Comeback Kid 🔥

Solana's back like a phoenix rising from FTX's ashes. CryptoPunks get physical, ATP serves up NFT poster slam and Atari's members only jacket. SafeMoon's execs in big trouble.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

What are we feeling?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

The Solana (SOL) blockchain, once left for dead after the cataclysmic collapse of FTX, has now staged a stunning resurgence.

80% rally over the last month, with a particularly fiery 24% leap in just a day.

Upon breaking out from the key $28 resistance level - which stood strong since November 2022's downturn - SOL has soared to new heights, hitting $39.36.

Now, what is fuelling Solana's good days?

Short Squeeze or Underdog's Revenge?

Analysts are chirping about a "classic short squeeze," a rapid market move where investors who bet against a stock or, in this case, a crypto, scramble to cover their positions as prices rise.

But Solana's surge seems to be whispering a different story—one of a tenacious underdog snapping at Ethereum's heels.

Remember the "Soylana Manlets"?

Those who held SOL through thick and thin are having the last laugh as the narrative shifts.

It's no longer just a question of surviving Ethereum's shadow. Solana is vying for the throne, touting a faster, more scalable, and cheaper platform.

Solana's Endurance Post-FTX Crisis

Post-FTX collapse, Solana's entanglement with the failed exchange led many to write it off.

Despite these adversities, including a hit to its treasury and SOL's price, the ecosystem has displayed resilience.

This is in part due to the robust support from its developer community, which continued to grow despite the challenges.

Developer Interest

A burgeoning developer base is a vital sign of a healthy blockchain ecosystem. With Solana's developer numbers surging by 40%, it's a strong indicator of its potential for sustainability and innovation, which in turn attracts investor attention.

Solana’s architecture, aimed at being a viable alternative to Ethereum, offers developers a platform for creating decentralised applications with greater efficiency and lower costs.

Bullish Predictions

Adding to the optimism, forecasts from asset management firms like VanEck anticipate a staggering potential for Solana, with predictions of up to a 10,600% price increase in future years.

The Elliott Wave theory, which analyses investor psychology and price patterns, presents a bullish case for SOL.

If the current wave count holds, Solana might be in the early stages of a strong upward wave, pointing to possible targets at $59-$63 and even $79-$83.

Despite the bullish outlook, investors should keep an eye on the critical $32.30 level.

A dip below this could invalidate the positive Elliott Wave scenario and potentially lead to a significant correction towards the $23 support zone.

Solana's growth has been significant, nearly quadrupling since December 2022

Strategic Collaborations and Developments

MakerDAO's Interest: MakerDAO, one of the oldest decentralised autonomous organisations, is considering Solana for its Endgame Plan, a scheme to revamp its governance and tokenomics.

Solflare and MetaMask Integration: Solana announced the launch of its wallet, Solflare, on MetaMask Snaps, facilitating direct management of SOL and NFTs via MetaMask, along with access to Solana's dApps.

Market Perspective

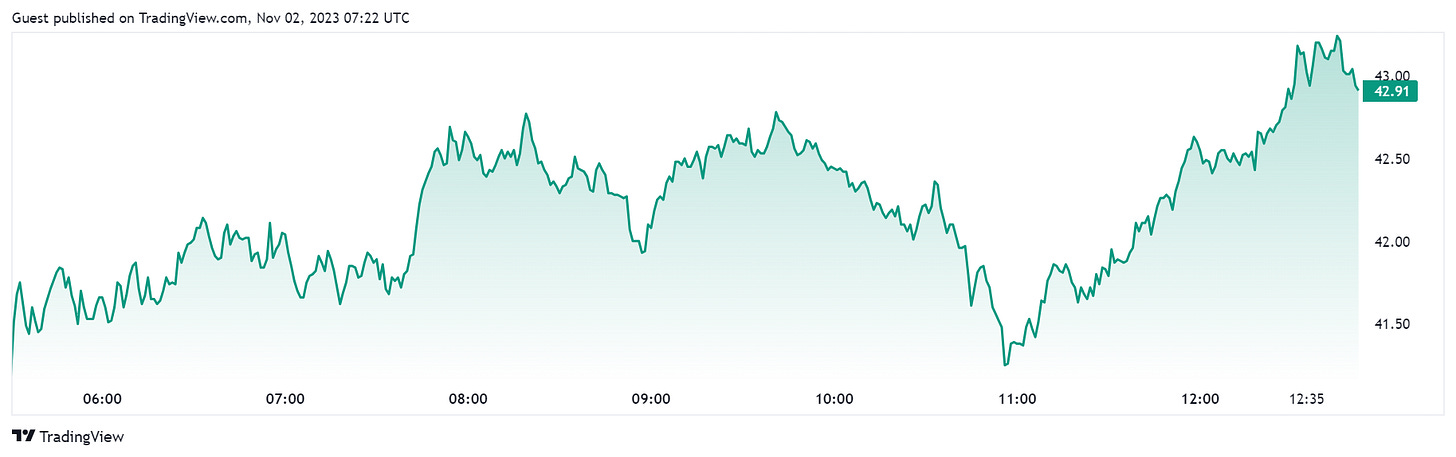

Moderate Rises Elsewhere: Bitcoin's performance showed little excitement following the Federal Reserve's decision to keep interest rates unchanged at 5.25%-5.50%. Bitcoin, while having a good month with a 30% increase, has seen less than a 2.5% rise today.

Ethereum's Steady Growth: Ethereum itself is up by 1.8%, trading at $1,836.64, showing steady but less dramatic growth.

XRP's Steady Climb: XRP also shows gains but at a lower rate, currently priced at $0.60, up less than 2% from the previous day.

Overall Market: The global cryptocurrency market cap today is $1.35 Trillion, a 2.6% change in the last 24 hours.

After FTX

After the fall of FTX last year, Solana is now focusing on the future with a vision that spans the next half-decade.

Solana co-founder Anatoly Yakovenko recently said.

“I think I would love to see us land, from a technical perspective, multiple leaders per slot. And this is something that is a very different roadmap from all the other blockchains.”

Joel Monegro, partner at Placeholder.

FTX implosion was a ‘clear market opportunity’ for Solana.

He compares this situation to Ethereum's struggles in 2018 and 2019, where his firm invested heavily and saw great returns.

Read more bout it here.

TTD Blockquotes 🎙️

Assistant United States Attorney Nicolas Roos.

“That’s fraud. It’s stealing, plain and simple. Before FTX, there was Alameda.”

Nicolas Roos painted SBF as a clear-cut fraudster, arguing that he set up systems to deceive and misuse funds.

With a barrage of evidence and witness testimonies, the prosecution underlined that SBF knowingly misled investors and the public about FTX's stability and the misappropriation of funds.

SBF's legal team is walking a tightrope, attempting to shift the narrative from intentional fraud to a series of unfortunate blunders made without malevolent intent.

They aim to sever the tie between SBF's actions and any deliberate criminal behaviour, possibly seeking to evoke a sense of empathy for a young entrepreneur who faltered under pressure.

“The defendant set up two separate ways. If you believe even one of the three cooperators, the defendant is guilty. An unlimited line of credit just means unlimited money from FTX. Ellison told you, he directed us. Gary Wang said the same. The defendant marketed the liquidation engine, saying FTX was safe. He told Congress, collateral must be placed on the platform itself, not just pledged. But the secret rules allowed Alameda to borrow billions without any risk of being liquidated.”

Prosecution's Closing Salvo

Charge of Fraud: The prosecutors have laid out what they believe is a clear case of fraud, involving the deceptive handling of customer funds and misrepresentations to investors and users of the FTX platform.

Alameda's Role: They have pinpointed Alameda Research, SBF’s trading firm, as a central cog in the alleged fraudulent scheme, where FTX customer funds were supposedly funnelled.

Evidence and Testimony: Armed with charts and nearly 20 witnesses, the prosecution's narrative posits that SBF was at the helm of a system designed to mislead and misuse funds. The testimonies aimed to reinforce this portrayal of deceit.

If convicted on all counts, SBF could be facing a sentence that could span a lifetime—up to 115 years in prison.

TTD NFTs🐝

Physical CryptoPunk Prints Available

Avant Arte, an online art store, partners with Yuga Labs to offer CryptoPunk NFT owners print versions of their digital assets for a limited 48-hour window.

The exclusive sale started on Oct. 26 at 3:00 pm UTC and will conclude on Oct. 28 at 3:00 pm UTC.

Two Collections on Sale: The "Punk-On-Chain" allows CryptoPunk owners to commission print copies of their NFTs after ownership verification, while "10,000 On-Chain" offers prints of the entire CryptoPunk collection to the public.

Distinct Features: "Punk-On-Chain" prints are UV pigment with white underpins and include a blockchain-based Certificate of Authenticity (CoA) QR code, whereas "10,000 On-Chain" prints are archival pigment with a silkscreen varnish, accompanied by a physical CoA.

"Punk-On-Chain" includes a blockchain CoA; "10,000 On-Chain" comes with a physical CoA.

CryptoPunks remain a high-value collection with individual pieces starting at $78,000 and a total market cap of $782 million.

ATP Tour Unveils Customisable NFT Posters

ATP Tour launches customisable NFT posters for the 2023 Nitto ATP Finals in partnership with Artchild.

The main poster design is by artist Honor Titus, celebrated for tennis-themed artwork.

Fans can personalise the poster colour scheme digitally and receive a physical version with the corresponding NFT.

Original poster priced at $50 plus shipping, available online and at the event's fan village.

Singles players will design unique posters for charity auction, benefiting Turin's green spaces.

The ATP continues to blend tradition with tech, building on previous NFT ventures like the "Love" art series.

Atari's NFT-Based Members Only Jackets

Atari re-introduces Members Only jackets exclusively for ARC NFT holders, reviving '80s nostalgia.

Sale of the updated, higher-quality jackets runs from launch until December 1.

ARC NFT owners get early jacket access plus benefits like voting rights and merchandise discounts.

Jackets to be delivered around February/March 2024, with interim Atari patches available for separate purchase.

Atari continues its venture into blockchain, distancing from "play-to-earn" while enhancing gaming with Web3 tech.

Where’s ETF?🚨

ETF approval would bring in major new sources of demand for Bitcoin👇🏻

TTD Arrest 🔐

In a tale that's taking off faster than a rocket to the moon, the SafeMoon saga has taken a dramatic twist.

The Department of Justice has whipped out the handcuffs, and the SEC has rolled out the red tape.

The SEC: charged SafeMoon, its creator Kyle Nagy, CEO John Karony, and CTO Thomas Smith with fraud and conducting unregistered securities sales related to the SAFEMOON token.

Justice Department's Charges: unsealed charges against the same individuals, accusing them of conspiracy to commit securities fraud, wire fraud, and money laundering conspiracy.

The executives are accused of withdrawing assets worth $200 million from SafeMoon and spending it on luxury items like sports cars (custom Porsche 911 sports car) and real estate.

Karony's been scooped up in Utah, Smith nabbed in New Hampshire, while Nagy... well, he's playing a high-stakes game of hide-and-seek.

The SEC highlighted that the SafeMoon team had promised investors that their funds would be locked in a liquidity pool and inaccessible to anyone, claims that were later found to be false.

The SEC has also accused the executives of engaging in market manipulation tactics, such as using company funds to purchase SAFEMOON tokens to artificially inflate its price and wash trading.

If convicted, the charges could lead to a sentence of up to 25 years for the defendants.

TTD PayPal ⛵

PayPal has smoothly sailed through the Financial Conduct Authority's (FCA) hoops and hurdles to secure a crypto registration in the UK.

The FCA's nod is no small feat; it’s like the Queen’s wave for financial firms looking to dabble in digital currencies.

PayPal UK Limited can now proudly join the ranks of approved businesses ready to serve up crypto services with a side of fish and chips.

Remember when PayPal hit the pause button on crypto purchases for its UK customers?

Well, that was the regulatory tango at play. Now, with the rules aligned, the pause is lifted.

The registration aligns PayPal with the Fifth Money Laundering Directive, ensuring it operates within the established legal framework intended to prevent financial crimes in the crypto space.

A Tight Ship

PayPal's got the green light, but don't expect a free-for-all. Every crypto whisper and shout in their marketing materials has to pass the FCA's strict standards.

Companies that fail to adhere to the FCA's regulations face severe penalties, including substantial fines and the potential for criminal charges. PayPal’s compliance helps it avoid such risks.

PayPal's been busy bees in the crypto hive this year. From dreaming up a native stablecoin to launching crypto checkouts for shopkeepers, they're making major moves.

TTD Surfer 🏄

Worldcoin's mobile World App has been downloaded over 4 million times, potentially making it the sixth most downloaded software wallet.

Maple Finance, a lending platform, is expanding its services on the Base network, targeting institutional users.

Binance is ending its partnership with financial services firm Advcash, which was used to move funds between sanctioned Russian banks and the exchange.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋