Hello,

For most of history, money came in many forms. Often backed by different underlying props. Once, it was cattle and grain, followed by lumps of shiny metal. Then came the paper that promised the metal. Today, if you strip off the dollar or its digital version — a stablecoin, you will likely find a bunch of short-dated U.S. Treasuries and bank deposits.

Although the form of money has changed from paper to blockchains, what’s underneath is mostly still government IOUs that enough people worldwide have decided to trust. You take the trust away, and it all crashes spectacularly.

Lately, a different asset has started consuming capital and people’s trust: GPUs and data centres for AI. They overheat, depreciate fast, and sometimes even sit idle for weeks. Some even dismiss it, calling the hullabaloo part of a hyped-up bubble. Yet, what nobody can argue is their role in driving the growth of the world’s largest economy in the first half of 2025.

Data centre investment powered 92% of GDP growth in H1 2025, despite accounting for only 4% of the U.S. GDP. Without it, the annualised growth rate would have been just 0.1%.

So, the world is busy conducting the next obvious experiment: trying to back dollars with compute and hardware that powers AI, allowing investors in one country to fund GPU clusters in another and earn yield from rented computing power. When done right, this brings together surplus, retail capital and those who find it challenging to access capital.

In today’s analysis, I will explain how it works and how crypto can help globalise this financing, despite the risks that may arise.

Let’s get to the story,

Prathik

Play. Earn. Own. That’s Klink Finance.

With Klink Finance you don’t just watch crypto, you act. Complete tasks, social quests, and partner offers to earn in crypto or cash. Build reputation, unlock rewards, and gain access to special drops.

Earn for gaming, app trials, surveys and more.

Flexible withdrawals: crypto or fiat, your choice.

Backed by a global user-base and trusted integration partners.

If you’re ready to turn your time into value, join the earning revolution with Klink.

The story of money has largely been about what we, as its users, are willing to treat as good enough collateral. Metal was once good enough because it was scarce and hard to fake (until it wasn’t). Gold-backed money worked because you could, at least in theory, show up with it at a bank and get the precious metal in return.

When a central bank says its currency is credible, it means that its Treasury can issue debt cheaply via Treasury Bills and recover the currency’s value without breaking a sweat. Crypto came along, promised a new financial system, and spent the last decade rebuilding dollar wrappers on blockchains. Today’s stablecoins, including Tether’s USDT and Circle’s USDC, show you a pool of reserves that includes T-Bills and cash, giving you the same dollar wrapped mostly in ERC-20 form.

This works fine as long as the world is content with storing its savings in U.S. paper bills. Except that’s not true. The current wave of capital is not being pumped into Treasuries, but into data centres and computing power.

Analysts at Swiss multinational bank UBS project that global AI-related annual capital expenditure will triple to $1.3 trillion by 2030, from over $400 billion this year. That’s over 1% of global GDP being spent on chips, specialised servers, and data centres.

Despite all this potential, the central banks don’t see them as ideal dollar collateral. That’s because a high-end GPU can cost tens of thousands of dollars and might sit in a leased rack in someone else’s building. It could turn obsolete faster than our mobile phones, and it can be challenging to repossess.

But crypto has a different risk tolerance and a thing for capital optimisation. If there is a scarce, income-generating asset in the world and a pool of stablecoins seeking yield, then someone will bring the two together.

That’s what compute-backed dollars promise. Instead of funding just NVIDIA’s cloud projects and Google’s DeepMind research, they give smaller AI labs and data centres a way to tap the same global dollar pool. If you believe the AI success story will play out, this lets you own a piece of it.

One example of this is USD.AI. Although it tracks the U.S. dollar, on the surface, and is backed by short-term U.S. T-Bills, it has set up a lending system to fund AI infrastructure.

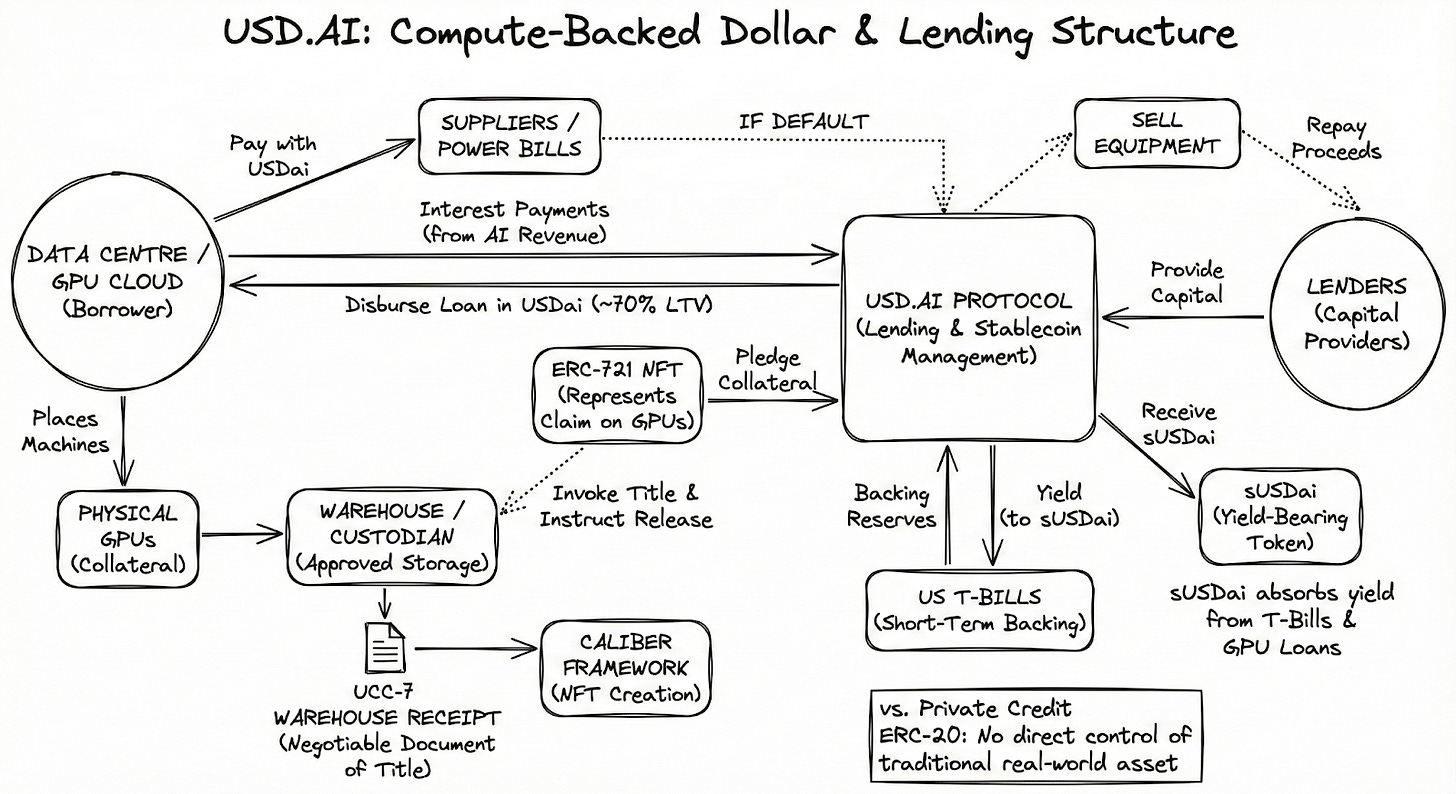

Data centre operators and GPU clouds can apply for loans in USDai. To do this, they work with a specialist underwriter, place their machines into a bankruptcy-remote vehicle, and store them with an approved custodian.

This is a legally sound process that binds each financed GPU to the parameters of Uniform Commercial Code Section 7, which treats a warehouse receipt as a negotiable document of title. USD.AI’s CALIBER (Collateralised Asset Ledger: Insurance, Bailment, Evaluation, and Redemption) framework turns that paper into an NFT. One ERC-721 token now represents a claim on a specific set of GPUs sitting in a data centre.

In contrast, an ERC-20 token acquired via private credit doesn’t give direct control of a traditional real-world asset.

USD.AI’s NFT is pledged to the protocol, which then disburses a loan in USDai, usually against approximately 70% of the hardware’s appraised value. The operator can use the stablecoins to pay suppliers and power bills. Once the GPUs start earning revenue from AI workloads, interest payments can be made via the protocol.

The lenders don’t hold USDai directly. Instead, they hold sUSDai, a separate token that absorbs yield from both the underlying Treasuries and the GPU loans.

If the borrower defaults, the protocol doesn’t need to sue them. It already holds the ERC-721 document of title, which can be invoked to instruct the warehouse to hand over the machines. The protocol can then sell the equipment and use the proceeds to repay the lenders.

What excites me about this is its geography-agnostic fundraising capability.

A university spin-out AI startup in India or a neo-cloud provider in Latin America could struggle to secure bank debt for GPUs. But here, they can tap into a global pool of stablecoins that don’t rely on local banking relationships. Meanwhile, the lender can be a retail investor in Nigeria, Korea or Timbuktu.

Crypto rails can turn this niche American legal arrangement into a cross-border project finance. Blockchain globalises data centre financing and lets people who were previously shut out of U.S. capital markets own a slice of the AI play. For AI companies just starting out and having difficulty accessing credit through traditional banking systems, it eases entry barriers.

Protocols such as USD.AI bet that if AI infrastructure continues to grow in line with current projections, the cashflows from renting compute will be reliable and robust.

But there’s a messier side to the story, too.

Let’s start with downtime. A Treasury Bill will not stop paying interest if a power station trips or a client ends the association. But a GPU earns nothing when it’s offline, a scenario that’s not far removed from reality for relatively new, small data centre operators.

Protocols can install telemetry on pledged machines and require minimum uptime and insurance for physical damage. Still, they cannot change the fundamental economics tied to customer turnover and fragile infrastructure.

Even if the protocol decides to take over ownership due to default in repayments, the resale value of the equipment may fall short of covering the total debt. Considering how quickly the GPU fleet can turn outdated, the hardware could be exposed to revaluation shocks.

This is precisely why private credit desks and banks will feel comfortable underwriting a warehouse or a wind farm over a crate of H100 GPUs that were just rendered obsolete by a newer chip.

There’s also the regulation dilemma.

A token like sUSDai is a high-yield note backed by real-world loans. Regulators may have opinions about who can hold such instruments and mandate certain disclosures. Stablecoin-specific rules being drafted in the U.S. and EU tend to assume reserves are cash and sovereign bonds, not fast-depreciating hardware in foreign warehouses. This is probably why USD.AI still backs USDai predominantly with U.S. Treasuries.

None of these risks takes anything away from the idea. They simply remind us that what backs money need not only be a bunch of government IOUs. Collateral can even come in the form of GPUs sitting in racks across geographical boundaries.

Treasuries serve as a robust backbone of the dollar because of a system involving the Fed, the Treasury market, the legal system, and decades of crisis management. None of that existed at one point. Today, it does. GPU racks don’t yet have this infrastructure. But I can see the discipline layer emerging through warehouse receipts, insurance, underwriters and a bankruptcy system in place.

Maybe we are not there yet. Maybe lenders still prefer to hear “a government bond portfolio” as an answer when they ask, “What backs my dollar?” But I’d like to bet on this world to surprise us. In a world where investors seek to optimise yield for their capital via exposure to unlisted, unregulated private entities, expecting them to accept compute-backed dollars might not be as far-fetched an idea.

That’s it for today’s deep dive. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.