Coins of War: Crypto's role in Russia's War

Crypto and the art of modern warfare. Are cryptos really dangerous? Tim thinks so. FTX sinks Galos Capital. Hong Kong wants retailers to trade cryptos. Have you banked profits on Bitcoin? Tell.

Hello y'all. This is The Token Dispatch. What makes a great work day? Good news, bad news or no news. Ain't no easy answer for this one. We've got to do what we've got to do. Dispatched tryana figure out how does one measure crypto profits? Cashing out and banking it in fiat? Does that even make sense for the purists? Banks + Crypto, it's a tough scene.

The ongoing conflict between Russia and Ukraine has put cryptocurrencies to the test. People on both sides are using cryptocurrencies to raise money for their armies, and it's actually proving to be a pretty effective way to get funding in the middle of a real-world conflict.

💰 💣 Crypto Fuelling the Conflict

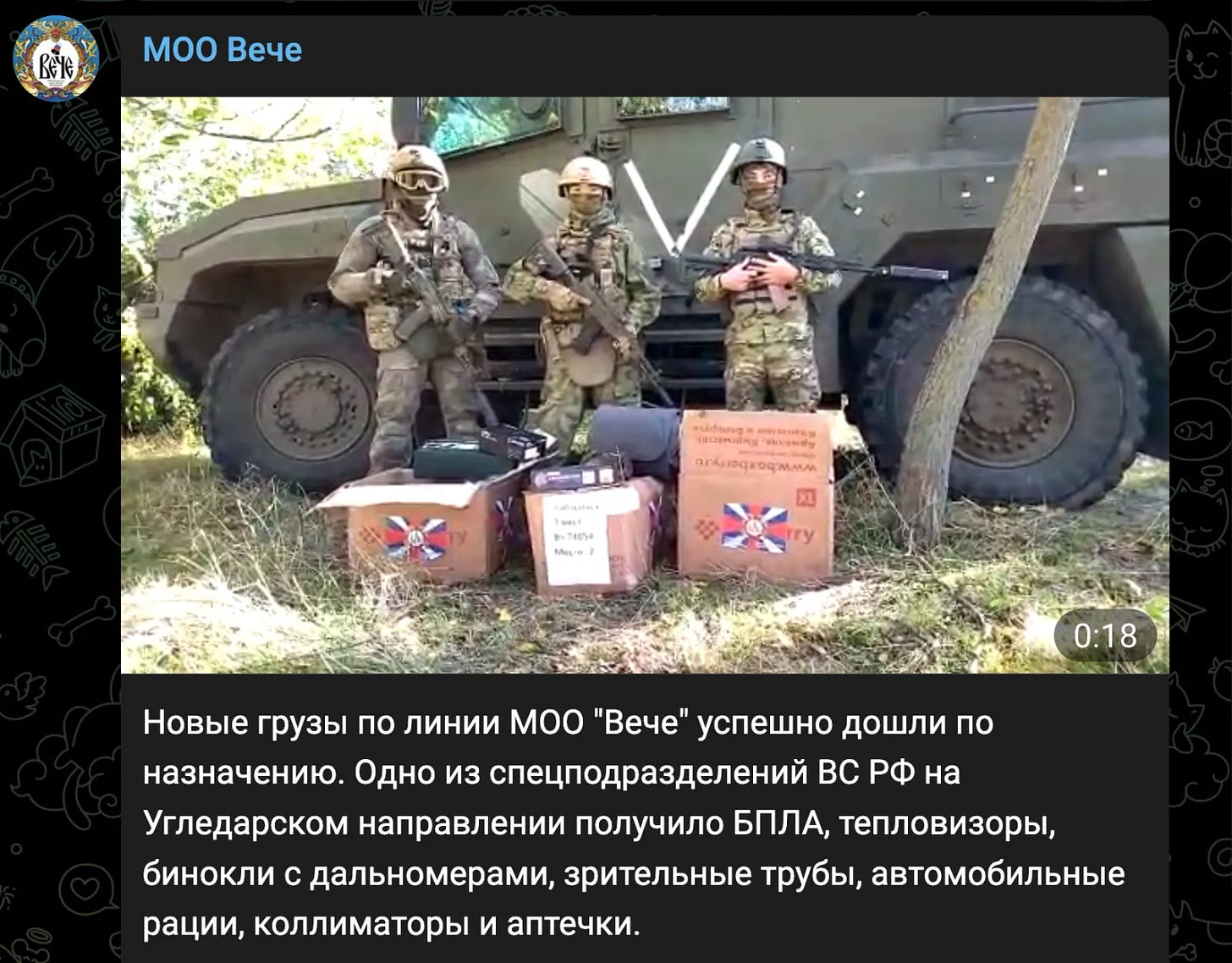

Some Russian pro-war groups and influencers are turning to cryptocurrencies to raise funds for the struggling Russian army in Ukraine. They're using Crypto to supply the army with everything they need, from ammunition and armour to surveillance drones and warm clothing.

Even though there are international sanctions on Russia for its invasion of Ukraine, these groups have managed to raise huge millions in cryptocurrency. But wait, here's the kicker: a significant part of the raised went to centralised exchanges, including Russian exchanges Garantex and Bitzlato, both suspected of processing large amounts of criminal funds. Not cool.

Who are the NACCs?

The Novorossia Aid Coordinating Center (NACC) is one of the organizations in Russia that raised at least $1.8 million in Crypto to supply the Russian army in Ukraine.

NACC has been using Crypto for donations since 2014 and added more cryptocurrency options, including Ethereum (ETH) and Tether (USDT) wallets after the war started. And they're not alone. Russian army sympathisers are donating Crypto from all over the world, including Europe, Australia, and the U.S.

🤔 How do they avoid getting their Crypto blocked by exchanges, you ask? NACC long ago figured out ways to do this, but Ukrainian volunteers are out there looking for wallets raising funds for the Russian troops, reporting them, and trying to get the money frozen. Sometimes, they succeed.

🤑 The Largest Beneficiaries

So who are the largest beneficiaries of this crypto-fueled fundraising frenzy? Rusich, a pro-Russian military movement, has raised over $240,000 via the blockchain, while blogger Vladimir Romanov has received around $177,000. These guys are really cashing in.

🚫 🕵️♀️ Tracking the Donations

Ukrainian startup HAPI is developing decentralised anti-money laundering (AML) tools to crack down on scam-related cryptocurrency wallets and has focused on Russia-related wallets since last summer.

Exchanges like Binance, Huobi, and Kucoin have been used to raise funds, and they've frozen accounts when they can. Binance, Chainalysis, Elliptic, and TRM Labs have all tracked donations to the Russian war effort, which often begin with public posts on Telegram. Despite the ability to trace these funds, freezing or blocking them has proven difficult. The speed of blockchain transactions and tricks like darknet sources make it difficult to stop the money flows. The amount of money raised is estimated to be around $7.2 million, and the U.S. and EU have been trying to stop the crypto flows. Good luck with that.

KYC/AML systems in place don't work for Crypto, making it difficult to stop the money flows. But Ukrainian start-up HAPI is developing decentralised anti-money laundering (AML) tools to crack down on scam-related cryptocurrency wallets and has focused on Russia-related wallets since last summer. Let's hope they succeed in cleaning up this mess.

💪The Takeaway

Despite the risks and challenges, crypto fundraising is becoming increasingly popular in times of war and conflict. The Russia-Ukraine conflict has revealed the potential of cryptocurrencies for fundraising in military conflicts. The Ukrainian government has raised over $100 million in crypto donations, while pro-Ukraine crypto fundraising groups have turned to novel crypto instruments such as decentralised autonomous organisations (DAOs).

TTD Blockquote 🔊

The inventor of the internet, the world wide web.

“It’s only speculative. Obviously, that’s really dangerous. Investing in certain things, which is purely speculative, isn’t what, where I want to spend my time”

Tim Berners-Lee 😲

The CTO of Inrupt. He who turned the original code of the World Wide Web into a NFT and sold it for a whopping $5.4 million. Yes Tim, we hear you.

“Blockchain protocols may be good for some things but they’re not good for Solid … Too slow, too expensive and too public … Personal data stores have to be fast, cheap and private. It’s a real shame in fact that the actual Web3 name was taken by Ethereum folks for the stuff that they’re doing with blockchain. In fact, Web3 is not the web at all."

Berners-Lee told CNBC’s Beyond The Valley podcast. Okay Tim.

China backs Hong Kong's Crypto push🐼

Hong Kong's Securities and Futures Commission (SFC) is mulling the possibility of allowing retail investors to trade cryptocurrencies once again. If this proposal goes through, it could mean big changes for the crypto landscape in Hong Kong.

The SFC has published a consultation paper outlining its proposed rules for virtual asset trading platforms, which includes the potential for licensed platforms to serve retail investors. But before you go all in on trading crypto, there are several criteria that must be met first. The SFC will require knowledge and risk assessments, as well as investor protection measures to be put in place. Additionally, only "large-cap virtual assets" will be eligible for listing.

Interested parties have until March 31, 2023, to weigh in on the proposal. If all goes as planned, the regime will come into effect on June 1, 2023. It's worth noting that this isn't the first time the SFC has allowed retail traders to trade crypto. Last year, it permitted traders to engage in derivative products and crypto exchange-traded funds (ETFs).

All This Backed by Beijing?

In October, Hong Kong opened its doors to crypto businesses in an effort to boost its financial hub. Now, there are rumblings that the push has the backing of Beijing. Representatives from China's Liaison Office have been spotted at the city's cryptocurrency gatherings, and many Chinese crypto entrepreneurs are reportedly planning their return to the territory. However, it's important to note that Beijing has not relaxed its own ban on crypto. Instead, it's allowing Hong Kong to explore its own pursuit of the crypto market. Despite the challenges facing the industry, Hong Kong is doubling down on its pro-crypto stance.

Did you make any profit on Bitcoin? 🤔

Looks like buying Bitcoin wasn't as sweet as expected for most retail investors! According to a recent report from the Bank for International Settlements, while sophisticated investors in the crypto market made a killing over the last seven years, regular folks who hopped on the Bitcoin train after 2015 didn't fare so well.

The report showed that many crypto app users in various economies made losses on their Bitcoin holdings, especially after the Terra crypto project and digital asset exchange FTX went bust. To add salt to the wound, it seems the big shots tend to sell their coins before a massive price drop, while smaller investors are still buying. Yikes! This report emphasizes the need for better protection for all investors in the crypto world.

Pay us in crypto #please🧧

Crypto Takes the Lead as a Payment Method for Remote Workers in Latam - According to the latest Deel Lab for Global Employment report, the majority of remote workers in Latin America prefer to be paid in cryptocurrency. The reasons behind the finding are said to be diverse, but include the instability of some of the local fiat currencies, and the influence of high levels of inflation in the region.

The region's use of cryptocurrency for payments increased from 61% to 64% in 2022, more than doubling the usage of these tools seen in the second region, EMEA, which was 27%. Despite the recent drop in cryptocurrency prices, receiving payments in cryptocurrency allows workers in Latam to easily transfer this liquidity into non-fiat-based saving assets or more profitable options.

Lure. Shutdown. Cashback. Withdrawal. FTX sort of day🥴

💷 The cashback: Sam Bankman Fried, the generous man, donated over $45 million to the Democratic Party in the US during the 2021-2022 election cycle. But it seems like the politicians who received the donations aren't feeling as generous. They've only promised to return a tiny fraction of the amount - just 2.2% or $1 million.

The Democratic National Committee (DNC) has agreed to return $850,000 to FTX, but that's not enough for FTX's new CEO John Ray III. He's asked for the money to be returned to the bankruptcy estate, and the politicians who received the donations have received some friendly reminders to return the funds by February 28th.

👀 The lure: FTX allegedly promised high earnings to African university students who successfully recruited fellow learners to the platform, according to a report by Africa Bitcoin News. Then many of the students were reportedly lost money when it collapsed in 2022. Not shocked!

💰 The withdrawal: FTX Japan finally lets customers withdraw their money after a long wait. The withdrawal process will be facilitated through Liquid Japan, which was purchased by FTX last spring. Customers who are eligible to withdraw their funds have already been notified via email and must create an account with Liquid Japan and confirm their existing balance.

🚪 The shutdown: Galois Capital, one of the world's largest crypto-focused quantitative funds, has announced its closure because of FTX. The fund reported having $40 million stuck at FTX in November, and its founder warned investors that it could take years to recover some of the funds. Apparently Galois sold its bankruptcy claims for 16 cents on the dollar and will return the remaining funds to its investors.

TTD NFT Buzz 📯

Multidisciplinary artist and painter Danny Cole launched the Creature World Fashion Label at this year's New York Fashion Week. The collection sold as Phygital NFTs, is gender-neutral and for universal wear and highlight the joyous and whimsical spirit of the world.

Ripple’s Creator fund Invests $250M in the Future of Phygital NFTs, to further innovate asset tokenization. Meet the Creator Fund wave 3 recipients.

Every time you sneaking in them Cadbury gems, remember this - Cadbury Gems has unveiled artwork-based NFTs, and every time they are re-sold, a portion of the proceeds is donated to the NGO, Save the Children in India.

Twelve institutions join Web 3.0 fellowship—including Musée d'Orsay and Vienna's Belvedere Museum— the programme is designed to mentor museums in the ways of the decentralised third generation of the Web that is home to blockchain, cryptocurrencies and NFTs

TTD Surfer🏄

A developer has adapted the Ordinals project for rival proof-of-work blockchain Litecoin, as Bitcoin Inscriptions surpass 154k.

Saudi Aramco, the near $2 trillion worth sSaudi Arabian Oil Group, has signed a memorandum of understanding (MoU) with droppGroup to build web3 tech.

Tencent and Bytedance, two Chinese tech giants, are planning to execute a significant number of job cuts in their metaverse divisions.

The Bank of Zambia and the country’s securities regulators are currently testing the technology to regulate cryptocurrencies.

Norwegian authorities seized $5.9 million worth krone in stolen crypto as part of an investigation into last year’s attack on Sky Mavis and its game Axie Infinity.

If you like us, do tell us. If you don't like us, still tell us. ✌️

Finally, after you done reading and telling, don't forget to share with everyone you love. Each one in your little, big world can sign up here. 🤟

So long. OKAY? ✋