Cobie: The Long Trade 👨💻

Twelve years, one failed altcoin, and the least likely path to a $375 million exit.

In 2012, Jordan Fish, a.k.a Cobie had $200 and a problem.

He was a computer science student at the University of Bristol, working at Tesco to pay rent, and the general situation was... not great. The basic arithmetic of being a working-class kid at university is that you need money to live, but you also need time to study, and there are only 24 hours in a day. So he took his $200 and bought bitcoin.

This was the correct decision, obviously, but not in the way you think.

If Fish had simply held that bitcoin and never touched it, never traded it, never done anything interesting or stupid with it, he would have around $300,000 today. That is a genuinely life-changing amount of money for someone who started with $200. But it is not “crypto influencer who everyone assumes is a billionaire” money. It is not even “guy who sold a podcast NFT for $25 million” money.

The weird thing about Fish’s story is what happened between the $200 and the exit. Because the story that crypto wants to tell about itself is that you buy the magic internet money, you hold the magic internet money, the number goes up, and you become a billionaire. Fish’s actual story is more like: you buy the magic internet money, you try to make your own magic internet money, and it fails, you get a normal job, you come back to crypto, you build things, you expose fraud, you start a podcast, you pause the podcast after your sponsor implodes, you start a fundraising platform, and then Coinbase buys it for $375 million.

That is a much weirder story, and it suggests some uncomfortable things about how wealth actually gets created in crypto.

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

In 2014, Fish did what any 20-something crypto enthusiast would do when they had a little bit of bitcoin and a lot of conviction: he tried to build a better Bitcoin. This was the era when everyone was building a better Bitcoin. The pitch for Maxcoin was that it would be faster than Bitcoin and use a different hashing algorithm (Keccak instead of SHA-256), which somehow mattered to people at the time.

Fish partnered with Max Keiser, a financial broadcaster who is now the Bitcoin advisor to the President of El Salvador, which gives you a sense of both how seriously people took this and how little any of it mattered. Maxcoin launched with genuine enthusiasm. It was one of the first “celebrity coins,” which is funny because it predates the entire concept of a memecoin by about seven years.

And then it died.

When the 2015 bear market hit, Maxcoin’s price collapsed. The project disappeared. If you were trying to find evidence that Maxcoin ever existed, you would have to do actual research, because the market has completely forgotten about it.

But Fish didn’t forget about it. What he learned from Maxcoin’s failure was that crypto is not actually about technology. It is about memes, narratives, and community. You can build a technically superior product and it doesn’t matter if no one cares.

This is the kind of lesson that costs most people their entire portfolio. Fish somehow managed to extract it from a failed project and then spend the next decade proving it was true.

Making Money By Not Trying to Make Money

After Maxcoin, Fish did the sensible thing and got a normal job. He worked at various tech startups, including Monzo, which became one of the UK’s biggest fintech companies. He was doing product management, which is what you do when you understand how to build software products but don’t want to actually write code anymore.

And then, around 2020, he came back to crypto.

Not quietly, not tentatively, but right at the moment when DeFi was about to eat the world and everyone who had stayed through the previous bear market was about to look like a genius.

DeFi was exploding. NFTs were about to explode. Every narrative was converging at once. Fish became an early supporter of Lido Finance, a liquid staking protocol which is now the second largest DeFi protocol by total value locked. He wasn’t just an investor or an advisor; he was the guy who understood that Ethereum’s transition to proof-of-stake would create massive demand for liquid staking solutions.

In October 2020, Fish and another crypto analyst named Ledger launched a podcast called UpOnly. The format was to bring on the most influential people in crypto and have long, unscripted conversations about whatever was happening. They interviewed Vitalik Buterin. They interviewed Sam Bankman-Fried (before he went to prison). They interviewed basically everyone who mattered.

UpOnly became essential listening, which created a strange dynamic. Fish was now simultaneously a market commentator, a protocol advisor, an investor, and a media personality. When projects got mentioned on UpOnly, their prices moved. This is the kind of influence that normally requires an investment bank and a Material Non-Public Information (MNPI) disclosure policy.

He kept most of his money in bitcoin and Ether, took tiny positions in altcoins (under 1% of his portfolio), almost never used leverage, and treated everything as zero until proven otherwise. He says:

“I use leverage close to never and typically to reduce risk rather than to add risk, which I bet many people just don’t quite grasp. I have used it to add risk maybe three times in the last 5 years, maybe 15 times ever, and I never go all in on anything. I have only ever done that on bitcoin and Ethereum before in the last decade. When I buy other things, I limit my risk to tiny amounts because I treat it as zero until proving otherwise. So always under 1% of the liquid portfolio. The liquid portfolio is also a smaller percentage of the overall portfolio to future proof against my own mistakes.”

This is the opposite of what crypto influencers tell you to do. The standard crypto influencer advice is to use 5x leverage on a memecoin you heard about from an anonymous account, hold until you hit a 100x, and then buy a Lamborghini.

Fish’s approach worked, obviously, but it worked in a way that suggests the entire narrative of crypto wealth creation might be wrong.

The Watchdog Problem

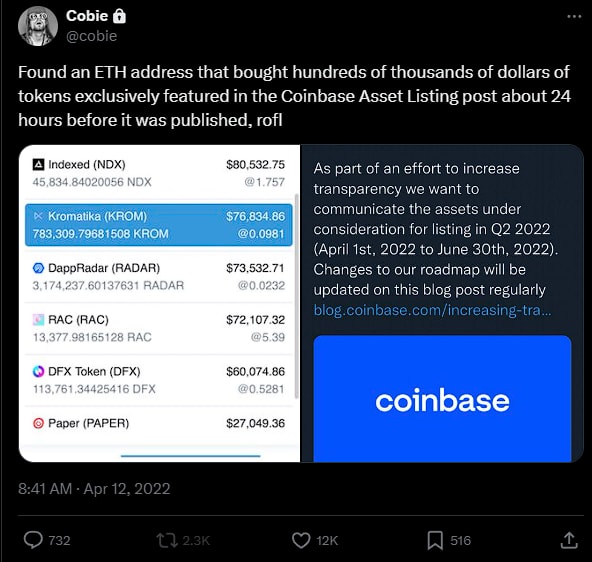

In 2022, Fish did something that probably cost him money but earned him a different kind of reputation. He published blockchain data showing suspicious trading activity connected to Coinbase employees. Specifically, someone appeared to be buying tokens right before Coinbase announced it would list them, which is textbook insider trading.

The SEC investigated. The DOJ prosecuted. A former Coinbase product manager named Ishan Wahi went to prison for two years.

This is the kind of thing that makes you a hero in the crypto community, but probably unemployable at most crypto companies. If you are a major exchange considering listing a new token, do you really want the guy who exposed insider trading at your competitor advising the project? It creates complications.

But Fish kept doing it. He kept calling out scams, kept questioning narratives, and kept being the person who said uncomfortable things in public.

In November 2022, FTX collapsed, and Fish had a problem. Actually, he had several problems.

The first problem was that UpOnly had taken sponsorship money from FTX. This was not a secret. Sam Bankman-Fried had appeared on the podcast. The FTX logo was on the show. When you watched old episodes, there it was, a monument to what seemed at the time like a legitimate exchange, but now looked like evidence of catastrophically bad judgment.

The second problem was that Fish had money on FTX when it collapsed. He said this publicly, which most people in his position would not have done. The standard move when you lose money in a spectacular fraud is to quietly absorb the loss and never mention it again. Fish mentioned it. He had funds on the exchange. Those funds were now gone.

The third problem was philosophical. Fish had spent years building a reputation as someone who could spot scams, call out bad actors, and generally serve as a voice of reason in an industry that frequently resembled a casino crossed with a Ponzi scheme. And yet, he had taken money from FTX and interviewed its founder, and apparently believed, like everyone else, that it was a real business.

How do you come back from that?

The answer turned out to be: you don’t, at least not right away. Fish and Ledger paused UpOnly. No announcement, no dramatic final episode, just silence. For nearly a year, one of crypto’s most visible personalities essentially disappeared. No podcast, minimal tweets, and no public appearances at conferences.

This was probably the correct decision, though it was definitely not the profitable one. The standard influencer playbook after a crisis is to come back immediately, apologise vaguely, promise to do better, and then continue doing exactly what you were doing before. The audience has a short memory. Sponsors want reach, not integrity. You can survive almost anything if you just keep posting.

When he came back, he came back with Echo.

The Exit That Makes No Sense

Echo launched in 2023 with the premise of letting normal people invest in early-stage crypto projects alongside venture capitalists. This was addressing a real problem. In crypto, there is a massive gap between what retail investors pay for tokens and what VCs pay. A VC might get into a project at a $10 million valuation. By the time retail can buy the token on an exchange, the valuation is $1 billion. The VC has already made a 100x. Retail is buying at the top.

Echo tried to close that gap by pooling retail capital and investing it in private rounds at VC terms. The platform facilitated over 300 deals and helped crypto projects raise roughly $200 million. This is not a trivial amount of money, but it is also not the kind of scale that normally commands a $375 million acquisition price.

And yet, in October 2025, Coinbase bought Echo for approximately $375 million.

The deal included another $25 million for the UpOnly NFT. This is a non-fungible token that, when burned, contractually obligates Fish and Ledger to produce eight new episodes. Think of it like exercising an option, except the underlying asset is two guys recording a podcast. Coinbase paid $25 million for what is essentially a very expensive mechanism to compel content creation.

This might be the first time in history that burning an NFT creates a legal obligation rather than destroying value.

But the Echo acquisition itself makes a kind of sense if you follow the logic. Coinbase is competing with Binance, which already has Binance Launchpad and other platforms that give retail investors access to early token sales. Coinbase doesn’t have that. Echo does have that. So Coinbase is buying the infrastructure and the brand and the community that Fish built over a decade of not trying to maximise his dollar earnings.

Here is how Fish described the outcome:

“When I started building Echo 2 years ago, I knew it had a 95% chance of failing. To be honest, I couldn’t really imagine any other outcome, but I thought that at least it might be a noble failure worth attempting. I certainly didn’t think Echo would be sold to Coinbase, but here we are.”

Probably the most honest description of a successful startup exit I have ever read.

What This Means for the Rest of Us

Fish’s story creates a problem for the standard crypto wealth narrative. The narrative is supposed to be: buy low, sell high, repeat until you’re a billionaire. Maybe throw in some 100x leverage trades if you are feeling adventurous. Fish didn’t do that. He bought Bitcoin with $200, made some small trades, built a failed altcoin, got a normal job, came back to crypto, supported good projects, exposed fraud, started a podcast, built a fundraising platform, and sold it to Coinbase.

That is a much longer and weirder path than “bought Dogecoin at $0.0001 and sold at $0.70.”

When people speculated that Fish was a billionaire, he wrote a long thread explaining that he wasn’t. His actual net worth, including the Echo exit and a decade of crypto holdings, is probably in the high nine figures. That is an enormous amount of money. But it took 12 years of grinding through multiple bear markets, surviving scams and frauds and exchange collapses, and consistently choosing not to maximise short-term profits.

Fish probably made more money by treating crypto as a place to build things than he would have made by treating it as a casino. And if that’s true, it suggests that most people are playing the wrong game.

Crypto Twitter doesn’t want to hear about getting rich in a decade. But that might be the only way it actually works.

That’s Cobie. See you again with another deep dive.

Until then, stay curious?

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.