Hello

Today, we are diving deep into Circle’s Q2 2025 earnings, its first after it did a blockbuster debut at Wall Street in early June.

TL;DR

Circle's first quarter as a public company delivered on the promise that boring businesses can scale

Revenue growth of 53% YoY, expanding adjusted margins, and a doubling USDC float more than offset IPO-related accounting noise

The regulated stablecoin play is working, but execution on Arc blockchain and defending against Tether's compliant version will determine if this 5x stock run has staying power

Investment Thesis: Circle has chosen the regulated, transparent, partner-heavy lane over Tether's offshore dominance. Q2 shows this strategy can deliver faster growth and institutional trust, with upcoming stablecoin legislation turning compliance from cost centre into moat.

Your Solution to Regulated Token Finance

Vision Chain is Bitpanda’s new Ethereum-based L2, built for tokenising real-world assets like stocks, commodities, and fiat in full compliance with European regulations BitpandaThe Daily Hodl.

It’s more than another rollup. It’s the foundation for real-world finance on-chain:

Fast, low-cost Ethereum Layer-2 with institutional-grade control

On-chain KYC and token-level policies for regulated issuance

Designed for banks, FinTechs, developers, asset managers and everyday users alike Bitpanda

If you think Web3 isn’t usable without structure, Vision Chain is here to prove otherwise.

👉See what true compliance on-chain looks like

Financial Performance & Adoption Metrics

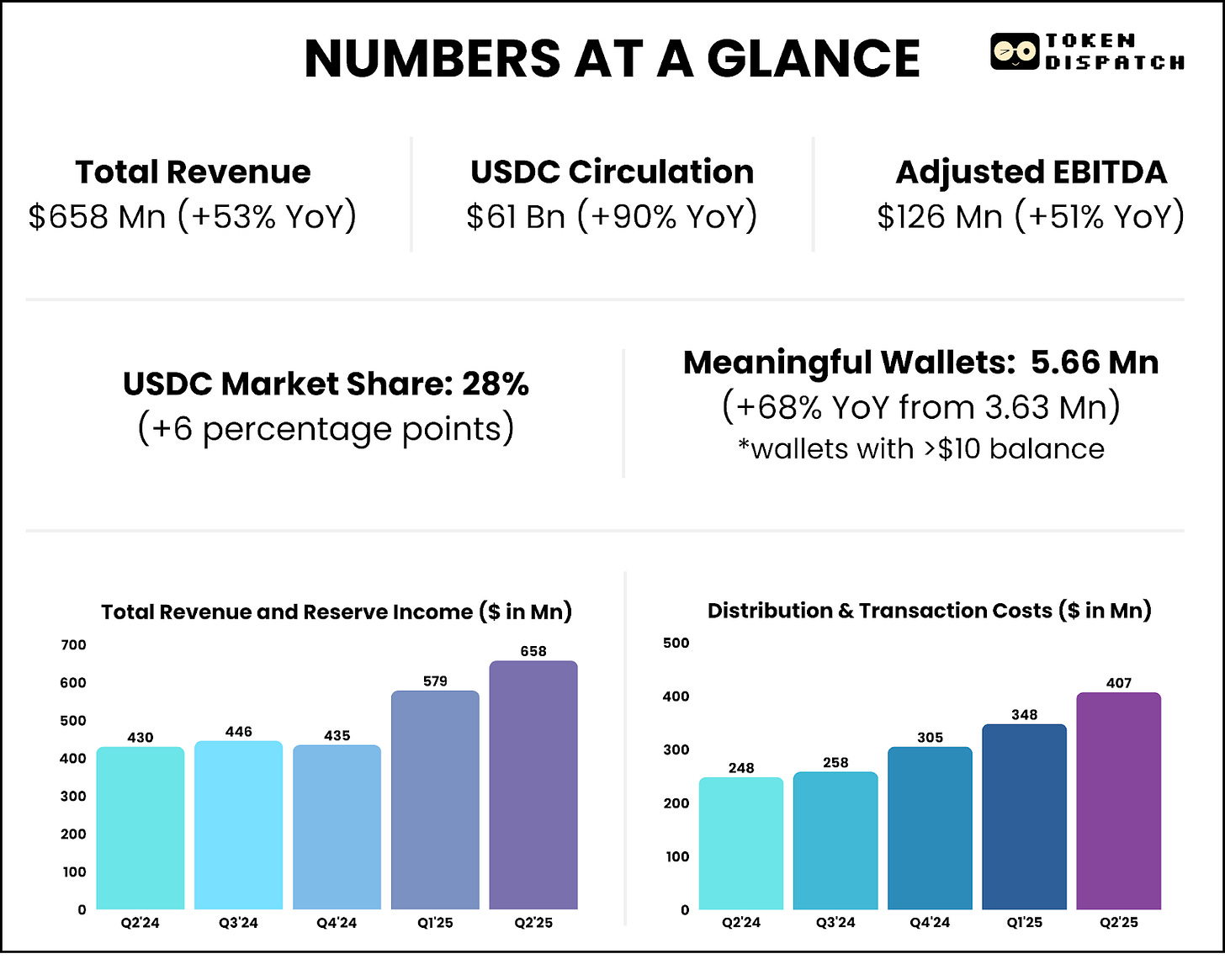

USDC issuer Circle on Tuesday reported a better-than-estimated revenue for the quarter ending June 30, 2025, the first quarter after its Wall Street debut on June 5. Its net revenue stood at $658 million in Q2, up 53% from the same quarter last year and better than the average revenue of $647.3 million estimated by analysts surveyed by Bloomberg.

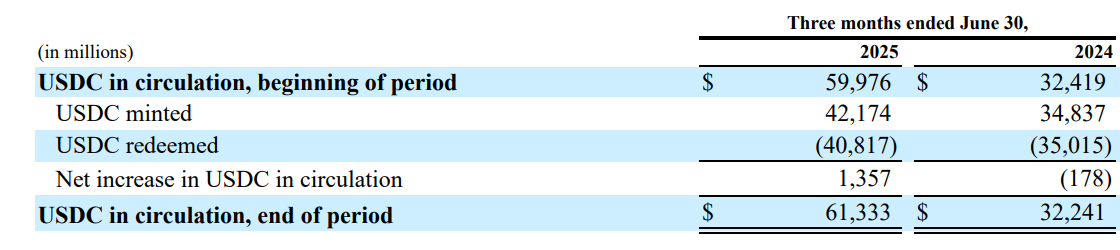

Even the average USDC in circulation during the quarter almost doubled to $61 billion from ~$32 billion in Q2 2024.

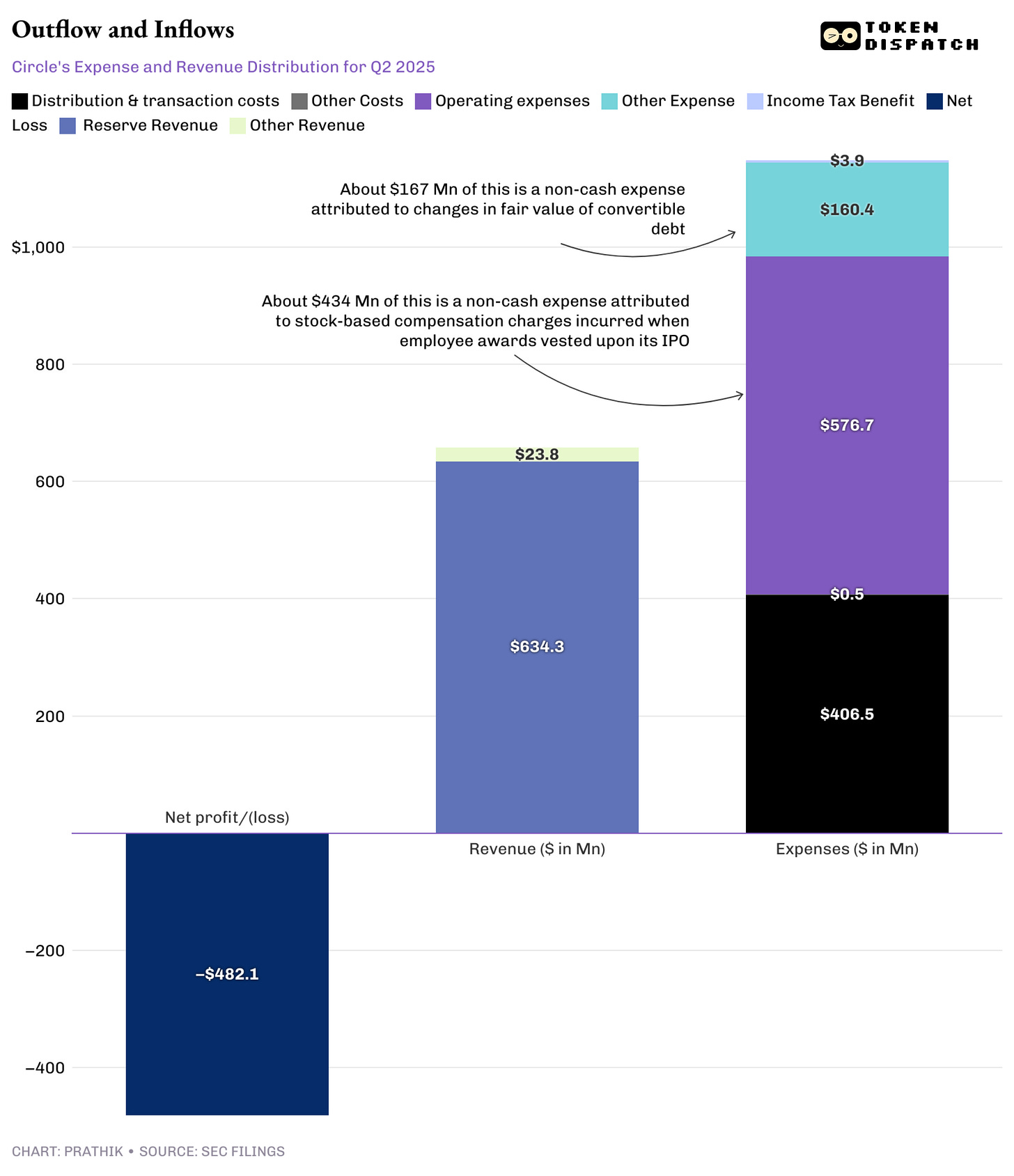

Circle earns the bulk of its revenue from interest on the US Treasury bills that back USDC. In Q2, reserves invested mainly in short-duration Treasuries contributed $634 million, about 96% of total revenue and reserve income, up ~47% year on year. The average reserve base was ~$61 billion at a 4.14% annualised reserve rate (vs 5.17% a year earlier), so the larger float more than offset lower yields.

Circle’s net earnings dropped to a net loss of $482.10 million from a net income of $32.92 million in the same period last year. What drove the bottom line into the red despite a 53% YoY growth in revenue? Primarily $434 million of stock-based compensation and a $167 million change in the fair value of convertible debt. Circle incurred stock-based compensation charges when employee awards vested upon its IPO.

When you exclude such non-cash expenses, what you arrive at is the performance of the core business, which then reflects strong profitability during the quarter.

Adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) then stands at ~$126 million, up 50% from last year’s Q2 adjusted EBITDA of $83 million.

Why exclude such one-time costs? Adjusted EBITDA is a key measure used by company management and board of directors to evaluate the performance of regular business operations and make like-for-like comparisons with previous periods where no such one-time costs were incurred.

Circle’s growing dominance in the stablecoin space also reflects its quarterly performance. USDC’s market share has climbed to ~28% in Q2 this year, up about six percentage points year over year.

Meaningful Wallets (MeW) across the USDC network also rose to 5.66 million in this quarter from 3.36 million last year. This metric shows the number of on-chain wallets holding at least $10, reflecting how wide USDC’s adoption has grown.

Distribution and transaction costs account for Circle’s largest single head expense category. That’s because USDC did not become the largest regulated stablecoin in the US by living only on Circle’s balance sheet. It spread by attaching itself to big storefronts (Coinbase chief among them), exchanges, wallets, fintechs, and, increasingly, payments companies.

Circle’s distribution and transaction costs rose 64.6% YoY to $406.47 million for the quarter, primarily driven by a $90.2 million increase in distribution costs paid to Coinbase as a combined result of increased reserve income and their on-platform balances. In Q2, USDC paid $332 million in distribution costs to Coinbase as the crypto exchange held 21% of the circulating USDC at quarter-end.

Circle’s contribution, or revenue-less-distribution, comes around $250 million with a ~38% margin.

Market Reaction

The market reaction captured both the excitement of the earnings and the news that followed.

Issued at $31 in June, the stock ripped as high as $298.99 in mid-July as investors priced in Circle’s forward revenue in its valuation amid a bullish stablecoin sentiment across the industry. Although the stock has corrected 50% from its peak after the first three weeks of euphoria cooled, it popped again after Q2 results in early trading hours, only to ease back after hours on the announcement of a follow-on offering: 10 million Class A shares, ~2 million primary (new capital for Circle) and ~8 million secondary (existing holders cashing out). For traders, it was also a cue to take some profits after a 5x run. For long-only funds, it meant more liquidity and a slightly broader public float.

What is Circle going to do with all these funds? The company wants to move beyond issuing just a stablecoin on somebody else’s chain; just hours after its results, it announced that it will be building rails of its own.

It will soon launch Arc, a public Layer-1 blockchain purpose-built for stablecoin finance. Arc’s idea is if most of your product’s value lives in speed, certainty and compliance, you build an environment tuned for those outcomes. Arc aims for high throughput and sub-second finality, with a built-in FX engine and Ethereum compatibility so developers don’t have to relearn everything.

Arc will use USDC as its native gas token with fees denominated in dollars, not volatile crypto, making costs predictable for merchants, fintechs and institutions. A testnet in the fall will be the first proof point. If Arc gains traction, it will most likely open another revenue stream for Circle by way of fees for facilitating regulated dollar flows.

Competition & Regulatory Environment

Circle’s largest competitor, Tether, continues to dominate global liquidity and, as a private company, capture a far larger share of reserve yield for itself. The USDT issuer reported $4.9 billion in Q2 net profit with over $127 billion in US Treasuries, more than double of Circle’s reserves.

Circle has chosen a different lane: regulated, transparent, partner-heavy. That means thinner take-rates but thicker trust, especially with institutions that have to explain it to their stakeholders why they hold a digital dollar. In Q2, that lane delivered faster growth, clearer economics and public-market visibility that the offshore market leader cannot offer.

For retail investors, that positioning reflects in the Q2 results. The fact that a business can grow revenue 50-plus percent with expanding adjusted margins, in a quarter that also absorbed IPO-related accounting charges, shows the operating leverage it enjoys in an environment that is expected to get even friendlier.

The US stablecoin law signed this summer effectively codified the rules Circle already lives by: 1:1 reserves, cash and T-bills, full segregation, frequent audits. The law turns compliance from a cost centre into a moat. Banks and payment processors who were hesitant now have a federal framework to point to.

Yet, there are caveats and ground to cover before Circle can begin threatening Tether’s dominance. If anything, Tether’s recent plans to launch a US-regulated stablecoin should throw more caution.

Read: The Outlaw Comes Onshore 🗽

Secondly, there’s the dependence on partners. Revenue-sharing got USDC distribution everywhere people already are; it also means your net take can drift if partners renegotiate.

Third, Arc’s execution risk. Arc will have to prove not just speed but institutional-grade privacy, compliance tooling, and integrations that make CFOs and risk committees comfortable.

Road Ahead

Near-term, expect Circle to favourably ride the three flywheels it can actually control. One: distribution. More corridors and enterprise on-ramps for Circle Payments Network (CPN), more simpler ways for banks, Payment Service Providers (PSPs) and treasury teams to hold and move USDC.

Two: developer experience. Gateway and Arc need to make cross-chain and on-chain UX so clean that payments builders stop thinking about bridges and focus on the utility.

Three: platform revenue. Q2’s ~3x jump in “other revenue” was off a small base, but it is the line item that would matter most if rates fell. Every dollar that comes from software & services (and soon from Arc’s fees) is a dollar less left at the mercy of the reserve rate curve.

For readers who just want one takeaway, here it is: Circle’s first quarter as a public company looked solid but predictable. The money coming in was mostly interest on safe assets. The money going out included big cheques to the partners who helped them grow. What was left, on an adjusted basis, was healthy profit and wider margins. The stock did the wild thing growth stocks do: it ran ahead of itself, took a breather when more shares hit the market, and found a new base. The forward story rests a lot on whether Circle can make dollars on the internet move as easily as tapping a card or doing Venmo. Q2 suggests that the USDC issuer can indeed achieve that, and that the market will reward it for doing the boring things at scale.

Institutions might want to ask some important questions. Does this stay a 50%-plus growth float business if rates slide? When rates fall, each dollar of USDC generates less revenue, meaning Circle needs increasing USDC circulation to maintain current revenue levels. Will Arc and the Payments Network work in synergy to provide Circle with an additional revenue stream? Circle might not have to answer all of that in one year. But it will have to factor in these questions if it has to remain as a reliable partner when Tether’s compliant version of USDT hits the market.

That’s all for Circle Q2 earnings’ coverage. We will be back with another one soon.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.