Coinbase Rides the Wave Up ⬆️

Coinbase records a bumper 2023 Q4. MicroStrategy closing in on S&P 500 entry? $1.9 billion in crypto funding in Q4 2023. Ethereum traders snap up $120 million looping. BTC & ETH immune to 51% attacks.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

Them WWE cards. Nostalgic👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

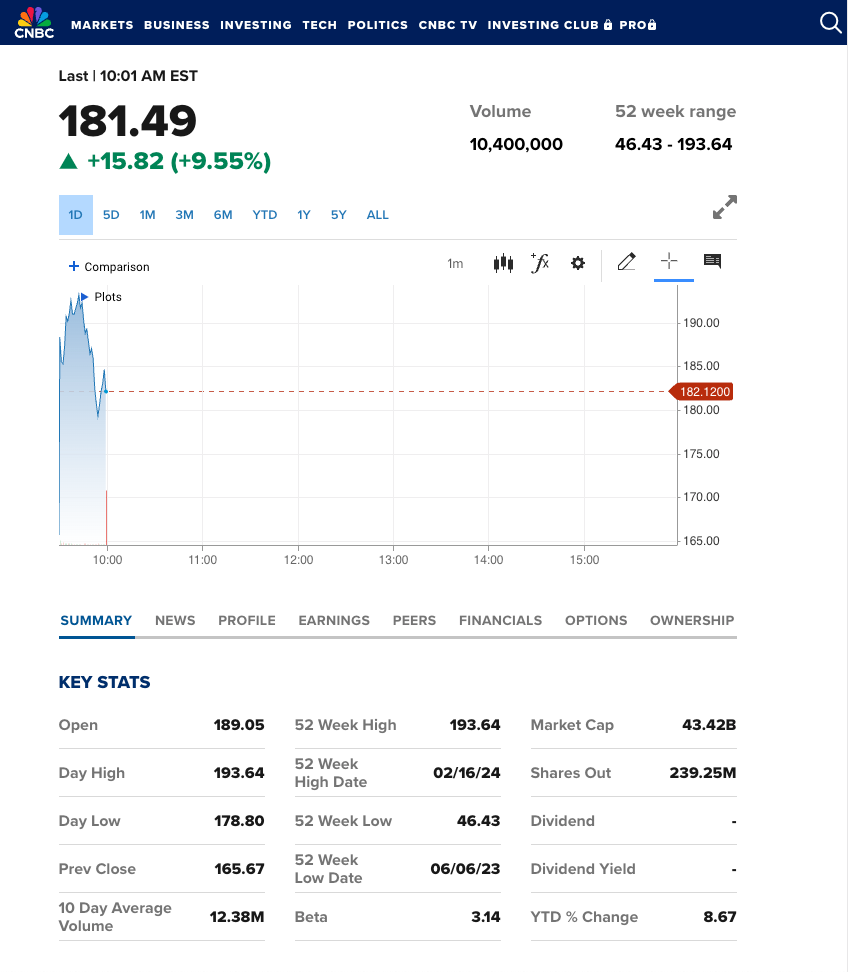

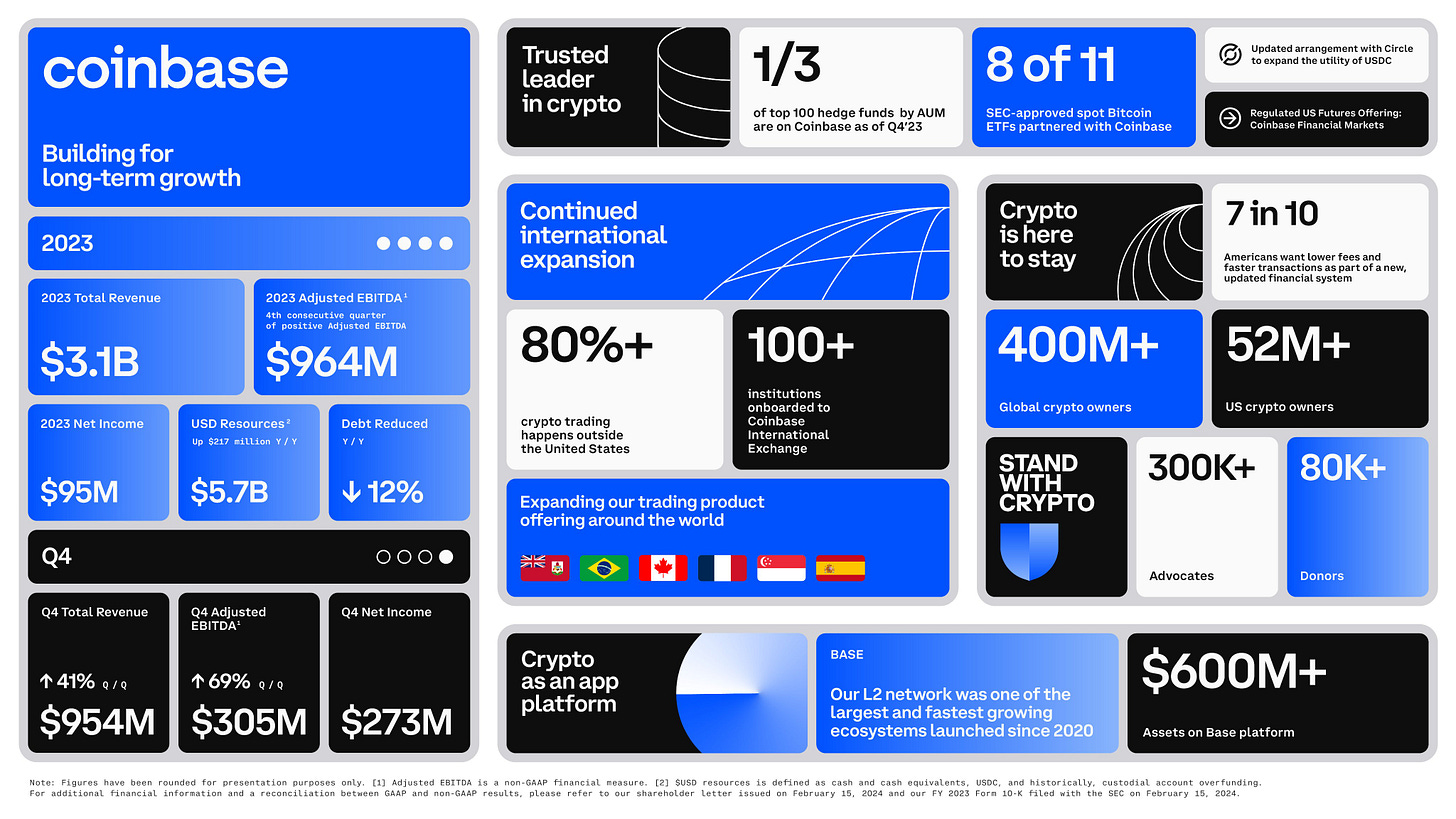

America’s biggest cryptocurrency exchange - Coinbase - hits it big in the final quarter of 2023.

The result, the stock hit a high of $193.6, close to 20% higher in the last couple of trading sessions.

Strong Revenue Growth

41% increase in total revenue: Coinbase saw a significant revenue jump to $954 million, compared to the previous quarter.

83% surge in transaction revenue: Trading activity boomed, driving transaction revenue to $529 million.

164% growth in consumer trading volume: Retail investors were highly active, pushing consumer trading volume to $29 billion.

92% increase in institutional trading volume: Large investors also participated heavily, with institutional trading volume reaching $125 billion.

Profitability Achieved

First positive quarter in 2023: Coinbase reported a net income of $273 million, marking a return to profitability.

69% increase in adjusted EBITDA: The company's adjusted EBITDA reached $305 million, highlighting improved financial health.

Fourth consecutive quarter of positive adjusted EBITDA: This achievement indicates sustainable profitability amidst market fluctuations.

Subscription and Services on the Rise

12% growth in subscription and services revenue: This segment, encompassing stablecoins, custodial fees, and interest income, reached $375 million.

Diversification beyond trading: This revenue stream provides stability and lessens reliance on volatile trading activity.

Market Rebound Impact

Bitcoin price surge: The price of bitcoin increased over 50% during the quarter, fuelling trading activity and revenue growth.

Approval of Bitcoin ETFs: Anticipation of and eventual approval of Bitcoin ETFs further boosted market sentiment and trading volume.

Cathie keeps offloading

ARK Invest sold $34.3 million in shares of the crypto exchange from three of its funds—ARK Innovation ETF (ARKK); ARK Fintech Innovation ETF (ARKF); and ARK Next Generation Internet ETF (ARKW), a Thursday filing showed.

MicroStrategy Nears S&P 500 Entry ⚛️

MicroStrategy's share price surge brings its market cap closer to the $15.8 billion requirement for S&P 500 entry.

MicroStrategy's Unique Position in Bitcoin Investment Landscape

Historically marketed as a "Bitcoin ETF with perks," offering cash flow and capital leveraging capabilities.

Inclusion in S&P 500 could significantly increase access to Bitcoin exposure for passive investors.

MicroStrategy's Bitcoin Holdings Top $10 Billion

MicroStrategy's 190,000 Bitcoin are now worth over $10 billion.

Bitcoin price climbed to nearly $53,000, pushing holdings above $10 billion mark.

Company recently acquired additional 850 Bitcoin for $37.2 million.

Bitcoin price fluctuated in January amidst launch of several spot Bitcoin ETFs.

Eligibility Hurdles Remain for MicroStrategy

Beyond market cap, S&P 500 requires U.S. domicile, sufficient liquidity, and four quarters of profitability.

Coinbase, with a higher market cap, remains excluded due to profitability concerns.

Bitcoin ETFs are also ineligible for the index.

Analysts caution against using MSTR as a pure Bitcoin play due to company-specific factors.

Crypto Funding Rebounds 💸

According to PitchBook’s latest Emerging Tech Research, crypto funding hit $1.9 billion across 326 deals in Q4 2023. It marks the first time that venture VC investments in crypto startups have risen since the March quarter of 2022.

Key details

Venture funding for crypto startups is back: $1.9 billion invested in Q4 2023, a 2.5% increase from Q3.

End of the "crypto winter"? Rising crypto asset prices and public market valuations fuel investor interest.

Strongest startups attract capital: While deal count declined, fewer companies secure larger investments.

Financial institutions enter the scene: Bitcoin ETFs launch and institutional money paves the way for growth.

Rising crypto asset prices: Bitcoin doubled in value year-over-year.

Public market gains: Crypto companies like Coinbase, Marathon Digital , and MicroStrategy saw significant stock price increases.

Notable Q4 2023 Crypto Fundraises

Wormhole: $225 million at $2.5 billion valuation (open-source blockchain development platform)

Swan Bitcoin: $165 million (crypto exchange)

Blockchain.com: $100 million (crypto exchange)

Together.ai: $102.5 million at $463.5 million valuation (decentralised cloud platform).

Where’s ETF?🚨

An estimated 71% of new Bitcoin investments come from the 10 spot Bitcoin exchange-traded funds (ETFs) that were approved in the United States on Jan. 11, report by on-chain data analytics firm CryptoQuant.👇

In the Numbers 🔢

$120 million

A pair of high-value Ethereum traders are up nearly $120 million, according to DL News’ analysis.

What do we know?

Two wallet addresses, 0x28 and 0x74, hold over 1.1 million in Ether and staked Ether derivatives — worth $3 billion.

Used lending protocols to increase their exposure to Ether. Deposited in a handful of lending protocols like MakerDAO, Spark, Morpho and Compound.

The identities of wallet owners not known publicly.

Wallets caught attention in 2022 for nearly being liquidated for $600 million worth of Ether.

What is Looping?

Looping is a strategy that allows traders to multiply their capital by borrowing and lending assets.

Deposit an asset into a lending protocol.

Borrow a different asset.

Swap the borrowed asset for the original asset.

Redeposit the original asset into the lending protocol.

Allows traders to multiply their capital by a factor of 3-5 times.

This creates a loop where the trader's capital is multiplied by the difference between the interest rate earned on the deposited asset and the interest rate paid on the borrowed asset.

How the Traders Made $120 Million

The two traders used leverage range of 1-2x, meaning they borrowed no more than twice the amount of capital they deposited. They were able to make a profit because the price of Ether went up.

Bitcoin & Ethereum Immune to 51% Attacks 🧿

New research from Coin Metrics suggests It is no longer viable for nation-states to destroy the Bitcoin and Ethereum network via 51% attacks due to the astronomical costs required to do so.

The Key Points

What is a 51% attack? In Proof-of-Work (PoW) blockchains like Bitcoin and Ethereum (before its upcoming switch to Proof-of-Stake), a malicious actor who controls over 51% of the mining power can disrupt the network in various ways, potentially reversing transactions or preventing new ones.

Why were nation-states considered a threat? Nation-states with vast resources were previously seen as potential actors capable of launching such attacks.

Coin Metrics' findings: The research revealed that the hashrate (mining power) of both Bitcoin and Ethereum has grown significantly, making it prohibitively expensive for any single entity, even a nation-state, to acquire enough mining power to launch a successful 51% attack.

The estimated cost: For Bitcoin is in the tens of billions of dollars, while for Ethereum, it's even higher.

Implications: This news provides reassurance to investors and users of Bitcoin and Ethereum, suggesting their networks are more secure than previously thought against large-scale attacks.

The Surfer 🏄

Sky Mavis reduces Ronin DEX liquidity rewards by 50% to save $5.72 million in expenses due to the surge in RON token prices.

The UK Financial Conduct Authority (FCA) is cracking down on cryptocurrency advertisements, issuing warnings to 450 crypto firms for violating advertising rules and banning one firm indefinitely.

Ethiopia teams up with a Hong Kong company to build a $250 million data centre, potentially opening the door to state-backed crypto mining.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋