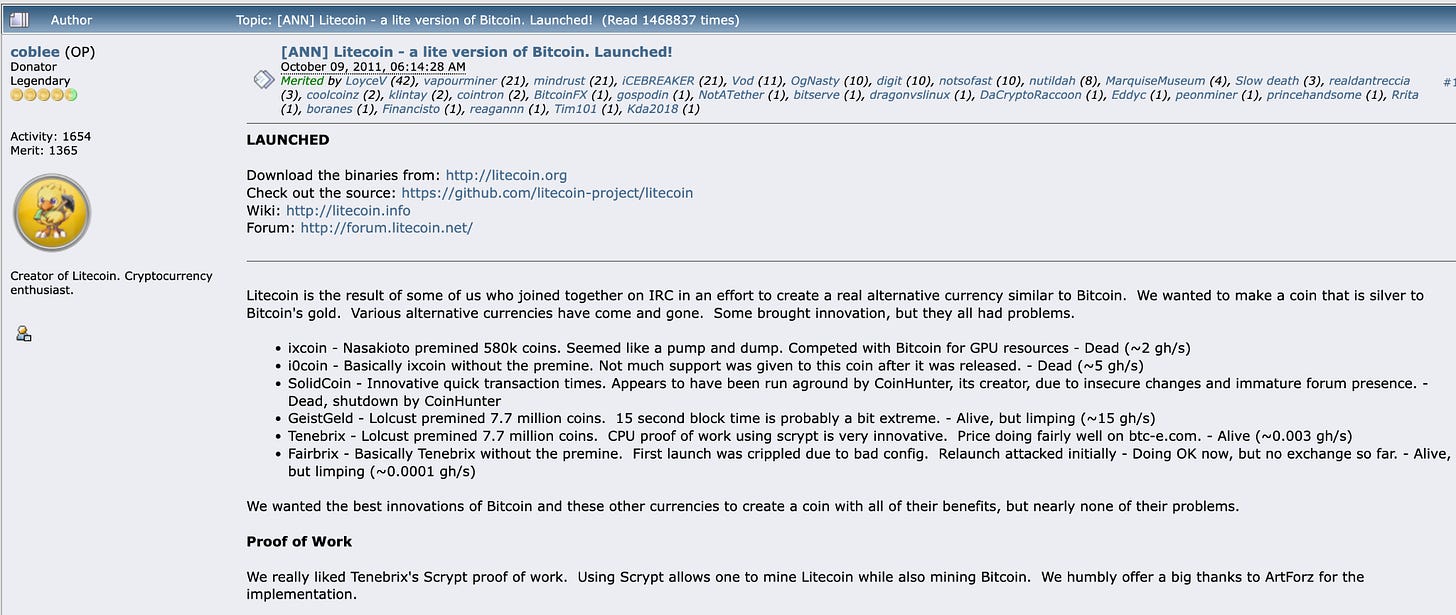

On October 7, 2011, Lee posted on the Bitcointalk forum announcing Litecoin. He had written it in his spare time while working at Google, mining only 150 coins before making it public. The idea was to create “silver to Bitcoin’s gold.” Bitcoin would be for large transactions and storing value, while Litecoin would be for buying coffee.

Litecoin blocks confirm every 2.5 minutes, compared to Bitcoin’s 10 minutes. It uses a different mining algorithm called Scrypt instead of Bitcoin’s SHA-256. The total supply would be 84 million coins, as opposed to Bitcoin’s 21 million. Transaction fees would also be lower.

These might sound like minor tweaks, but they mattered for Lee’s original use case of sitting at McDonald’s buying Bitcoin from strangers. With Litecoin, you would only have to wait 2.5 minutes instead of 10.

Another crucial move Lee made was launching Litecoin fairly. This is important because it explains why Litecoin survived when basically every other 2011 altcoin died. Before Litecoin, there were about a dozen other Bitcoin alternatives. They all failed, and Lee thinks the main reason is that they were “premined.” The creators would mine a bunch of coins for themselves before releasing the software publicly, giving themselves a huge advantage. If the coin succeeded, the creators would get rich. This made people distrust these projects. It’s not a new story, is it?

Lee mined 150 Litecoins and then released the code. On day one, around a thousand other people started mining alongside him. Nobody had an unfair advantage. This turned out to be a big deal.

The Google Years and the Coinbase Years

Lee continued working at Google for two more years after launching Litecoin. In 2013, he left to join Coinbase as an engineering manager. This was back when Coinbase was a startup, before it became the default way normal people buy crypto. Lee worked there until 2017, eventually becoming director of engineering. During this time, Coinbase added support for Litecoin, which created an interesting situation where Lee was working at an exchange that listed his own cryptocurrency. Apparently, this was fine.

In 2017, Lee left Coinbase to work full-time on the Litecoin Foundation, a nonprofit he had founded to develop and promote Litecoin. And then, in December 2017, he did the thing that everyone still talks about.

The sale at the top.

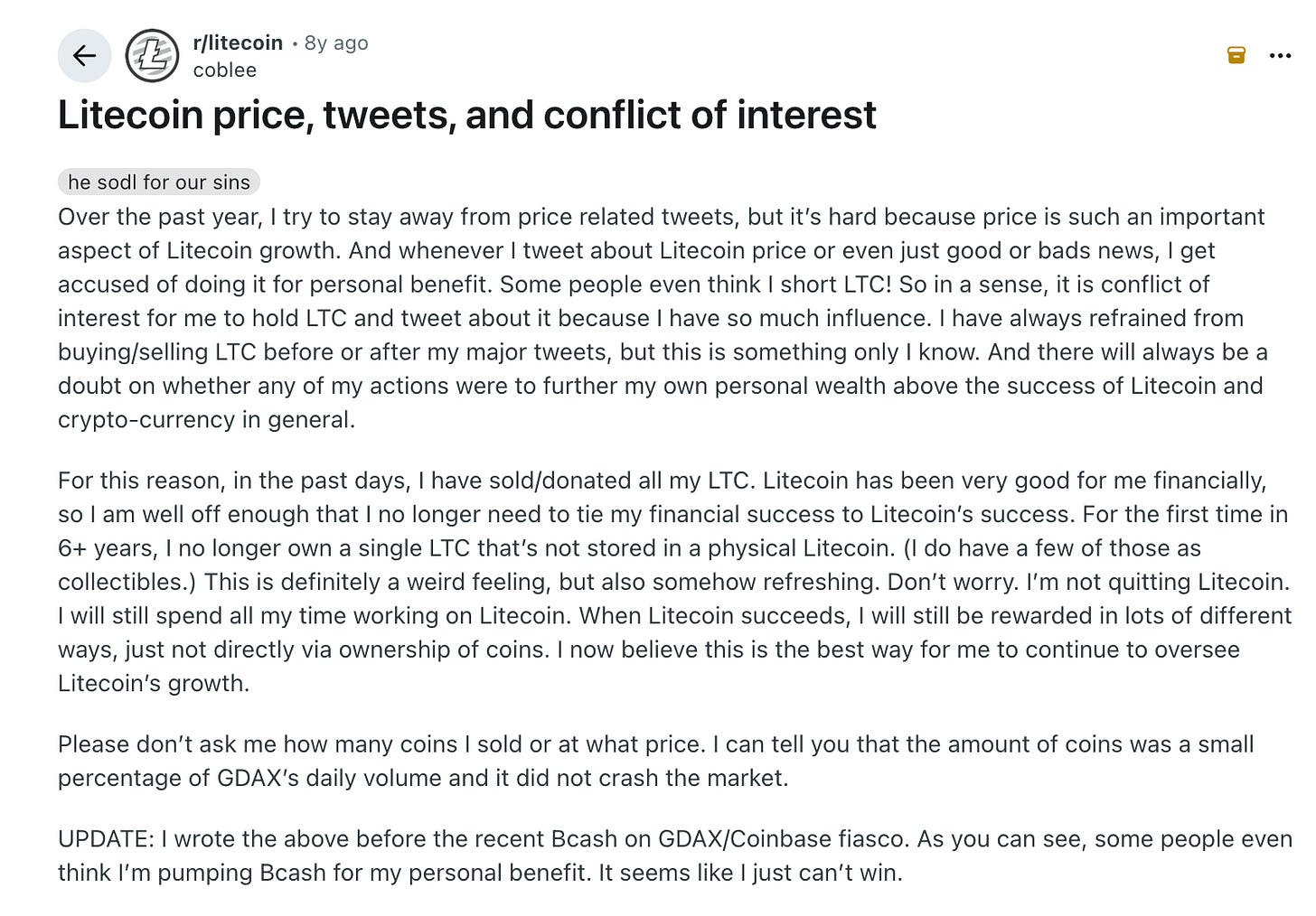

December 2017 marked the peak of the first major crypto bull market that caught the attention of the public. Bitcoin hit $19,000, and Litecoin hit $375. Lee announced on Reddit that he had sold or donated all of his Litecoin holdings.

His explanation was that holding Litecoin while being its most public advocate created a conflict of interest. “Whenever I tweet about Litecoin price or even just good or bad news, I get accused of doing it for personal benefit,” he wrote. So he sold everything. He kept a few physical Litecoins as collectibles, but that was it.

The community reacted about how you would expect. Some people thought it was noble and transparent. Most people thought he was abandoning the project.

The timing was particularly bad because, as it turned out, December 2017 was very close to the market top. Litecoin would eventually drop to around $25 in 2018, while Lee had sold at $375.

This is the kind of thing that would normally end a founder’s credibility. But Lee just kept working on Litecoin. He showed up to the Litecoin Foundation. He contributed code. He did interviews. He tweeted (still from the handle @SatoshiLite). He acted like someone who still owned a bunch of Litecoin, except he didn’t own any.

What Litecoin Actually Does

While all this drama was happening, Litecoin just kept working. Every 2.5 minutes, like clockwork, for 14 years now, it has processed blocks. It has never had a major outage or needed to restart. This is actually impressive. A lot of blockchains have had problems. Litecoin has just worked.

The main thing Litecoin does is payments.According to BitPay, a major crypto payment processor, Litecoin is consistently the most-used cryptocurrency for actual transactions by number of payments. More than Bitcoin, more than Ethereum, more than stablecoins. However, when measured by the total value or volume of payments, Bitcoin still accounts for a much larger share. Litecoin’s advantage is in smaller, everyday transactions, it’s faster and cheaper than Bitcoin while still being relatively simple and reliable.

In 2017, before Bitcoin, Litecoin activated SegWit, a technical upgrade that enabled the Lightning Network. Lee did this deliberately to test whether it would work, since Litecoin is similar enough to Bitcoin that it could serve as a testnet. There was a lot of fear-mongering at the time about SegWit being dangerous, but once it launched on Litecoin and nothing broke, Bitcoin followed suit. So Litecoin actually helped Bitcoin ship an important upgrade.

More recently, Litecoin added something called MimbleWimble Extension Blocks (MWEB), which adds optional privacy features. This is controversial because privacy in crypto makes regulators nervous, but Lee pushed for it anyway because he thinks fungibility (the property where every coin is interchangeable with every other coin) is important for money. With MWEB, you can send Litecoin transactions where only you and the recipient know the amount. The blockchain still works, but observers can’t see the details.

This is one of those cases where having a founder who can “steer the ship,” as Lee puts it, makes things happen that would be hard to do otherwise. Bitcoin doesn’t have this. Bitcoin has a lot of arguing and not much shipping. Litecoin has Lee saying “we’re doing this” and then they do it.

The Institutional Era

In 2024, things started getting weird in a different way. Canary Capital Group LLC filed for an ETF with the SEC. A company called Lite Strategy launched with a Litecoin treasury, similar to MicroStrategy’s Bitcoin strategy. In July 2024, Lee pledged to personally match up to $250,000 per year in Litecoin Foundation funding for the next five years.

None of this is what you would expect from someone who sold all their holdings because they thought it was a conflict of interest. But here we are. The ETF got delayed because of a government shutdown, while Lite Strategy traded on NASDAQ. Lee continued to be actively involved.

In a 2025 interview, Lee made some interesting comments. He said that if he could do it over, he would “just stack bitcoin and disappear.” He said creating Litecoin “did not make him more money” and that simply buying and holding Bitcoin would have been more profitable. This is probably true. If he had taken the money he spent on Litecoin’s development into Bitcoin in 2011, he would be much richer.

But that’s not really the point, is it? Lee also said he sometimes wishes he had stayed anonymous like Satoshi Nakamoto. Being a public founder of a cryptocurrency is stressful. People yell at you on Twitter. Every decision you make gets second-guessed. When you sell your coins, people accuse you of abandoning the project. When you don’t sell your coins, people accuse you of pumping your bags.

Satoshi solved this by disappearing. Lee solved it by selling everything and then staying anyway, which is possibly more stressful but at least it’s honest.

He has influence without financial skin in the game. He can advocate for Litecoin without people accusing him of pumping his bags. The cost is that people instead accuse him of not believing in the project he’s spending all his time on.

The Competitive Landscape

Litecoin is currently the 31st-largest cryptocurrency by market cap, with about $7 billion. While it’s down from its peak, it remains significant. Litecoin has been around longer than almost everything except Bitcoin. It has survived multiple cycles where most altcoins died.

But it’s also not growing the way newer cryptocurrencies have grown. Ethereum has smart contracts. Solana is fast. Cardano has a devoted community. Litecoin is just Litecoin. It’s silver to Bitcoin’s gold, which is exactly what Lee always said it would be, but that’s not a particularly exciting narrative in an industry that runs on exciting narratives.

Lee seems fine with this. His goal, as he’s stated, is to create “sound money.” He believes that cryptocurrency is “a better form of money than anything humanity has ever seen,” and that eventually only a few cryptocurrencies will survive. When that happens, he thinks Litecoin will be one of them, and it will actually be used like money instead of being a speculative asset.

Lee created Litecoin in 2011 as a faster, cheaper alternative to Bitcoin. He launched it fairly, positioned it as complementary to Bitcoin, and spent 14 years maintaining it even after selling his entire stake.

You could argue this is inefficient. If he had stayed at Google and gotten promoted, he would have a steadier career. If he had sold his Litecoin and moved on to the next project, he could have tried to catch another wave. If he had taken all the energy he spent on Litecoin and directed it elsewhere, the returns might have been better.

But he didn’t do any of that. He created Litecoin, sold it to avoid conflicts of interest, and then kept working on it because he believes it’s useful. This is either very principled or very stubborn, depending on how you look at it.

That’s Charlie Lee and Litecoin. More profiles coming.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.