Circle Wins EU 🏆

Circle gets MiCA stablecoin issuer license. Tether hasn't, not happy. US needs a law for stablecoins. US Marshals tap Coinbase for custody. Crypto VC funding $697M for June. VCs might dump altcoins?

Hello, y'all. Circle is round. What else do ya wanna know?

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Circle just became the EU's official stablecoin knight. ️

They've snagged the first-ever EMI license for stablecoins in Europe under MiCA.

Circle? The company behind the popular USDC stablecoin. EU approved.

USDC? The second largest stablecoin with $32 million market cap.

MiCA? The EU's big new crypto rulebook.

This means, now their USDC and EURC (Euro-coin) can now legally roam the European market.

Jeremy Allaire, Circle's co-founder and CEO

"Since our founding, Circle has sought to build durable, compliant, and well-regulated infrastructure for stablecoins, and our adherence to MiCA, which represents one of the most comprehensive crypto regulatory regimes in the world, is a huge milestone in bringing digital currency into mainstream scale and acceptance.”

What to know about MiCA?

The EU's Markets in Crypto-Assets Regulation introduces new rules for the crypto industry.

MiCA provides a legal framework for crypto businesses in the EU.

Non-compliant stablecoins may be delisted from July 1.

Crypto exchanges may delist or restrict services for non-compliant stablecoins.

Non-compliant issuers could leave the EU market entirely.

What it means?

Businesses: More legitimacy, but need MiCA approval.

Users: More protection, but fewer choices. Might shift to non-EU exchanges.

Exchanges take action: Major exchanges like Binance and Kraken have already begun delisting non-compliant stablecoins (» Tether).

Focus on Euro Tether (EURT): Even Bitstamp plans to delist the euro-backed EURT stablecoin.

Next steps: Crypto service provider rules incoming.

MiCA's regulations for crypto asset service providers are set for December 2024.

What did Circle do?

Circle filed an application with French regulators to become a licensed Electronic Money Institution(EMI) in April 2023.

This is a key requirement for issuing stablecoins under MiCA.

By securing the French EMI license, Circle avoids the need for a separate MiCA license when the regulation expands to Crypto Asset Service Providers (CASPs) in December.

This is because MiCA allows companies with licenses in one EU member state to "passport" their services to other member states.

What’s users gon’ do?

EU users must convert non-compliant stablecoins to regulated options like USDC.

Converting, for example, USDT to USDC won't change the underlying dollar value of your assets.

Tether not happy

The largest stablecoin($112 market cap) got a bit tangled up in the MiCA regulations.

Strict reserve requirements: MiCA demands 1:1 cash reserves for stablecoins, which Tether criticises as risky (prefers US Treasurys).

Transaction & volume caps: MiCA limits daily transactions (1 million) and volume (€200 million) for stablecoins, leading to delistings on some exchanges.

Licensing requirements: Tether's EMI license status is unclear, while competitor Circle already has one, raising concerns about Tether's compliance.

Tether, primarily based outside the EU, has to jump through hoops to comply.

Token Dispatch view

Tether’s USDT bosses the stable coin market, more than 3x of Circle's USDC.

MiCA snub is a hit.

Platforms have delisted USDT due to MiCA compliance concerns, including Bitstamp, OKX, and Uphold.

Circle moved its legal headquarters to Ireland.

Does that give it a competitive edge due to MiCA regulations?

Tether's large market share has a lot to do with its recent integration on the TON blockchain. We know how the TONcoin is playing out.

Read: TON - Next $100B Blockchain? 🟢

Tether CEO Paolo Ardoino - Concerned by EU's problematic MiCA stablecoin requirements.

"Tether has been actively involved in regulatory technical standards consultations over the past months and remains concerned that MiCA contains several problematic requirements.

These requirements could not only render the job of a stablecoin issuer extremely complex but also make EU-licensed stablecoins extremely vulnerable and riskier to operate.

As with any regulatory framework of this scale, further discussions on the technical implementation standards are crucial to providing clarity to the market over certain provisions."

In April, Ardoino posted to X

“Uninsured cash deposits are not a good idea. We should learn from what happened with Silicon Valley Bank and another major stablecoin in the US.

If a bank goes bankrupt, uninsured cash goes into bankruptcy. Stablecoins should be able to keep 100% of reserves in treasury bills, rather than exposing themselves to bank failures keeping big chunk of reserves in uninsured cash deposits.

In case of bank failure, securities return back to the legitimate owner.”

Meanwhile, the Philippines has become the first country to accept Tether (USDT).

This reminds: US needs a law for stablecoins

Other countries are already doing it, like MiCA in EU.

Lummis-Gillibrand bill and FIT21 offer hope for stablecoin clarity.

Lack of federal regulation creates uncertainty for US issuers.

Stablecoins offer new opportunities - payments, remittances and financial access.

Over 95% of stablecoins are dollar-denominated.

Block That Quote 🎙️

Coinbase’s chief legal officer, Paul Grewal.

“Liability shouldn't depending on what what court you get sued in”

Coinbase is firing back in its legal battle with the SEC.

Back in June, a judge KO'd the SEC's case against Binance, ruling their BNB token wasn't a security.

Coinbase sees this as a major victory, but also a giant flashing neon sign that says "CRYPTO RULES ARE ALL OVER THE PLACE"

Grewal emphasizes the need for clear and consistent regulations.

“The result of the SEC’s litigation-focused approach to crypto regulation is that market participants now face different rules, not only in different courts in this District, but in different federal courts around the country. We appreciate the Court's consideration.”

This isn't Coinbase's first fight for regulatory clarity.

In June, they sued the SEC and FDIC for failing to disclose documents related to crypto activities.

Big names like Binance and Consensys (MetaMask's parent company) are all on the same page.

What do they want? Crypto to have a rulebook, not a guessing game.

Coinbase Gets Government Gig

The US Marshals Service has chosen Coinbase Prime to handle its seized digital assets.

This decision comes after a competitive request for proposals (RFP) earlier in 2024.

The US Marshals Service is paying $32.5 million for the contract.

This means? Coinbase Prime will be responsible for custody, management, and disposal of seized crypto.

These assets are classified as "Class 1" digital assets, likely referring to well-established crypto like Bitcoin.

Why it matters to Coinbase? This contract is a sweet deal, potentially lasting five years with a possible bonus round of six months.

Plus, it adds a shiny badge to their resume, showing they can play nice with the feds.

As of March 2024, Coinbase safeguarded $330 billion of assets.

US Marshals prioritise secure and lawful handling of digital assets according to department policies.

Why it matters to crypto? This contract reflects the increasing recognition of digital assets within government processes.

A step forward in integrating crypto management into federal law enforcement operations.

In The Numbers 🔢

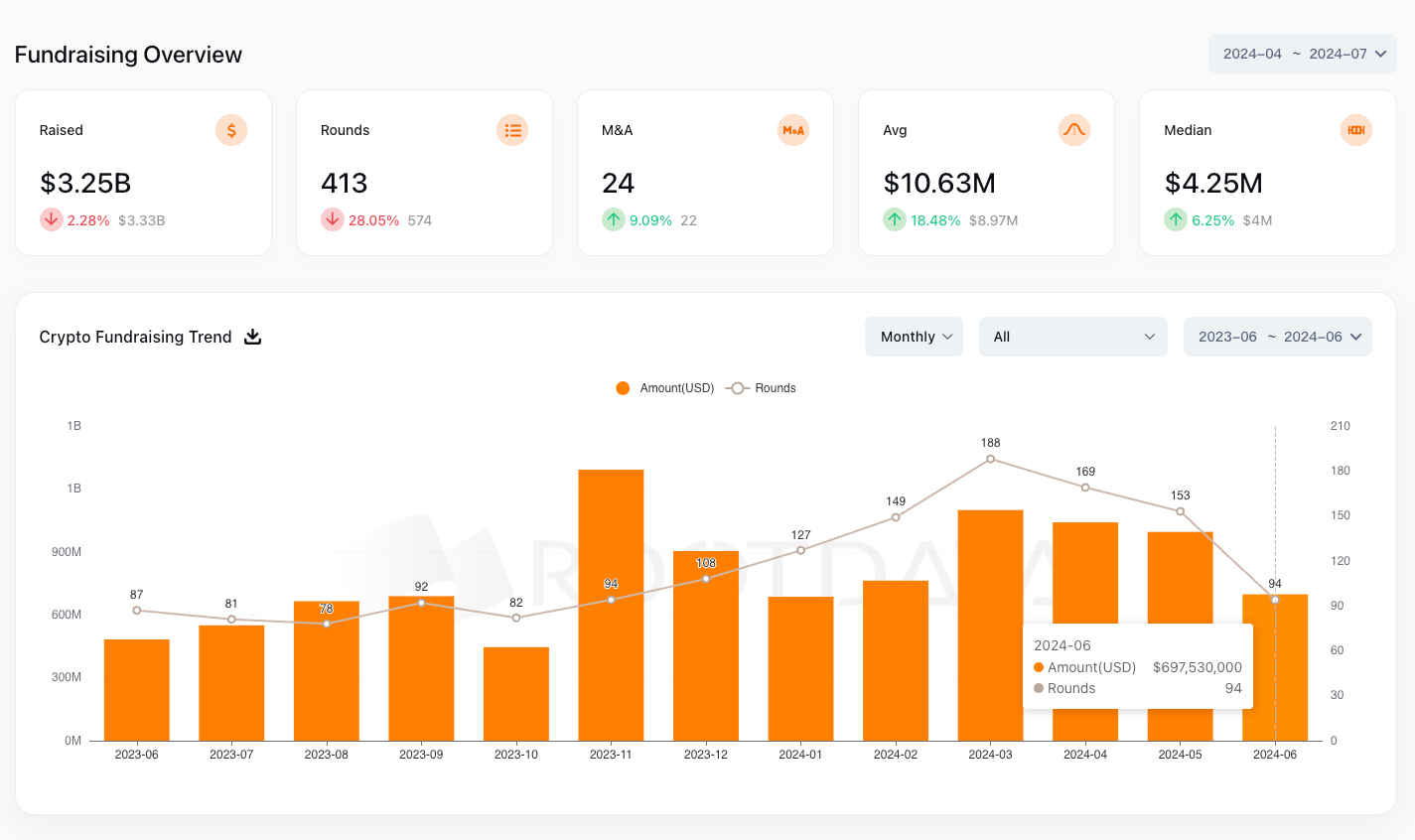

$697 million

The total VC investments in June 2024.

But, this is 30% less compared to May's $990 million.

But, June 2024 saw a 42% increase in total funding compared to June 2023.

Why the decline? Let’s say a maturing market with more selective investments.

Funding breakdown

DeFi: 20%

NFT/GameFi: 18%

L1/L2 Solutions: 11%

Tools & Wallets: 8%

AI: 9%

CeFi: 4%

Real-world Assets (RWA) & DePIN: 6%

Important investments

Robinhood's $200 million acquisition of Bitstamp.

GRIID (mining) secured a $155 million M&A deal.

Hut 8 (mining) received a $150 million strategic investment from Coatue to develop an AI infrastructure platform.

Avail (modular blockchain) and Conduit (rollup deployment platform) raised $43 million and $37 million, respectively.

For Altcoin investors: VCs might dump soon?

VCs are holding massive profits (over 1,100% in some cases) on a group of altcoins, including ENA, REZ, ONDO, DYM, SAGA, and TIA.

This high level of unrealised profit creates significant dump pressure.

VCs might sell their holdings soon, leading to price drops for these altcoins.

Robinhood Ramping Up Offerings

What are the recent moves by the financial services company - stock and crypto trading platform?

Crypto Futures on the Horizon: Is reportedly planning crypto futures contracts in the US and Europe.

To offer CME-based Bitcoin and Ether futures in the US, while leveraging Bitstamp's licenses for perpetual futures in Europe.

Robinhood's recent acquisition of Bitstamp positions them for this move, granting them necessary licenses and institutional reach.

First major foray into using AI: Has acquired Pluto, an AI-powered investment advisor.

Advanced data analysis using AI to identify trends and opportunities.

Personalised investment recommendations based on user profiles and goals.

Real-time insights and portfolio optimisation tools.

Expanding its reach: As of July 2nd, residents of Hawaii, Puerto Rico, and the US Virgin Islands can now join the Robinhood community.

This expansion comes due to a recent regulatory change in Hawaii that loosened restrictions on cryptocurrency services.

The Surfer 🏄

Bitcoin mining firm Genesis Digital Assets is considering a potential IPO in the US. The firm plans to launch a pre-IPO funding round in the coming weeks.

Hong Kong regulators will review crypto rules "as appropriate" in response to market developments. Finance secretary Christopher Hui says that requirements for cryptocurrency-related activities will be reviewed as the industry develops.

Bitget is in active discussions with India's Financial Intelligence Unit (FIU) to obtain licensing required for the Indian market. The registration will allow Bitget to comply with local laws, tax regulations, and maintain operational transparency.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋