Coinbase Exposes Docs on SEC's Internal Talks

The documents revealed regulators privately debated whether Ethereum was a security while publicly punishing crypto firms for regulatory non-compliance.

Coinbase published over 10,000 internal Security and Exchange Commission (SEC) documents obtained through Freedom of Information Act requests. The documents reveal a regulatory agency privately debating questions about cryptocurrency classification, even as it publicly pursued aggressive enforcement.

While the SEC demanded crypto companies to adhere to securities laws, behind closed doors, officials couldn't decide whether Ethereum (ETH) and XRP should be regulated as securities at all.

It was in June 2023 that the New York Attorney General’s office appealed to the SEC to treat Ethereum as a security, hoping it would back its case against KuCoin.

"We would like to request that the SEC file an amicus in support of the argument that Ether is a security, I think it would be beneficial to investor protection to get a court to hold that Ether is a security," wrote Shamiso Maswoswe, New York's Investor Protection Bureau Chief.

The SEC apparently declined, despite then-Chair Gary Gensler's public implications that most cryptocurrencies should be classified as securities.

This request came during New York's prosecution of KuCoin, which ultimately resulted in a $22 million settlement in December 2023. The exchange was forced to exit New York entirely.

Read: Heat On For KuCoin 🌡️

The documents also reveal the SEC's internal uncertainty about XRP, despite launching a high-profile enforcement action against Ripple in 2020 that dragged on for years.

"Could we ask him to opine on what risks to the XRP blockchain would or might materialise if Ripple 'walked away' or 'disappeared'?" SEC officials debated in a 2021 email.

This question strikes at the heart of the Howey Test that determines whether something is a security, yet the SEC was still asking it internally after bringing its case.

When the SEC later expressed concerns about Ripple's planned Liquidity Hub launch, Ripple responded bluntly in December 2021: "There is no requirement or obligation for Ripple to consult with the SEC over how to conduct its business."

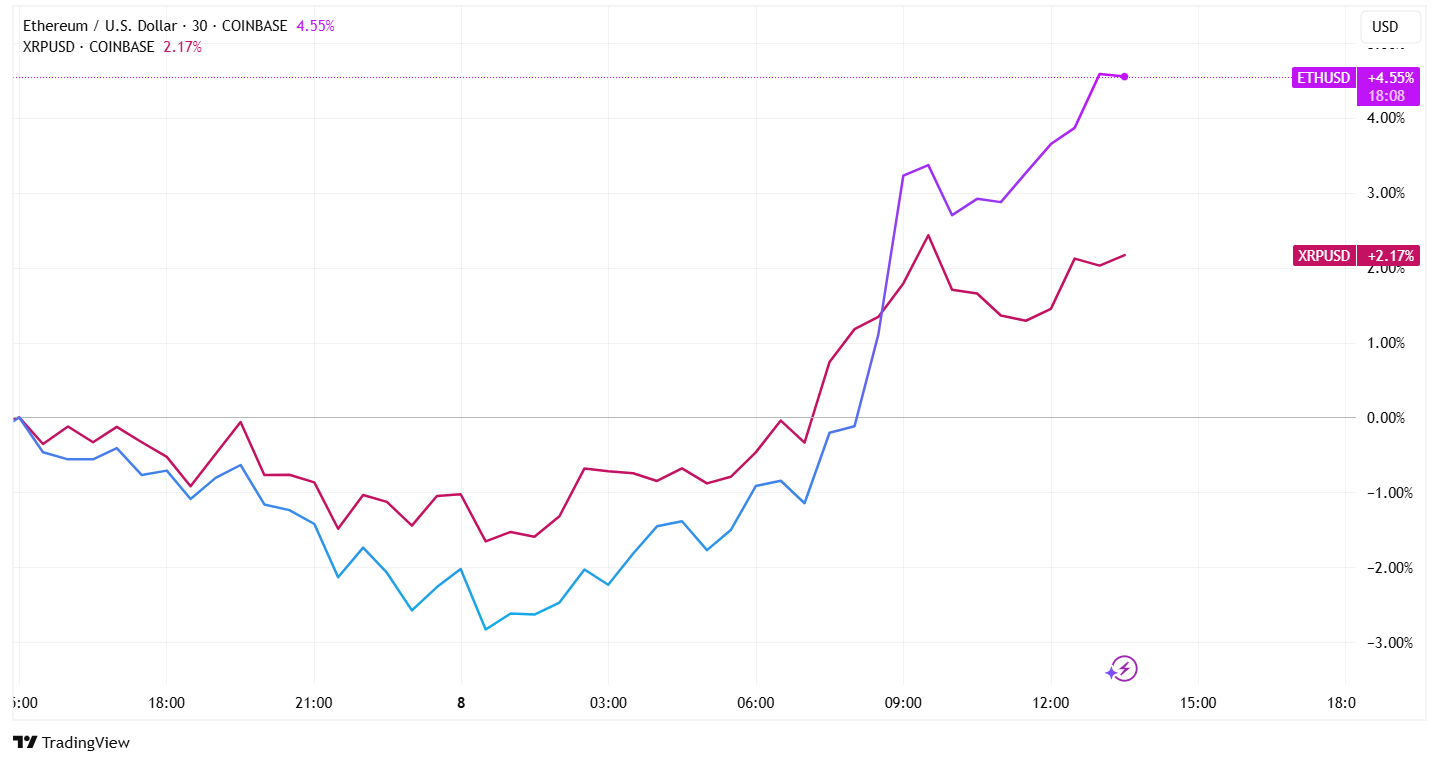

The crypto market responded with modest gains following the document release.

ETH rose more than 4% and XRP climbed 2%+ on Wednesday, suggesting investors view these revelations as confirmation of what many already suspected.

The SEC is undergoing a transition under Chair Paul Atkins, appointed by US President Donald Trump. The agency has dropped enforcement actions against Coinbase, Kraken, Ripple and many others in a shift from the previous administration's approach.

These documents will likely accelerate the push for Congress to establish a clear regulatory framework for digital assets rather than relying on enforcement actions based on decades-old securities laws.

These documents expose not just regulatory confusion but an unacceptable regulatory asymmetry: certainty in enforcement, uncertainty in classification.